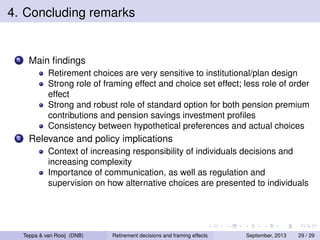

This document summarizes the results of a study on how framing effects influence retirement decisions. The study used hypothetical questions from surveys in the Netherlands and US to examine how individuals' preferences for pension contributions and investment profiles are affected by how the choices are framed or presented. The results show strong evidence that framing effects, choice set effects, and the standard option presented influence individuals' decisions. Preferences were also found to be more vulnerable to framing for more complex decisions. The findings suggest communication around retirement choices needs to properly frame options to avoid unintended influences on individuals' decisions.

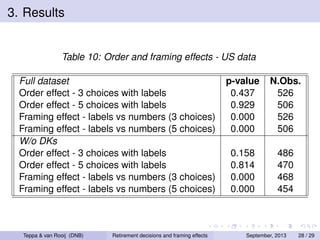

![3. Results

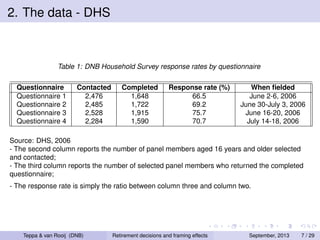

Table 6a: Role of standard option - Pension premium contributions - probit estimates

Variable

14 percent

16 percent

Coefficient

Coefficient

[Marg.eff.]

[Marg.eff.]

(Std. Err.)

(Std. Err.)

Labeled standard

1.027 ***

-0.177 *

[0.311]

[-0.069]

(0.125)

(0.099)

SAS financial literacy

0.114

0.025

[0.043]

[0.010]

(0.091)

(0.088)

Female

-0.153 *

0.082

[-0.056]

[0.032]

(0.080)

(0.077)

Age less than 40 years

0.346 **

-0.020

[0.132]

[-0.008]

(0.127)

(0.121)

Age between 40 and 64 years

0.224 **

-0.170 *

[0.083]

[-0.067]

(0.107)

(0.102)

Gross household income (in logs)

0.010

-0.183 **

[0.003]

[-0.072]

(0.088)

(0.086)

Total fin. assets (in logs)

-0.010

-0.016

[-0.003]

[-0.006]

(0.028)

(0.027)

Constant

-0.978

1.422 **

(0.721)

(0.705)

Log-likelihood

-749.708

-816.210

Pseudo R2

0.066

0.028

N.Obs.

1215

1215

Teppa & van Rooij (DNB)

Retirement decisions and framing effects

18 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.208 **

[0.082]

(0.098)

-0.184 **

[-0.073]

(0.088)

-0.066

[-0.026]

(0.076)

-0.334 **

[-0.132]

(0.121)

-0.196 *

[-0.077]

(0.102)

0.006

[0.002]

(0.085)

0.045 *

[0.018]

(0.027)

-0.428

(0.701)

-817.545

0.024

1215

September, 2013

23 / 29](https://image.slidesharecdn.com/tallinnlabels-131119052235-phpapp01/85/Federica-Teppa-Maarten-van-Rooij-Are-Retirement-Decisions-Vulnerable-to-Framing-Effects-23-320.jpg)

![3. Results

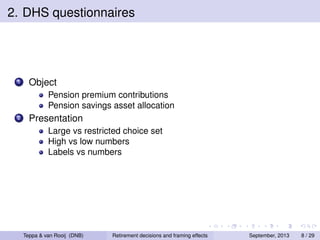

Table 6b: Role of standard option - Pension savings investment profile - probit estimates

Variable

45-55 percent

30-70 percent

Coefficient

Coefficient

[Marg.eff.]

[Marg.eff.]

(Std. Err.)

(Std. Err.)

Labeled standard

0.712 ***

-0.115

[0.158]

[-0.046]

(0.112)

(0.081)

SAS financial literacy

0.339 ***

-0.187 **

[0.094]

[-0.074]

(0.102)

(0.090)

Female

-0.209 **

-0.159 **

[-0.053]

[-0.063]

(0.094)

(0.078)

Age less than 40 years

0.263 *

0.020

[0.072]

[0.008]

(0.147)

(0.122)

Age between 40 and 64 years

0.191

0.024

[0.049]

[0.009]

(0.124)

(0.009)

Gross hh income (in logs)

0.032

0.063

[0.008]

[0.025]

(0.104)

(0.087)

Total fin. assets (in logs)

0.082 **

-0.038

[0.021]

[-0.015]

(0.033)

(0.028)

Constant

-2.118 **

0.205

(0.842)

(0.704)

Log-likelihood

-538.100

-801.155

Pseudo R2

0.092

0.023

N.Obs.

1184

1184

Teppa & van Rooij (DNB)

Retirement decisions and framing effects

15-85 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.182 **

[0.069]

(0.084)

-0.163 *

[-0.061]

(0.091)

0.262 ***

[0.096]

(0.081)

-0.204

[-0.007]

(0.127)

-0.170

[-0.063]

(0.108)

-0.141

[-0.052]

(0.090)

0.012

[0.004]

(0.028)

1.087

(0.734)

-736.706

0.051

1184

September, 2013

24 / 29](https://image.slidesharecdn.com/tallinnlabels-131119052235-phpapp01/85/Federica-Teppa-Maarten-van-Rooij-Are-Retirement-Decisions-Vulnerable-to-Framing-Effects-24-320.jpg)

![3. Results

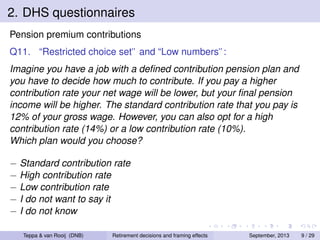

Table 7: Role of risk attitudes - Pension savings investment profiles - probit estimates

Variable

Labeled standard

Saving1

Saving2

Saving3

Saving4

Saving5

Saving6

Joint significance test

Log-likelihood

Pseudo R2

N.Obs.

