Tax alert service tax - 13.01.2017

•

0 likes•857 views

The document summarizes changes to India's service tax law that take effect on January 22, 2017. For tour operators, the taxable value increases to 60% but credit can be claimed on all input services. For transportation of goods by vessel, service tax will now be payable under reverse charge if a foreign supplier engages a foreign service provider to transport goods from outside India to an Indian customs station. The person liable will be whoever complies with the relevant sections of India's Customs Act regarding those goods.

Report

Share

Report

Share

Download to read offline

Recommended

Budget 2017-2018 - analysis of indirect tax proposals - general

“There is no significant loss or gain in my indirect tax proposals. – para 181 of FM Speech on 01.02.2017

This entire presentation is linked with English, Hindi and Tamil Film Titles for the purpose of creativity and humor and has no connection with the film or its contents.

Budget 2017-18 - analysis of direct tax proposals

No change in tax slabs

The rate of income tax for individuals and HUF within the slab of 2.5 lakhs to Rs. 5 lakhs reduced from 10% to 5%.

Additional surcharge of 10% on the tax payable by a person having total income exceeding Rs. 50 lakhs but not exceeding Rs. 1 crore.

Service tax alert

CHANGES W.E.F. 01.06.2015

Section 66B – Rate of Service Tax - Increased

The rate of service tax has been increased from 12% to 14% subsuming cess.

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Newsletter june 2016

Tax Quest

Finance Act, 2016 has effected a number of changes that are effective from 01.06.2016 and this

alert seeks to provide a brief view on such changes.

1. Service Tax on Ocean Freight – Import Segment

WITHHOLDING ON GRATUITY PAYMENT SUPREME COURT OF INDIA

Key Takeaways:

- Facts of the case

- Issues and Orders of the case

- Contention of the parties

- Observations by Honourable Supreme Court

- Conclusions

Recommended

Budget 2017-2018 - analysis of indirect tax proposals - general

“There is no significant loss or gain in my indirect tax proposals. – para 181 of FM Speech on 01.02.2017

This entire presentation is linked with English, Hindi and Tamil Film Titles for the purpose of creativity and humor and has no connection with the film or its contents.

Budget 2017-18 - analysis of direct tax proposals

No change in tax slabs

The rate of income tax for individuals and HUF within the slab of 2.5 lakhs to Rs. 5 lakhs reduced from 10% to 5%.

Additional surcharge of 10% on the tax payable by a person having total income exceeding Rs. 50 lakhs but not exceeding Rs. 1 crore.

Service tax alert

CHANGES W.E.F. 01.06.2015

Section 66B – Rate of Service Tax - Increased

The rate of service tax has been increased from 12% to 14% subsuming cess.

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Newsletter june 2016

Tax Quest

Finance Act, 2016 has effected a number of changes that are effective from 01.06.2016 and this

alert seeks to provide a brief view on such changes.

1. Service Tax on Ocean Freight – Import Segment

WITHHOLDING ON GRATUITY PAYMENT SUPREME COURT OF INDIA

Key Takeaways:

- Facts of the case

- Issues and Orders of the case

- Contention of the parties

- Observations by Honourable Supreme Court

- Conclusions

Service tax amendments by union budget,2015

Presentation on major service tax changes by Union Budget,2015

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...DVSResearchFoundatio

Key Takeaways:

- Background of the provision

- Facts of the case

- Contentions of the parties

- Final ruling

- Key observationsService Tax-Budget impact, 2016

There are so many changes done by Finance Bill, 2016 in various Act's. Provisions for service tax has also been amended or proposed to be amended. This budget was much awaited because a massive change is awaiting in the form of GST. Looking, to the large number of changes, we have consolidated changes with respect to Service tax in one presentation. Changes are classified according to subject in order to ensure ease of understanding.

Basic provisons of service tax regime ppt

This PPT will help you in understanding the Negative List approach in Taxation of Services and the amended provisions & rules therein.

