Money bill vs. finance bill

•

3 likes•1,036 views

The document discusses the difference between introducing the GST bills as a "Money Bill" versus a "Finance Bill". A Money Bill allows the Lok Sabha greater power due to restrictions on the Rajya Sabha's ability to amend or reject it. Introducing GST as a Money Bill would suit the government given its majority in the Lok Sabha. However, opposition parties prefer it be a Finance Bill to allow greater scrutiny and debate by the Rajya Sabha. The Finance Minister has refused to commit to either approach.

Report

Share

Report

Share

Download to read offline

Recommended

Delegated Legislation

It will explain norms and values of delegated legislation in administrative law.

Rules of statutory Interpretation

This is very important and describes Rules of statutory Interpretation

Money bill vs finance bill

In a debate on the constitutional amendment in the Rajya Sabha on Thursday, the Congress party wanted Finance Minister Arun Jaitley to commit that the subsequent GST legislations would be tabled as financial Bills and not as money Bills. He was non-committal, on the ground that these were yet to be prepared.

DIFFERENCE BETWEEN CONSTRUCTION AND INTERPRETATION

Interpretation means the art of finding out the true sense of an enactment by giving the words their natural and ordinary meaning whereas Construction means drawing conclusions in the basis of the true spirit of the enactment.

Interpretation takes place when we look for the original meaning of the constitution. All other forms of constitutional analysis engage in construction

THE CONCEPT OF JUDICIAL REVIEW: A COMPARATIVE STUDY AMONG USA, UK, CANADA, AU...

THE SLIDES SHOW THE THE CONCEPT OF JUDICIAL REVIEW AMONG COUNTRIES LIKE USA, UK, CANADA, AUSTRALIA, FRANCE AND SWITZERLAND

Delegated legialation ppt by prity

This ppt basically covers the all aspects of delegated legislstion. it not only covers its contextual backgrounds but tries to cover its aspects in administrative law. Through this, one can be able to understand each and everything about delegated legislation. It is for the basic learners to the law students too. It identifies the principles of delegated legislation in every field and it puts more emphasis in understanding the basic law behind this concept.

Recommended

Delegated Legislation

It will explain norms and values of delegated legislation in administrative law.

Rules of statutory Interpretation

This is very important and describes Rules of statutory Interpretation

Money bill vs finance bill

In a debate on the constitutional amendment in the Rajya Sabha on Thursday, the Congress party wanted Finance Minister Arun Jaitley to commit that the subsequent GST legislations would be tabled as financial Bills and not as money Bills. He was non-committal, on the ground that these were yet to be prepared.

DIFFERENCE BETWEEN CONSTRUCTION AND INTERPRETATION

Interpretation means the art of finding out the true sense of an enactment by giving the words their natural and ordinary meaning whereas Construction means drawing conclusions in the basis of the true spirit of the enactment.

Interpretation takes place when we look for the original meaning of the constitution. All other forms of constitutional analysis engage in construction

THE CONCEPT OF JUDICIAL REVIEW: A COMPARATIVE STUDY AMONG USA, UK, CANADA, AU...

THE SLIDES SHOW THE THE CONCEPT OF JUDICIAL REVIEW AMONG COUNTRIES LIKE USA, UK, CANADA, AUSTRALIA, FRANCE AND SWITZERLAND

Delegated legialation ppt by prity

This ppt basically covers the all aspects of delegated legislstion. it not only covers its contextual backgrounds but tries to cover its aspects in administrative law. Through this, one can be able to understand each and everything about delegated legislation. It is for the basic learners to the law students too. It identifies the principles of delegated legislation in every field and it puts more emphasis in understanding the basic law behind this concept.

Rule of law of Administrative Law

Rule of Law is important topic for all entrance examination. Here we comparison of Rule of Law in India with U.S.A & England. It is very useful all law students.

topic : Analytical school (jurisprudence)

there is brief description of analytical school of jurisprudence ...

Administrative law 2nd lecture

In this ppt we discuss the basic of administrative law with separation of power. It will helpful for those students who are preparing for law entrance examination. It will be also helpful for those students who are Pursuing LLB or LLM.

Writs

We have discussed about different types of writs and cases related to them. Also discussed about article 32 and 226 of Indian Constitution

Presentationon colourable legislation

This presentation is an attempt to explain the colourable legislation in a simple language with the limitations on it and supported by the landmark cases delivered by the apex court.

Coparcenary in Hindu Law

The present slides relate to the concept of Coparcenary in the Hindu law. Useful for Law students and Professionals.

