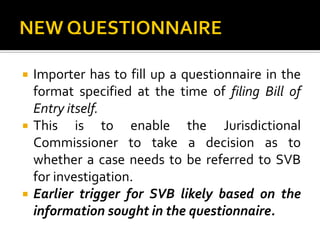

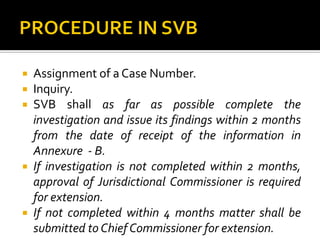

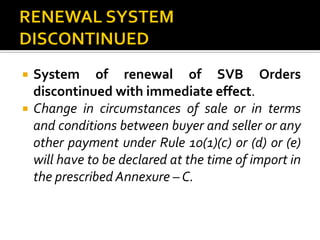

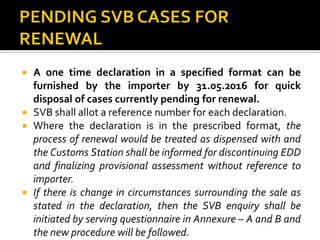

This document outlines new procedures for Special Valuation Branch (SVB) investigations of related party transactions under Indian customs valuation rules. Key points include: SVB investigations will now be based on questionnaires submitted with bills of entry rather than automatic for related parties; no extra duty deposits will be required upfront but can be imposed if information is not provided; SVB has strict timelines to issue investigation reports to streamline assessments; renewals of SVB orders are discontinued; importers can make one-time declarations to close existing renewal cases. The changes aim to reduce transaction costs and delays associated with SVB investigations.