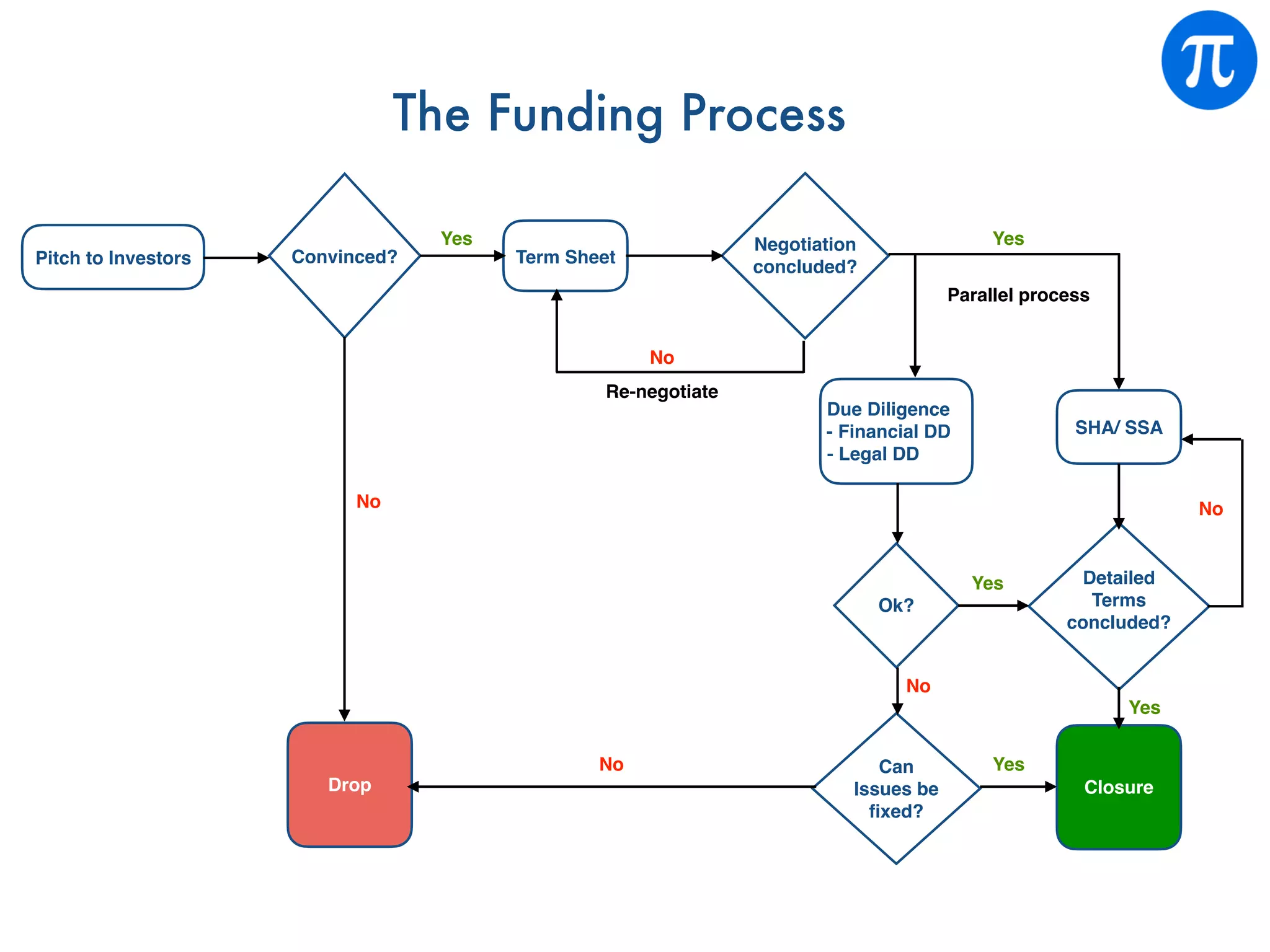

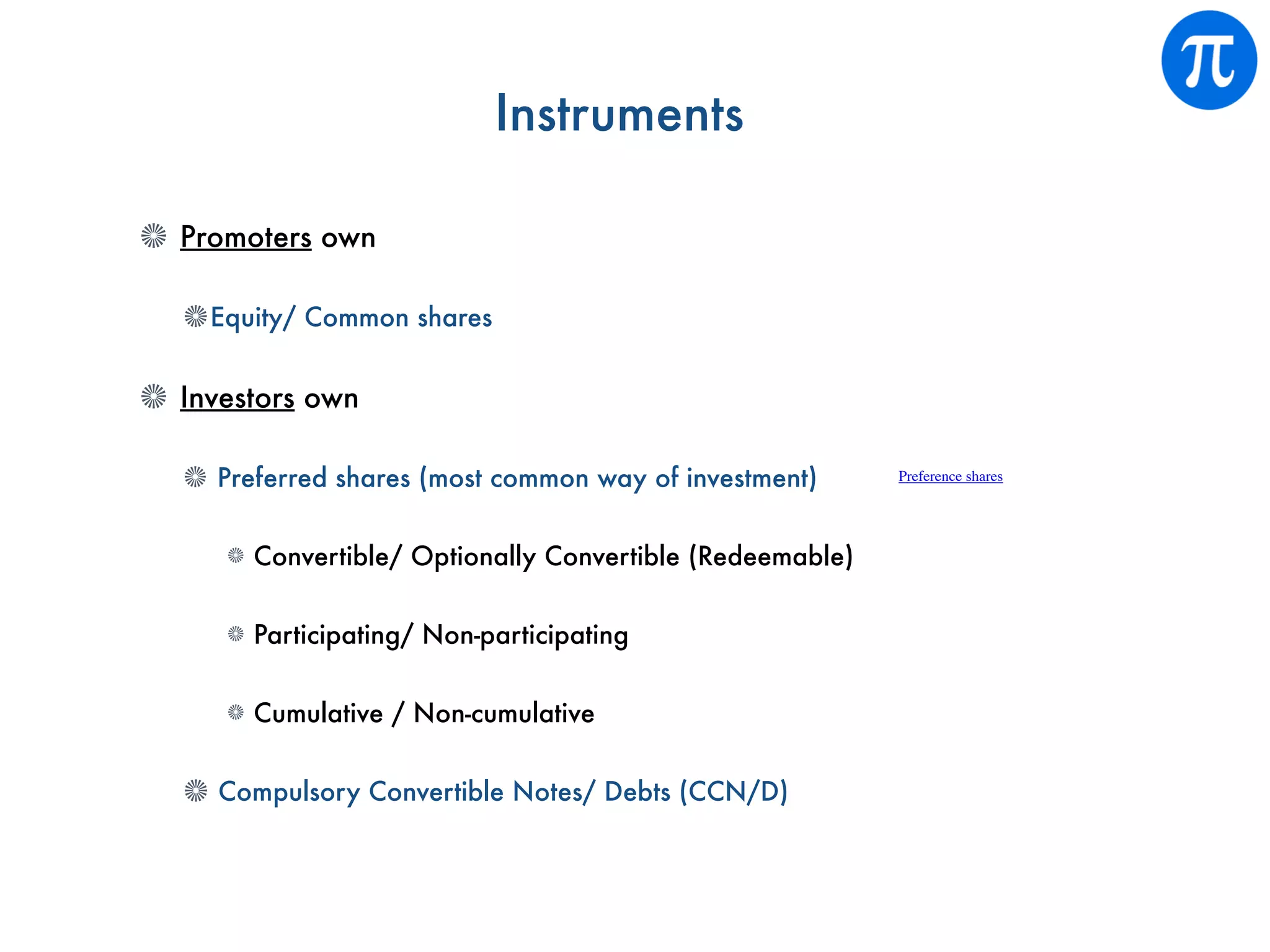

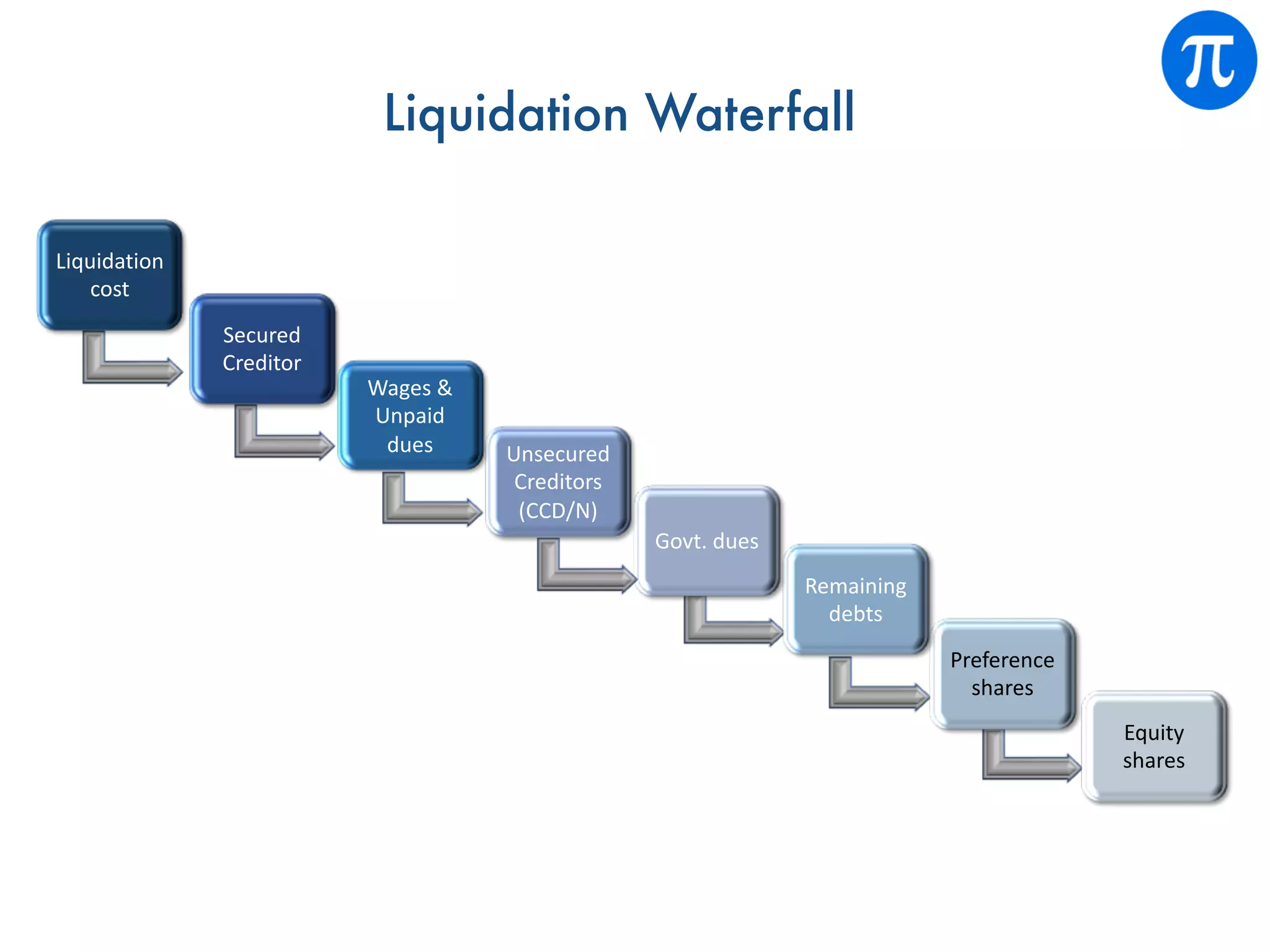