Export Refund under GST Laws Final

Coverage

Zero Rated Supplies

Detailed Analysis of Section 54

Types of Export Refunds under GST

Export of Goods upon Payment of IGST

Export of Services upon Payment of IGST

Export of Goods/services under BOND/LUT

Export of Goods/Services to SEZ

Refund if any for Supplies to Merchant Exporter

Refund for Deemed Exports

Procedural Aspects relating to Refund claims

Interest for delayed Refunds

Credit of Amount Rejected as Refund Claims

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Chapter V - Eligibility and conditions for taking credit

Service Tax Proposals in Budget 2016

You will get to know about changes proposed in Finance Budget 2016 in India with respect to service tax provisions and its impact on the industry.

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Hello Friends ,

This slides contains

1) Service Tax Amendments Finance Act 2016

2) CENVAT Rules Amendments Fiance Act 2016

3) Case Laws-

a) No Service Tax on FLats where value of land is included.

b) No Service Tax Audit by Departmental Person

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...DVSResearchFoundatio

Key Takeaways:

- Background and Overview of Legal Provision

- Facts of the Case

- Contentions of the Assessee and Revenue

- Supreme Court's Verdict

- Key Learnings and Way ForwardAnalysis of Proposed Amendments in GST Law in Budget 2021

Sharing our analysis of Proposed Amendments in GST Law in Budget 2021

Demonetisation and income tax

On 12th January 1946, Rs. 500 was demonetized and people were given 10 days for exchange. After this period explanation was required as to why exchange was not done in the first 10 days.

The Scheme was a failure as out of the total issue of Rs. 143.97 crores of High Denomination Notes, Rs. 134.90 crores were exchanged. Thus only Rs. 9 crores were demonetized.

1946 exercise turned out to be only an exchange.

More Related Content

What's hot

Service tax amendments by union budget,2015

Presentation on major service tax changes by Union Budget,2015

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...DVSResearchFoundatio

Key Takeaways:

- Background of the provision

- Facts of the case

- Contentions of the parties

- Final ruling

- Key observationsService Tax-Budget impact, 2016

There are so many changes done by Finance Bill, 2016 in various Act's. Provisions for service tax has also been amended or proposed to be amended. This budget was much awaited because a massive change is awaiting in the form of GST. Looking, to the large number of changes, we have consolidated changes with respect to Service tax in one presentation. Changes are classified according to subject in order to ensure ease of understanding.

Basic provisons of service tax regime ppt

This PPT will help you in understanding the Negative List approach in Taxation of Services and the amended provisions & rules therein.

Export Refund under GST Laws Final

Coverage

Zero Rated Supplies

Detailed Analysis of Section 54

Types of Export Refunds under GST

Export of Goods upon Payment of IGST

Export of Services upon Payment of IGST

Export of Goods/services under BOND/LUT

Export of Goods/Services to SEZ

Refund if any for Supplies to Merchant Exporter

Refund for Deemed Exports

Procedural Aspects relating to Refund claims

Interest for delayed Refunds

Credit of Amount Rejected as Refund Claims

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Chapter V - Eligibility and conditions for taking credit

Service Tax Proposals in Budget 2016

You will get to know about changes proposed in Finance Budget 2016 in India with respect to service tax provisions and its impact on the industry.

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Hello Friends ,

This slides contains

1) Service Tax Amendments Finance Act 2016

2) CENVAT Rules Amendments Fiance Act 2016

3) Case Laws-

a) No Service Tax on FLats where value of land is included.

b) No Service Tax Audit by Departmental Person

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...DVSResearchFoundatio

Key Takeaways:

- Background and Overview of Legal Provision

- Facts of the Case

- Contentions of the Assessee and Revenue

- Supreme Court's Verdict

- Key Learnings and Way ForwardAnalysis of Proposed Amendments in GST Law in Budget 2021

Sharing our analysis of Proposed Amendments in GST Law in Budget 2021

What's hot (20)

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...

Applicability of sec 194C for Truck Operators:Analysis of SC Ruling - Choudha...

