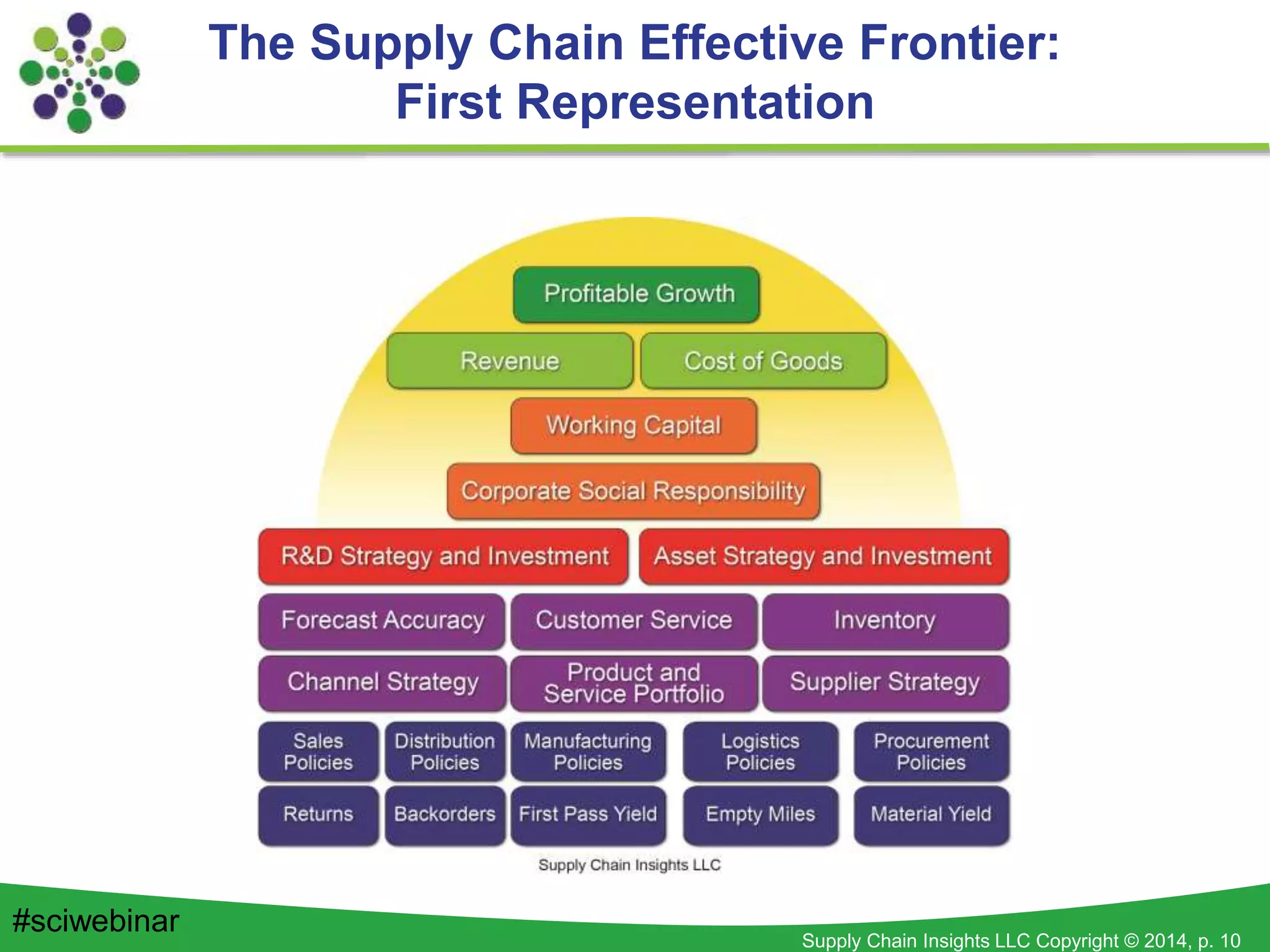

