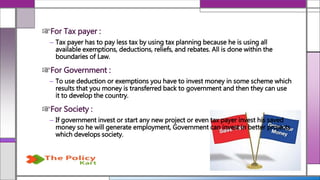

The document discusses tax planning, tax avoidance, and tax evasion, emphasizing the legal and illegal methods of reducing tax liabilities. Tax planning involves arranging financial affairs within legal frameworks to benefit from exemptions and deductions without evading taxes, while tax avoidance uses legal loopholes, and tax evasion involves illegal activities. Effective tax planning is portrayed as beneficial for taxpayers, governments, and society by ensuring compliance while supporting economic development and social projects.