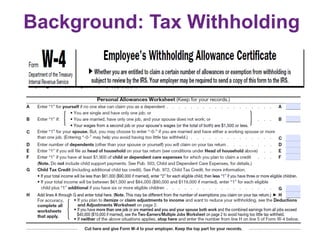

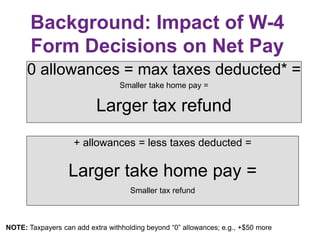

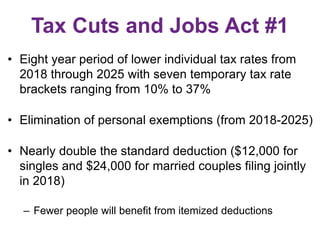

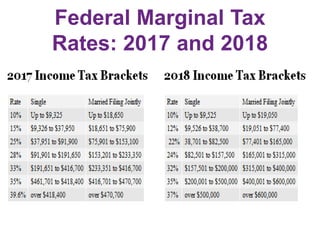

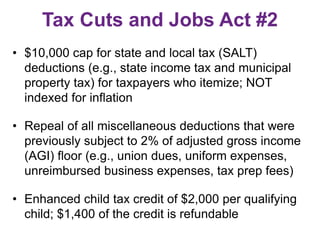

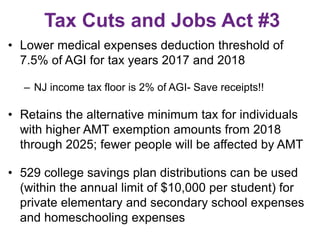

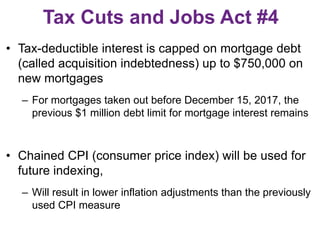

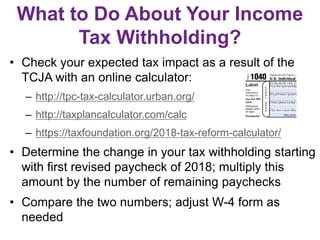

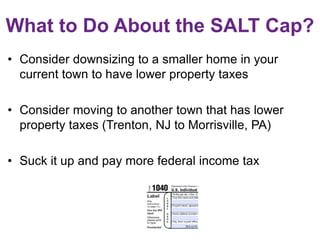

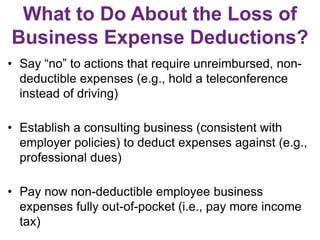

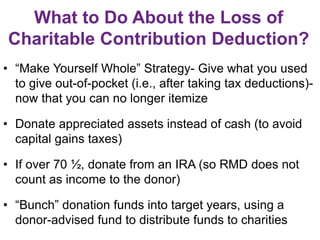

The Tax Cuts and Jobs Act of 2017 made significant changes to the US tax code that will impact taxpayers. It lowered tax rates for individuals and doubled the standard deduction. However, it also capped state and local tax deductions, eliminated miscellaneous deductions, and increased the child tax credit. The act is temporary and many provisions will expire after 2025. Taxpayers need to check their withholding and adjust their W-4 forms to avoid underpayment of taxes owed or overpayment resulting in smaller refunds.