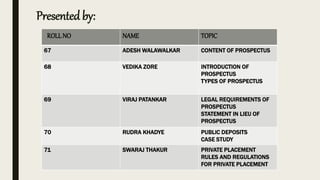

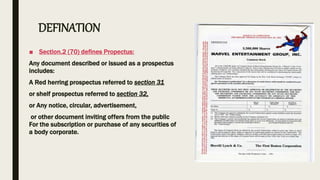

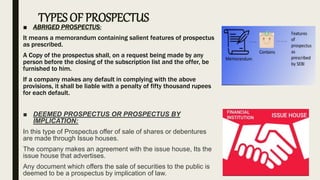

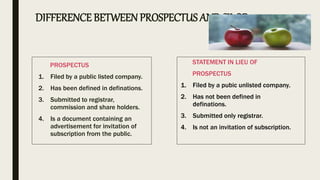

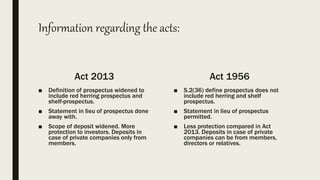

This document provides an overview of the content and legal requirements of a prospectus according to the Companies Act, 2013. It begins with defining a prospectus and stating its purpose of providing important financial information to help investors decide whether to subscribe to a company's shares or debentures. It then discusses the types of prospectuses, including abridged, deemed, red herring, shelf, and when a prospectus is not required. The document also outlines the legal requirements for a prospectus and the key information it must contain, such as details about the company, directors, capital structure, and auditors' reports. Finally, it briefly discusses private placements under the Act and the applicable sections and rules.