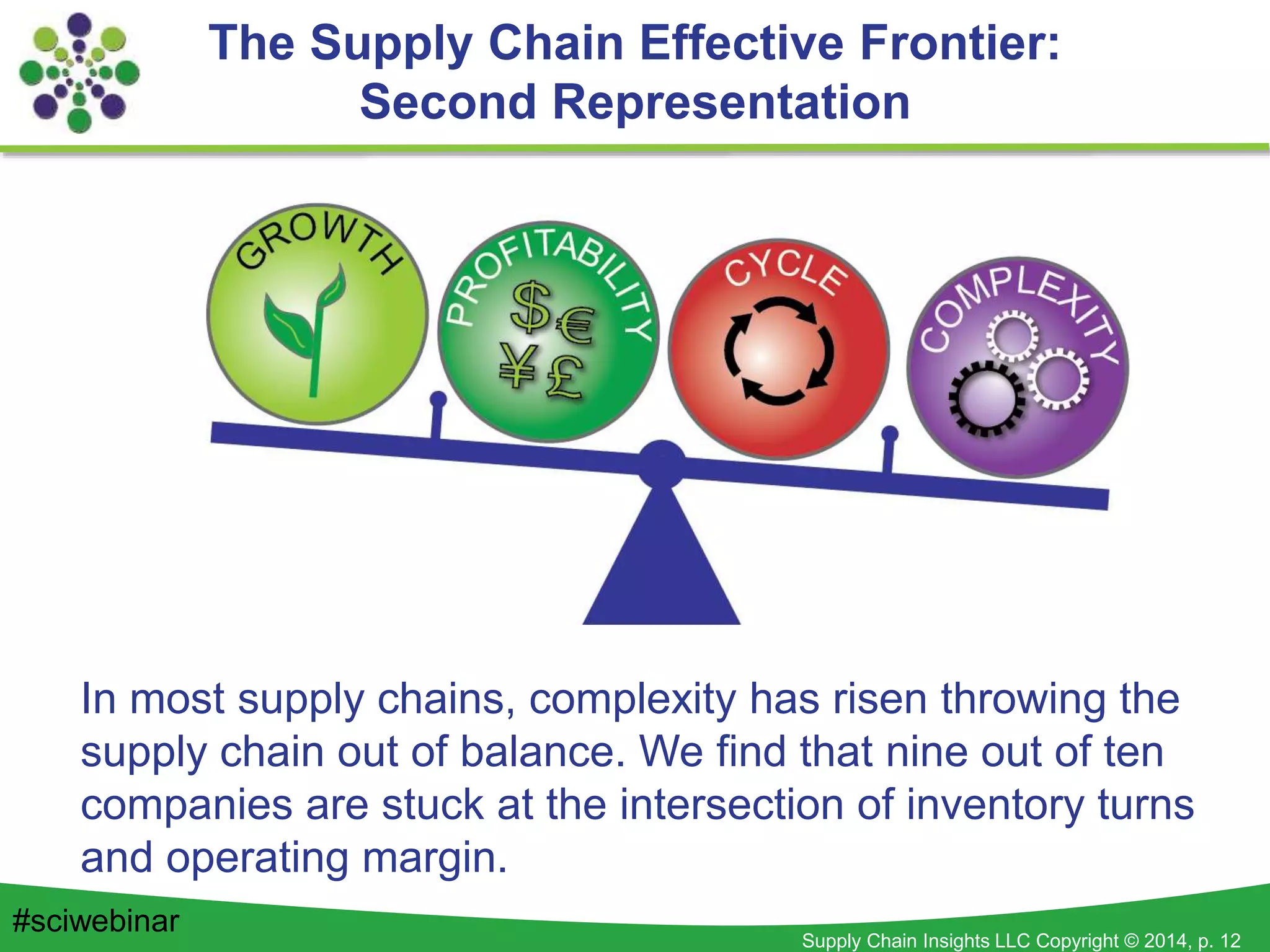