A Presentation on Service Tax Overview and Recent Developments dated 06.07....

A Presentation on Service Tax Overview and Recent Developments dated 06.07....

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...

Automatic Vacation of Stay Granted by Tribunal: Analysis of SC Ruling DCIT vs...

Analysis of Proposed Amendments in GST Law in Budget 2021

Analysis of Proposed Amendments in GST Law in Budget 2021

Viewers also liked

Demonetisation and income tax

On 12th January 1946, Rs. 500 was demonetized and people were given 10 days for exchange. After this period explanation was required as to why exchange was not done in the first 10 days.

The Scheme was a failure as out of the total issue of Rs. 143.97 crores of High Denomination Notes, Rs. 134.90 crores were exchanged. Thus only Rs. 9 crores were demonetized.

1946 exercise turned out to be only an exchange.

Gst - Enrolment plan

Enrolment Plan for your State

The schedule of the enrolment activation drive for states is given below. We encourage you to complete the enrolment during the specified dates. However, the window will be open till 31/01/2017 for those who miss the chance.

Taxation Issues w.r.t. Demonetisation

The recent move of the Indian government to demonetise the currency notes of Rs. 500 & Rs. 1000 denominations has resulted in a huge furore throughout India. It has thrown up a large number of tax related issues. Some of these are covered in this presentation that was prepared on 20th November.

Effects of Demonetisation

The current situation of overnight demonetisation of 500 and 1000 Rupee notes has created havoc in the country.

In one of the historical reforms of the economy of India, Rs 500 and Rs 1,000 notes were banned effective on 9th November , Tuesday midnight. This was one of the boldest movements by the Government of India.Overall, this scheme is going to impact the businesses, the common man, and financial institutions – all at some level or the other.

Customs act 1962

A brief overview of Customs Act and Customs provisions applicable to Central Excise.

Prepared by Debjyoti Bhattacharyya

Viewers also liked (8)

Questions and answers on customs act from the different chapters

Questions and answers on customs act from the different chapters

Similar to Tax alert service tax - 13.01.2017

Service tax alert

Covers the recent withdrawal of exemption of applicability of service tax on inbound cargo services

Analysis of Finance Act,2020 vis a-vis GST

Analysis of Finance Act, 2020 vis-à-vis GST

The Finance Act, 2020 has made several amendments to the CGST Act, 2017 and corresponding amendments to the IGST Act, 2017 and UTGST Act, 2017. We have attempted to analyse the provision wise amendment made by the Finance Act, 2020 to the CGST Act, 2017.

Changes proposed in service tax by union budget 2016 17

Changes proposed in service tax by union budget 2016 17

Service tax 1994

Gives idea about the service tax which was introduced in 1994 with an object of broadening the tax base and augmentation of governments revenue.

Snr budget 2020 indirect tax proposals

Honourable Finance Minister Nirmala Sitharaman has presented her second Union Budget in the Parliament on 01 February 2020.This Budget focused on bringing a series of measures aimed at promoting investments in the country, creating a world class infrastructure and stimulating economic growth.

Introducing New Government Regulation on Toll Road.pdf

For nearly two decades, Government Regulation Number 15 of 2005 on Toll Roads ("GR No. 15/2005") has served as the cornerstone of toll road legislation. However, with the emergence of various new developments and legal requirements, the Government has enacted Government Regulation Number 23 of 2024 on Toll Roads to replace GR No. 15/2005. This new regulation introduces several provisions impacting toll business entities and toll road users. Find out more out insights about this topic in our Legal Brief publication.

Summary of changes in vat deduction at source sandra & associates

Every year Bangladesh Government brings changes in the VAT law. In 2019, Bangladesh Government brought a new law called Value Added Tax and Supplementary Duty 2012.

This snapshot reflects the differences between the two laws in respect to withholding VAT regime. I hope the users will find this helpful

Recent Amendments in Service Tax

Amendments made by Finance Act 2016 and thereafter till 22nd June 2016

Budget 2014 - Indirect Tax Provisions

Analysis of Amendments in Service Tax provisions, Highlights of amendment made in Central Excise Act and Customs Act proposed in Union Budget, 2014.

