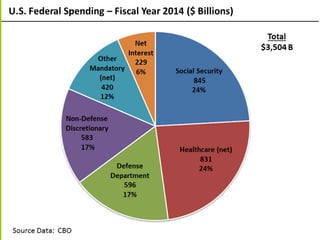

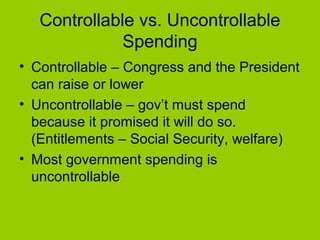

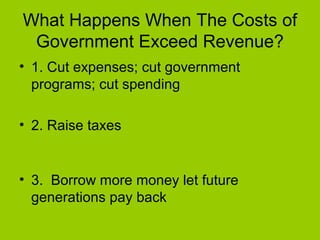

The document discusses different types of taxes paid by Americans and how tax revenue is used by the federal government. It describes major tax types like income tax, corporate tax, payroll taxes, excise taxes, estate and gift taxes, customs duties, and sales taxes. It also discusses how tax revenue is spent on government programs and services, how the federal budget is created, and what happens when costs exceed tax revenue through cutting spending, raising taxes, or increasing the national debt.