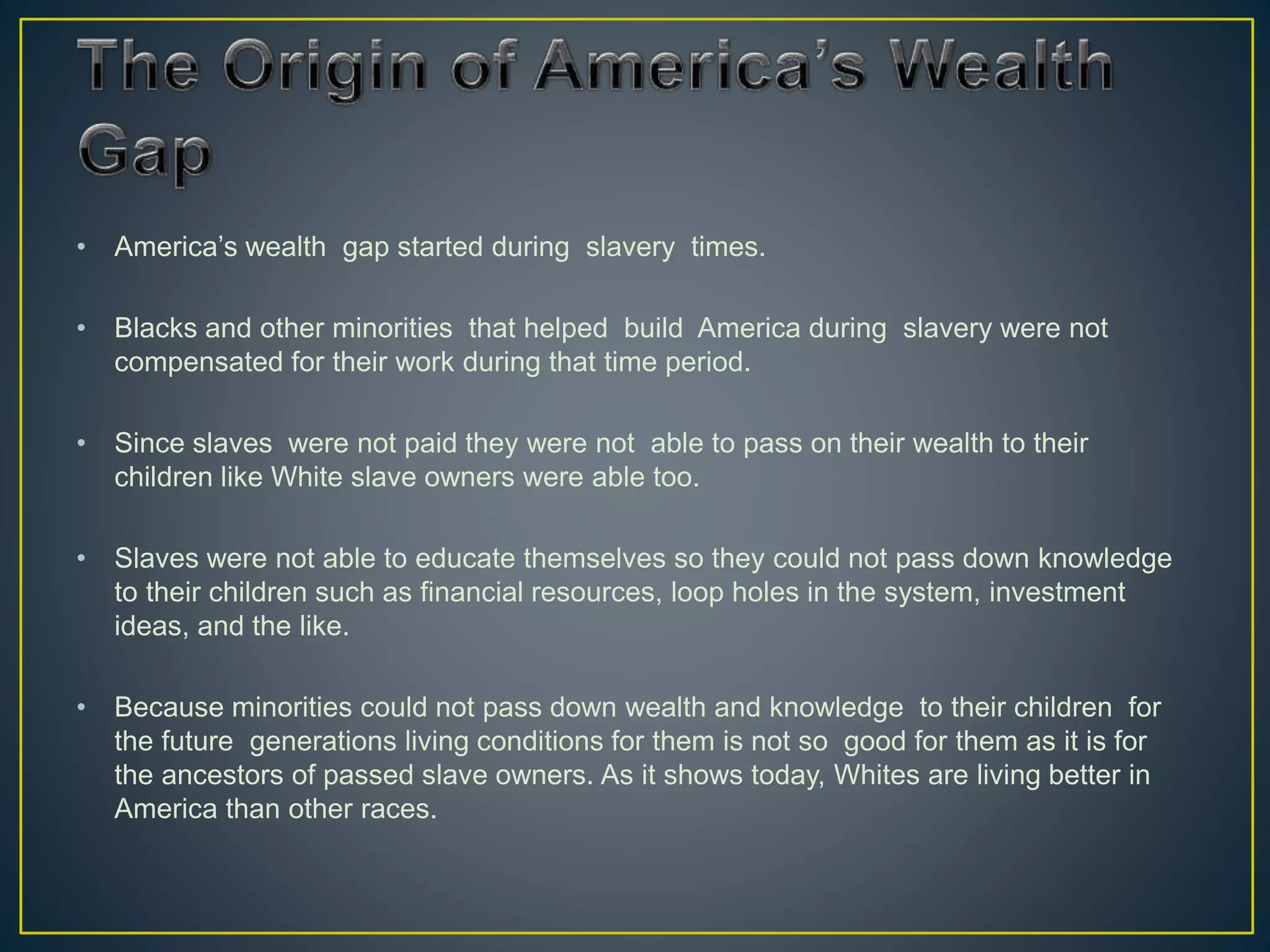

The document discusses how America's wealth gap originated during slavery and has persisted due to systemic inequalities. Slaves were unable to be compensated for their work, pass on wealth, or gain financial knowledge, putting African Americans at a long-term economic disadvantage compared to whites. Centuries later, statistics still show large disparities in net worth, homeownership, and the impacts of recessions between black and white households. Contributing factors discussed include tax policies that benefit the wealthy, bailouts of major corporations that prioritized shareholder profits over workers, and influence of wealthy donors on political decisions. The document argues these types of actions have exacerbated the wealth gap in America.