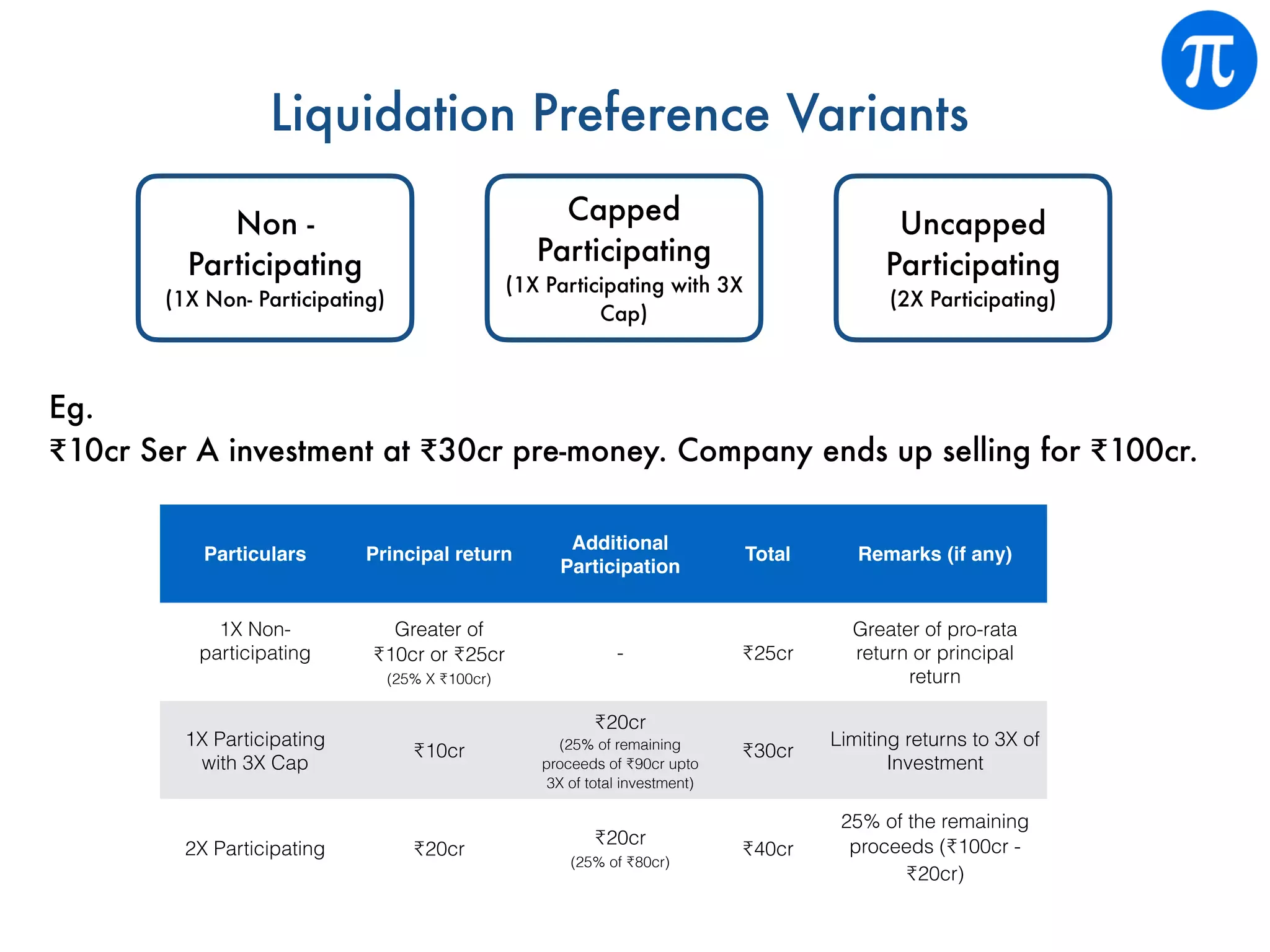

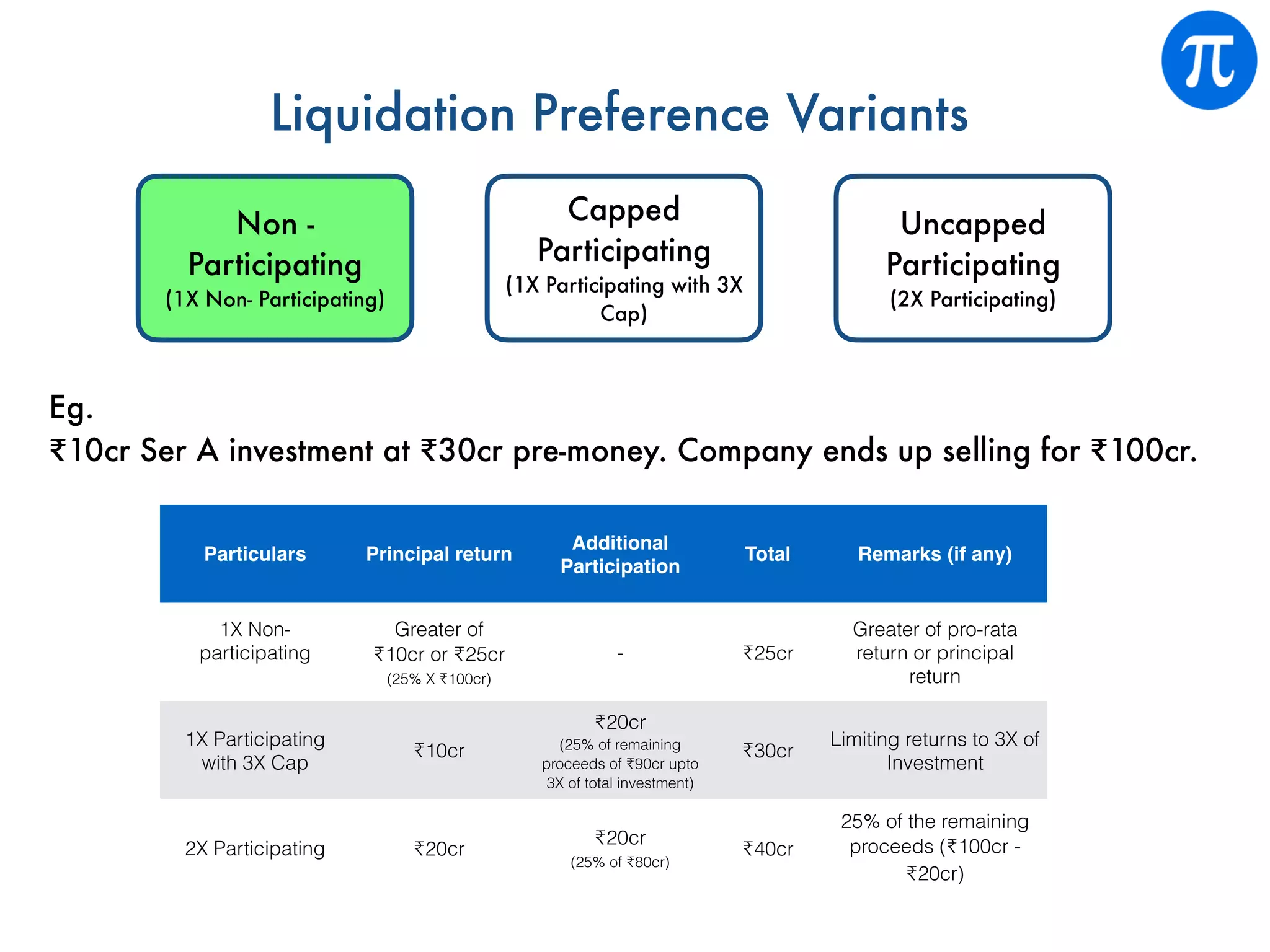

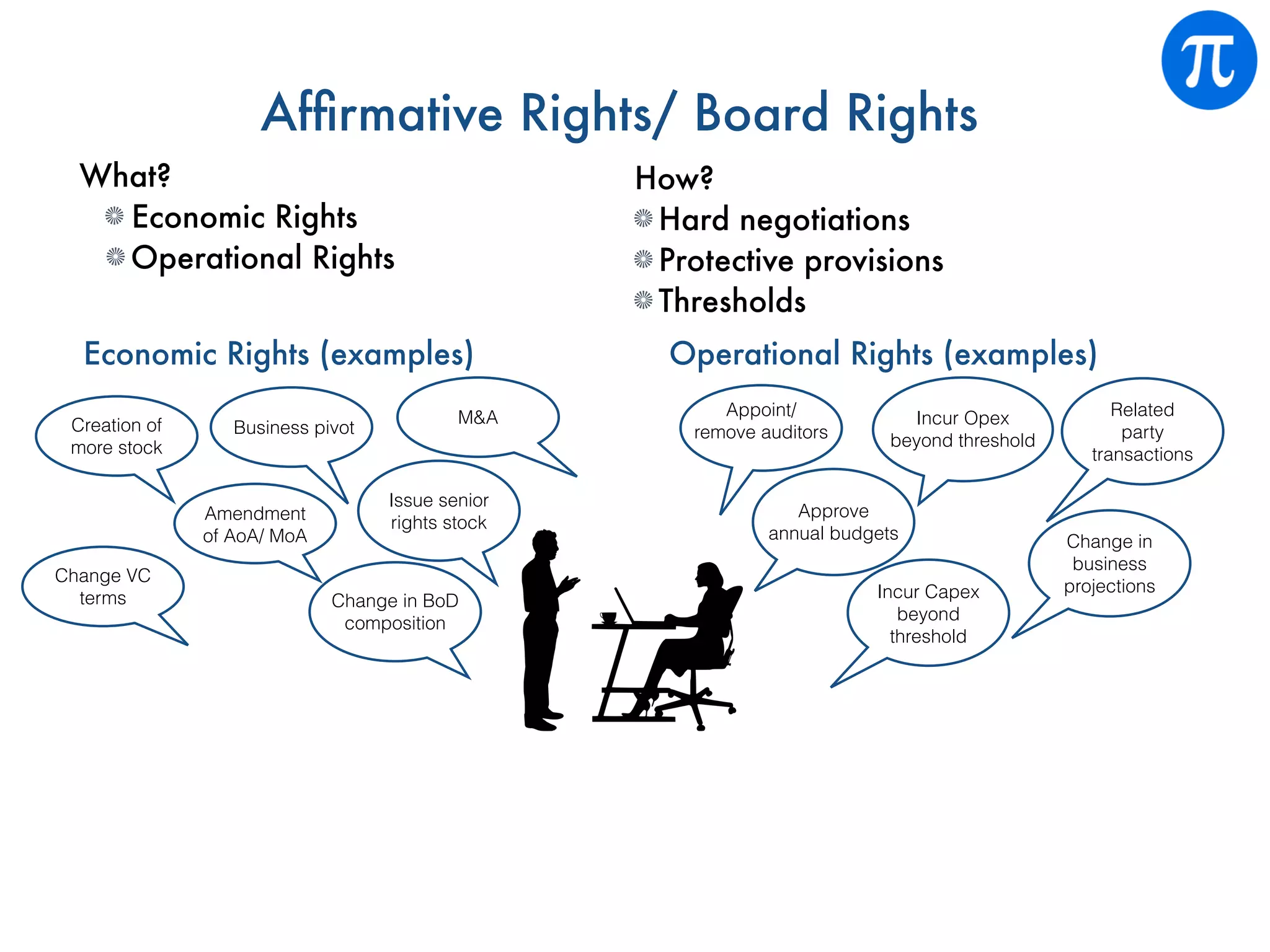

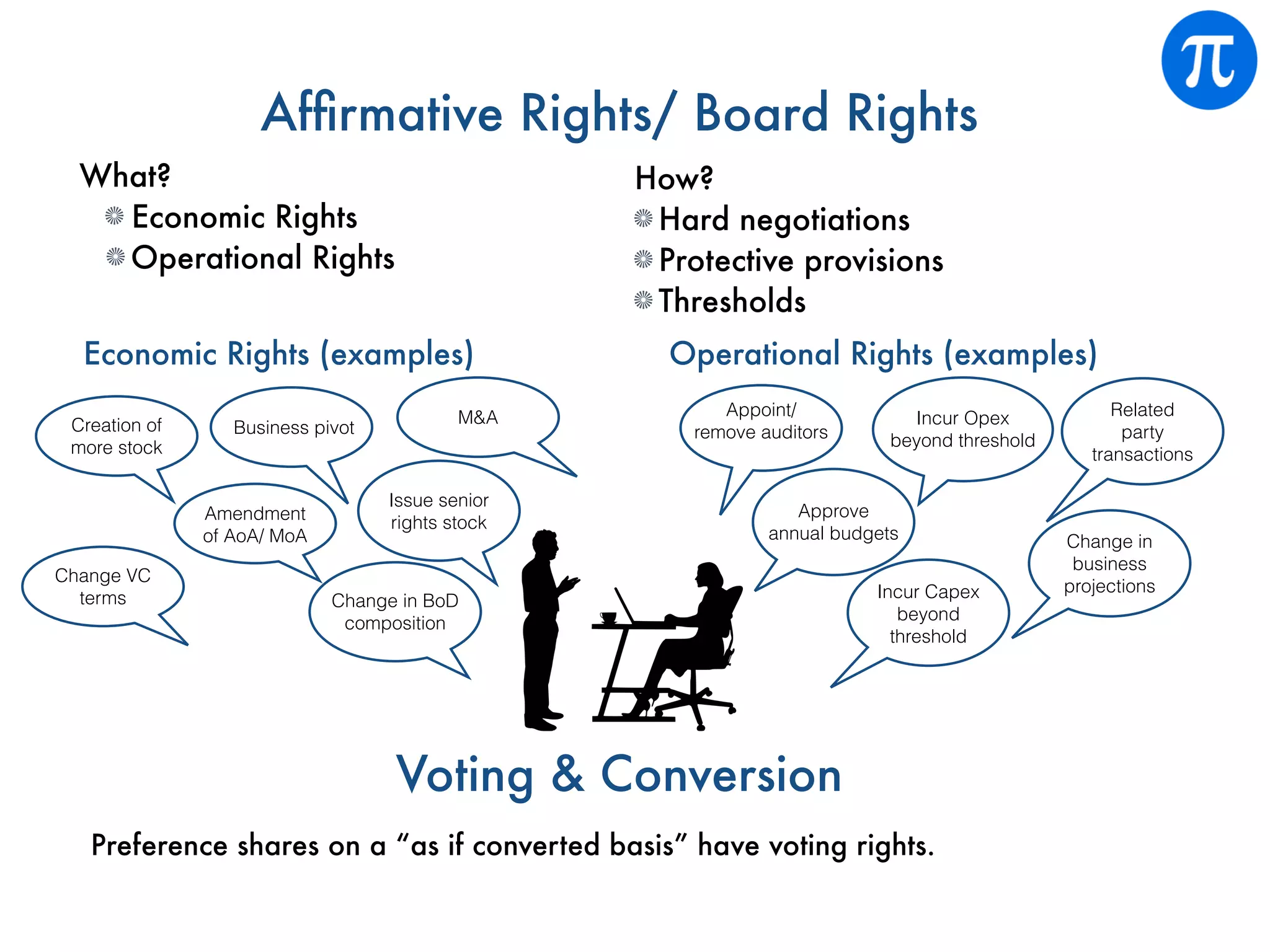

