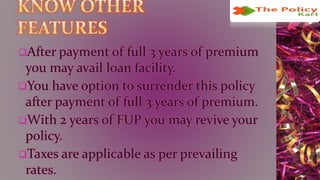

LIC's Jeevan Pragati, launched on February 3, 2016, is a non-linked, with-profit endowment assurance plan providing a mix of protection and savings. The policy offers increasing death benefits every five years, along with optional riders and liquidity options such as loans and surrenders. It includes tax benefits and allows for assignment and nomination, with a free look period of 15 days.