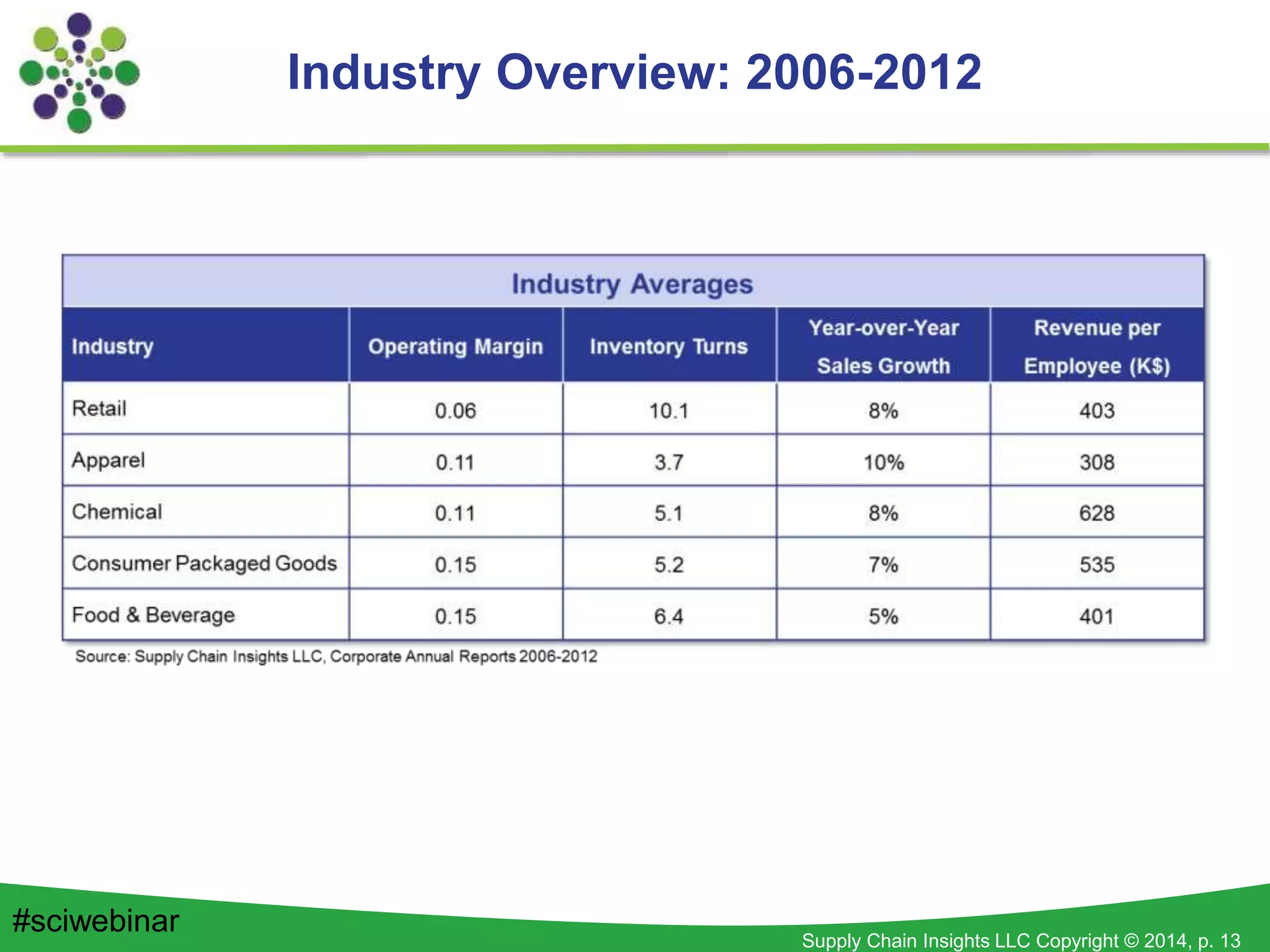

