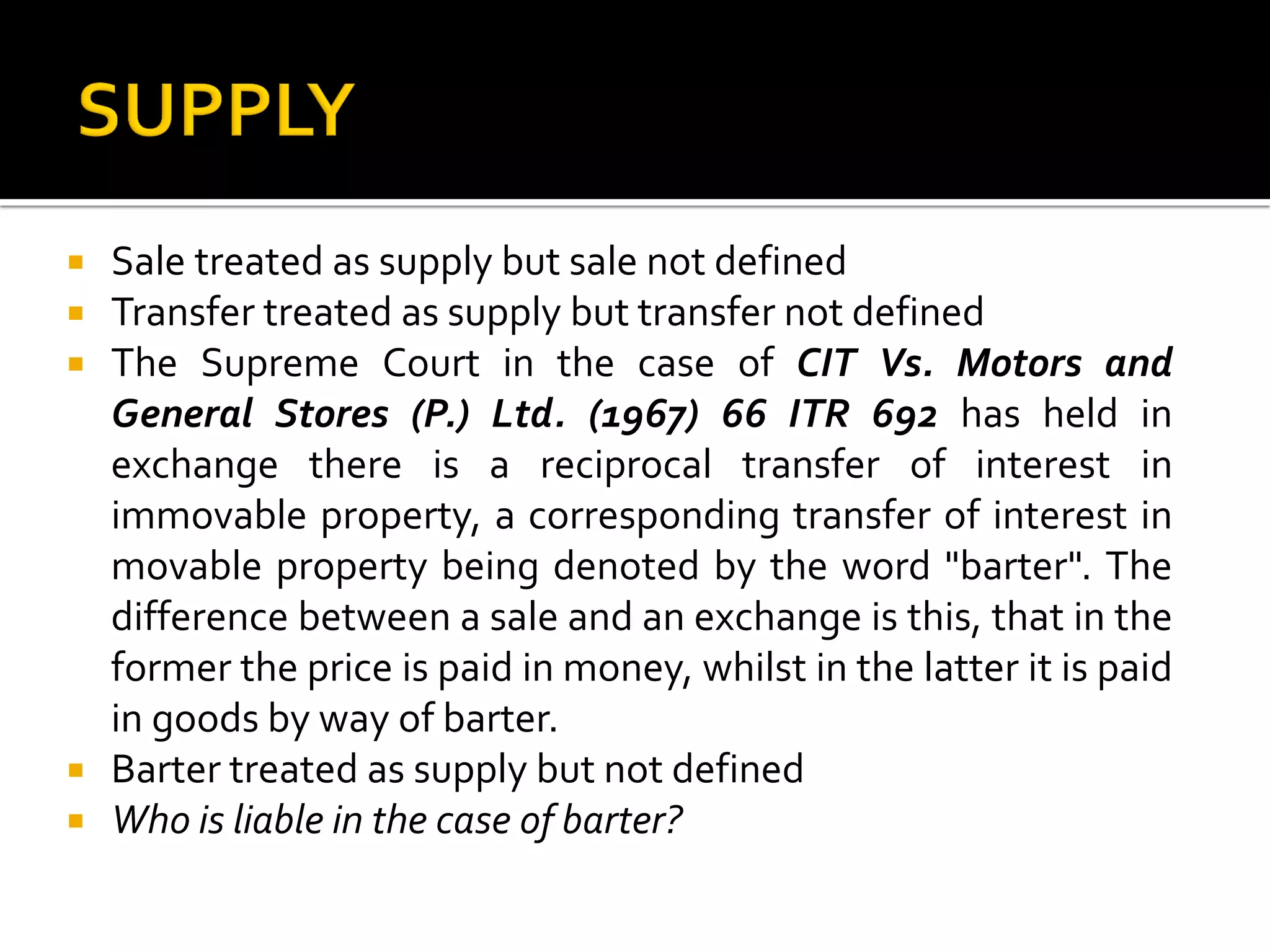

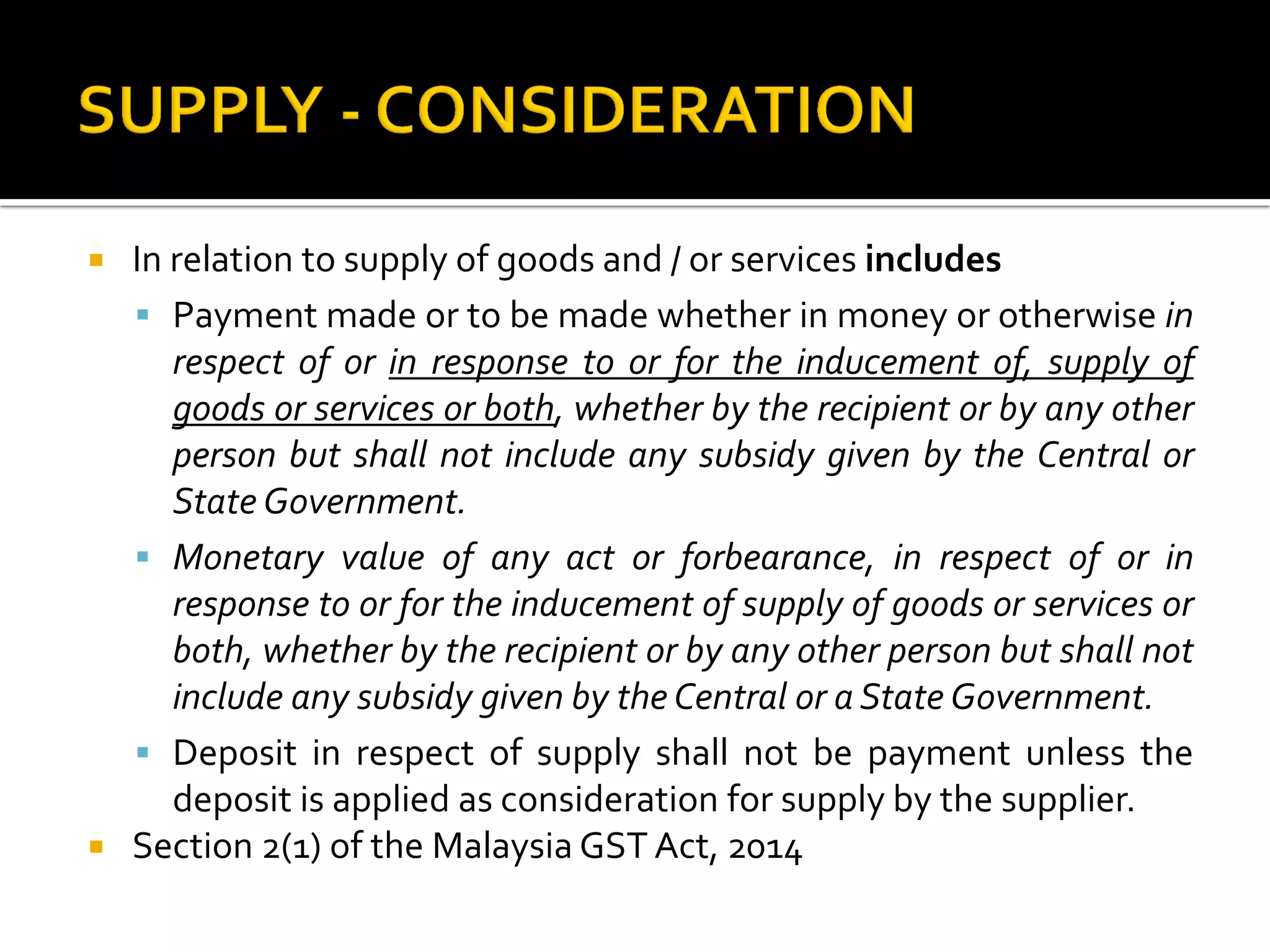

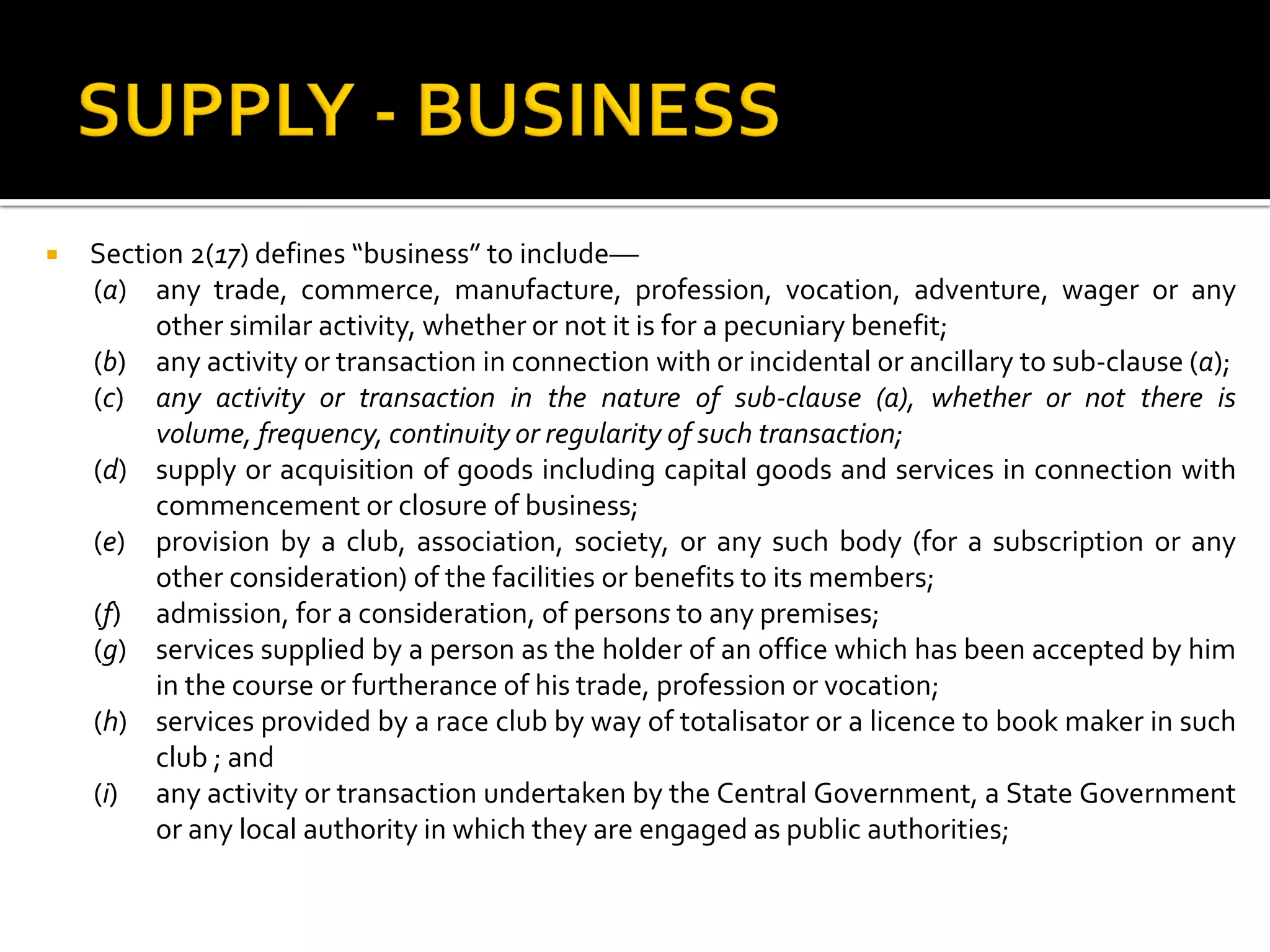