Union Budget 2017-18: Overview of indirect taxes - Dr Sanjiv Agarwal

Union Budget 2017-18: Overview of indirect taxes - Dr Sanjiv Agarwal - Article published in Business Advisor, dated February 10, 2017 - http://www.magzter.com/IN/Shrinikethan/Business-Advisor/Business/

Similar to Tax alert service tax - 13.01.2017 (20)

Changes proposed in service tax by union budget 2016 17

Changes proposed in service tax by union budget 2016 17

Introducing New Government Regulation on Toll Road.pdf

Introducing New Government Regulation on Toll Road.pdf

Summary of changes in vat deduction at source sandra & associates

Summary of changes in vat deduction at source sandra & associates

Union Budget 2017-18: Overview of indirect taxes - Dr Sanjiv Agarwal

Union Budget 2017-18: Overview of indirect taxes - Dr Sanjiv Agarwal

More from oswinfo

Mcci session 1 - 18.04.2017 - GST

VAT driven local purchases

Cost driven CST purchases

Duty burden on imports

Complex State Laws

Ever changing tax landscape

Different decisions on the same issue

Border controls

GST - Levy - Supply - Business Impact

VAT driven local purchases

Cost driven CST purchases

Duty burden on imports

Complex State Laws

Ever changing tax landscape

Different decisions on the same issue

Border controls

Tax Quest - November 2016 - GST Special

The Goods & Service Tax regime is most likely to become a reality from April 2017. The Government of India has been taking a number of steps at unbelievable speed to implement the new regime. Following the Model Law, the Draft Rules for registration, payment, invoice, returns and refunds were released. The Government has also released an FAQ on GST.

Taxsutra gst - the constitutional debate

The mood is positive for GST with the Congress appearing to soften its stand and press reports indicating a possible five hour debate in the Parliament on the 122nd Constitutional Amendment.

Newsletter july 2016

Section 206AA – Rule 37BC

Central Board of Direct Taxes vide Notification No. 53/2016 dated 24.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 37BC through the IT (17th Amendment) Rules, 2016.

Taxsutra e-commerce - gst

The e-commerce boom was marked by multiple players, rosy valuations and now slowly reality has set in and the price wars have taken their toll. The VAT authorities across the country have had their tryst with this industry with notices, demands, levy of entry tax and litigation. Currently whenever there is a tax or a business problem, the immediate response from the industry or the administrator or the media is that GST is the only solution.

Real infra - june 2016

Section 65(105)(zzzh) provides for a levy of service tax on services in relation to ‘construction of complex’ and an explanation was added by Finance Act, 2010.

Equalisation levy 11.06.2016

The new law provides for an equalisation levy of 6% on the amount of consideration received, or receivable on specified services carried on by a non-resident not having a permanent establishment in India.

Article co-owners of house property - dt & dt implications

When more than one person owns a property and the said property realizes revenue in the form of rent and interest on loan is involved, direct and indirect tax implications require examination in the light of relevant statutory provisions and judicial precedents.

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of indirect tax proposals - general

Budget 2016-2017 - analysis of indirect tax proposals - general

Tnvat recent changes - effective from 29.01.2016

Major amendments have been carried out to the TNVAT Act and Rules and the amendments are effective from 29.01.2016.

