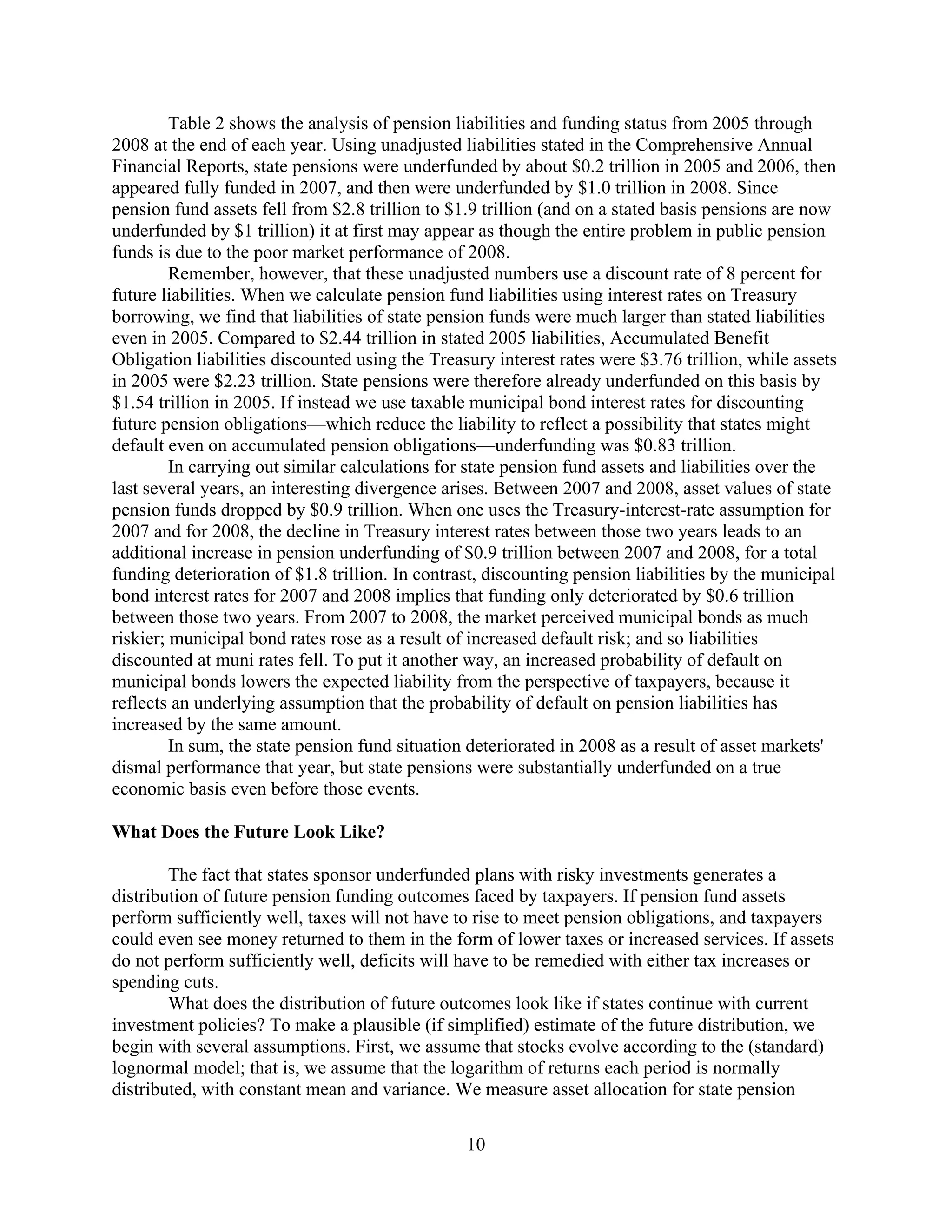

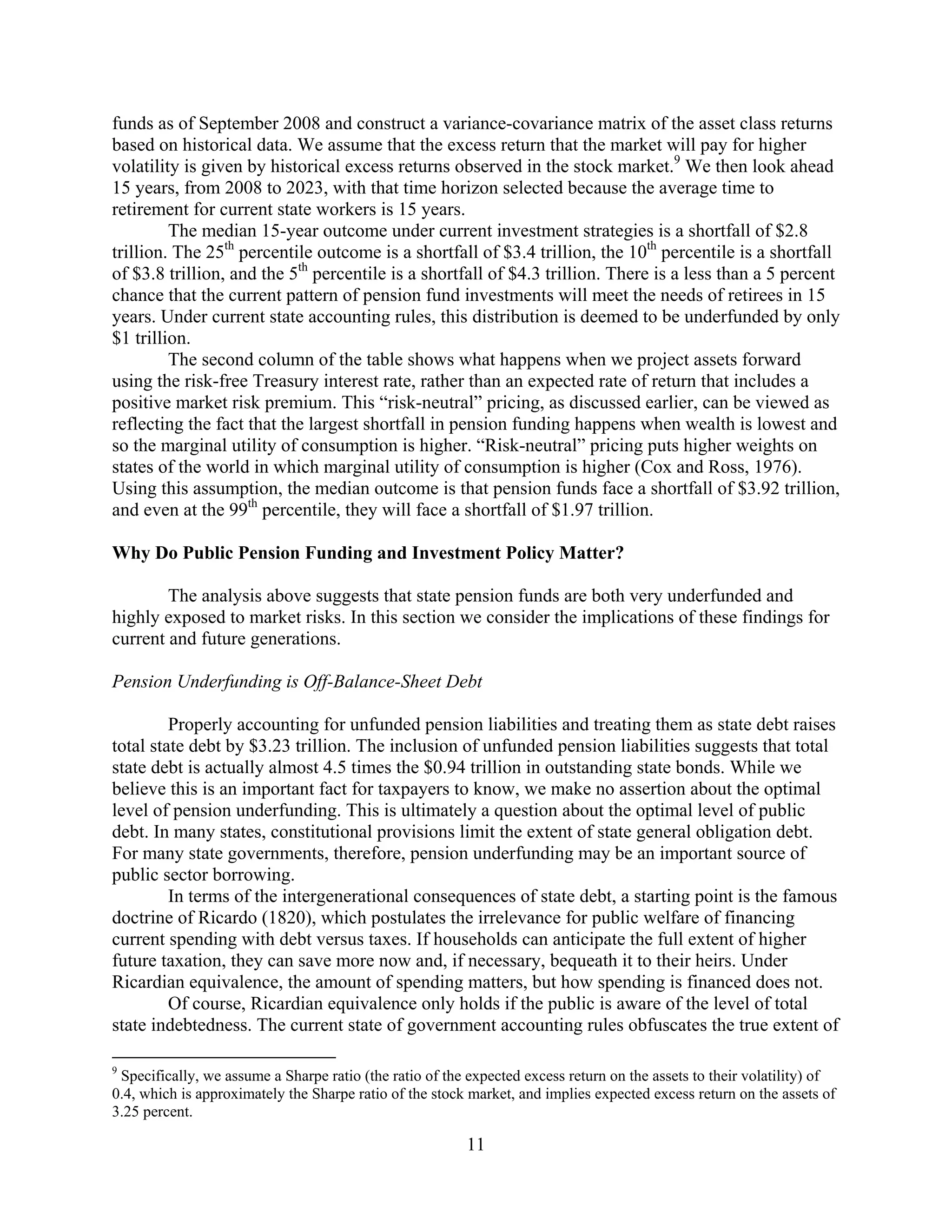

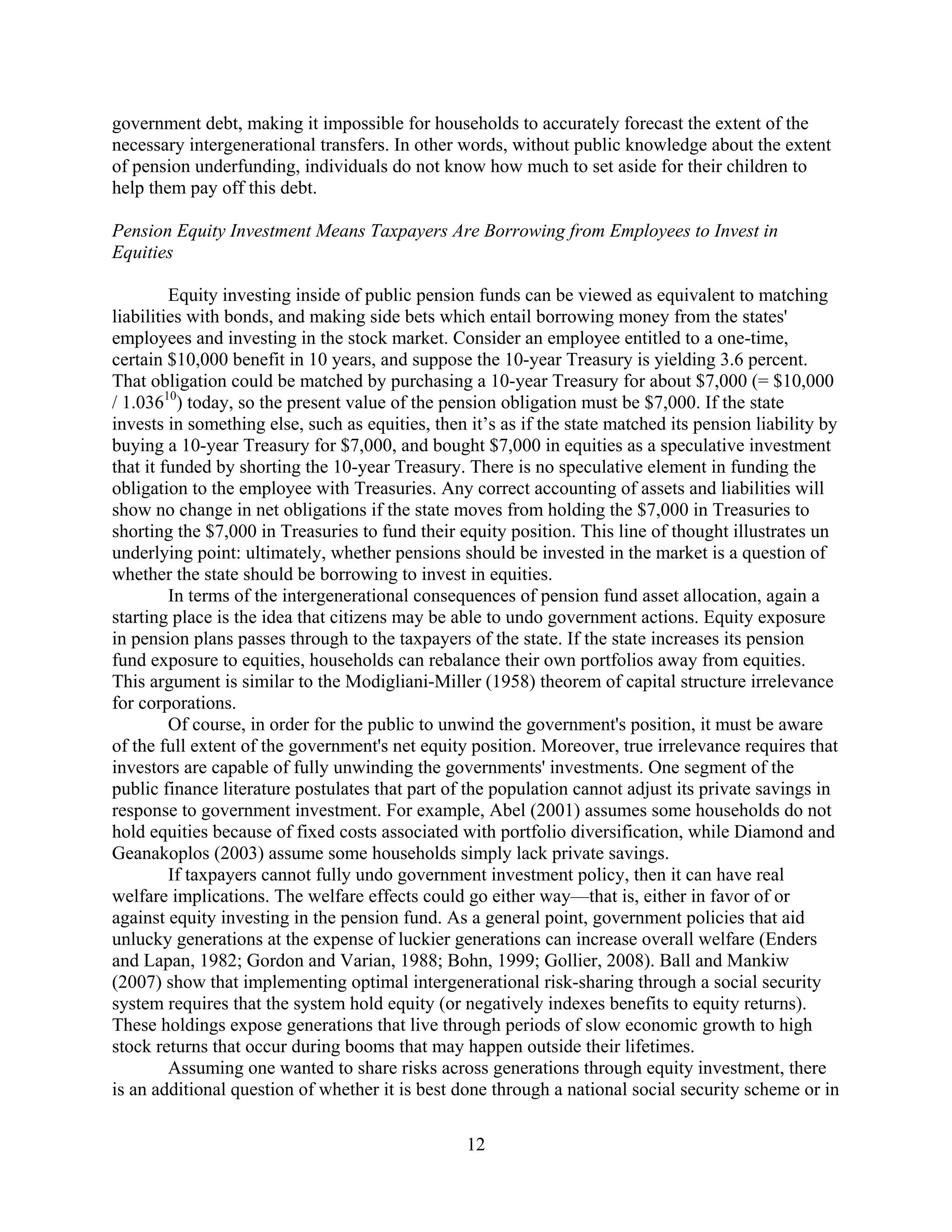

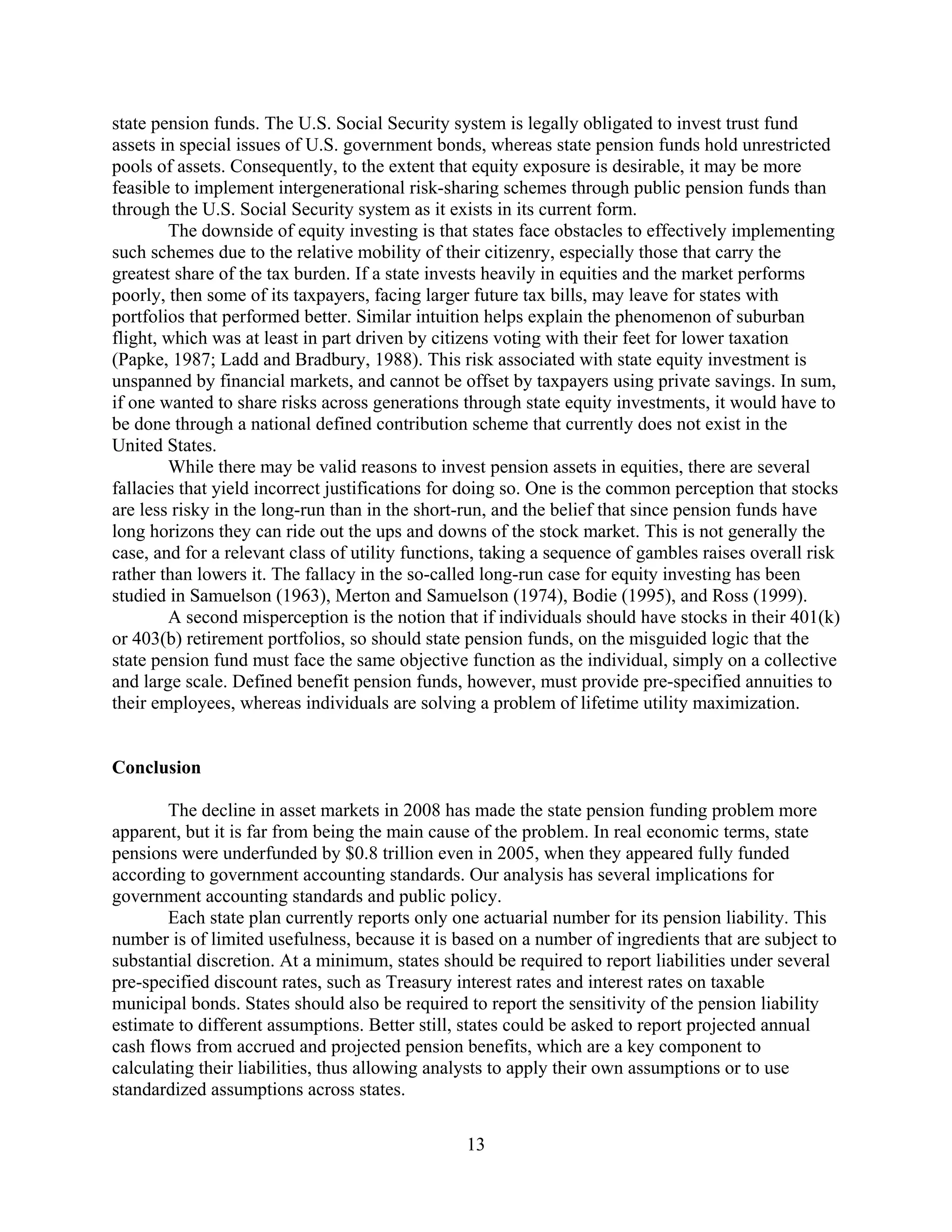