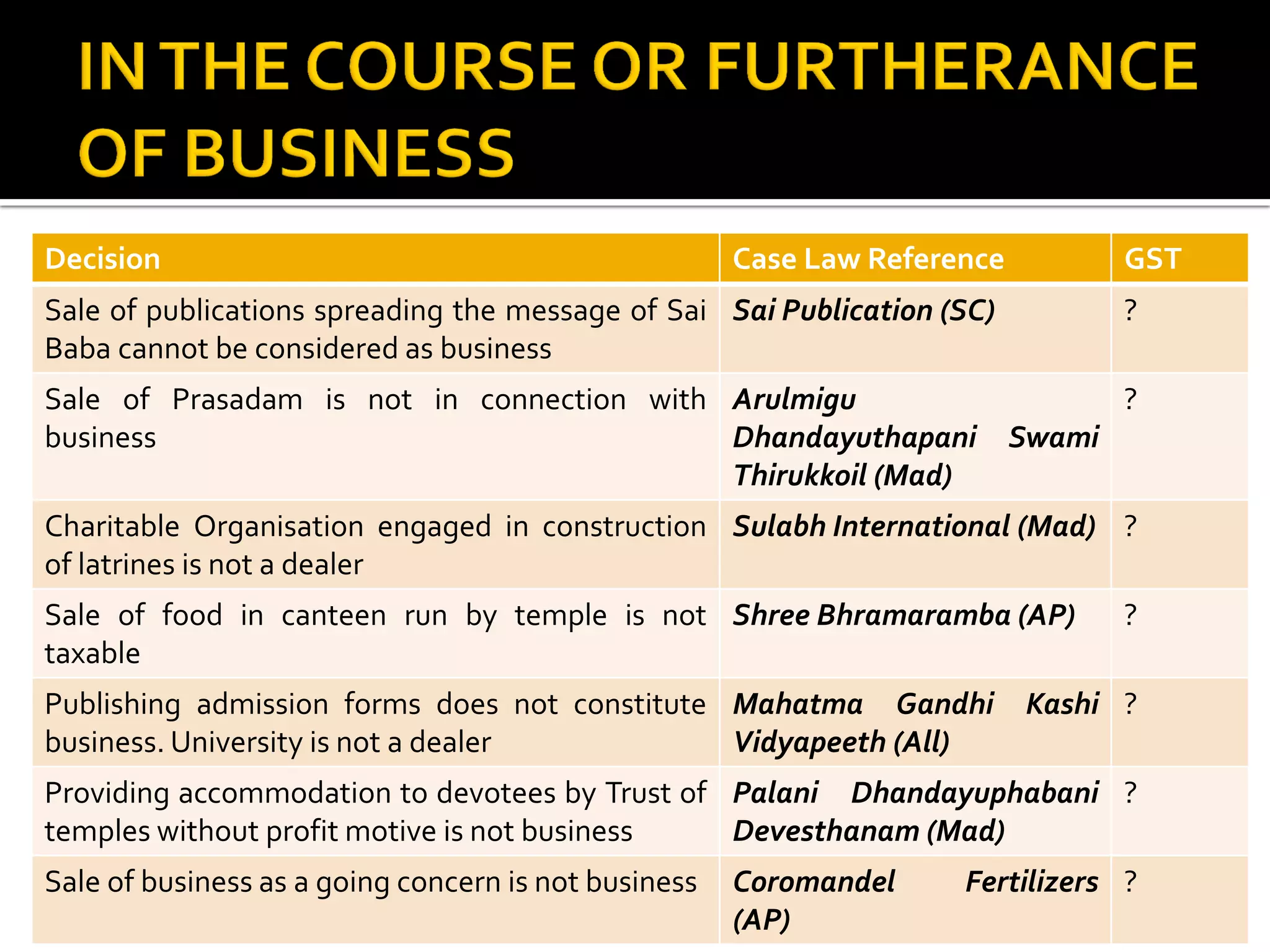

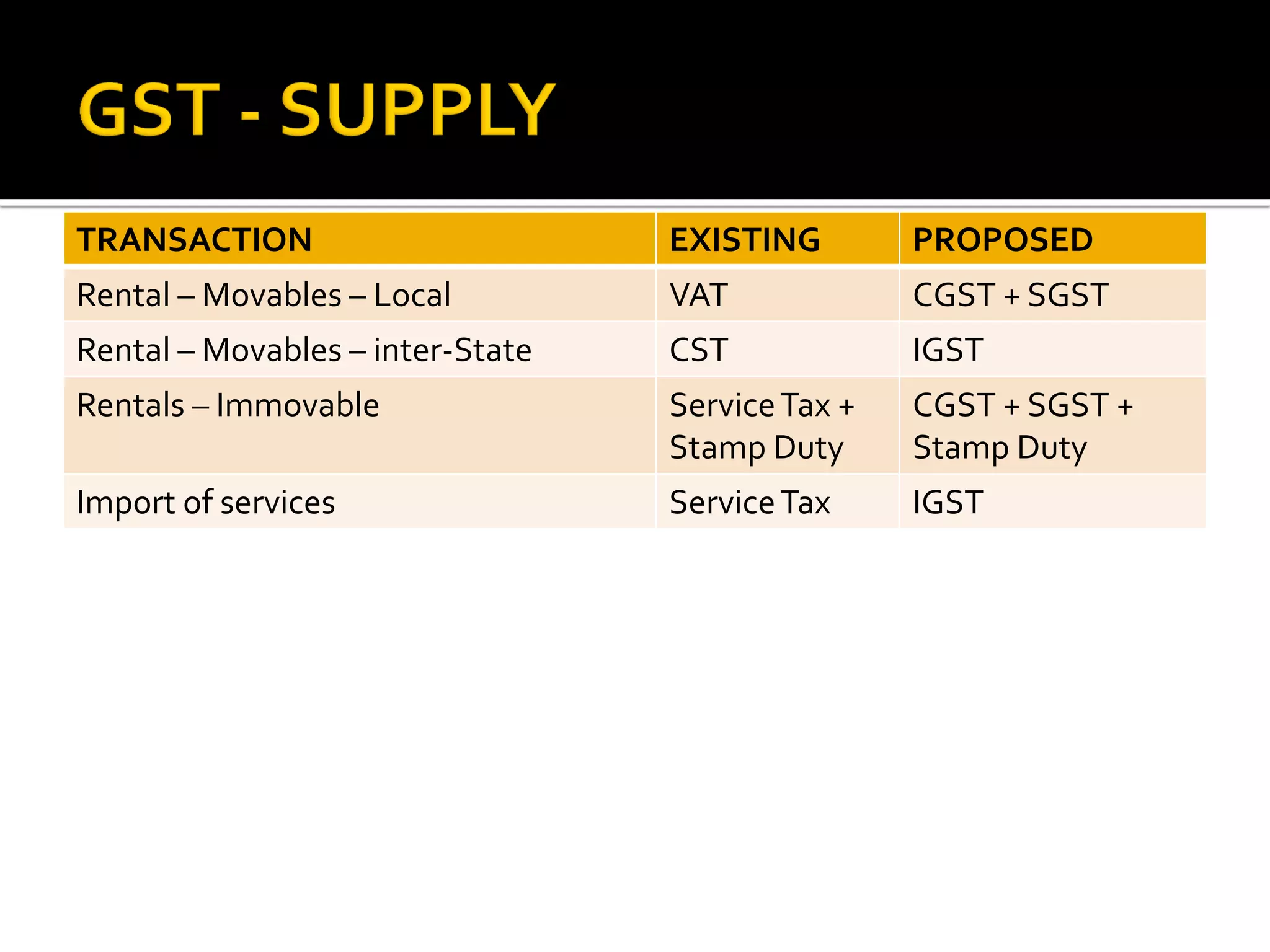

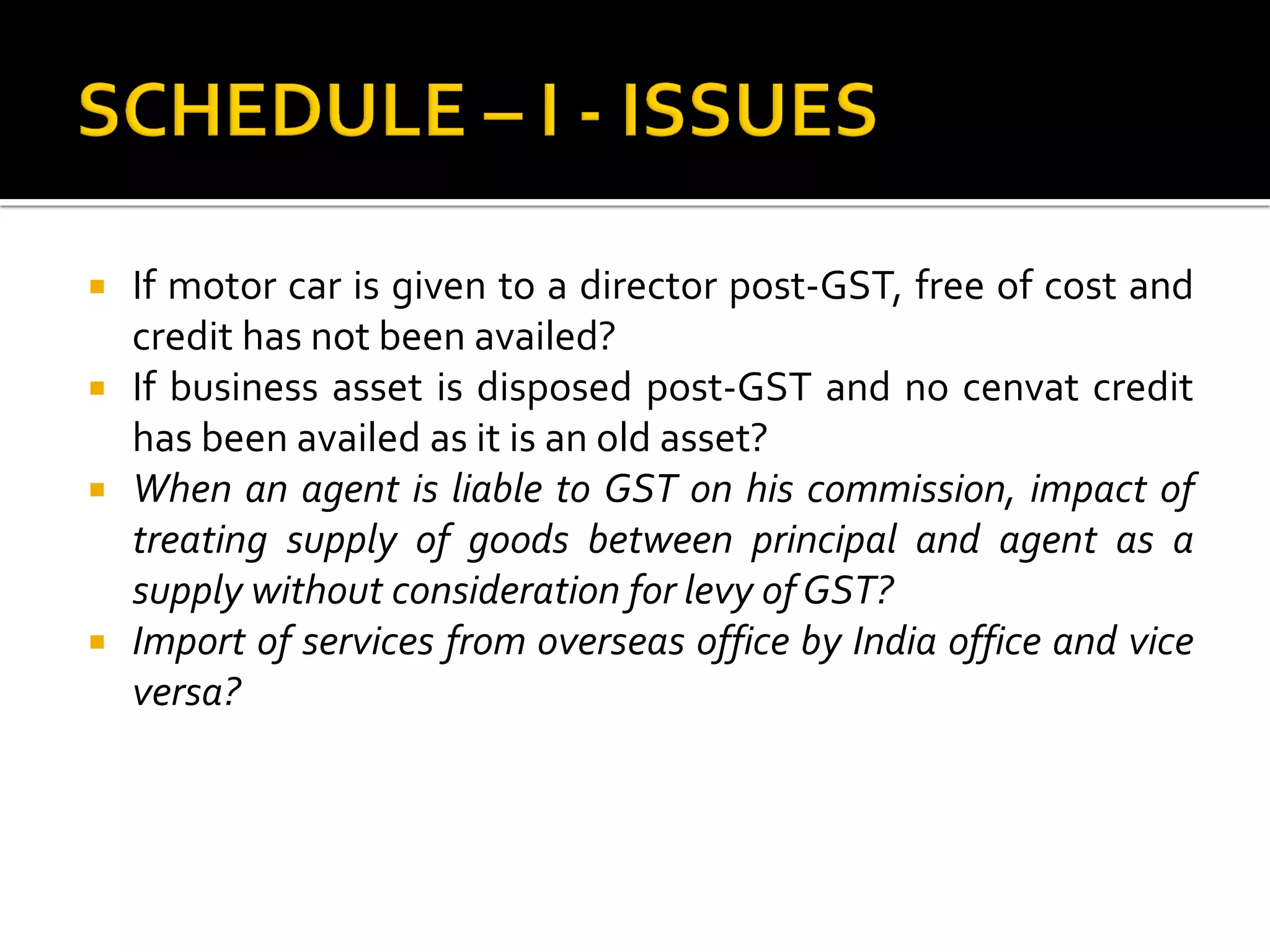

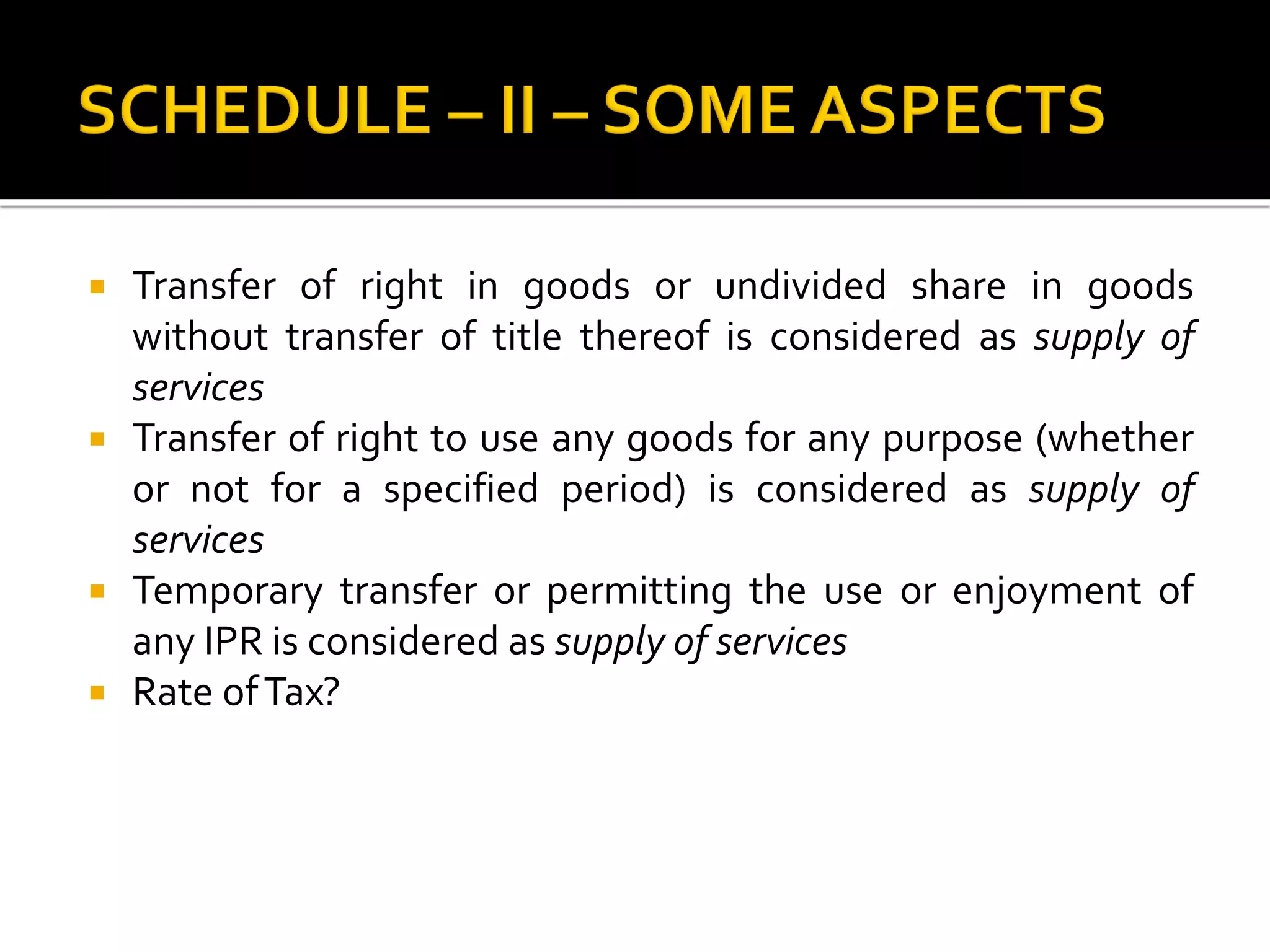