Parliamentary sovereignty

Parliamentary sovereignty is a most thinkable constitutional principle of UK's west minister system of parliament. So, here we discuss some important issues on parliamentary sovereignty.

AUDI ALTERAM PARTEM: PRINCIPLES OF NATURAL JUSTICE

These slides are regarding Audi Alteram Administrative law is the body of law that governs the activities of administrative agencies of government. Administrative law deals with the decision-making of administrative units of government such as tribunals, boards or commissions in such areas as international trade, manufacturing, taxation, broadcasting, immigration and transport. Administrative law expanded greatly during the twentieth century, as legislative bodies worldwide created more government agencies to regulate the social, economic and political spheres of human interaction.

4. DEFINITION Administrative law deals with the powers and functions of the administrative authorities, the manner in which the powers are to be exercised by them and the remedies that are available to the aggrieved persons when those powers are abused by the authorities. Jain and Jain – Four aspects of Administrative Law. Administrative Law deals with mainly 4 aspects: Composition and the powers of administrative authorities. Fixes the limits of the powers of these authorities. Prescribes the procedure to be followed by these authorities in exercising such powers. Controls these administrative authorities through judicial and other means.

THE PRINCIPLES OF NATURAL JUSTICE Natural justice is a principle that is intended to ensure law with fairness and to secure justice. The Principles of Natural Justice have come out from the need of man to protect himself from the excesses of organized power. The Principles of Natural Justice are considered the basic Human Rights because they attempt to bring justice to the parties naturally. THREE BASIC PILLARS Three core points in the concept of principles of natural justice include: Nemo in propria causa judex, esse debet - No one should be made a judge in his own case, or the rule against bias. Audi alteram partem - Hear the other party, or the rule of fair hearing, or the rule that no one should be condemned unheard. Speaking order or reasoned decision- Speaking order means an order which contains reasons for the decision. No system of law can survive without these three basic pillars.

‘’Audi alteram partum means ‘‘hear the other side’’ or ‘‘no man should be condemned unheard 'or ‘‘both the sides must be heard before passing any order’’. This is the basic requirement of rule of law.

AUDI ALTERAM PARTEM “A party is not to suffer in person or in purse without an opportunity of being heard.’’ It is mainly applicable in the field of administrative action and is regarded as the first principle of civilised jurisprudence. In short, before an order is passed against any person, reasonable opportunity of being heard must be given to him.

The maxim includes two elements • NOTICE. • HEARING.

JUDICIAL REVIEW (Brief Notes)

Judicial review is a process under which executive or legislative actions are subject to review by the judiciary. Judicial Review plays an important role in Indian Judiciary.

Taxsutra gst - the constitutional debate

The mood is positive for GST with the Congress appearing to soften its stand and press reports indicating a possible five hour debate in the Parliament on the 122nd Constitutional Amendment.

More Related Content

What's hot

Rule of law of Administrative Law

Rule of Law is important topic for all entrance examination. Here we comparison of Rule of Law in India with U.S.A & England. It is very useful all law students.

topic : Analytical school (jurisprudence)

there is brief description of analytical school of jurisprudence ...

Administrative law 2nd lecture

In this ppt we discuss the basic of administrative law with separation of power. It will helpful for those students who are preparing for law entrance examination. It will be also helpful for those students who are Pursuing LLB or LLM.

Writs

We have discussed about different types of writs and cases related to them. Also discussed about article 32 and 226 of Indian Constitution

Presentationon colourable legislation

This presentation is an attempt to explain the colourable legislation in a simple language with the limitations on it and supported by the landmark cases delivered by the apex court.

Coparcenary in Hindu Law

The present slides relate to the concept of Coparcenary in the Hindu law. Useful for Law students and Professionals.

Parliamentary sovereignty

Parliamentary sovereignty is a most thinkable constitutional principle of UK's west minister system of parliament. So, here we discuss some important issues on parliamentary sovereignty.

AUDI ALTERAM PARTEM: PRINCIPLES OF NATURAL JUSTICE

These slides are regarding Audi Alteram Administrative law is the body of law that governs the activities of administrative agencies of government. Administrative law deals with the decision-making of administrative units of government such as tribunals, boards or commissions in such areas as international trade, manufacturing, taxation, broadcasting, immigration and transport. Administrative law expanded greatly during the twentieth century, as legislative bodies worldwide created more government agencies to regulate the social, economic and political spheres of human interaction.

