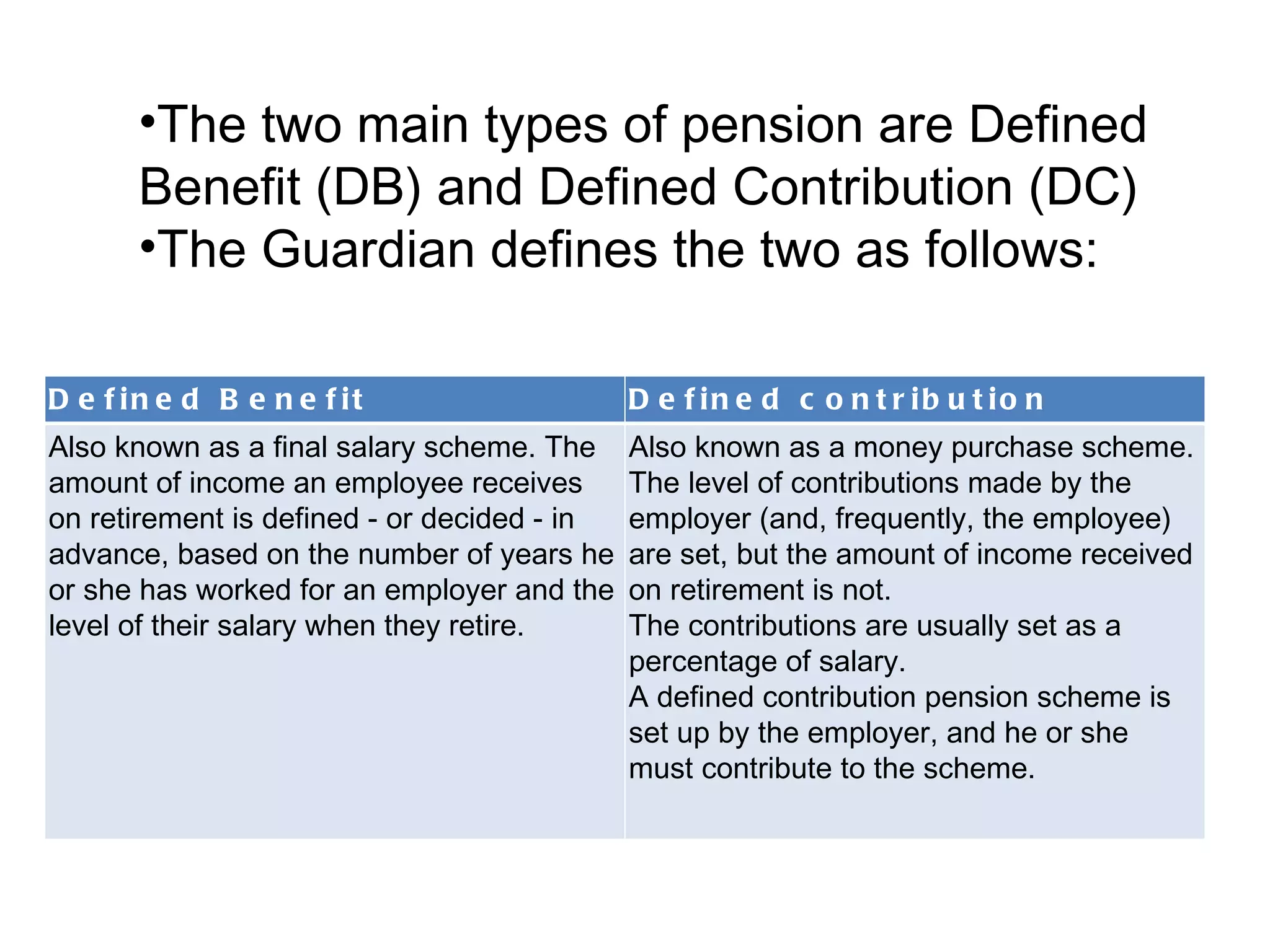

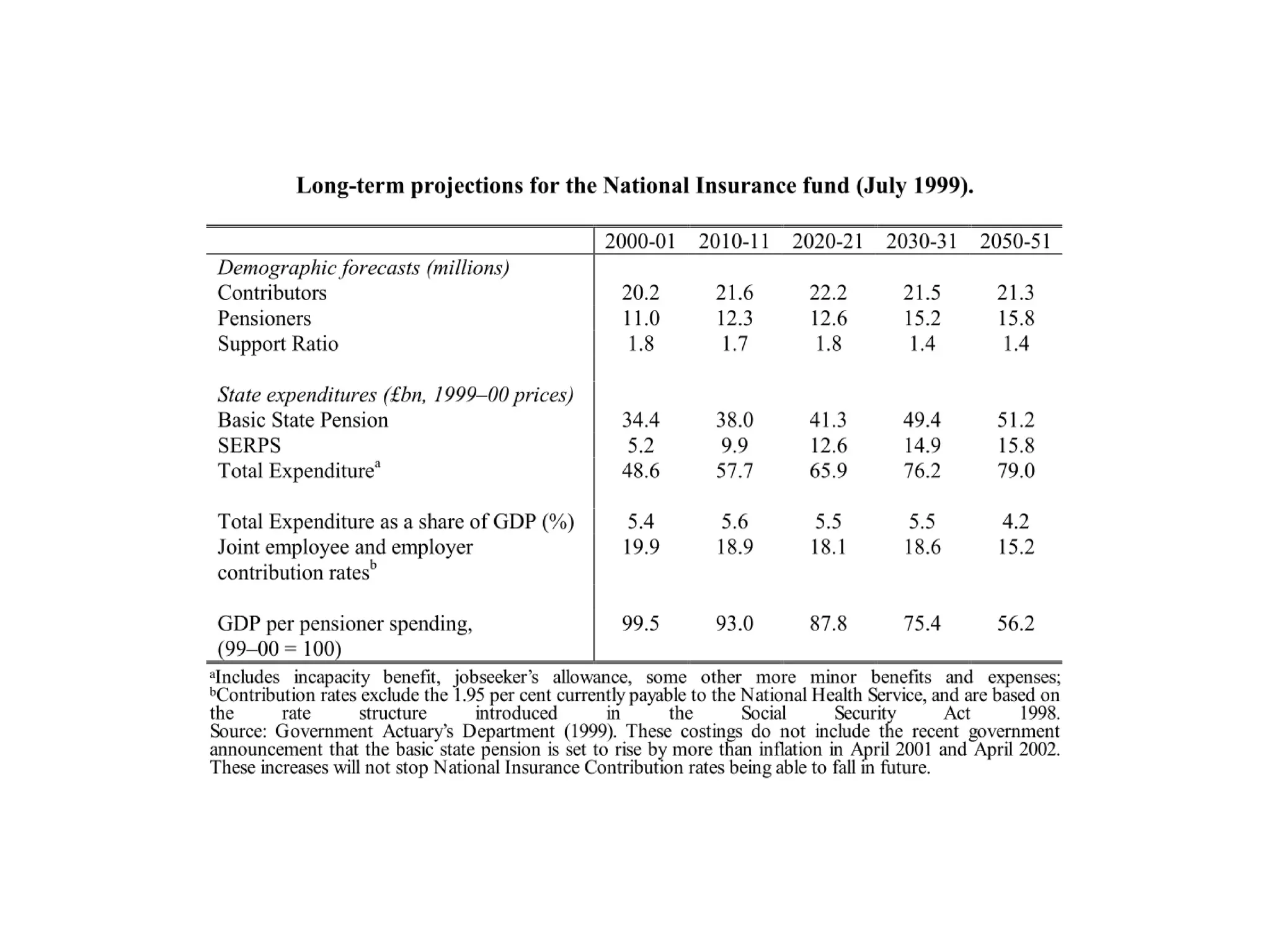

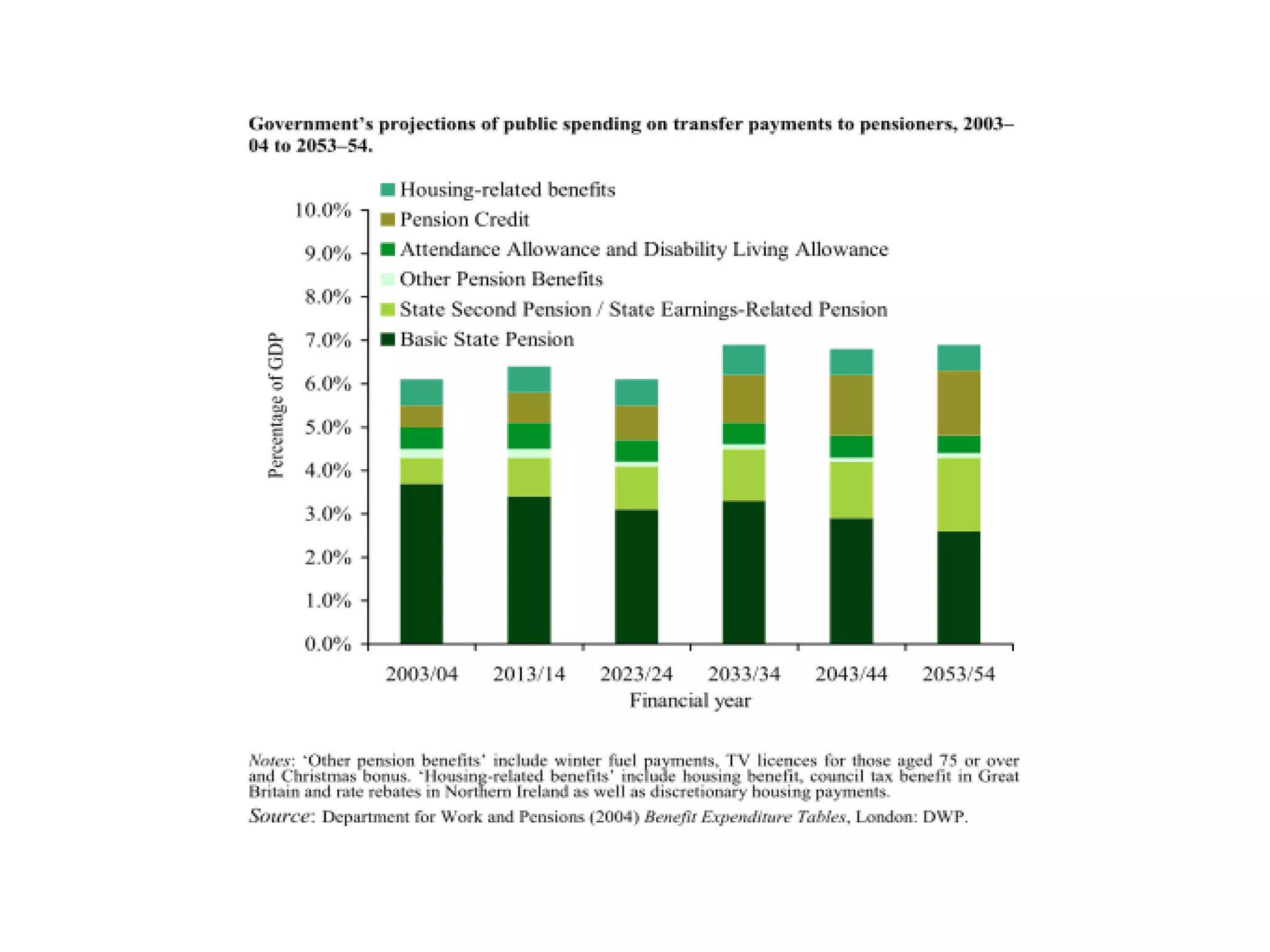

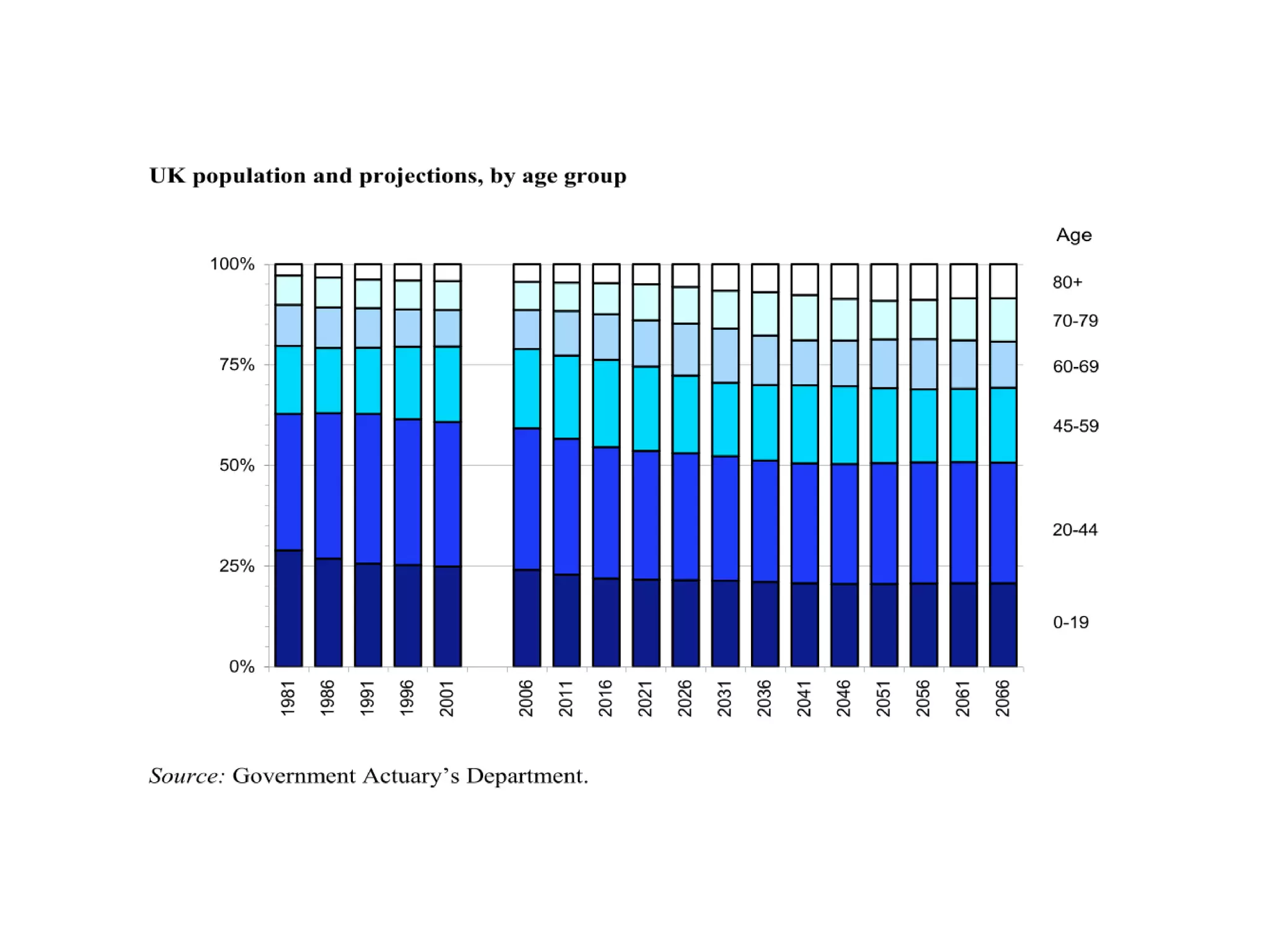

The document discusses different approaches to encouraging retirement saving in the UK, specifically whether traditional tax incentives or framing retirement saving options through default options is better. It provides background on pensions, defining defined benefit and defined contribution plans. It also outlines issues facing pension provision like aging populations and low private saving rates. Current trends in the UK show rising pension deficits and controversy over reforms to public pensions.