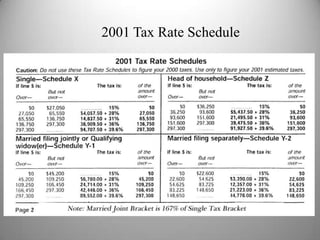

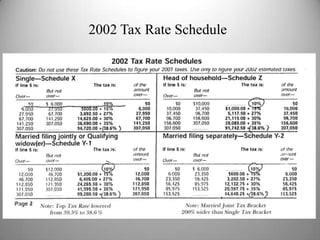

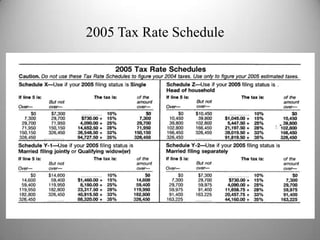

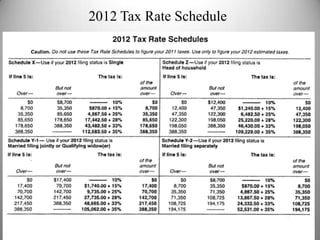

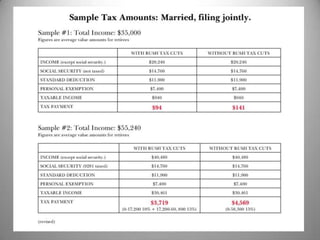

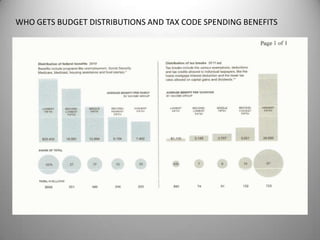

This document summarizes the tax code changes and spending cuts that would go into effect on January 1, 2013 if Congress fails to act, known as the "fiscal cliff." Most individual income tax rates would increase substantially. Capital gains and dividend tax rates would also rise significantly. Spending cuts of 9.4% for defense and 8.2% for non-defense programs would take effect. The Congressional Budget Office predicts this would cause the economy to enter a recession with unemployment rising to over 9%. There is debate around a more balanced approach that raises revenues through tax reform in addition to spending cuts.