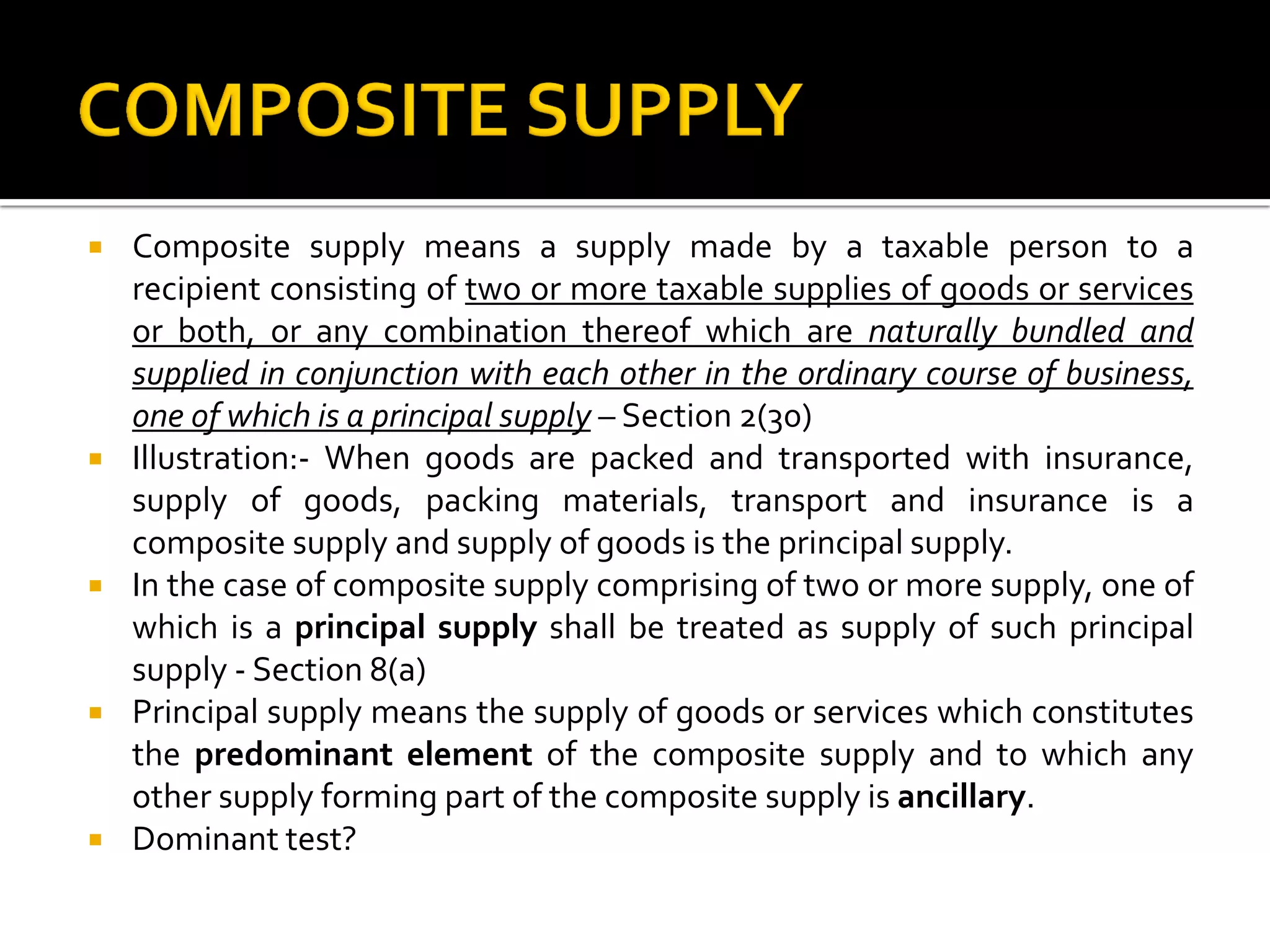

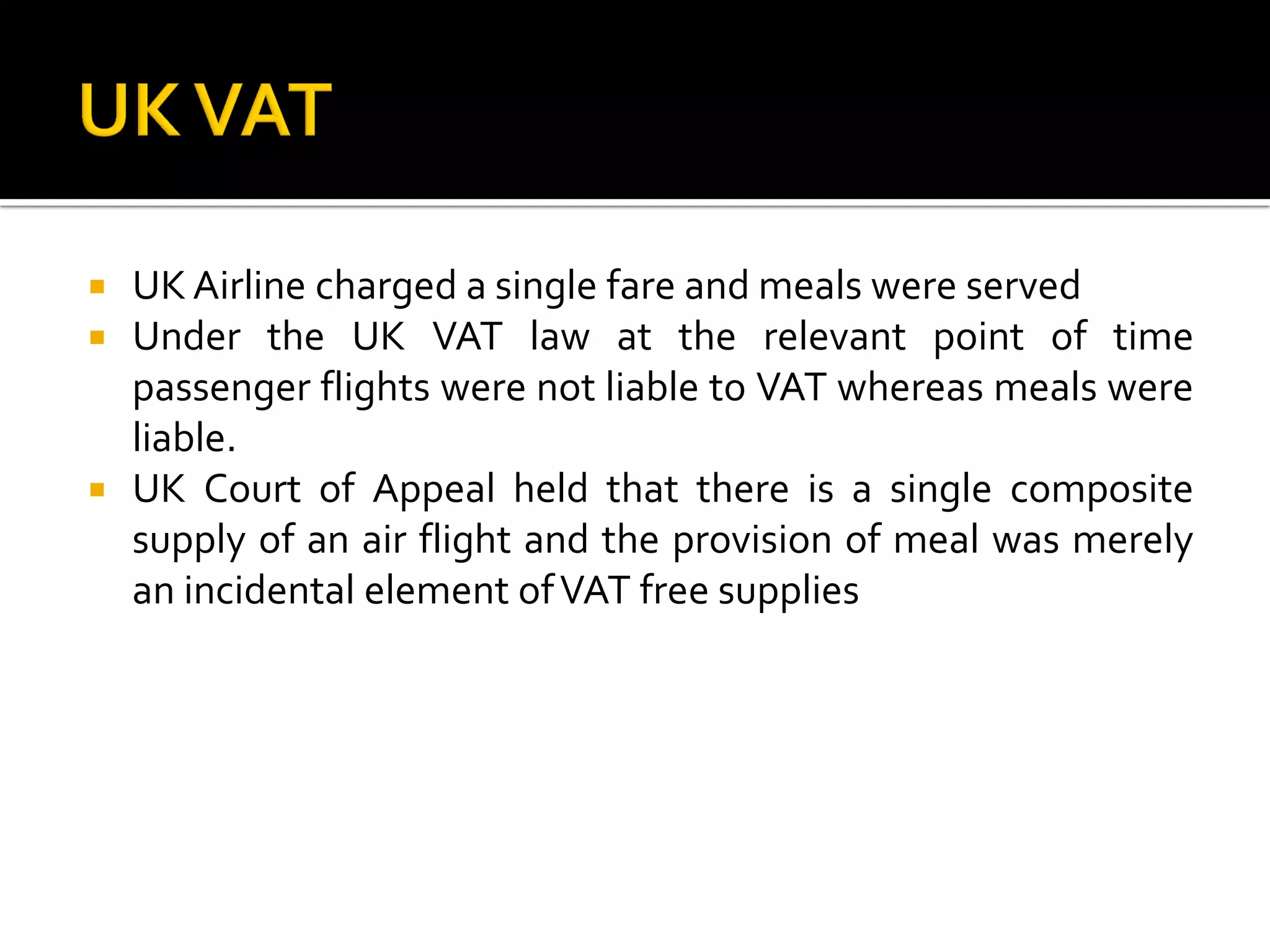

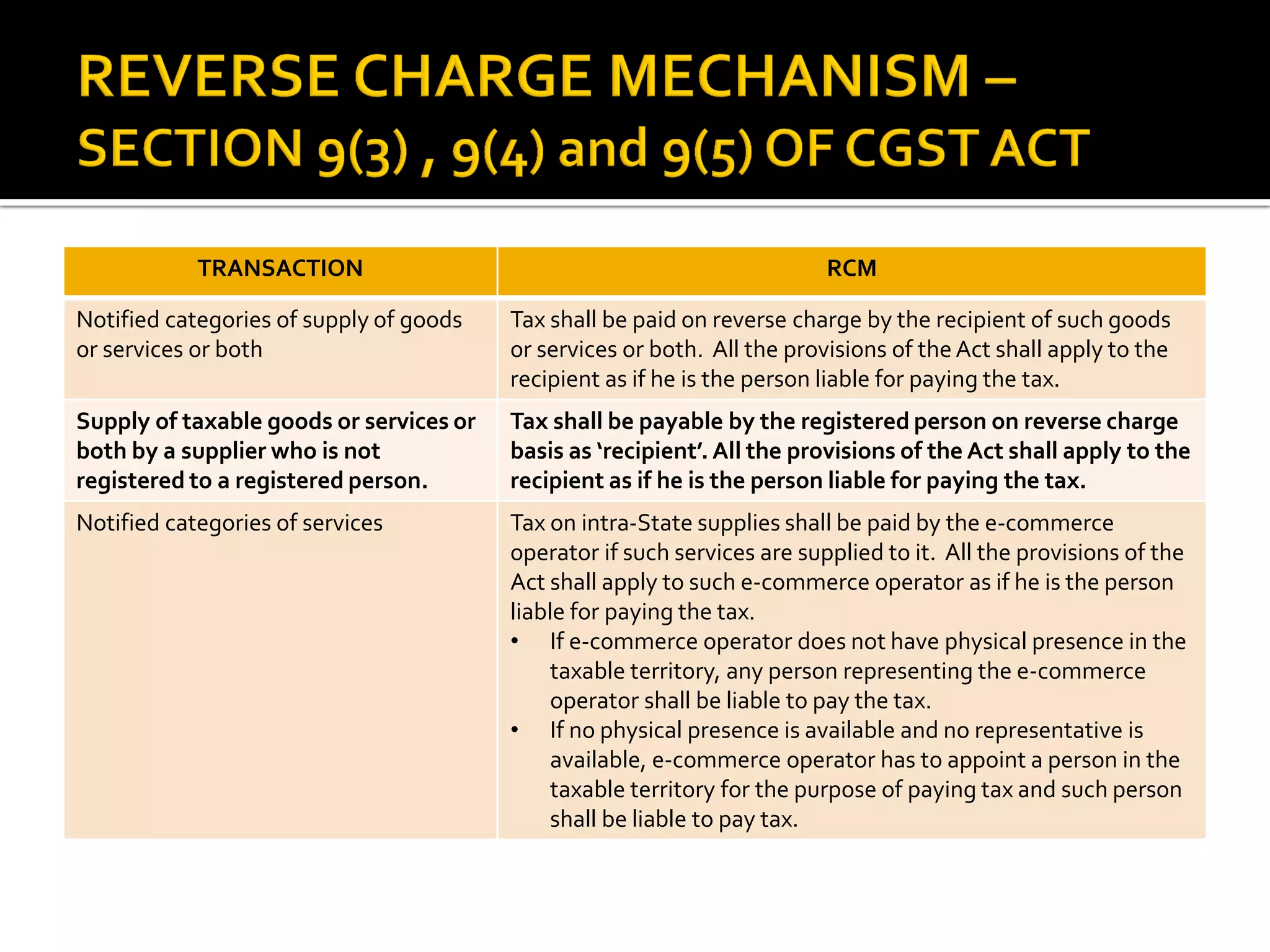