4. DEFINITION Administrative law deals with the powers and functions of the administrative authorities, the manner in which the powers are to be exercised by them and the remedies that are available to the aggrieved persons when those powers are abused by the authorities. Jain and Jain – Four aspects of Administrative Law. Administrative Law deals with mainly 4 aspects: Composition and the powers of administrative authorities. Fixes the limits of the powers of these authorities. Prescribes the procedure to be followed by these authorities in exercising such powers. Controls these administrative authorities through judicial and other means.

THE PRINCIPLES OF NATURAL JUSTICE Natural justice is a principle that is intended to ensure law with fairness and to secure justice. The Principles of Natural Justice have come out from the need of man to protect himself from the excesses of organized power. The Principles of Natural Justice are considered the basic Human Rights because they attempt to bring justice to the parties naturally. THREE BASIC PILLARS Three core points in the concept of principles of natural justice include: Nemo in propria causa judex, esse debet - No one should be made a judge in his own case, or the rule against bias. Audi alteram partem - Hear the other party, or the rule of fair hearing, or the rule that no one should be condemned unheard. Speaking order or reasoned decision- Speaking order means an order which contains reasons for the decision. No system of law can survive without these three basic pillars.

‘’Audi alteram partum means ‘‘hear the other side’’ or ‘‘no man should be condemned unheard 'or ‘‘both the sides must be heard before passing any order’’. This is the basic requirement of rule of law.

AUDI ALTERAM PARTEM “A party is not to suffer in person or in purse without an opportunity of being heard.’’ It is mainly applicable in the field of administrative action and is regarded as the first principle of civilised jurisprudence. In short, before an order is passed against any person, reasonable opportunity of being heard must be given to him.

The maxim includes two elements • NOTICE. • HEARING.

JUDICIAL REVIEW (Brief Notes)

Judicial review is a process under which executive or legislative actions are subject to review by the judiciary. Judicial Review plays an important role in Indian Judiciary.

What's hot (20)

AUDI ALTERAM PARTEM: PRINCIPLES OF NATURAL JUSTICE

AUDI ALTERAM PARTEM: PRINCIPLES OF NATURAL JUSTICE

Similar to Money bill vs. finance bill

Taxsutra gst - the constitutional debate

The mood is positive for GST with the Congress appearing to soften its stand and press reports indicating a possible five hour debate in the Parliament on the 122nd Constitutional Amendment.

Types of Bills and Amendments

Schedules

Subject

Articles

Parts

Ordinary Bill

Public bill

Private bill

Union executives iii

This presentation includes Indian Parliamentary System, Council of States(Rajya sabha), House of People (Lok Sabha), Office of Profit, Indian Legislative Procedure System, Money Bill, Ordinary Bill, Parliamnet Privilage, Comptroller and Auditor General, CAG Reports, Consolidated Fund of India, Public Accounts of India.

Budget 2017-2018 - analysis of indirect tax proposals - general

“There is no significant loss or gain in my indirect tax proposals. – para 181 of FM Speech on 01.02.2017

This entire presentation is linked with English, Hindi and Tamil Film Titles for the purpose of creativity and humor and has no connection with the film or its contents.

Proposed GST - Will it finally happen? - Dr Sanjiv Agarwal

Proposed GST - Will it finally happen? - Dr Sanjiv Agarwal - Article published in Business Advisor, dated January 10, 2015 http://www.magzter.com/IN/Shrinikethan/Business-Advisor/Business/

Gst overview, gst concept and status caknowledge

The introduction of Goods and Services Tax on 1 st of July 2017 was a very significant step in the field of indirect tax reforms in India. By amalgamating a large number of Central and State taxes into a single tax, the aim was to mitigate cascading or double taxation in a major way and pave the way for a common national market. caknowledge.com provide latest updates on GST in India

Cbec releases document on updated gst concept and status

CBEC Released a document on updated GST concept and status on 1st Jan 2018

Financial relations between centre and state government

THIs PPT Presentation is an important framework through which we can understand the Financial relations between the Centre and State Gvernment

Similar to Money bill vs. finance bill (20)

