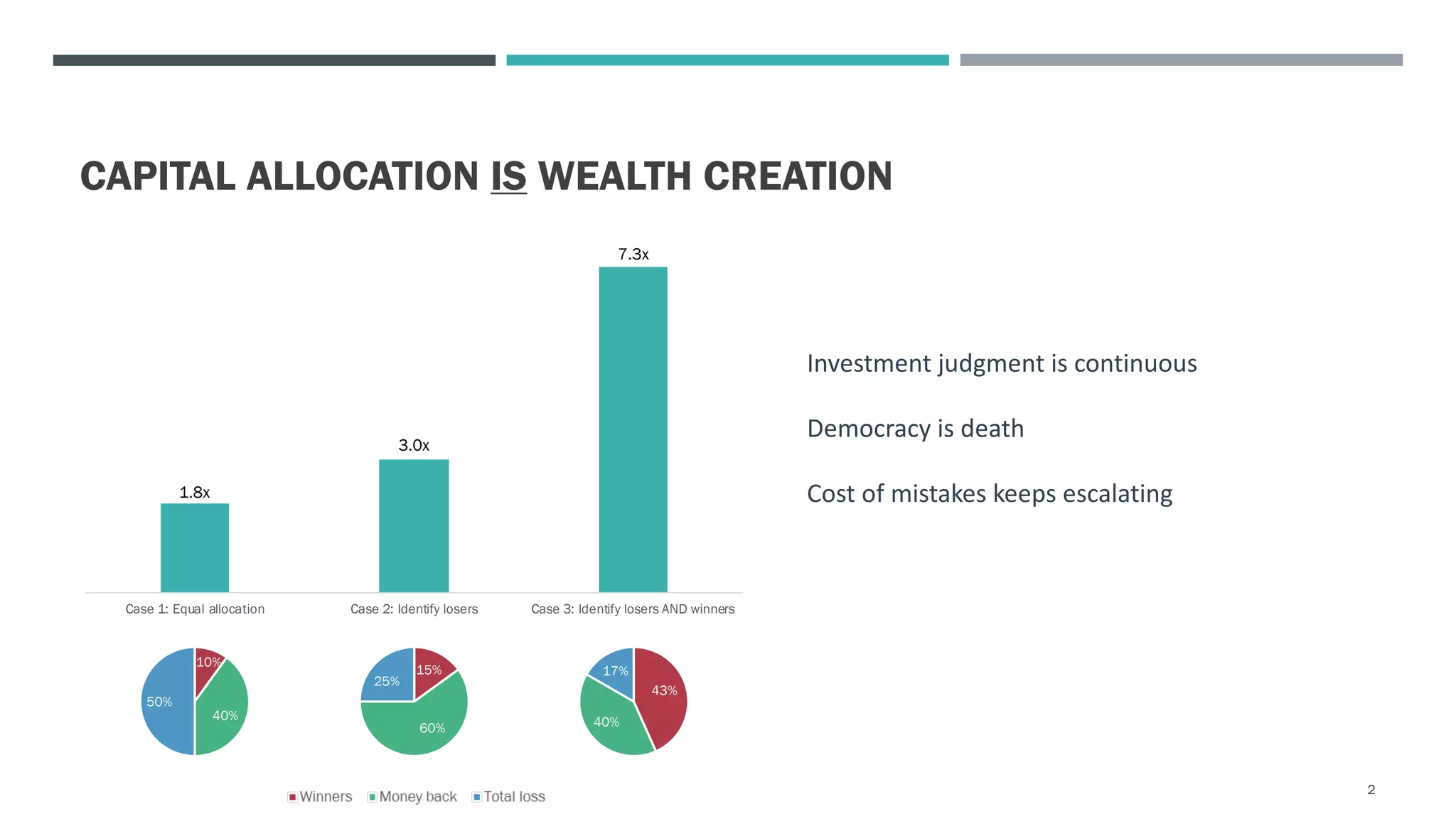

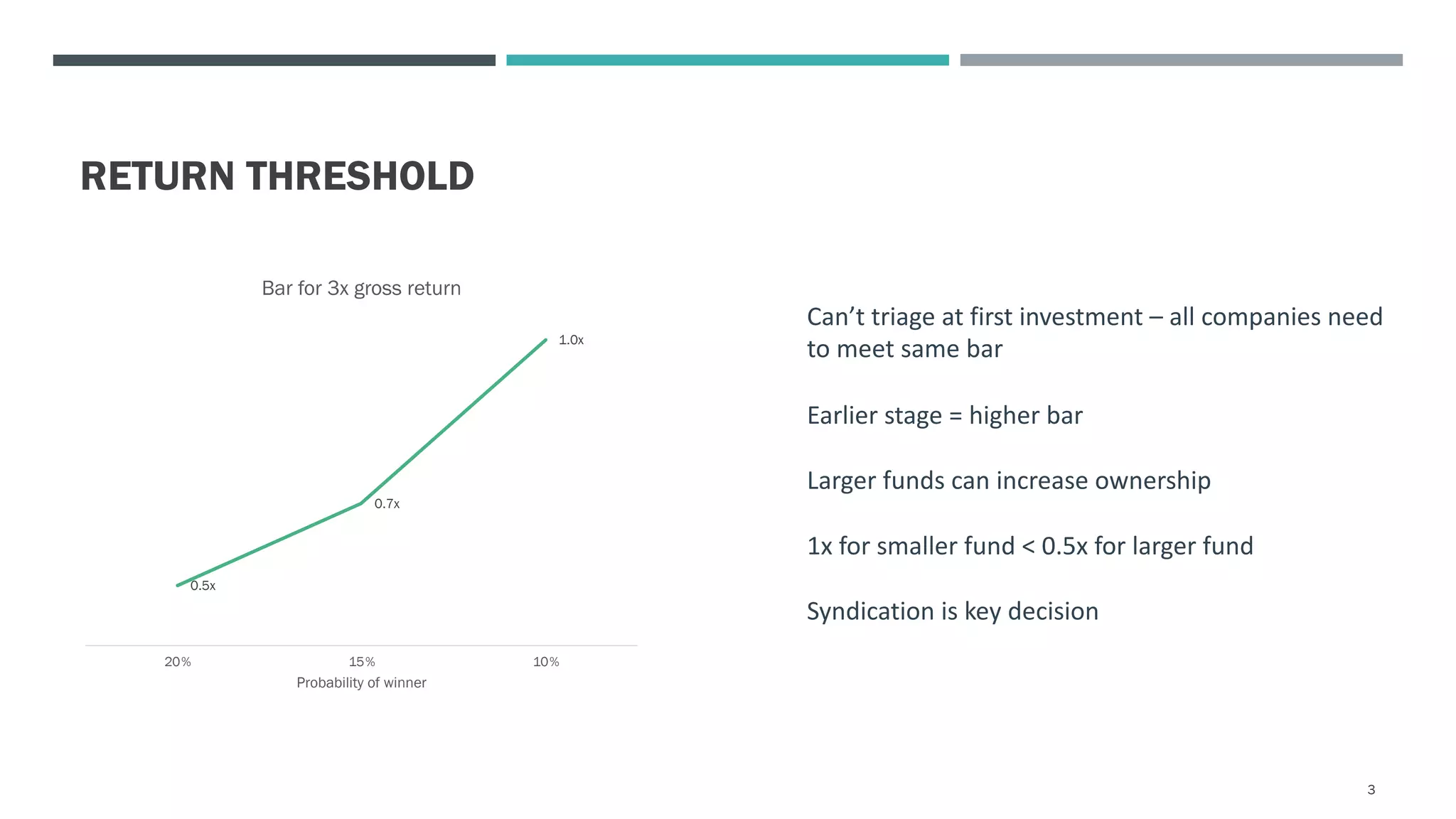

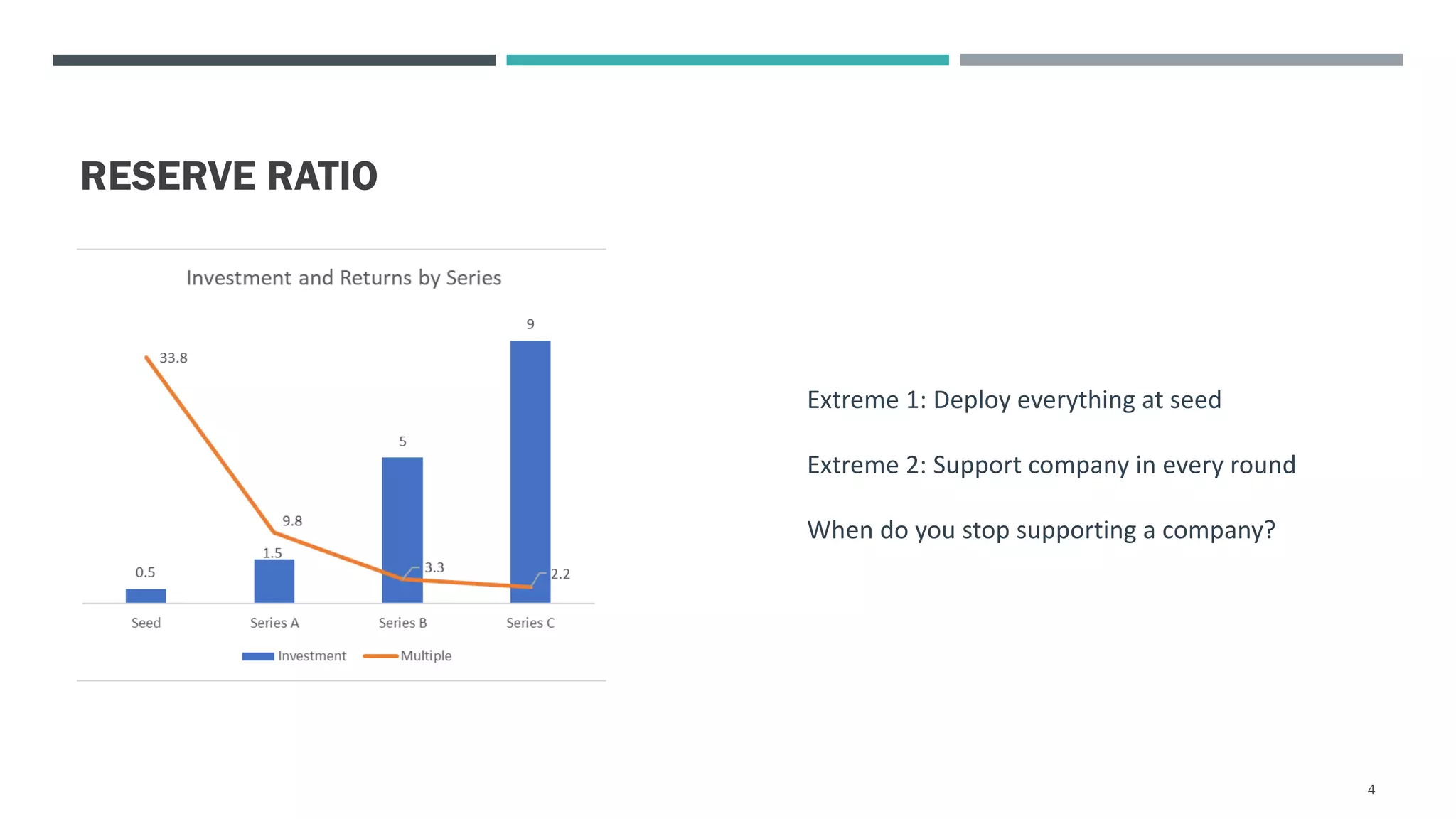

The document discusses the challenges of portfolio construction in venture capital, emphasizing that there are no definitive answers when it comes to investment strategies. It outlines various case scenarios for capital allocation and the trade-offs involved, including considerations for backing winners and maintaining portfolio size. Additionally, it highlights the importance of rules in decision-making while stressing that trust and intellectual honesty are irreplaceable in the venture capital process.