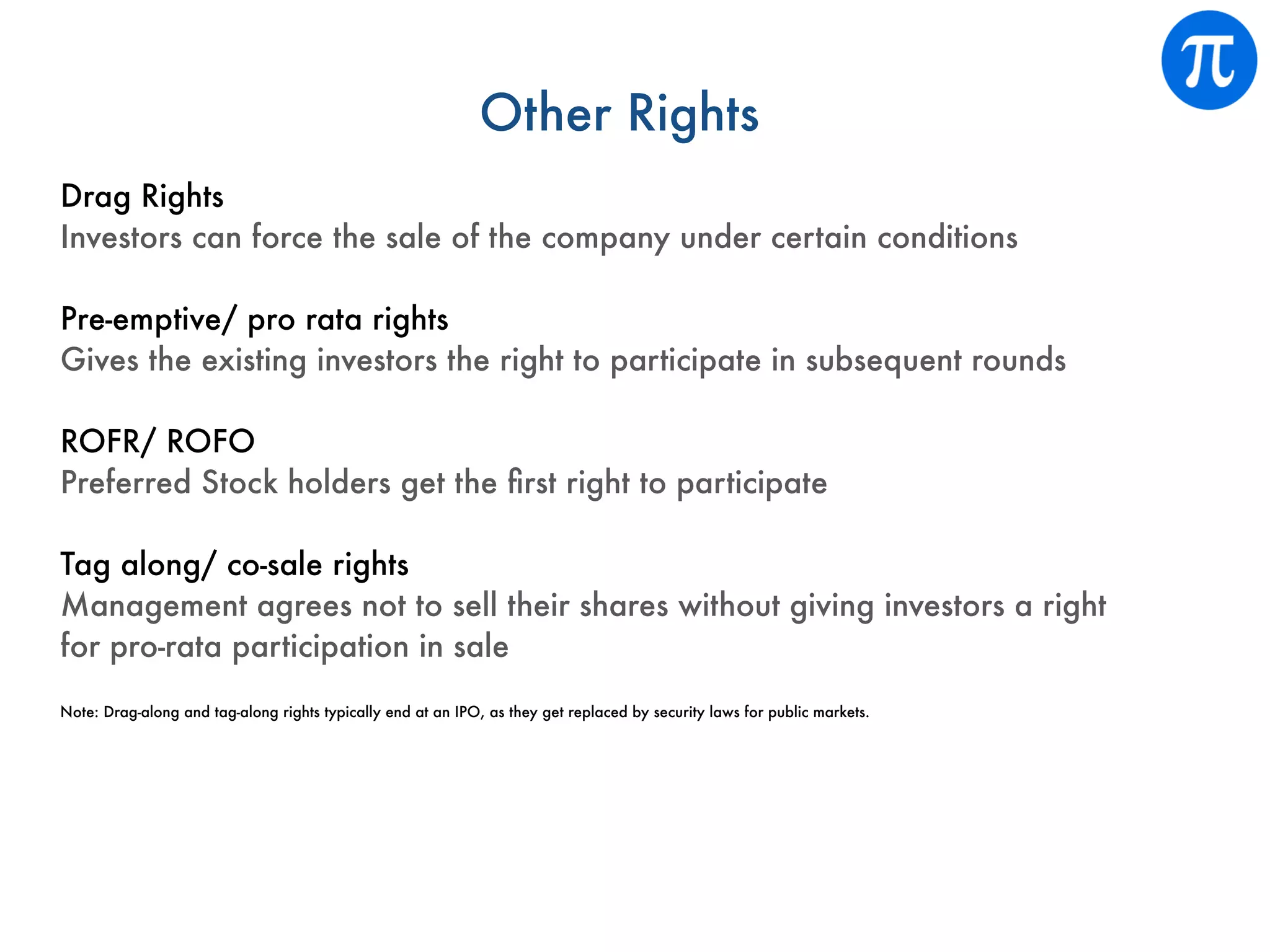

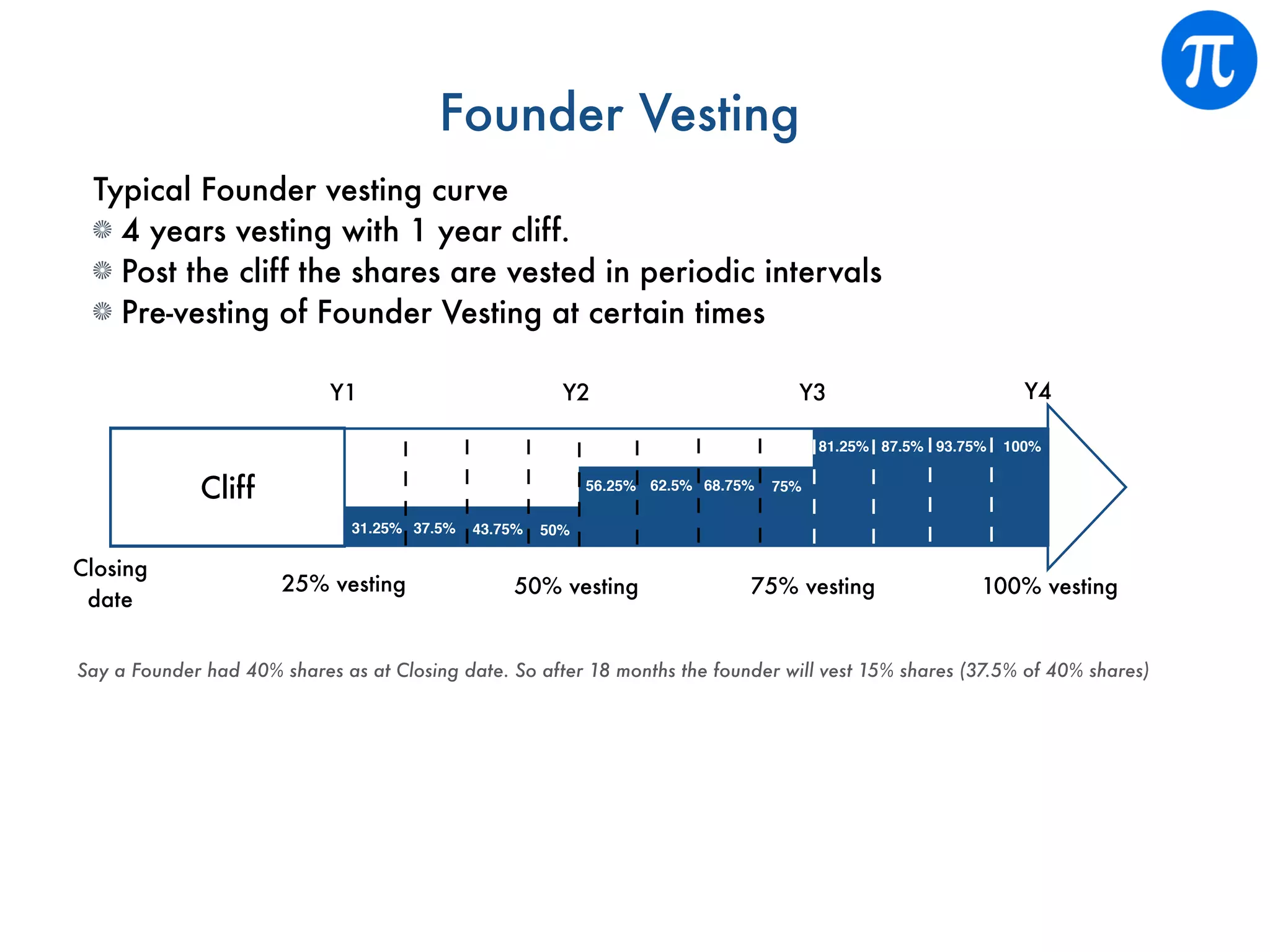

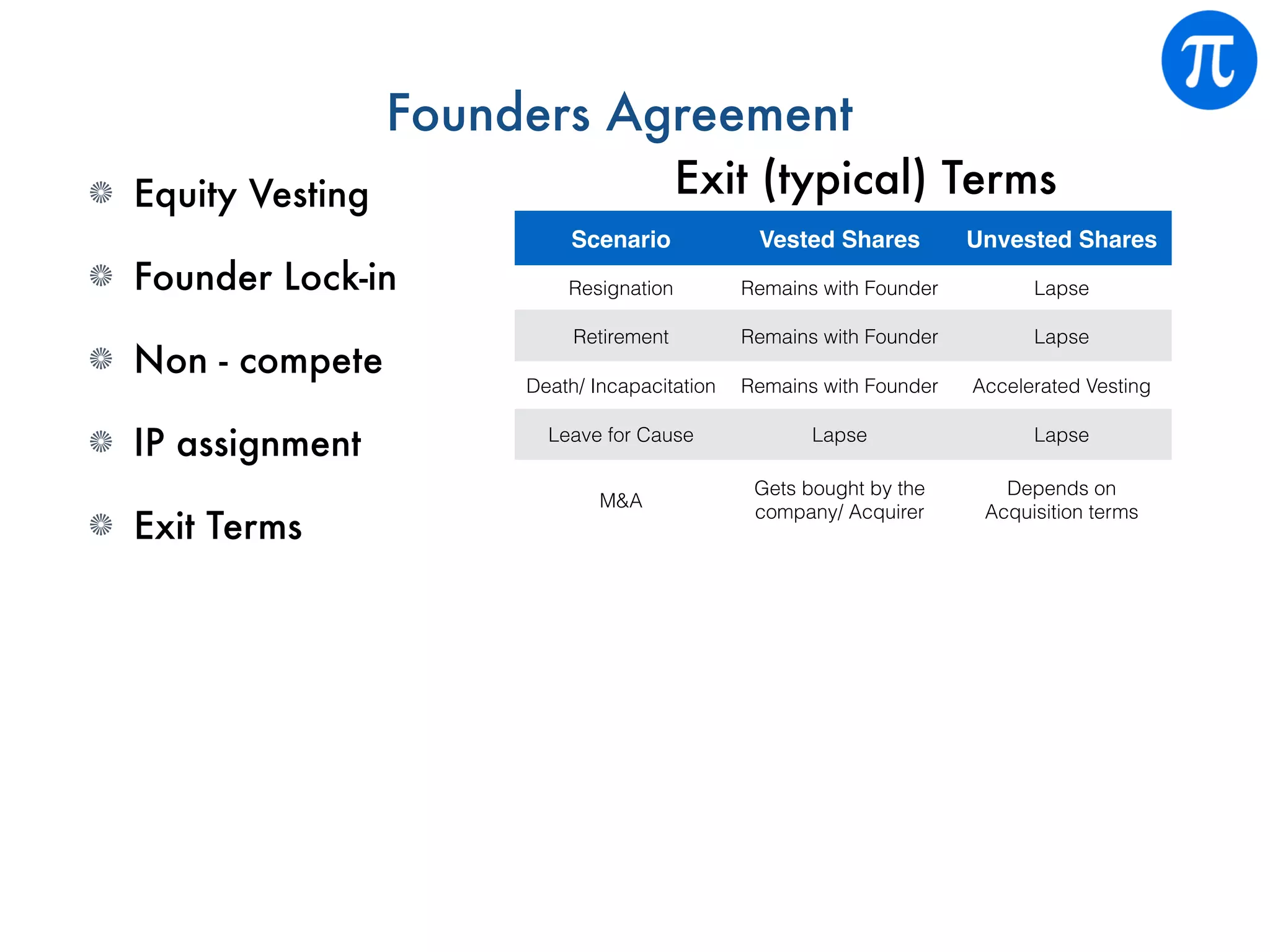