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

More from oswinfo (20)

Article co-owners of house property - dt & dt implications

Article co-owners of house property - dt & dt implications

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of indirect tax proposals - general

Budget 2016-2017 - analysis of indirect tax proposals - general

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

Tax alert rains in tamil nadu - extension and other matters

Recently uploaded

Counting Class for Micro Observers 2024.pptx

Duties of Micro Observers during election counting to Parliament / Assembly Constituency

一比一原版(QUT毕业证)昆士兰科技大学毕业证成绩单

QUT毕业证【微信95270640】☀️原版仿制昆士兰科技大学毕业证书扫描件本科学位证书【办证Q微信95270640】QUT毕业证书扫描件原版仿制毕业成绩单,能完美还原海外各大学QUTBachelor Diploma degree, Master Diploma(本科/硕士昆士兰科技大学毕业证书、成绩单)QUT大学Offer录取通知书、雅思成绩单、托福成绩单、雅思托福代考、语言证书、学生卡、高仿留服认证书等毕业/入学/在读材料。1:1完美还原海外各大学毕业材料上的昆士兰科技大学毕业证书扫描件本科学位证书QUT毕业证书扫描件原版仿制毕业成绩单工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪。

(诚招代理)办理国外高校毕业证成绩单文凭学位证,真实使馆公证(留学回国人员证明)真实留信网认证国外学历学位认证雅思代考国外学校代申请名校保录开请假条改GPA改成绩ID卡

1.高仿业务:【本科硕士】毕业证,成绩单(GPA修改),学历认证(教育部认证),大学Offer,,ID,留信认证,使馆认证,雅思,语言证书等高仿类证书;

2.认证服务: 学历认证(教育部认证),大使馆认证(回国人员证明),留信认证(可查有编号证书),大学保录取,雅思保分成绩单。

3.技术服务:钢印水印烫金激光防伪凹凸版设计印刷激凸温感光标底纹镭射速度快。

办理昆士兰科技大学昆士兰科技大学硕士毕业证成绩单流程:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

-办理真实使馆公证(即留学回国人员证明)

-办理各国各大学文凭(世界名校一对一专业服务,可全程监控跟踪进度)

-全套服务:毕业证成绩单真实使馆公证真实教育部认证。让您回国发展信心十足!

(详情请加一下 文凭顾问+微信:95270640)欢迎咨询!小便处山娃很想笑却怎么也笑不出来山娃很迷惑父亲的家除了一扇小铁门连窗户也没有墓穴一般阴森森有些骇人父亲的城也便成了山娃的城父亲的家也便成了山娃的家父亲让山娃呆在屋里做作业看电视最多只能在门口透透气不能跟陌生人搭腔更不能乱跑一怕迷路二怕拐子拐人山娃很惊惧去年村里的田鸡就因为跟父亲进城一不小心被人拐跑了至今不见踪影害得田鸡娘天天哭得死去活来疯了一般那情那景无不令人摧肝裂肺山娃很听话天天呆在小屋里除了地

Many ways to support street children.pptx

By raising awareness, providing support, advocating for change, and offering assistance to children in need, individuals can play a crucial role in improving the lives of street children and helping them realize their full potential

Donate Us

https://serudsindia.org/how-individuals-can-support-street-children-in-india/

#donatefororphan, #donateforhomelesschildren, #childeducation, #ngochildeducation, #donateforeducation, #donationforchildeducation, #sponsorforpoorchild, #sponsororphanage #sponsororphanchild, #donation, #education, #charity, #educationforchild, #seruds, #kurnool, #joyhome

What is the point of small housing associations.pptx

Given the small scale of housing associations and their relative high cost per home what is the point of them and how do we justify their continued existance

一比一原版(WSU毕业证)西悉尼大学毕业证成绩单

WSU毕业证【微信95270640】《西悉尼大学毕业证书》《QQ微信95270640》学位证书电子版:在线制作西悉尼大学毕业证成绩单GPA修改(制作WSU毕业证成绩单WSU文凭证书样本)、西悉尼大学毕业证书与成绩单样本图片、《WSU学历证书学位证书》、西悉尼大学毕业证案例毕业证书制作軟體、在线制作加拿大硕士学历证书真实可查.