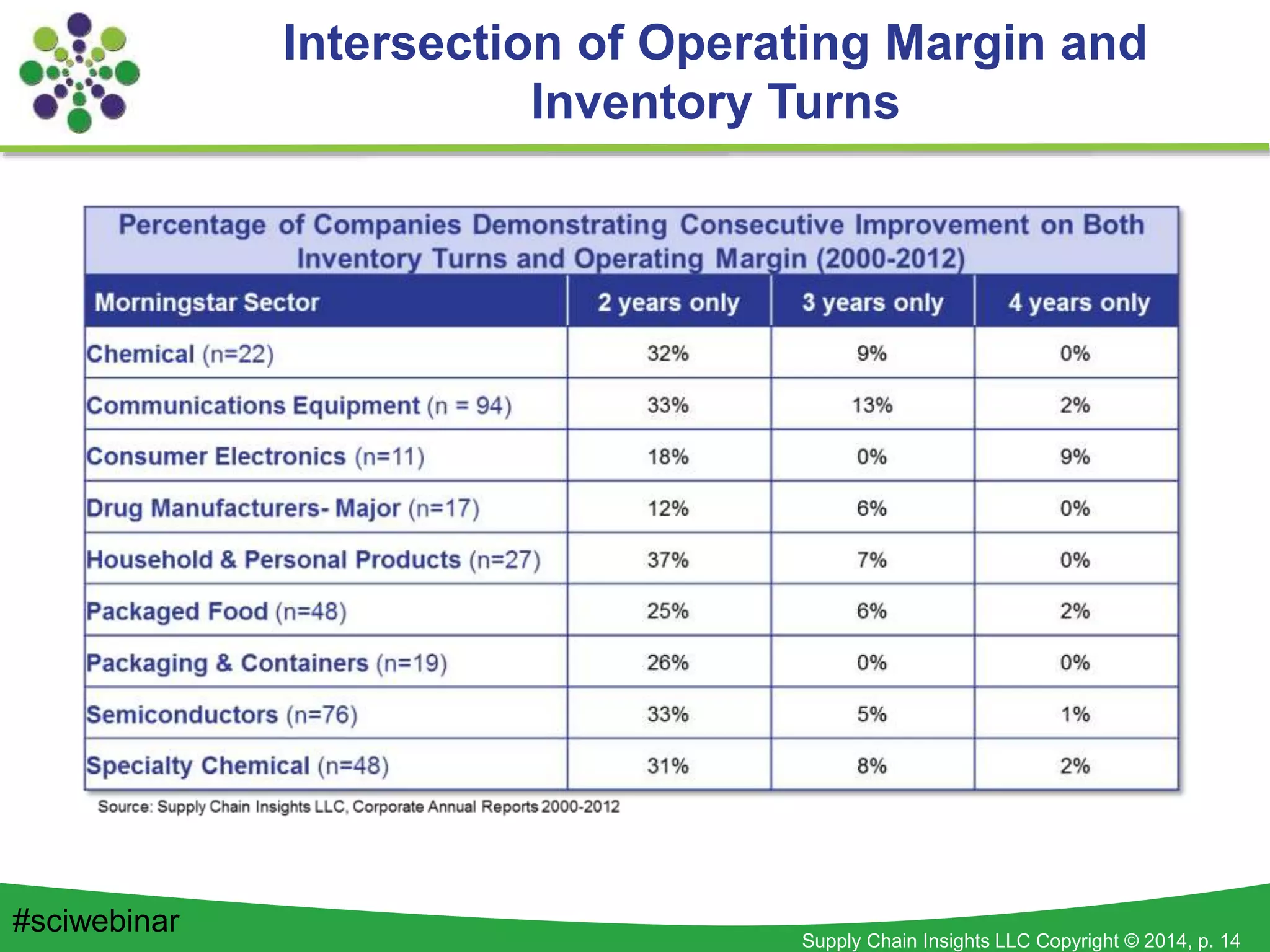

