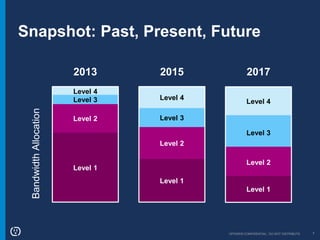

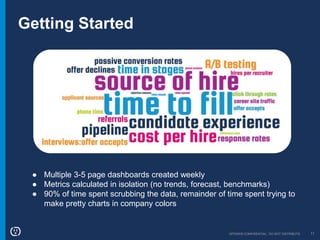

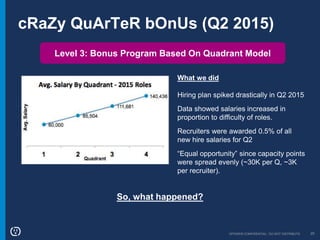

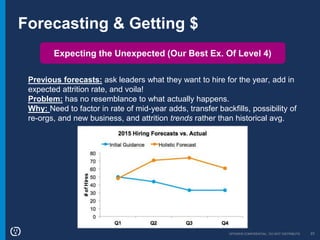

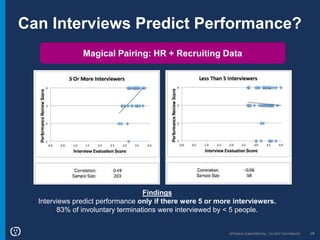

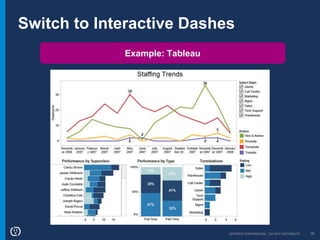

The document discusses Opower's journey developing talent analytics capabilities. It began with basic reporting but struggled due to data issues. It then implemented a quadrant model to categorize roles and set recruiter goals and capacity. This helped improve performance metrics like time to fill. Forecasting also improved by factoring in more variables. Integrating HR and recruiting data provided insights like interviews needing more people to predict performance. The presentation emphasizes iterative improvement and using data to solve problems.