[留学文凭学历认证(留信认证使馆认证)西悉尼大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理西悉尼大学西悉尼大学毕业证假文凭信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。碌爬起把牛驱到后龙山再从莲塘里采回一蛇皮袋湿漉漉的莲蓬也才点多点半早就吃过早餐玩耍去了山娃的家在闽西山区依山傍水山清水秀门前潺潺流淌的蜿蜒小溪一直都是山娃和小伙伴们盛夏的天然泳场水不深碎石底石缝里总有摸不尽的鱼虾活蹦乱跳的还有乌龟和王八贼头贼脑的倒也逗人喜爱日上三竿时山娃总爱窜进自家瓜棚里跟小伙伴们坐着聊天聊着聊着便忍不住往瓜田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就之

快速制作(ocad毕业证书)加拿大安大略艺术设计学院毕业证本科学历雅思成绩单原版一模一样

原版纸张【微信:741003700 】【(ocad毕业证书)加拿大安大略艺术设计学院毕业证】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Uniform Guidance 3.0 - The New 2 CFR 200

This session provides a comprehensive overview of the latest updates to the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (commonly known as the Uniform Guidance) outlined in the 2 CFR 200.

With a focus on the 2024 revisions issued by the Office of Management and Budget (OMB), participants will gain insight into the key changes affecting federal grant recipients. The session will delve into critical regulatory updates, providing attendees with the knowledge and tools necessary to navigate and comply with the evolving landscape of federal grant management.

Learning Objectives:

- Understand the rationale behind the 2024 updates to the Uniform Guidance outlined in 2 CFR 200, and their implications for federal grant recipients.

- Identify the key changes and revisions introduced by the Office of Management and Budget (OMB) in the 2024 edition of 2 CFR 200.

- Gain proficiency in applying the updated regulations to ensure compliance with federal grant requirements and avoid potential audit findings.

- Develop strategies for effectively implementing the new guidelines within the grant management processes of their respective organizations, fostering efficiency and accountability in federal grant administration.

The Role of a Process Server in real estate

A process server is a authorized person for delivering legal documents, such as summons, complaints, subpoenas, and other court papers, to peoples involved in legal proceedings.

一比一原版(Adelaide毕业证)阿德莱德大学毕业证成绩单

Adelaide毕业证【微信95270640】国外文凭购买阿德莱德大学留信认证毕业证书印刷品《Q微信95270640》学历认证怎么做:原版仿制阿德莱德大学电子版成绩单毕业证认证《阿德莱德大学毕业证成绩单》、阿德莱德大学文凭证书成绩单复刻offer录取通知书、购买Adelaide圣力嘉学院本科毕业证、《阿德莱德大学毕业证办理Adelaide毕业证书哪里买》、阿德莱德大学 Offer在线办理Adelaide Offer阿德莱德大学Bachloer Degree。

【实体公司】办阿德莱德大学阿德莱德大学硕士学位证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.阿德莱德大学毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供阿德莱德大学阿德莱德大学硕士学位证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640光总是太短太匆忙记得今年正月就在父亲扛起蛇皮袋将要跨出门槛的一刹那山娃突然抱紧父亲的大腿嚎啕大哭父亲吃力地掰开山娃的手哽咽道山娃好好听话好好念书到了暑假爸也接你进城爸的城好远好大好美山娃于是天天扳着手指算计着读书也格外刻苦无奈时间总过得太慢太慢每次父亲往家打电话山娃总抢着接听一个劲地提醒父亲别忘了正月说的话电话那头总会传来父亲嘿嘿的笑连连说记得记得但别忘了拿奖状进城啊考试一结束山娃就迫不及待地给间

ZGB - The Role of Generative AI in Government transformation.pdf

This keynote was presented during the the 7th edition of the UAE Hackathon 2024. It highlights the role of AI and Generative AI in addressing government transformation to achieve zero government bureaucracy

Canadian Immigration Tracker March 2024 - Key Slides

Highlights

Permanent Residents decrease along with percentage of TR2PR decline to 52 percent of all Permanent Residents.

March asylum claim data not issued as of May 27 (unusually late). Irregular arrivals remain very small.

Study permit applications experiencing sharp decrease as a result of announced caps over 50 percent compared to February.

Citizenship numbers remain stable.