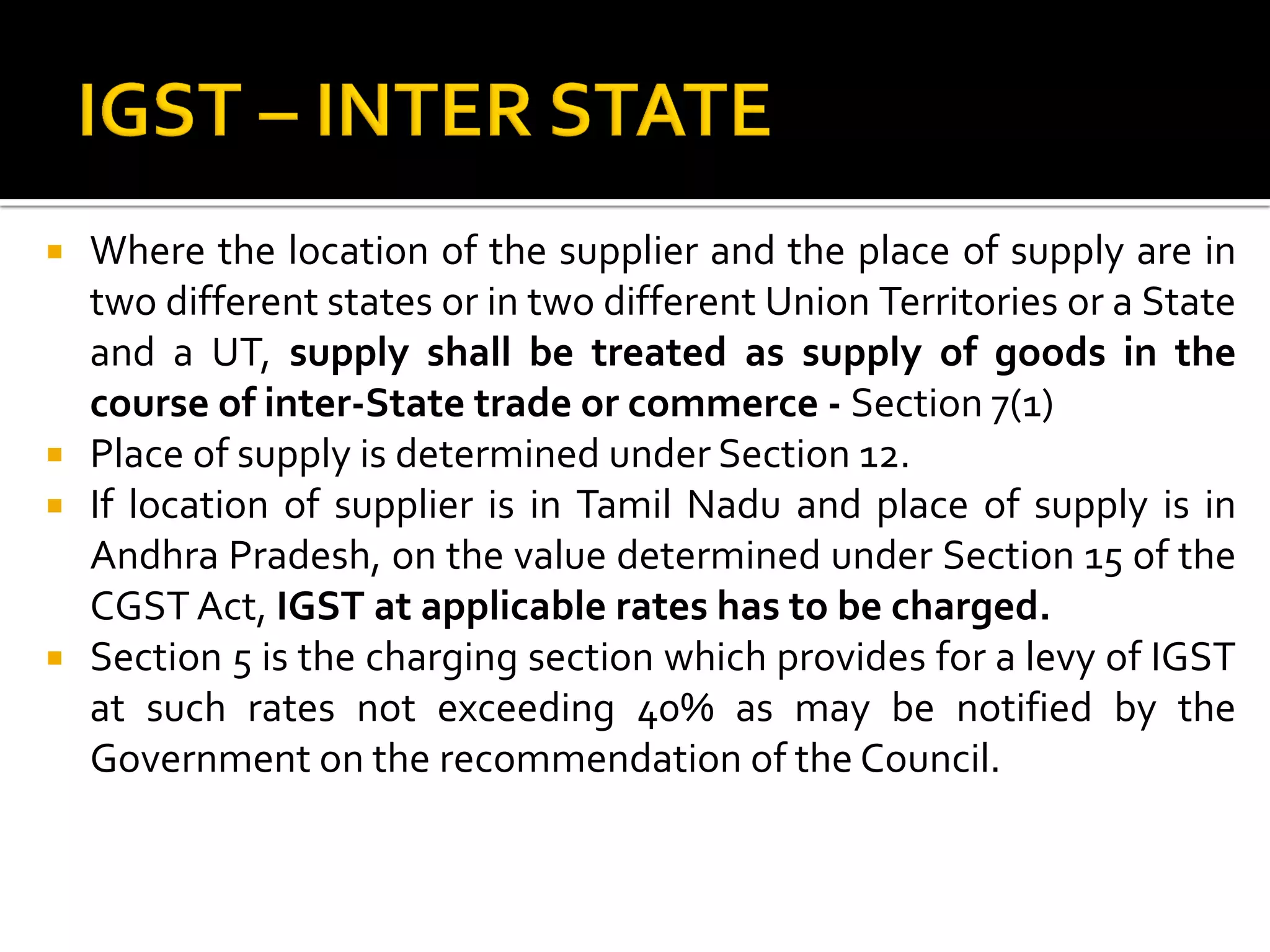

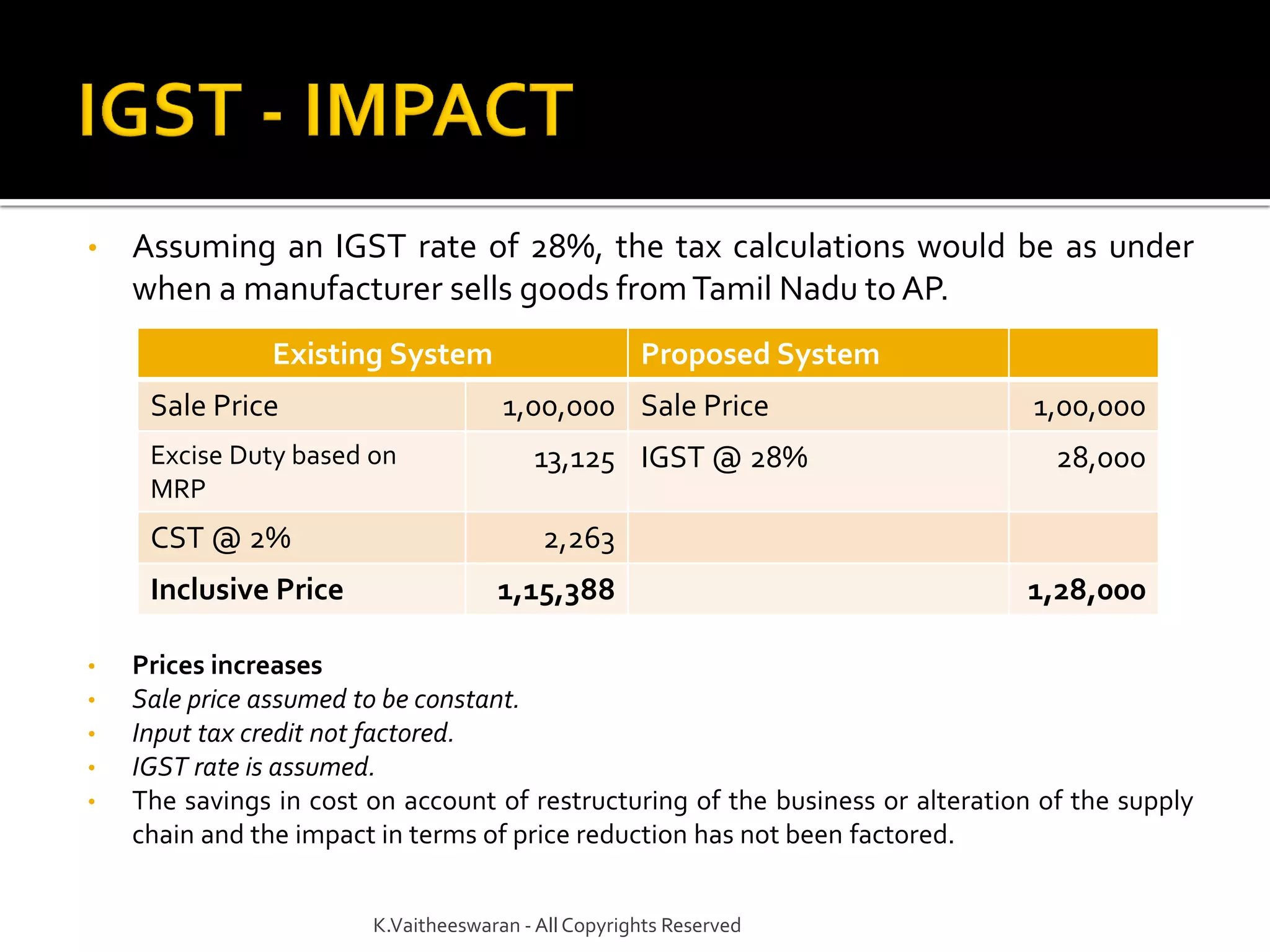

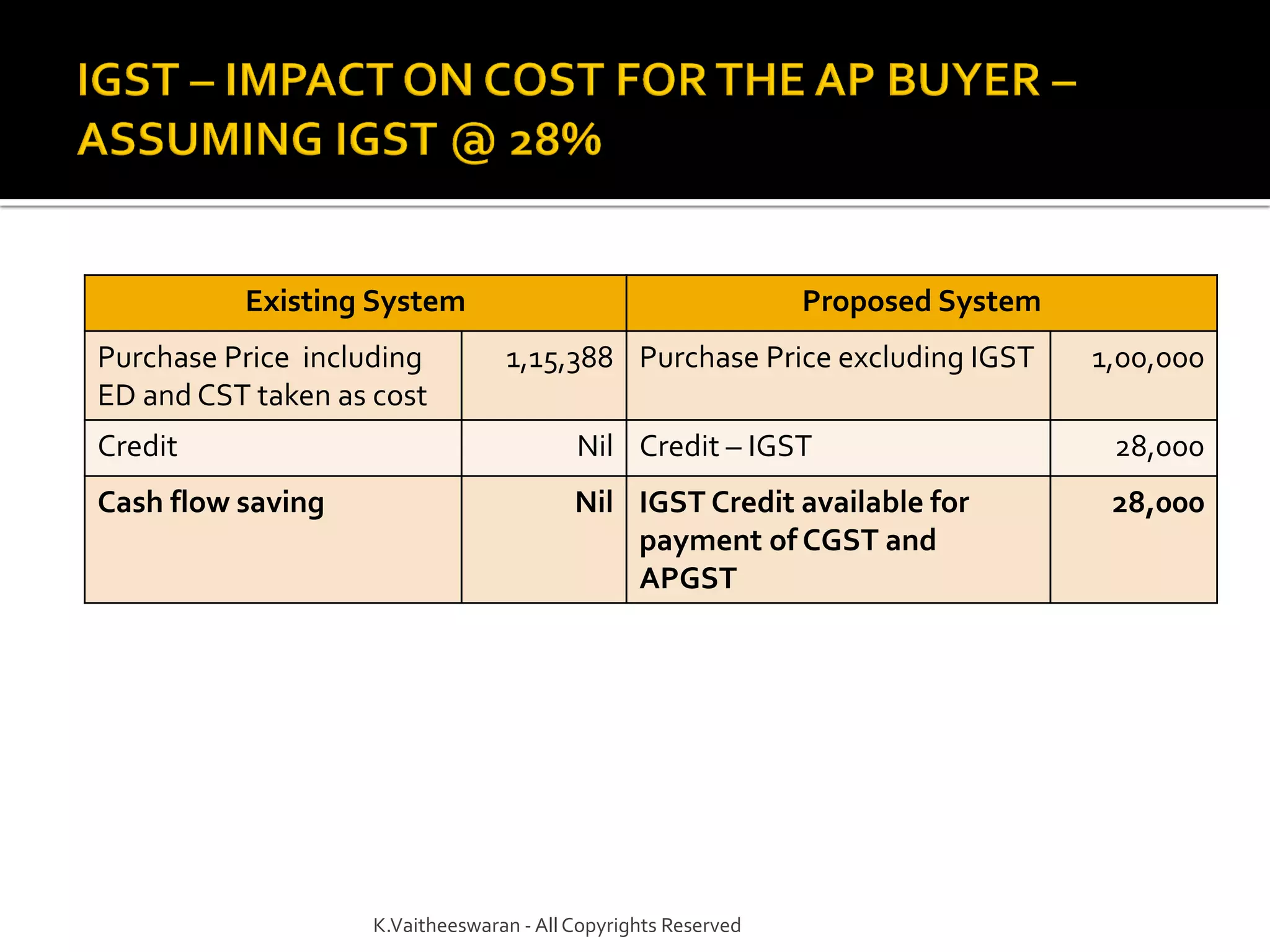

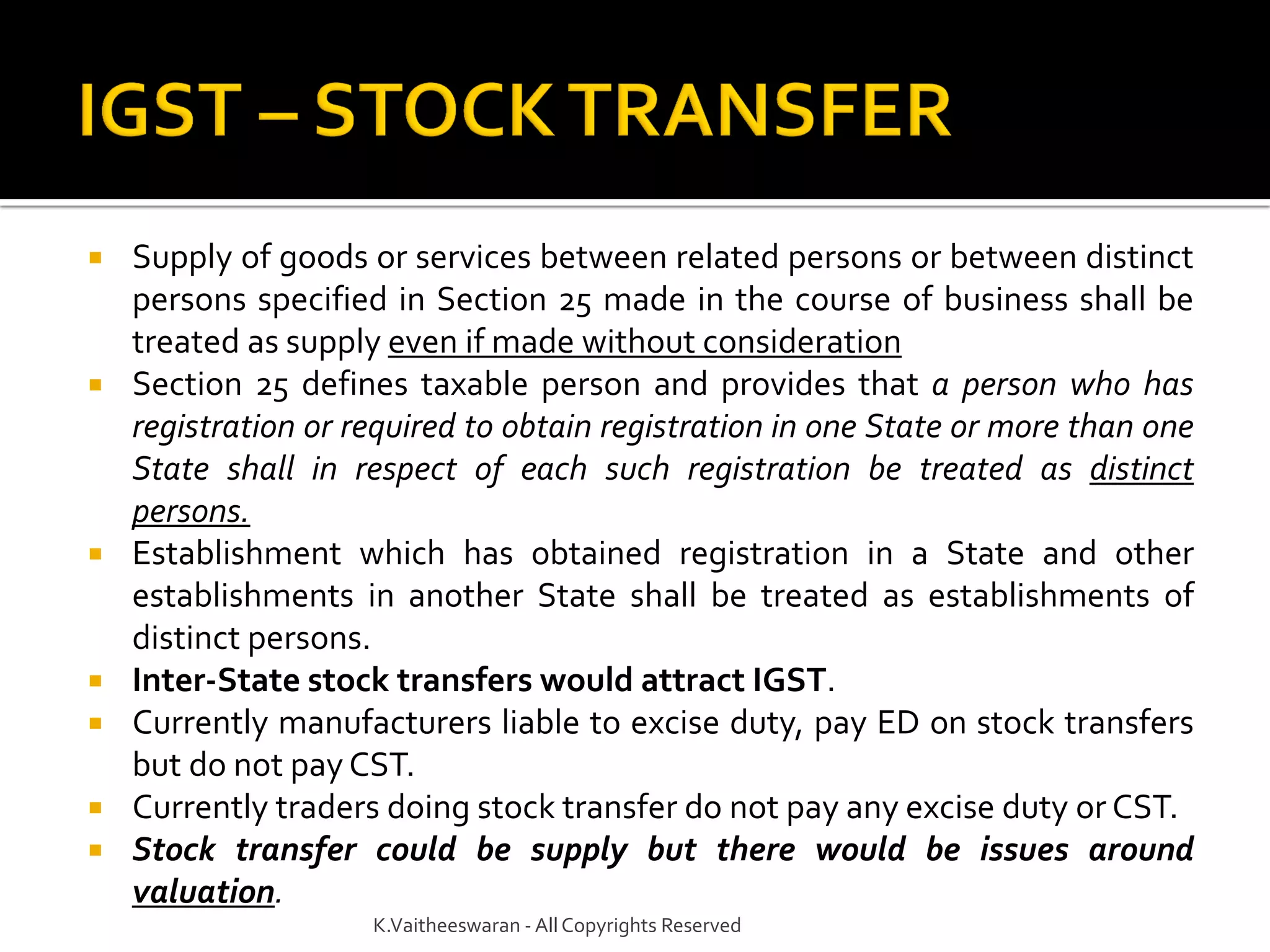