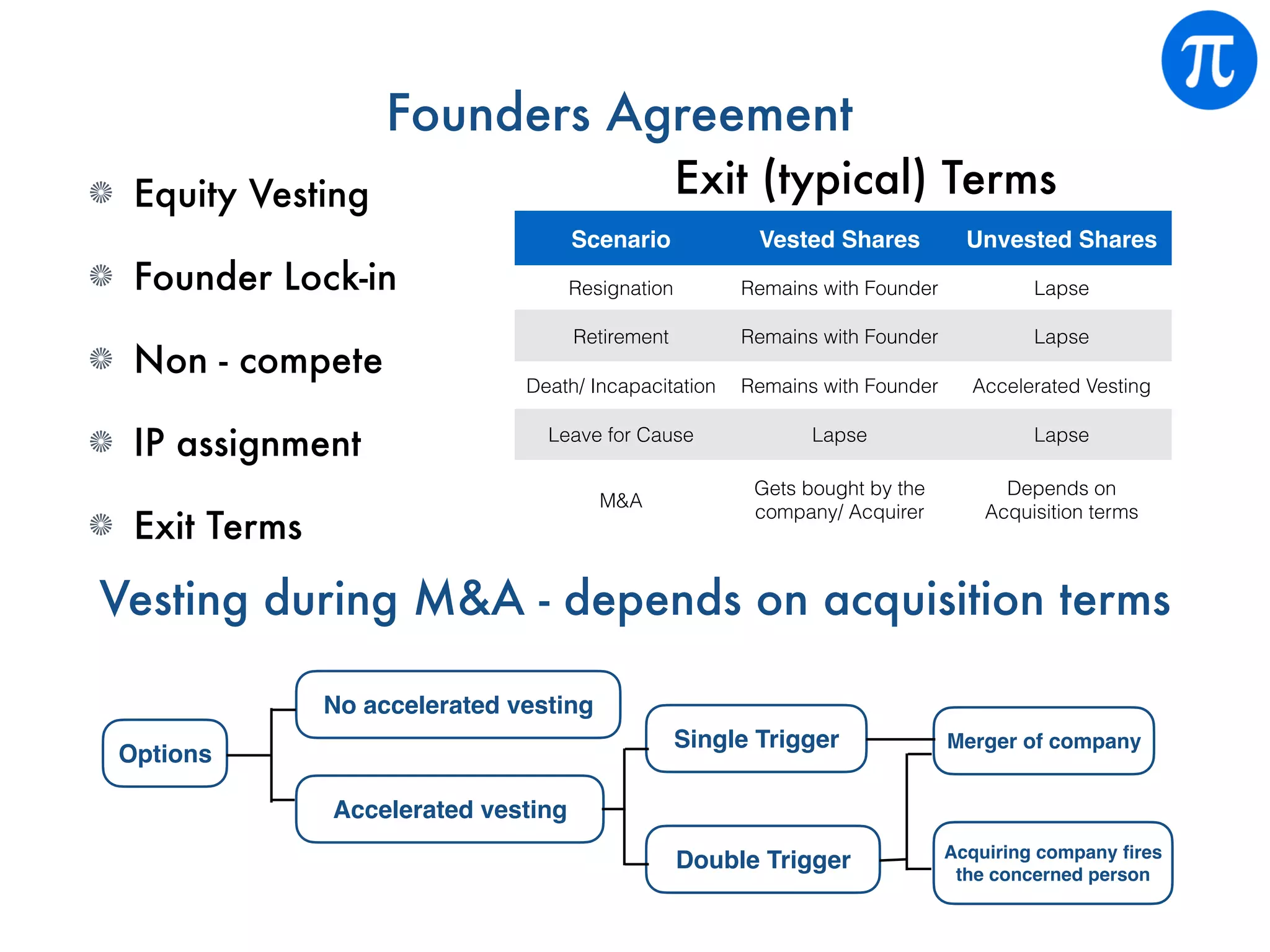

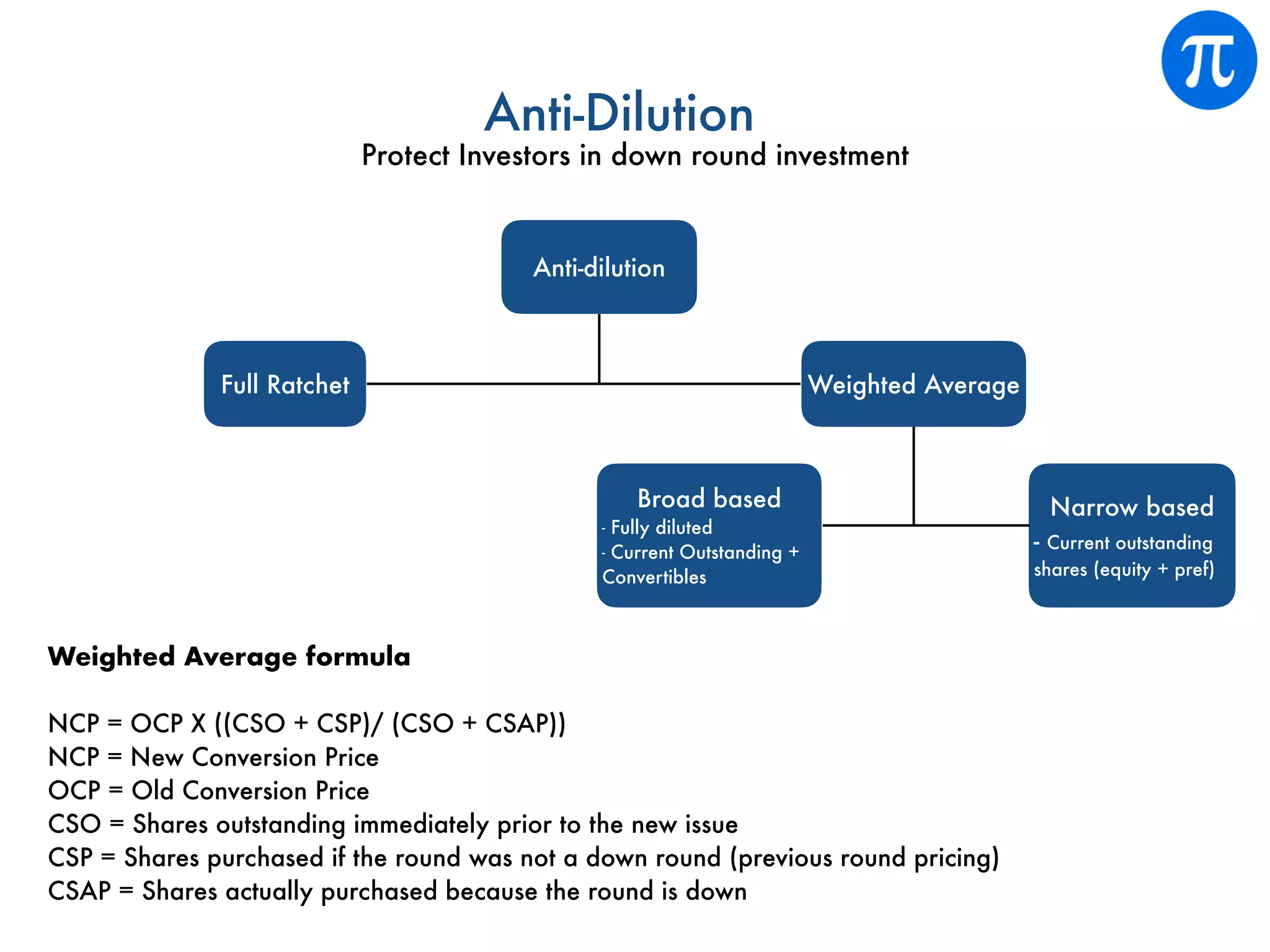

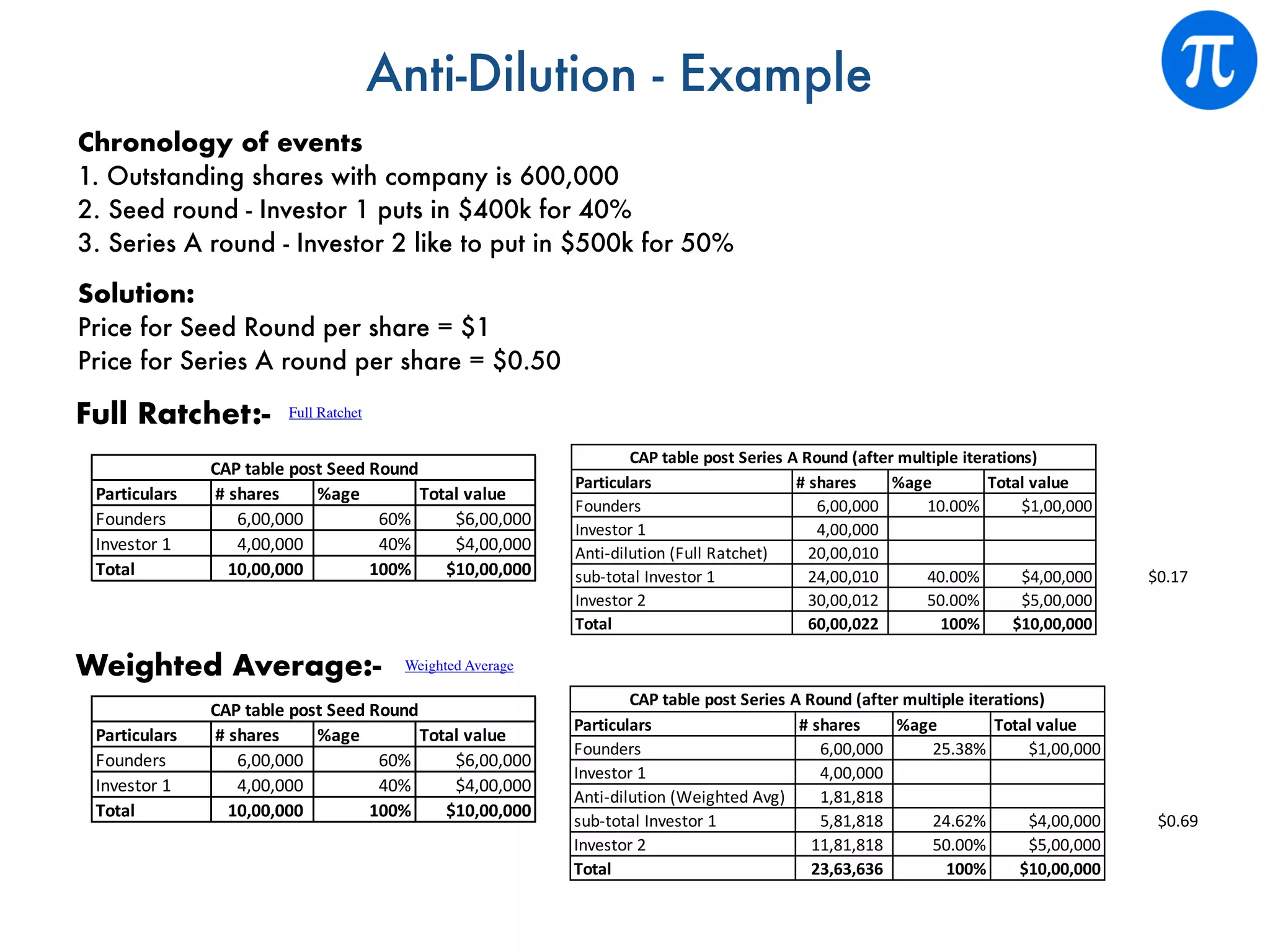