Slide 3 has the overall numbers and change.

一比一原版(ANU毕业证)澳大利亚国立大学毕业证成绩单

ANU毕业证【微信95270640】《澳大利亚国立大学学位证书》【Q微信95270640】《ANU研究生文凭证书》【澳大利亚国立大学毕业证书成绩单找工作】办理硕士毕业证成绩单在校证明【Q微信95270640】《澳大利亚国立大学硕士学位证书购买》《ANU学士学历文凭证书办理》《澳大利亚国立大学学位证书本科学历》【Q微信95270640】伪造《ANU学士毕业证成绩单》 历认证 学习时间毕业证在线【Q微信95270640】毕业证『做ANU毕业证成绩单仿制』毕业证留信网认证包过学历认证【Q微信95270640】做学费单《毕业证明信-推荐信》成绩单,录取通知书,Offer,在读证明,【Q微信95270640】雅思托福成绩单,真实大使馆教育部认证,回国人员证明,留信网认证。网上存档永久可查!◆办理真实使馆认证(即留学回国人员证明,不成功不收费!!!)

[留学文凭学历认证(留信认证使馆认证)澳大利亚国立大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理澳大利亚国立大学澳大利亚国立大学毕业证假文凭信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。咋的叫声是否就是这最后的点睛之笔悠然走在林间的小路上宁静与清香一丝丝的盛夏气息吸入身体昔日生活里的繁忙与焦躁早已淡然无存心中满是悠然清淡的芳菲身体不由的轻松脚步也感到无比的轻快走出这盘栾交错的小道眼前是连绵不绝的山峦浩荡天地间大自然毫无吝啬的展现它的磅礴与绚美淡淡熏香细腻游滑的飘荡在鼻尖茂密的树木遍布起立在漫山遍野绿幽幽的景色这是盛夏才有的芳菲啊宁静之中悠然的心情多了些许阔达想起那些曾经环绕心头睡

Understanding the Challenges of Street Children

By raising awareness, providing support, advocating for change, and offering assistance to children in need, individuals can play a crucial role in improving the lives of street children and helping them realize their full potential

Donate Us

https://serudsindia.org/how-individuals-can-support-street-children-in-india/

#donatefororphan, #donateforhomelesschildren, #childeducation, #ngochildeducation, #donateforeducation, #donationforchildeducation, #sponsorforpoorchild, #sponsororphanage #sponsororphanchild, #donation, #education, #charity, #educationforchild, #seruds, #kurnool, #joyhome

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

Powerpoint 2024 Street Maintenance Program Admendment

Recently uploaded (20)