Budget 2017-2018 - analysis of indirect tax proposals - general

Budget 2017-2018 - analysis of indirect tax proposals - general

Proposed GST - Will it finally happen? - Dr Sanjiv Agarwal

Proposed GST - Will it finally happen? - Dr Sanjiv Agarwal

Cbec releases document on updated gst concept and status

Cbec releases document on updated gst concept and status

The constitutional and legal basis of public finance

The constitutional and legal basis of public finance

Financial relations between centre and state government

Financial relations between centre and state government

02 vision ias csp21 test 2 s pol freeupscmaterials.org

02 vision ias csp21 test 2 s pol freeupscmaterials.org

More from oswinfo

Mcci session 1 - 18.04.2017 - GST

VAT driven local purchases

Cost driven CST purchases

Duty burden on imports

Complex State Laws

Ever changing tax landscape

Different decisions on the same issue

Border controls

GST - Levy - Supply - Business Impact

VAT driven local purchases

Cost driven CST purchases

Duty burden on imports

Complex State Laws

Ever changing tax landscape

Different decisions on the same issue

Border controls

Budget 2017-18 - analysis of direct tax proposals

No change in tax slabs

The rate of income tax for individuals and HUF within the slab of 2.5 lakhs to Rs. 5 lakhs reduced from 10% to 5%.

Additional surcharge of 10% on the tax payable by a person having total income exceeding Rs. 50 lakhs but not exceeding Rs. 1 crore.

Tax alert service tax - 13.01.2017

Background

Even though Union Budget, 2017 is supposed to be on 01.02.2017, the Government has introduced significant changes to service tax law through the issue of Notification No. 01/2017, 02/2017, 03/2017 and 04/2017 dated 12.01.2017.

Demonetisation and income tax

On 12th January 1946, Rs. 500 was demonetized and people were given 10 days for exchange. After this period explanation was required as to why exchange was not done in the first 10 days.

The Scheme was a failure as out of the total issue of Rs. 143.97 crores of High Denomination Notes, Rs. 134.90 crores were exchanged. Thus only Rs. 9 crores were demonetized.

1946 exercise turned out to be only an exchange.

Gst - Enrolment plan

Enrolment Plan for your State

The schedule of the enrolment activation drive for states is given below. We encourage you to complete the enrolment during the specified dates. However, the window will be open till 31/01/2017 for those who miss the chance.

Tax Quest - November 2016 - GST Special

The Goods & Service Tax regime is most likely to become a reality from April 2017. The Government of India has been taking a number of steps at unbelievable speed to implement the new regime. Following the Model Law, the Draft Rules for registration, payment, invoice, returns and refunds were released. The Government has also released an FAQ on GST.

Newsletter july 2016

Section 206AA – Rule 37BC

Central Board of Direct Taxes vide Notification No. 53/2016 dated 24.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 37BC through the IT (17th Amendment) Rules, 2016.

Taxsutra e-commerce - gst

The e-commerce boom was marked by multiple players, rosy valuations and now slowly reality has set in and the price wars have taken their toll. The VAT authorities across the country have had their tryst with this industry with notices, demands, levy of entry tax and litigation. Currently whenever there is a tax or a business problem, the immediate response from the industry or the administrator or the media is that GST is the only solution.

Real infra - june 2016

Section 65(105)(zzzh) provides for a levy of service tax on services in relation to ‘construction of complex’ and an explanation was added by Finance Act, 2010.

Equalisation levy 11.06.2016

The new law provides for an equalisation levy of 6% on the amount of consideration received, or receivable on specified services carried on by a non-resident not having a permanent establishment in India.

Article co-owners of house property - dt & dt implications

When more than one person owns a property and the said property realizes revenue in the form of rent and interest on loan is involved, direct and indirect tax implications require examination in the light of relevant statutory provisions and judicial precedents.

Newsletter june 2016

Tax Quest

Finance Act, 2016 has effected a number of changes that are effective from 01.06.2016 and this

alert seeks to provide a brief view on such changes.

1. Service Tax on Ocean Freight – Import Segment

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of indirect tax proposals - general

Budget 2016-2017 - analysis of indirect tax proposals - general

More from oswinfo (20)

Article co-owners of house property - dt & dt implications

Article co-owners of house property - dt & dt implications

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Recent changes service tax and cenvat creit - w.e.f 01.04.2016

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of direct tax proposals

Budget 2016-2017 - analysis of indirect tax proposals - general

Budget 2016-2017 - analysis of indirect tax proposals - general

Recently uploaded

一比一原版(WSU毕业证)西悉尼大学毕业证成绩单

WSU毕业证【微信95270640】《西悉尼大学毕业证书》《QQ微信95270640》学位证书电子版:在线制作西悉尼大学毕业证成绩单GPA修改(制作WSU毕业证成绩单WSU文凭证书样本)、西悉尼大学毕业证书与成绩单样本图片、《WSU学历证书学位证书》、西悉尼大学毕业证案例毕业证书制作軟體、在线制作加拿大硕士学历证书真实可查.