Teppa & van Rooij (DNB)

45-55 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.720 ***

[0.155]

(0.120)

-0.253 **

[-0.067]

(0.117)

-0.346 ***

[-0.086]

(0.102)

-0.130

[-0.031]

(0.151)

0.056

[0.013]

(0.124)

0.309 **

[0.085]

(0.121)

0.187

[0.050]

(0.141)

0.000

-494.184

0.127

1122

30-70 percent

Coefficient

[Marg.eff.]

(Std. Err.)

-0.125

[-0.050]

(0.085)

0.069

[0.027]

(0.101)

-0.284 ***

[-0.113]

(0.084)

0.259 **

[0.102]

(0.132)

-0.007

[-0.003]

(0.105)

0.065

[0.025]

(0.110)

0.225 *

[0.089]

(0.131)

0.000

-744.214

0.043

1122

Retirement decisions and framing effects

15-85 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.218 **

[0.082]

(0.089)

0.083

[0.031]

(0.104)

0.440 ***

[0.162]

(0.087)

0.082

[0.030]

(0.135)

0.004

[0.001]

(0.109)

-0.163

[-0.061]

(0.113)

-0.319 **

[-0.122]

(0.132)

0.000

-673.521

0.086

1122

September, 2013

25 / 29](https://image.slidesharecdn.com/tallinnlabels-131119052235-phpapp01/85/Federica-Teppa-Maarten-van-Rooij-Are-Retirement-Decisions-Vulnerable-to-Framing-Effects-25-320.jpg)

![3. Results

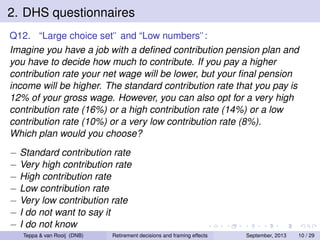

Table 8: Pension savings investment profiles and household wealth - probit estimates

Variable

45-55 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.611 ***

[0.143]

(0.085)

0.040 **

[0.010]

(0.013)

-0.430 ***

(0.083)

-814.520

0.037

1733

Labeled standard

Total hh wealth

Constant

Log-likelihood

Pseudo R2

N.Obs.

Labeled standard

Financial hh wealth

Constant

Log-likelihood

Pseudo R2

N.Obs.

Teppa & van Rooij (DNB)

30-70 percent

Coefficient

[Marg.eff.]

(Std. Err.)

-0.063

[-0.025]

(0.064)

0.008

[0.003]

(0.012)

0.008

(0.061)

-1200.407

0.001

1733

15-85 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.220 ***

[0.085]

(0.089)

-0.032 *

[-0.012]

(0.012)

0.219 ***

(0.061)

-1147.166

0.001

1733

0.610 ***

[0.143]

(0.085)

0.121 ***

[0.031]

(0.031)

-1.391 ***

(0.077)

-811.476

0.041

1733

-0.062

[-0.024]

(0.085)

-0.005

[-0.002]

(0.101)

0.069

(0.101)

-1200.614

0.001

1733

0.219 ***

[0.084]

(0.065)

-0.066 **

[-0.025]

(0.029)

0.172 **

(0.055)

-1148.061

0.006

1733

Retirement decisions and framing effects

September, 2013

26 / 29](https://image.slidesharecdn.com/tallinnlabels-131119052235-phpapp01/85/Federica-Teppa-Maarten-van-Rooij-Are-Retirement-Decisions-Vulnerable-to-Framing-Effects-26-320.jpg)

![3. Results

Table 9: Pension savings investment profiles and portfolio choice - probit estimates

Variable

45-55 percent

30-70 percent

Coefficient

Coefficient

[Marg.eff.]

[Marg.eff.]

(Std. Err.)

(Std. Err.)

Labeled standard

0.599 ***

-0.069

[0.140]

[-0.027]

(0.086)

(0.065)

No risky assets

0.027

0.012

[0.007]

[0.005]

(0.063)

(0.054)

Bonds and money lent out

0.052

-0.175

[0.013]

[-0.070]

(0.114)

(0.115)

Options, mutual funds and stocks

0.299 ***

0.022

[0.078]

[0.008]

(0.074)

(0.066)

Real estate

-0.007

0.001

[-0.002]

[0.001]

(0.022)

(0.019)

Business equity

0.144

0.133

[0.037]

[0.053]

(0.179)

(0.156)

Mortgages

-0.063

-0.059

[-0.016]

[-0.023]

(0.047)

(0.041)

Financial debt

-0.322

0.115

[-0.084]

[0.046]

(0.256)

(0.248)

Log-likelihood

-805.364

-1197.307

Pseudo R2

0.048

0.003

Teppa & van Rooij (DNB)

Retirement decisions and framing effects

N.Obs.

1733

1733

15-85 percent

Coefficient

[Marg.eff.]

(Std. Err.)

0.237 ***

[0.091]

(0.066)

-0.025

[-0.009]

(0.054)

0.146

[0.056]

(0.112)

-0.262 ***

[-0.100]

(0.080)

-0.008

[-0.003]

(0.019)

0.076

[0.029]

(0.167)

0.078 *

[0.029]

(0.248)

0.072

[0.027]

(0.248)

-1139.747

0.013

September, 2013

1733

27 / 29](https://image.slidesharecdn.com/tallinnlabels-131119052235-phpapp01/85/Federica-Teppa-Maarten-van-Rooij-Are-Retirement-Decisions-Vulnerable-to-Framing-Effects-27-320.jpg)