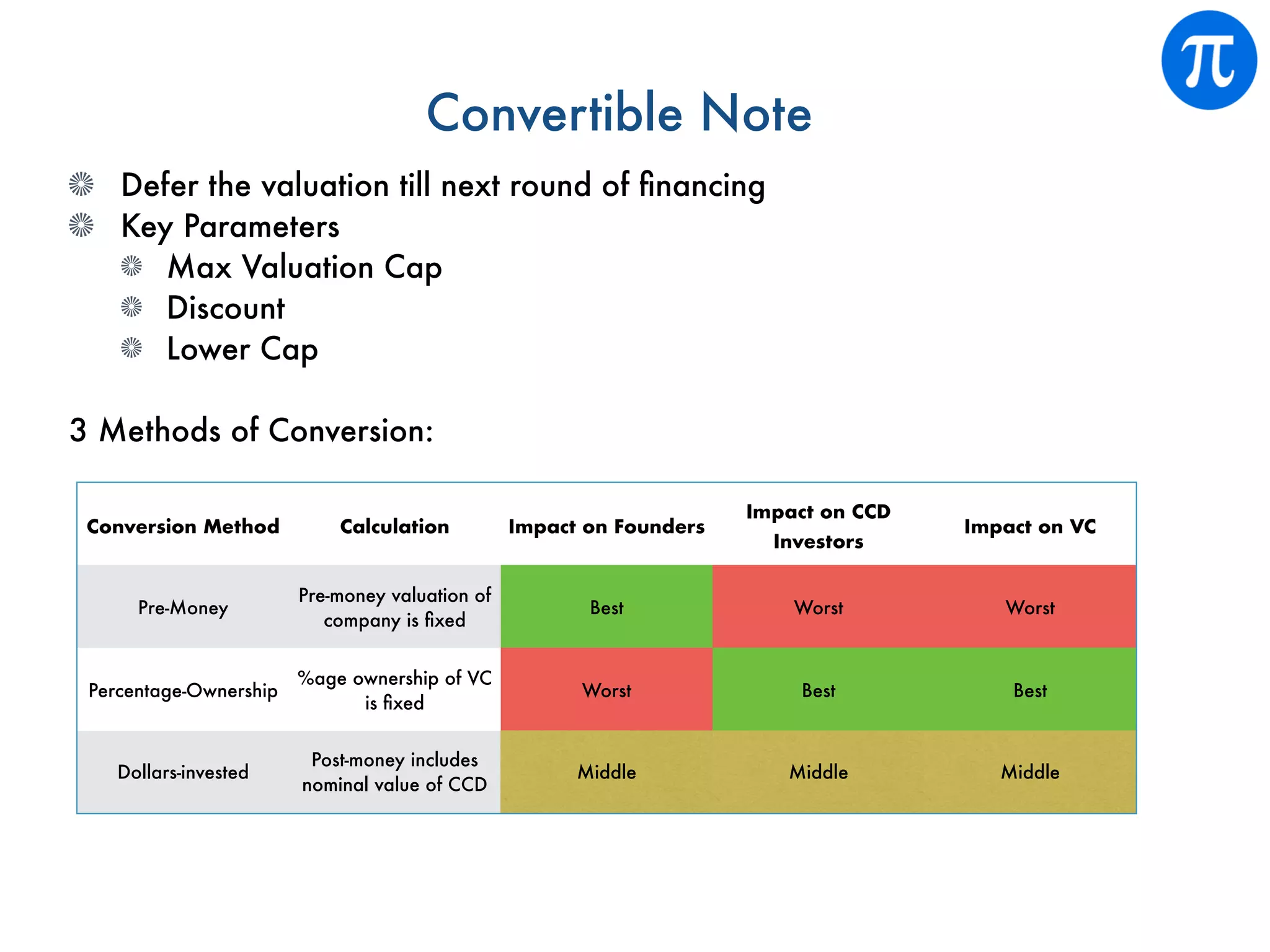

This document summarizes key terms related to venture capital term sheets. It discusses the purpose of a term sheet, common instruments used in financings like preferred shares and convertible notes, liquidation preferences, rights that investors obtain like affirmative rights and board seats, founder vesting schedules, and other terms like anti-dilution, valuation methods for convertible notes, and more. The document provides examples to illustrate concepts like liquidation preferences and anti-dilution calculations.