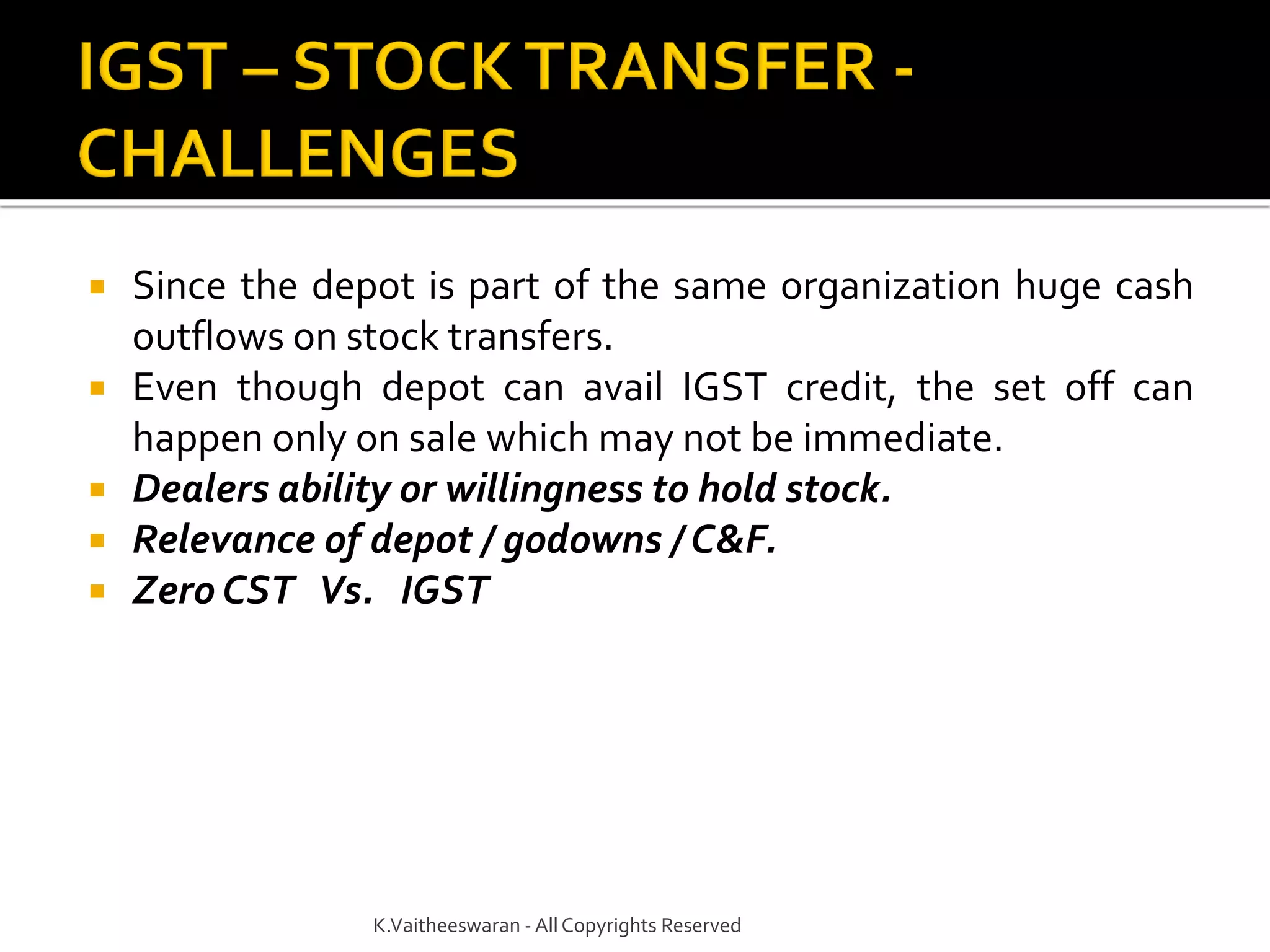

The document discusses the complexities and implications of the Goods and Services Tax (GST) introduced in India, detailing its framework, including various tax laws and amendments. It emphasizes the challenges related to compliance, legal structures, and the need for a robust IT infrastructure to support the GST system. Additionally, it explores specific scenarios of taxation, the treatment of supplies, composite and mixed supplies, and the implications for businesses and individuals under the new tax regime.