What is the point of small housing associations.pptx

What is the point of small housing associations.pptx

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

PNRR MADRID GREENTECH FOR BROWN NETWORKS NETWORKS MUR_MUSA_TEBALDI.pdf

PNRR MADRID GREENTECH FOR BROWN NETWORKS NETWORKS MUR_MUSA_TEBALDI.pdf

ZGB - The Role of Generative AI in Government transformation.pdf

ZGB - The Role of Generative AI in Government transformation.pdf

Canadian Immigration Tracker March 2024 - Key Slides

Canadian Immigration Tracker March 2024 - Key Slides

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

Tax alert service tax - 13.01.2017

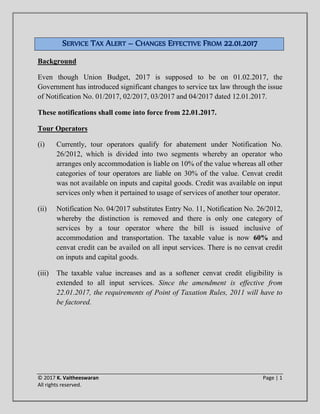

- 1. © 2017 K. Vaitheeswaran Page | 1 All rights reserved. SERVICE TAX ALERT – CHANGES EFFECTIVE FROM 22.01.2017 Background Even though Union Budget, 2017 is supposed to be on 01.02.2017, the Government has introduced significant changes to service tax law through the issue of Notification No. 01/2017, 02/2017, 03/2017 and 04/2017 dated 12.01.2017. These notifications shall come into force from 22.01.2017. Tour Operators (i) Currently, tour operators qualify for abatement under Notification No. 26/2012, which is divided into two segments whereby an operator who arranges only accommodation is liable on 10% of the value whereas all other categories of tour operators are liable on 30% of the value. Cenvat credit was not available on inputs and capital goods. Credit was available on input services only when it pertained to usage of services of another tour operator. (ii) Notification No. 04/2017 substitutes Entry No. 11, Notification No. 26/2012, whereby the distinction is removed and there is only one category of services by a tour operator where the bill is issued inclusive of accommodation and transportation. The taxable value is now 60% and cenvat credit can be availed on all input services. There is no cenvat credit on inputs and capital goods. (iii) The taxable value increases and as a softener cenvat credit eligibility is extended to all input services. Since the amendment is effective from 22.01.2017, the requirements of Point of Taxation Rules, 2011 will have to be factored.

- 2. © 2017 K. Vaitheeswaran Page | 2 All rights reserved. Transportation of Goods by Vessel (i) When ocean freight was subjected to service tax from 01.06.20116, there was no tax impact when a foreign supplier of goods engaged a foreign liner and both the provider and the receiver of services were located in the non- taxable territory. This was by virtue of Entry No. 34(c), Notification No. 25/2012. (ii) A proviso is being introduced to Entry No. 34, Notification No. 25/2012 w.e.f. 22.01.2017, whereby the exemption is not applicable to services by way of transportation of goods by a vessel from a place outside India upto the customs station of clearance in India. (iii) Service Tax Rules, 1994 are being amended from 22.01.2017 whereby if services are provided by a person located in a non-taxable territory to a person located in a non-taxable territory by way of transportation of goods by vessel from a place outside India upto the customs station of clearance in India, the person liable to pay service tax is the person in India who complies with Sections 29, 30 or 38 read with Section 148 of the Customs Act, 1962 with respect to such goods. Notification No. 30/2012 has also been amended. (iv) The effect of these changes are that when a supplier located in say UK, engages a service provider in UK, for transportation of goods by vessel from a place outside India to the customs station of clearance in India, service tax is payable under reverse charge mechanism by the person who complies with Section 29, 30 or 38 read with Section 148 of the Customs Act, 1962. (v) Section 29 refers to ‘person in charge of the vessel or aircraft’; Section 30 contemplates person in charge of the vessel or aircraft as well as a person other than a carrier who is authorised to issue delivery order in favour of an importer to file an import manifest; Section 38 confers power on the proper officer to require the person in charge to produce documents; Section 148 refers to agents appointed by the person in charge.

- 3. © 2017 K. Vaitheeswaran Page | 3 All rights reserved. WISHING EVERYONE A HAPPY PONGAL, MAKAR SAKRANTI AND LOHRI Disclaimer:- This Service Tax Alert is only for the purpose of information and does not constitute or purport to be an advise or opinion in any manner. The information provided is not intended to create an attorney-client relationship and is not for advertising or soliciting. K.Vaitheeswaran & Co. do not intend in any manner to solicit work through this Tax Alert. The Tax Alert is only to share information based on recent developments and regulatory changes. K.Vaitheeswaran & Co. is not responsible for any error or mistake or omission in this Tax Alert or for any action taken or not taken based on the contents of this Tax Alert. CHENNAI BENGALURU '‘VENKATAGIRI’ Flat No.8/3 and 8/4, Ground Floor, No.8 (Old No.9), Sivaprakasam Street, T. Nagar, Chennai – 600 017. Tel.: 044 + 2433 1029 / 2433 4048 402, Front Wing, House of Lords, 15 / 16, St. Marks Road, Bengaluru – 560 001. Tel.: 092421 78157 Email: vaithilegal@gmail.com vaithilegal@yahoo.co.in Web: www.vaithilegal.com