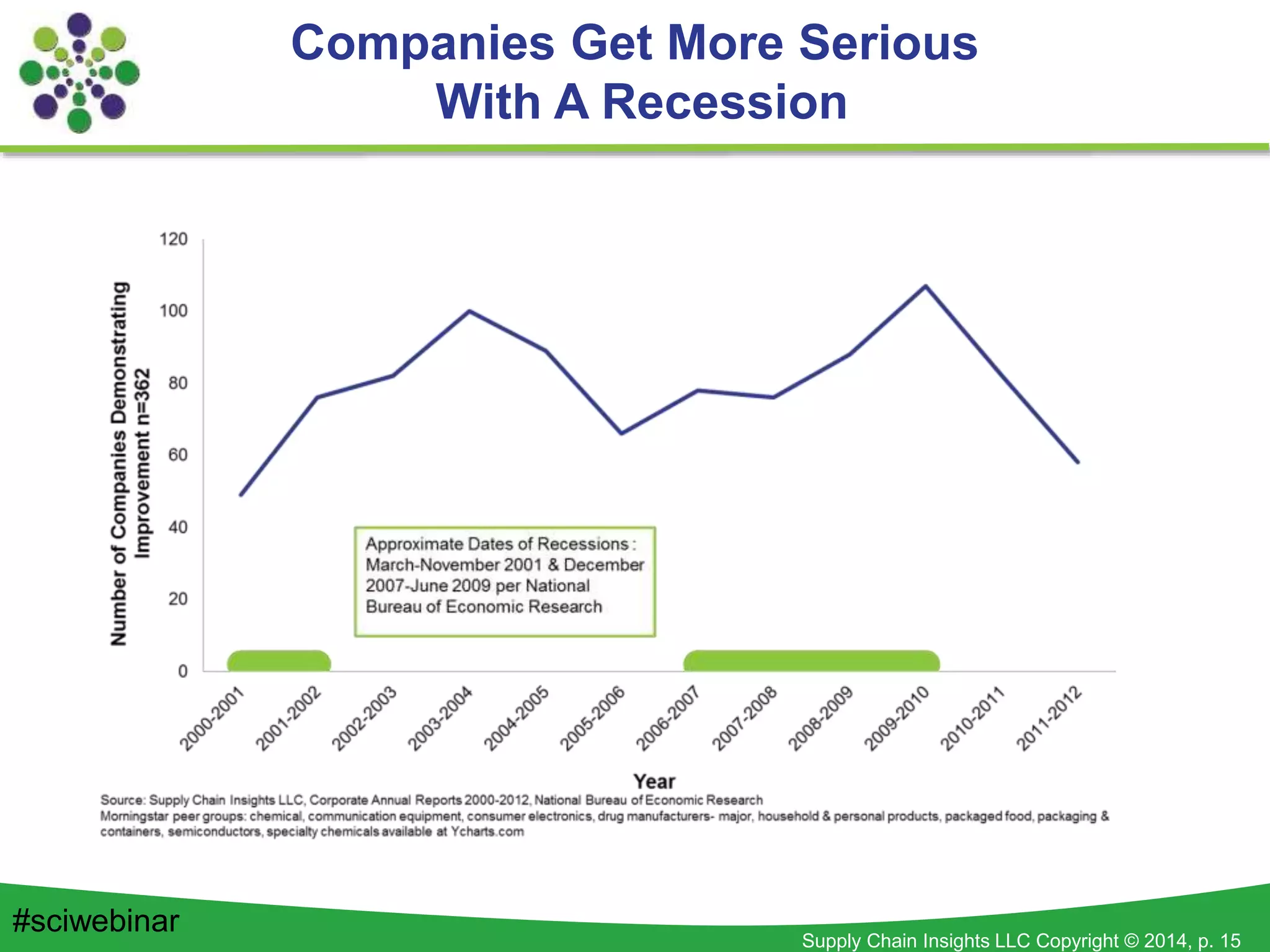

