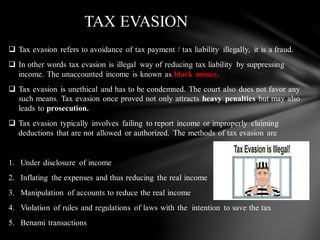

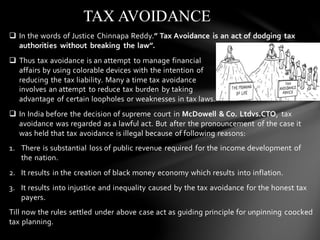

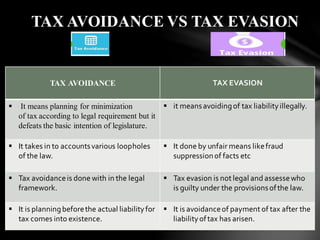

This document discusses tax evasion, tax avoidance, and tax planning in India. It defines each term and explains the differences between them. Tax evasion is illegal and involves failing to report income or improperly claiming deductions. Tax avoidance uses legal loopholes to reduce tax liability but still defeats the intention of tax laws. Tax planning is the recommended approach, as it involves legitimate strategies like maximizing deductions, investments, and year-end planning to minimize tax burden. The document also outlines some common penalties for tax non-compliance in India.