[留学文凭学历认证(留信认证使馆认证)西悉尼大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理西悉尼大学西悉尼大学毕业证假文凭信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。碌爬起把牛驱到后龙山再从莲塘里采回一蛇皮袋湿漉漉的莲蓬也才点多点半早就吃过早餐玩耍去了山娃的家在闽西山区依山傍水山清水秀门前潺潺流淌的蜿蜒小溪一直都是山娃和小伙伴们盛夏的天然泳场水不深碎石底石缝里总有摸不尽的鱼虾活蹦乱跳的还有乌龟和王八贼头贼脑的倒也逗人喜爱日上三竿时山娃总爱窜进自家瓜棚里跟小伙伴们坐着聊天聊着聊着便忍不住往瓜田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就之

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

Up the Ratios is a non-profit organization dedicated to bridging the gap in STEM education for underprivileged students by providing free, high-quality learning opportunities in robotics and other STEM fields. Our mission is to empower the next generation of innovators, thinkers, and problem-solvers by offering a range of educational programs that foster curiosity, creativity, and critical thinking.

At Up the Ratios, we believe that every student, regardless of their socio-economic background, should have access to the tools and knowledge needed to succeed in today's technology-driven world. To achieve this, we host a variety of free classes, workshops, summer camps, and live lectures tailored to students from underserved communities. Our programs are designed to be engaging and hands-on, allowing students to explore the exciting world of robotics and STEM through practical, real-world applications.

Our free classes cover fundamental concepts in robotics, coding, and engineering, providing students with a strong foundation in these critical areas. Through our interactive workshops, students can dive deeper into specific topics, working on projects that challenge them to apply what they've learned and think creatively. Our summer camps offer an immersive experience where students can collaborate on larger projects, develop their teamwork skills, and gain confidence in their abilities.

In addition to our local programs, Up the Ratios is committed to making a global impact. We take donations of new and gently used robotics parts, which we then distribute to students and educational institutions in other countries. These donations help ensure that young learners worldwide have the resources they need to explore and excel in STEM fields. By supporting education in this way, we aim to nurture a global community of future leaders and innovators.

Our live lectures feature guest speakers from various STEM disciplines, including engineers, scientists, and industry professionals who share their knowledge and experiences with our students. These lectures provide valuable insights into potential career paths and inspire students to pursue their passions in STEM.

Up the Ratios relies on the generosity of donors and volunteers to continue our work. Contributions of time, expertise, and financial support are crucial to sustaining our programs and expanding our reach. Whether you're an individual passionate about education, a professional in the STEM field, or a company looking to give back to the community, there are many ways to get involved and make a difference.

We are proud of the positive impact we've had on the lives of countless students, many of whom have gone on to pursue higher education and careers in STEM. By providing these young minds with the tools and opportunities they need to succeed, we are not only changing their futures but also contributing to the advancement of technology and innovation on a broader scale.

一比一原版(QUT毕业证)昆士兰科技大学毕业证成绩单

QUT毕业证【微信95270640】☀️原版仿制昆士兰科技大学毕业证书扫描件本科学位证书【办证Q微信95270640】QUT毕业证书扫描件原版仿制毕业成绩单,能完美还原海外各大学QUTBachelor Diploma degree, Master Diploma(本科/硕士昆士兰科技大学毕业证书、成绩单)QUT大学Offer录取通知书、雅思成绩单、托福成绩单、雅思托福代考、语言证书、学生卡、高仿留服认证书等毕业/入学/在读材料。1:1完美还原海外各大学毕业材料上的昆士兰科技大学毕业证书扫描件本科学位证书QUT毕业证书扫描件原版仿制毕业成绩单工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪。

(诚招代理)办理国外高校毕业证成绩单文凭学位证,真实使馆公证(留学回国人员证明)真实留信网认证国外学历学位认证雅思代考国外学校代申请名校保录开请假条改GPA改成绩ID卡

1.高仿业务:【本科硕士】毕业证,成绩单(GPA修改),学历认证(教育部认证),大学Offer,,ID,留信认证,使馆认证,雅思,语言证书等高仿类证书;

2.认证服务: 学历认证(教育部认证),大使馆认证(回国人员证明),留信认证(可查有编号证书),大学保录取,雅思保分成绩单。

3.技术服务:钢印水印烫金激光防伪凹凸版设计印刷激凸温感光标底纹镭射速度快。

办理昆士兰科技大学昆士兰科技大学硕士毕业证成绩单流程:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

-办理真实使馆公证(即留学回国人员证明)

-办理各国各大学文凭(世界名校一对一专业服务,可全程监控跟踪进度)

-全套服务:毕业证成绩单真实使馆公证真实教育部认证。让您回国发展信心十足!