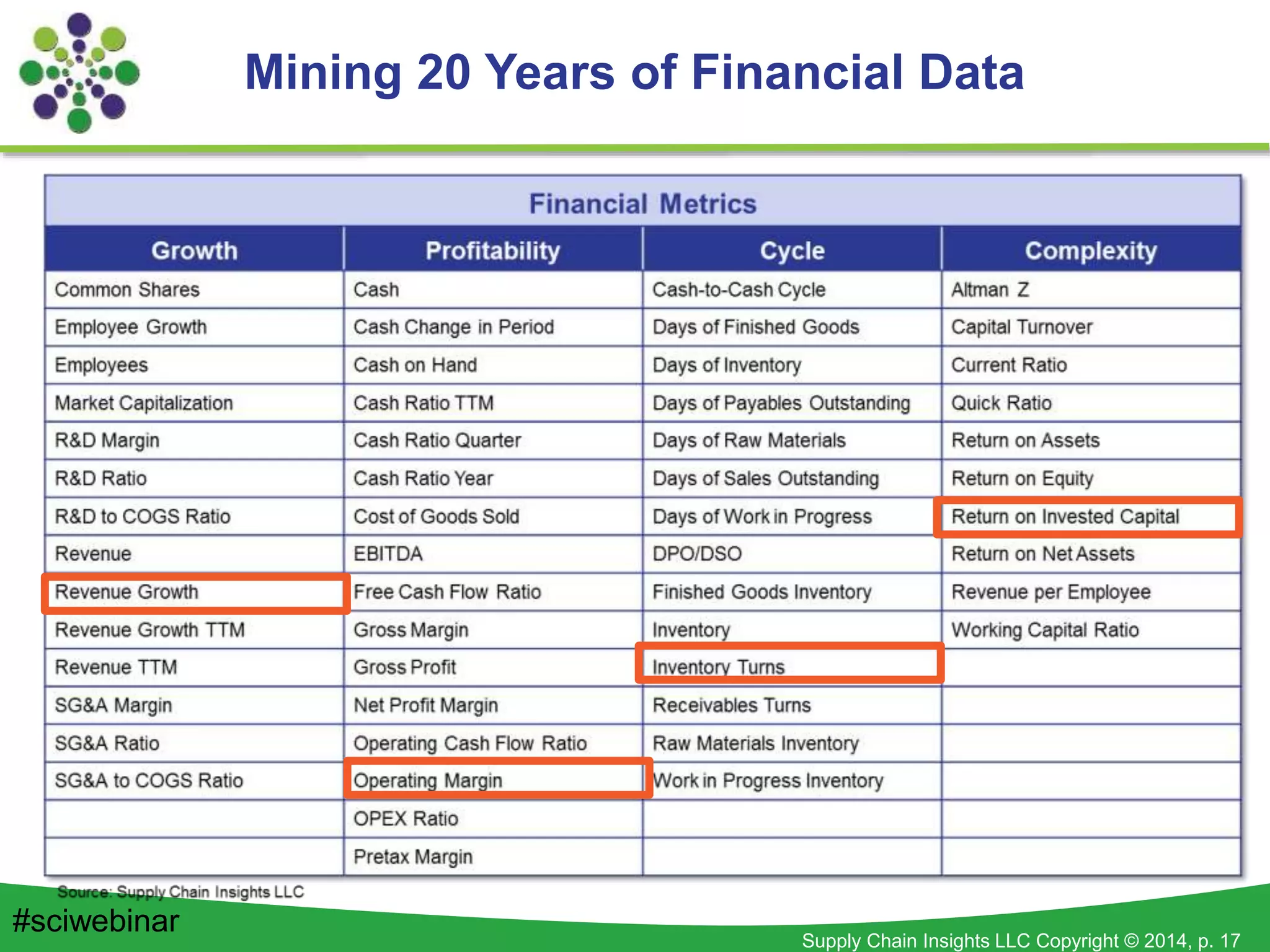

