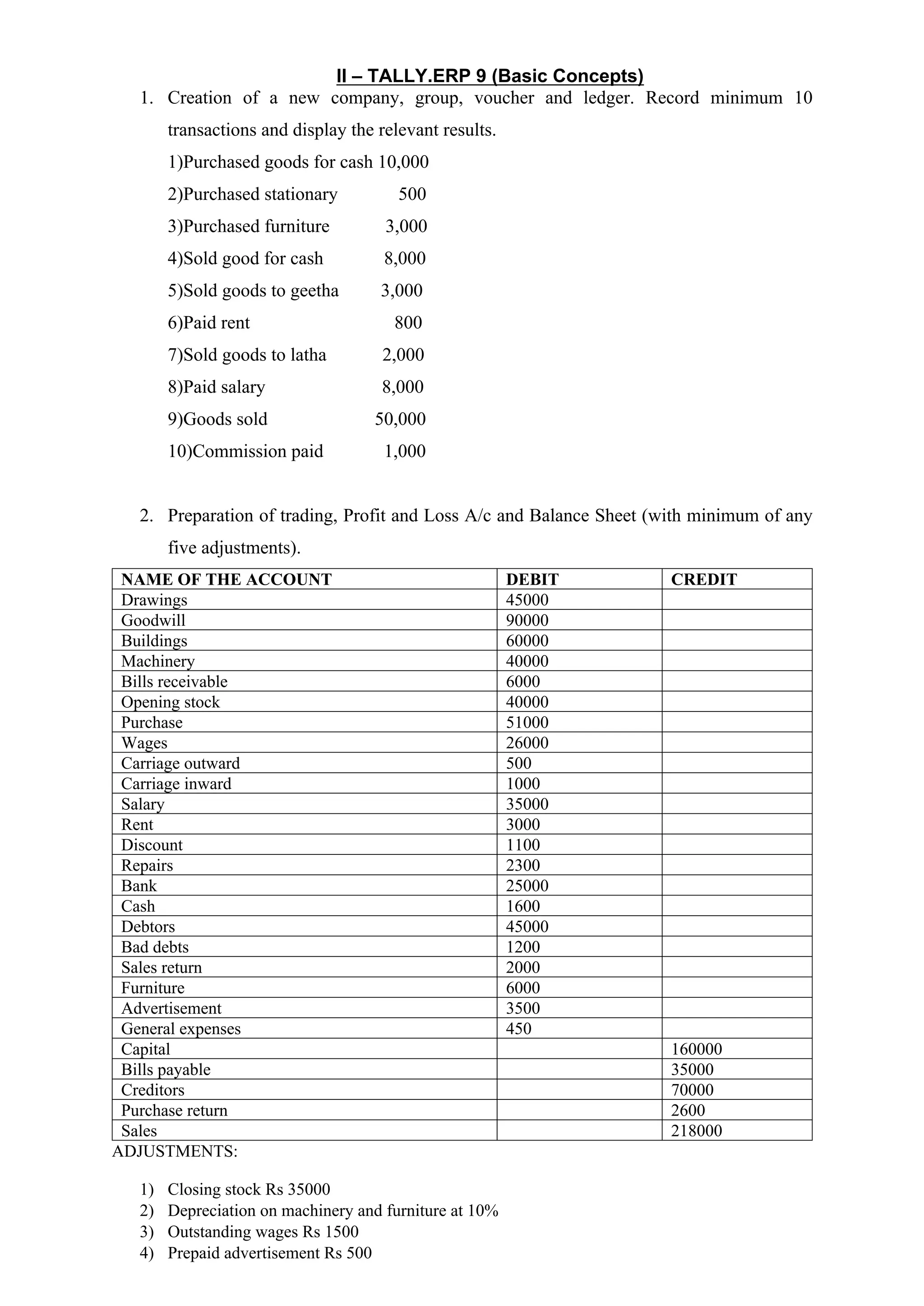

1. The document provides instructions for completing various accounting tasks in Tally.ERP 9 including: creating a new company and recording transactions, preparing financial statements with adjustments, preparing cash flow and fund flow statements with ratio analysis, preparing a trial balance with adjustments, and preparing subsidiary books.

2. It also provides details for preparing receipts and payments accounts and income and expenditure accounts for a non-trading organization, including sample data for the Delhi Football Association for the year ended March 31, 2017.

3. Key tasks covered include recording transactions, preparing trading, profit and loss, and balance sheet accounts, making adjustments, calculating inventory under different costing methods, and maintaining subsidiary books for cash, purchases and sales.