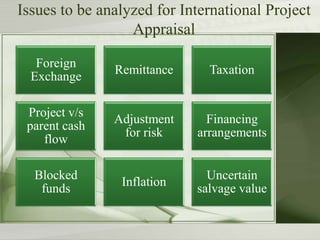

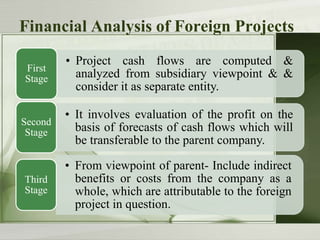

This document discusses key factors that must be analyzed when appraising international projects. These include foreign exchange risk, remittance restrictions, taxation issues, differences between project and parent cash flows, financing arrangements, blocked funds, inflation, uncertain salvage value, and risk adjustment. Foreign exchange risk and restrictions like blocked funds can create differences between a project's local and parent company cash flows. Both project cash flows and amounts remittable to the parent must be considered. Risk is generally best addressed through adjusting cash flows rather than the discount rate alone. A thorough analysis of all relevant political, economic, and financial risks is important for accurately evaluating the viability of international projects.