(详情请加一下 文凭顾问+微信:95270640)欢迎咨询!小便处山娃很想笑却怎么也笑不出来山娃很迷惑父亲的家除了一扇小铁门连窗户也没有墓穴一般阴森森有些骇人父亲的城也便成了山娃的城父亲的家也便成了山娃的家父亲让山娃呆在屋里做作业看电视最多只能在门口透透气不能跟陌生人搭腔更不能乱跑一怕迷路二怕拐子拐人山娃很惊惧去年村里的田鸡就因为跟父亲进城一不小心被人拐跑了至今不见踪影害得田鸡娘天天哭得死去活来疯了一般那情那景无不令人摧肝裂肺山娃很听话天天呆在小屋里除了地

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

Powerpoint 2024 Street Maintenance Program Admendment

Uniform Guidance 3.0 - The New 2 CFR 200

This session provides a comprehensive overview of the latest updates to the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (commonly known as the Uniform Guidance) outlined in the 2 CFR 200.

With a focus on the 2024 revisions issued by the Office of Management and Budget (OMB), participants will gain insight into the key changes affecting federal grant recipients. The session will delve into critical regulatory updates, providing attendees with the knowledge and tools necessary to navigate and comply with the evolving landscape of federal grant management.

Learning Objectives:

- Understand the rationale behind the 2024 updates to the Uniform Guidance outlined in 2 CFR 200, and their implications for federal grant recipients.

- Identify the key changes and revisions introduced by the Office of Management and Budget (OMB) in the 2024 edition of 2 CFR 200.

- Gain proficiency in applying the updated regulations to ensure compliance with federal grant requirements and avoid potential audit findings.

- Develop strategies for effectively implementing the new guidelines within the grant management processes of their respective organizations, fostering efficiency and accountability in federal grant administration.

2024: The FAR - Federal Acquisition Regulations, Part 36

Jennifer Schaus and Associates hosts a complimentary webinar series on The FAR in 2024. Join the webinars on Wednesdays and Fridays at noon, eastern.

Recordings are on YouTube and the company website.

https://www.youtube.com/@jenniferschaus/videos

Russian anarchist and anti-war movement in the third year of full-scale war

Anarchist group ANA Regensburg hosted my online-presentation on 16th of May 2024, in which I discussed tactics of anti-war activism in Russia, and reasons why the anti-war movement has not been able to make an impact to change the course of events yet. Cases of anarchists repressed for anti-war activities are presented, as well as strategies of support for political prisoners, and modest successes in supporting their struggles.

Thumbnail picture is by MediaZona, you may read their report on anti-war arson attacks in Russia here: https://en.zona.media/article/2022/10/13/burn-map

Links:

Autonomous Action

http://Avtonom.org

Anarchist Black Cross Moscow

http://Avtonom.org/abc

Solidarity Zone

https://t.me/solidarity_zone

Memorial

https://memopzk.org/, https://t.me/pzk_memorial

OVD-Info

https://en.ovdinfo.org/antiwar-ovd-info-guide

RosUznik

https://rosuznik.org/

Uznik Online

http://uznikonline.tilda.ws/

Russian Reader

https://therussianreader.com/

ABC Irkutsk

https://abc38.noblogs.org/

Send mail to prisoners from abroad:

http://Prisonmail.online

YouTube: https://youtu.be/c5nSOdU48O8

Spotify: https://podcasters.spotify.com/pod/show/libertarianlifecoach/episodes/Russian-anarchist-and-anti-war-movement-in-the-third-year-of-full-scale-war-e2k8ai4

如何办理(uoit毕业证书)加拿大安大略理工大学毕业证文凭证书录取通知原版一模一样

原版纸张【微信:741003700 】【(uoit毕业证书)加拿大安大略理工大学毕业证】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

What is the point of small housing associations.pptx

Given the small scale of housing associations and their relative high cost per home what is the point of them and how do we justify their continued existance

