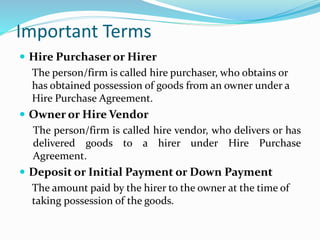

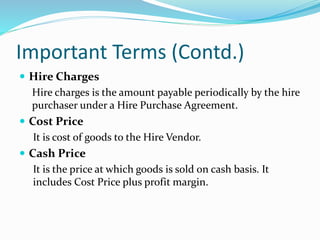

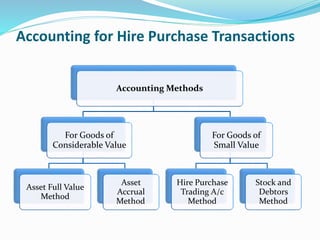

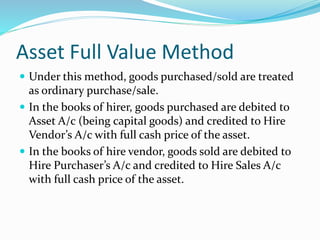

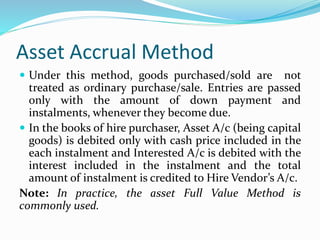

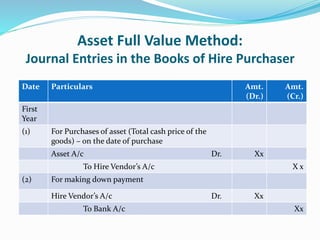

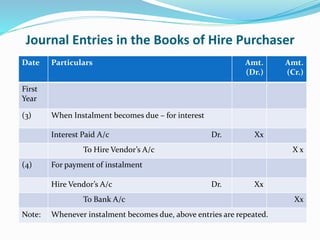

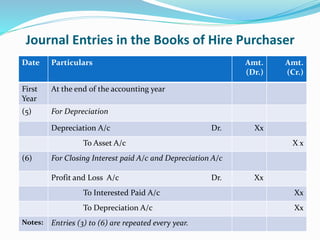

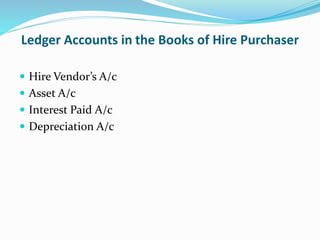

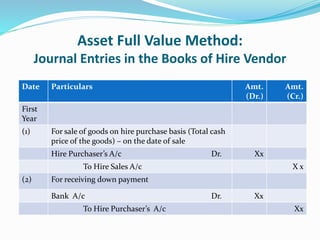

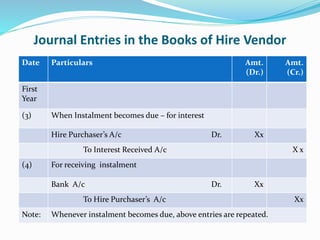

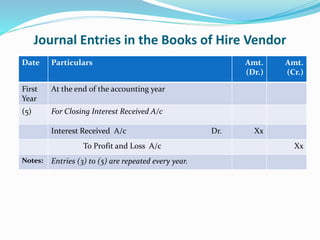

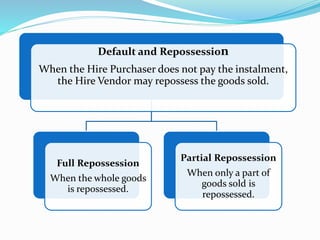

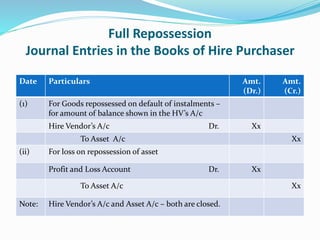

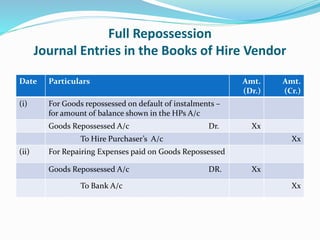

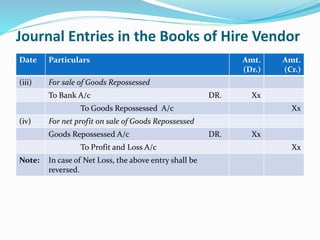

This document provides information on the hire purchase system in India. It defines key terms like hire purchaser, hire vendor, down payment, and hire charges. It describes two accounting methods for hire purchase transactions - the asset full value method and asset accrual method. Journal entries for the hire purchaser and hire vendor are shown for the full value method. The document also discusses accounting for default and repossession of goods.