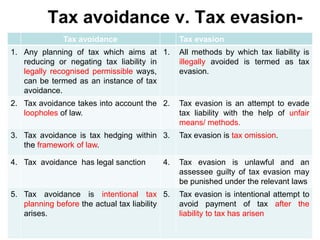

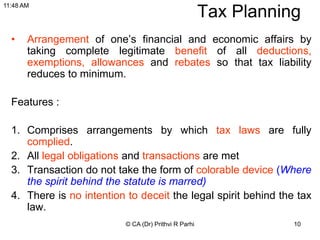

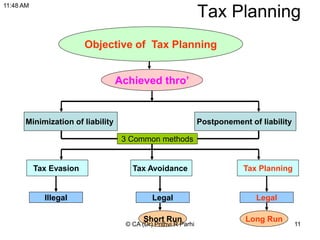

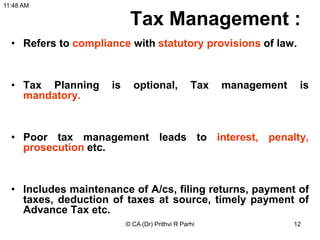

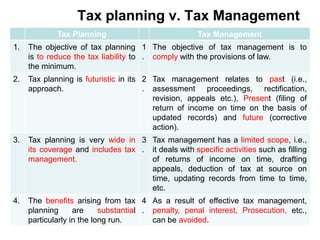

This document discusses various topics related to tax planning including tax evasion, tax avoidance, tax planning, tax management, the need for tax planning, and limitations of tax planning. It defines key terms such as tax evasion as illegally avoiding tax liability, tax avoidance as legally minimizing tax liability, and tax planning as arranging one's affairs to reduce tax liability. The document notes the importance of tax planning to save tax, defer liability, and gain incidental benefits, but also limitations such as complexity that may require expert advice or lead to litigation.

![Tax Evasion

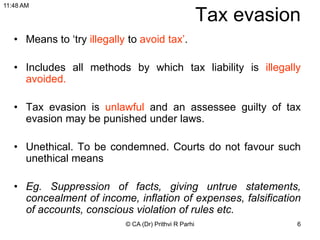

All method by which tax liability is illegally avoided are termed as tax evasion. An

assesse guilty of tax evasion may be punished under the relevant law.

Tax` evasion may involve stating an untrue statement knowingly, submitting

misleading documents, suppression of facts, not maintaining proper accounts of

income earned (if required under law), omission of material facts on assessment.

All such procedures and method are required by the statute to be abided with but

the assessee who dishonestly claims the benefit under the statue before complying

with the said abidance by making false statements, would be within the ambit of tax

evasion.

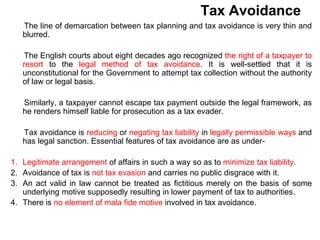

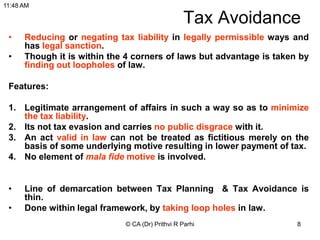

A person may plan his finances in such a manner, strictly within the four corners of

the taxing statue that his tax liability is minimised or made nil.

If this is done and as observed strictly in accordance with and taking advantage of

the provision contained in the Act, by no stretch of imagination can it be said that

payment of tax has been evaded for.

In the context of payment of tax, ‘evasion’ necessarily means, ‘to try illegally to avoid

paying tax’ – CIT v. Sri Abhayananda Rath Family Benefit Trust [2002] 123 Taxman

81 (Ori.).](https://image.slidesharecdn.com/taxplanningbasics-200610063619/85/Tax-Planning-Basics-5-320.jpg)