一比一原版(Adelaide毕业证)阿德莱德大学毕业证成绩单

Adelaide毕业证【微信95270640】国外文凭购买阿德莱德大学留信认证毕业证书印刷品《Q微信95270640》学历认证怎么做:原版仿制阿德莱德大学电子版成绩单毕业证认证《阿德莱德大学毕业证成绩单》、阿德莱德大学文凭证书成绩单复刻offer录取通知书、购买Adelaide圣力嘉学院本科毕业证、《阿德莱德大学毕业证办理Adelaide毕业证书哪里买》、阿德莱德大学 Offer在线办理Adelaide Offer阿德莱德大学Bachloer Degree。

【实体公司】办阿德莱德大学阿德莱德大学硕士学位证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.阿德莱德大学毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供阿德莱德大学阿德莱德大学硕士学位证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640光总是太短太匆忙记得今年正月就在父亲扛起蛇皮袋将要跨出门槛的一刹那山娃突然抱紧父亲的大腿嚎啕大哭父亲吃力地掰开山娃的手哽咽道山娃好好听话好好念书到了暑假爸也接你进城爸的城好远好大好美山娃于是天天扳着手指算计着读书也格外刻苦无奈时间总过得太慢太慢每次父亲往家打电话山娃总抢着接听一个劲地提醒父亲别忘了正月说的话电话那头总会传来父亲嘿嘿的笑连连说记得记得但别忘了拿奖状进城啊考试一结束山娃就迫不及待地给间

The Role of a Process Server in real estate

A process server is a authorized person for delivering legal documents, such as summons, complaints, subpoenas, and other court papers, to peoples involved in legal proceedings.

Many ways to support street children.pptx

By raising awareness, providing support, advocating for change, and offering assistance to children in need, individuals can play a crucial role in improving the lives of street children and helping them realize their full potential

Donate Us

https://serudsindia.org/how-individuals-can-support-street-children-in-india/

#donatefororphan, #donateforhomelesschildren, #childeducation, #ngochildeducation, #donateforeducation, #donationforchildeducation, #sponsorforpoorchild, #sponsororphanage #sponsororphanchild, #donation, #education, #charity, #educationforchild, #seruds, #kurnool, #joyhome

Recently uploaded (20)

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

PNRR MADRID GREENTECH FOR BROWN NETWORKS NETWORKS MUR_MUSA_TEBALDI.pdf

PNRR MADRID GREENTECH FOR BROWN NETWORKS NETWORKS MUR_MUSA_TEBALDI.pdf

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

PPT Item # 9 - 2024 Street Maintenance Program(SMP) Amendment

2024: The FAR - Federal Acquisition Regulations, Part 36

2024: The FAR - Federal Acquisition Regulations, Part 36

MHM Roundtable Slide Deck WHA Side-event May 28 2024.pptx

MHM Roundtable Slide Deck WHA Side-event May 28 2024.pptx

Russian anarchist and anti-war movement in the third year of full-scale war

Russian anarchist and anti-war movement in the third year of full-scale war

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

What is the point of small housing associations.pptx

What is the point of small housing associations.pptx

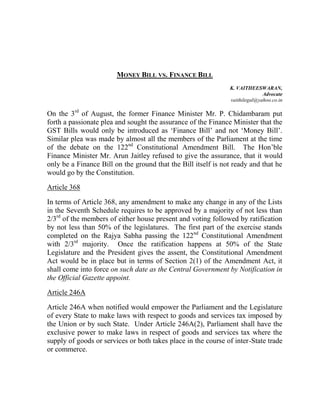

Money bill vs. finance bill

- 1. MONEY BILL VS. FINANCE BILL K. VAITHEESWARAN, Advocate vaithilegal@yahoo.co.in On the 3rd of August, the former Finance Minister Mr. P. Chidambaram put forth a passionate plea and sought the assurance of the Finance Minister that the GST Bills would only be introduced as ‘Finance Bill’ and not ‘Money Bill’. Similar plea was made by almost all the members of the Parliament at the time of the debate on the 122nd Constitutional Amendment Bill. The Hon’ble Finance Minister Mr. Arun Jaitley refused to give the assurance, that it would only be a Finance Bill on the ground that the Bill itself is not ready and that he would go by the Constitution. Article 368 In terms of Article 368, any amendment to make any change in any of the Lists in the Seventh Schedule requires to be approved by a majority of not less than 2/3rd of the members of either house present and voting followed by ratification by not less than 50% of the legislatures. The first part of the exercise stands completed on the Rajya Sabha passing the 122nd Constitutional Amendment with 2/3rd majority. Once the ratification happens at 50% of the State Legislature and the President gives the assent, the Constitutional Amendment Act would be in place but in terms of Section 2(1) of the Amendment Act, it shall come into force on such date as the Central Government by Notification in the Official Gazette appoint. Article 246A Article 246A when notified would empower the Parliament and the Legislature of every State to make laws with respect to goods and services tax imposed by the Union or by such State. Under Article 246A(2), Parliament shall have the exclusive power to make laws in respect of goods and services tax where the supply of goods or services or both takes place in the course of inter-State trade or commerce.