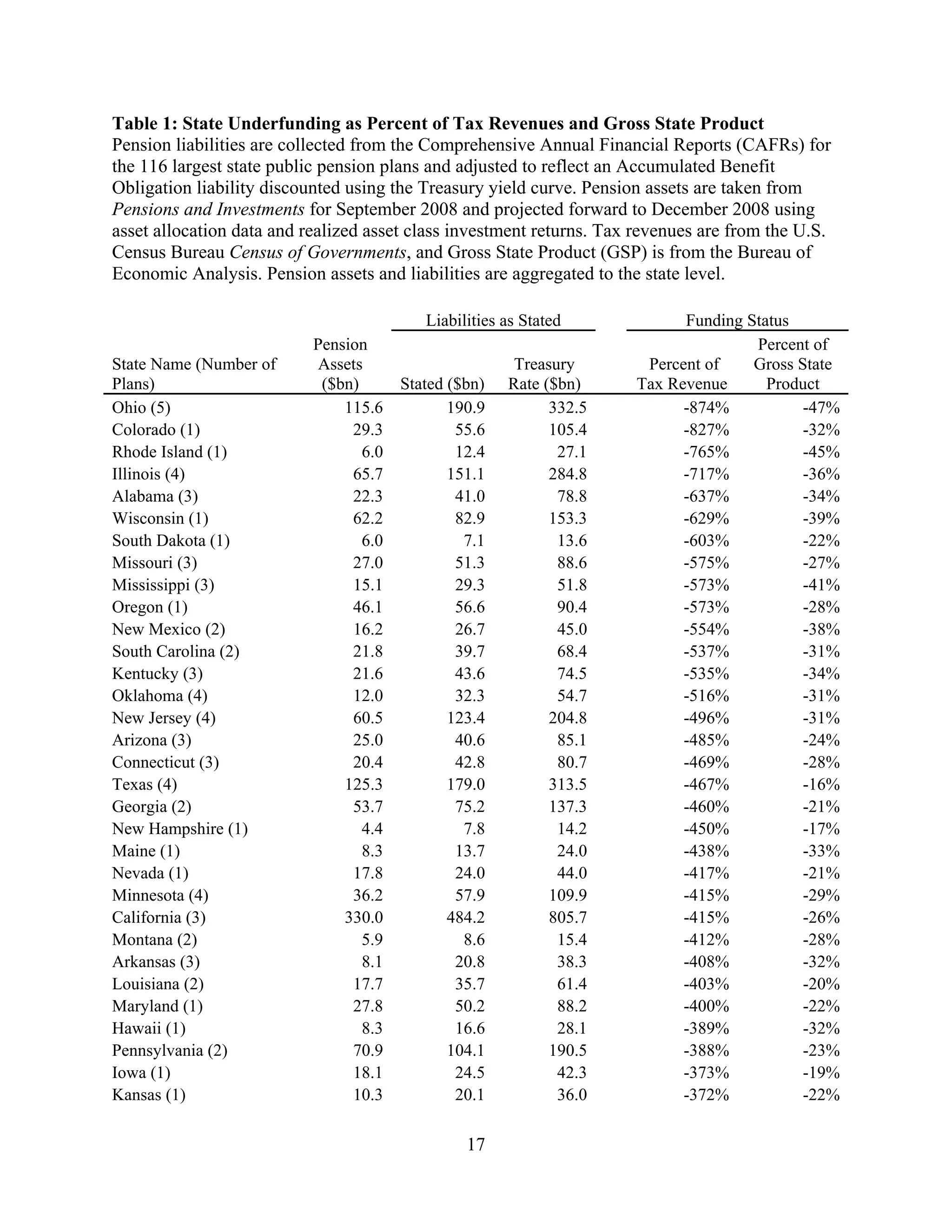

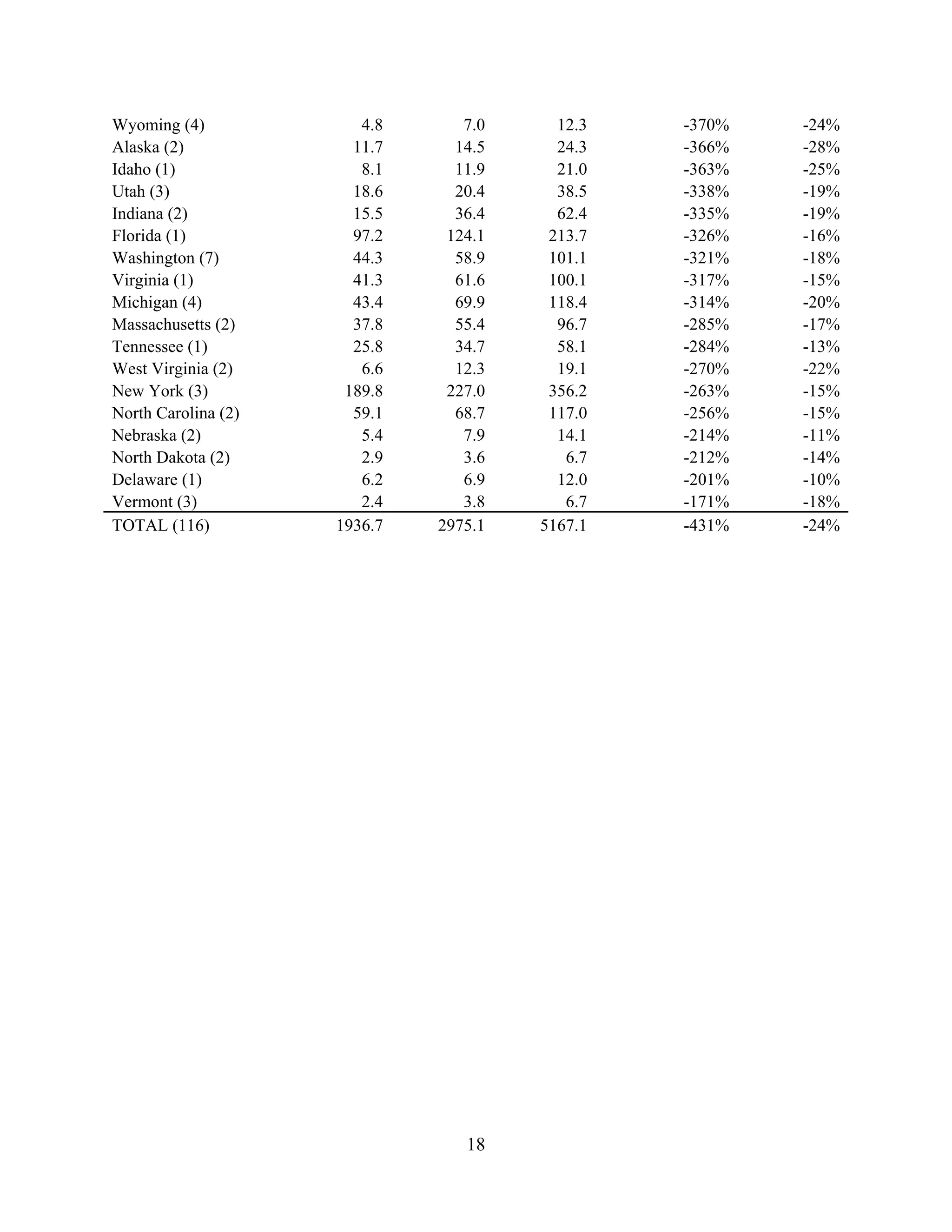

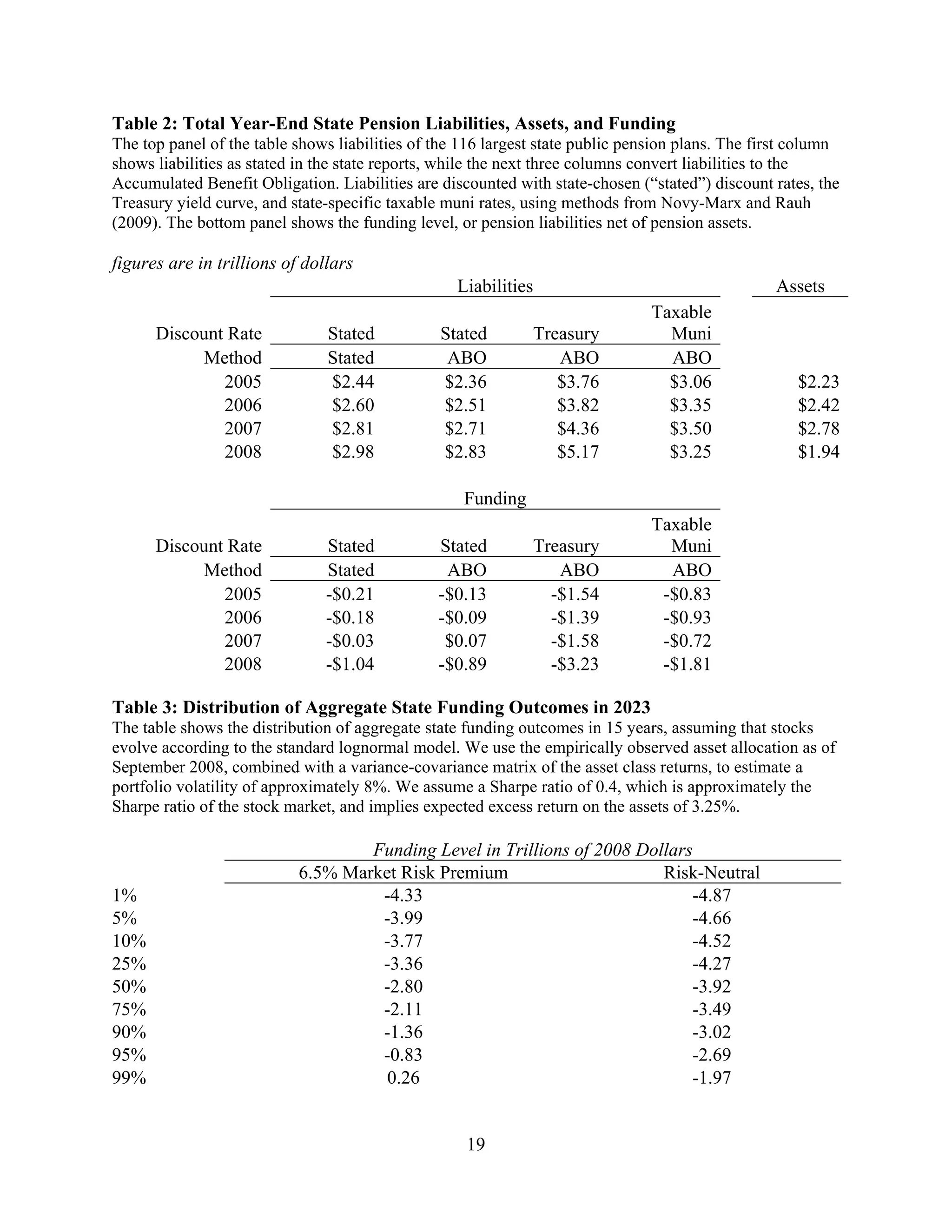

This document discusses the true funding status of public pension plans in the United States. It finds that while states have reported $1.94 trillion in pension assets, the actual liabilities using appropriate market-based discount rates are $5.17 trillion, resulting in an underfunding of $3.23 trillion. This underfunding is much larger than reported by states and represents a significant hidden debt burden on taxpayers. The document argues states should use risk-free discount rates like Treasury rates instead of the typical 8% rate when calculating pension liabilities, as pension obligations are very low risk from the state's perspective.