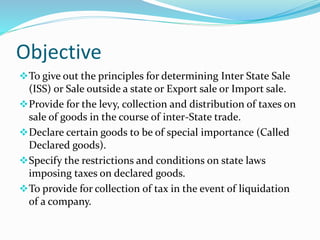

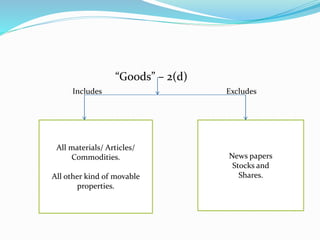

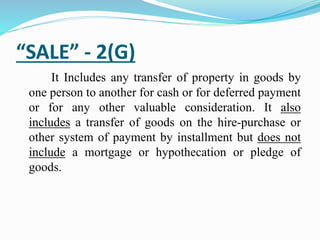

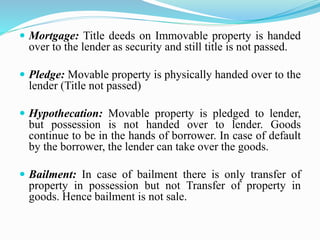

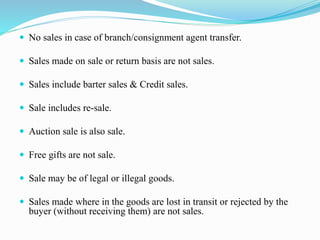

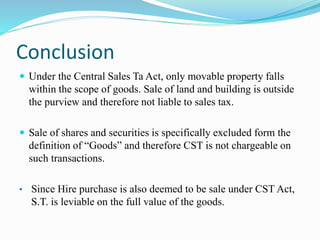

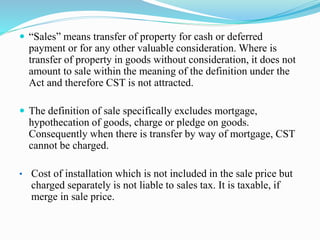

The Central Sales Tax Act provides principles for determining inter-state sales and levies tax on sales occurring during inter-state trade. It aims to regulate state sales taxes on declared goods moving between states. Only movable property is considered goods under the Act. A sale involves the transfer of property in goods for consideration, excluding transfers like mortgages or pledges where ownership is not passed. Various transactions like hire purchases or barter trades are included in the definition of sale.