- 2. The question is whether the Central GST Bill and the IGST Bill which would be introduced by the Parliament needs to be introduced as a ‘Finance Bill’ or a ‘Money Bill’. Money Bill Article 110 defines ‘Money Bill’ and a Bill shall be deemed to be a Money Bill if it contains only provisions dealing with (a) imposition, abolition, remission, alteration or regulation of any tax; (b) regulation of the borrowing of money or giving of guarantee by Government of India; (c) custody of the Consolidated Fund or the Contingency Fund of India, the payment and withdrawal from such fund; (d) the appropriation of moneys out of the Consolidated Fund of India; (e) declaration of expenditure charged on the consolidated fund or increase in the amount of expenditure; (f) receipt of money on account of consolidated fund or the Public Account of India; (g) any other matter incidental to any of the matters specified in (a) to (f) above. In terms of Article 109 a Money Bill shall not be introduced in the Council of States (Rajya Sabha). Once the Lok Sabha passes the Money Bill, it shall be transmitted to the Rajya Sabha for its recommendations and the Rajya Sabha shall within a period of 14 days from the date of receipt return the Bill to the Lock Sabha with recommendations. The Lok Sabha may thereupon either accept or reject all or any of the recommendations of the Rajya Sabha. Further, if the Rajya Sabha does not return the Bill within the said period of 14 days, it shall be deemed to have been passed by both Houses at the expiry of the said period in the form in which it was passed by the Lok Sabha.

- 3. Article 117 provides that a Bill or amendment for any of the matters specified in Article 110(a) to (f) shall not be introduced or moved except on the recommendation of the President and the Bill making such provision shall not be introduced in the Council of States. Finance Bill The zeal for a Finance Bill is apparent since the ruling NDA does not have a majority in the Rajya Sabha and the elders could very well raise issues and seek reference to a Select Committee of the Parliament which will ensure that GST is delayed. Similarly, the reluctance in giving an assurance to introduce as a Finance Bill is also apparent, since introduction of a Money Bill would suit the Government given the urgency for implementation of GST and the majority it enjoys in the Lok Sabha. When the CGST Bill and IGST Bill is introduced as a Money Bill in the Lok Sabha then even if the Rajya Sabha returns the Bill with modifications, it has very little role to play given the strict time frame and the power of the Lok Sabha to reject the recommendations. Article 111 further strengthens the Money Bill since while a President can return a Bill with a message requesting both houses to reconsider the Bill or suggest any amendment, no such power is available to the President in the case of the Money Bill. Lok Sabha Speaker Article 110 is divided into three segments where Article 110(1) deals with what are the matters that would be deemed to be a ‘Money Bill’; Article 110(2) provides that a Bill would not be a Money Bill merely by reason that it provides for imposition of fines or penalties or payment of fees for licenses or for services or by reason that it provides for imposition, abolition, remission, alteration or regulation of any tax by a local authority. Article 110(3) provides that if any question arises whether a Bill is a Money Bill or not the decision of the Speaker of the Lok Sabha shall be final.

- 4. Union Budget Every year, at the time of the Budget, the Finance Bill is introduced as a Money Bill in the Lok Sabha. New levies such as service tax in 1994; securities transaction tax; dividend distribution tax; banking cash transaction tax; fringe benefit tax; special additional duty (SAD) were all Money Bills and some of them were during the period when Mr. Chidambaram was the Finance Minister. Article 366(12A) which is part of the 122nd Amendment defines ‘GST’ as any tax on such of goods or services or both except taxes on supply of the alcoholic liquor for human consumption. GST is indeed a new levy but it is still a tax and Article 110(1)(a) very well covers the imposition, abolition, remission, alteration or regulation of any tax. Whatever be the issue the citizens of the country woke up to the concept of legislative procedures and the Parliamentarians have succeeded in involving the media and the public in the debate on the distinction between a Money Bill and a Finance Bill.