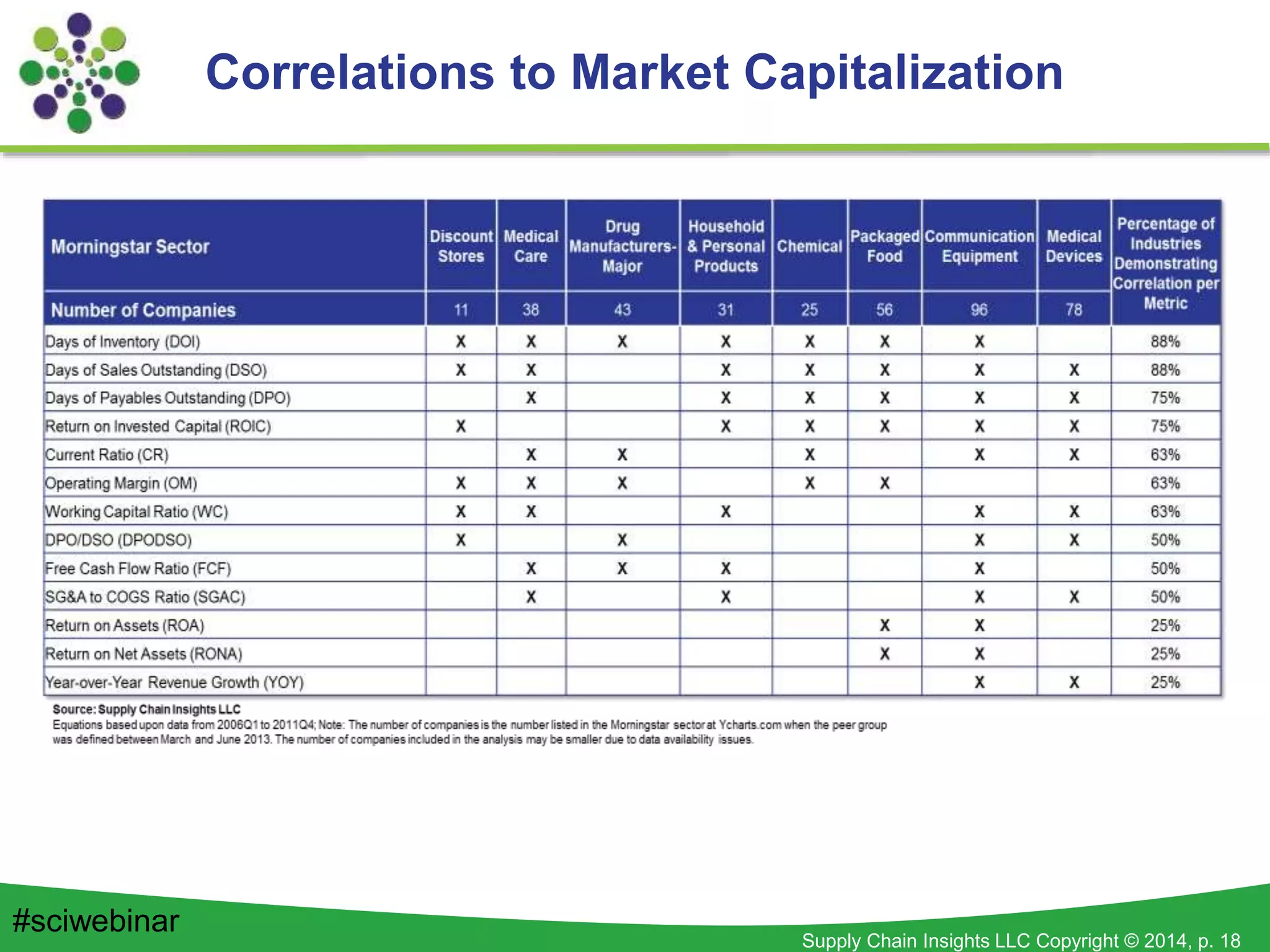

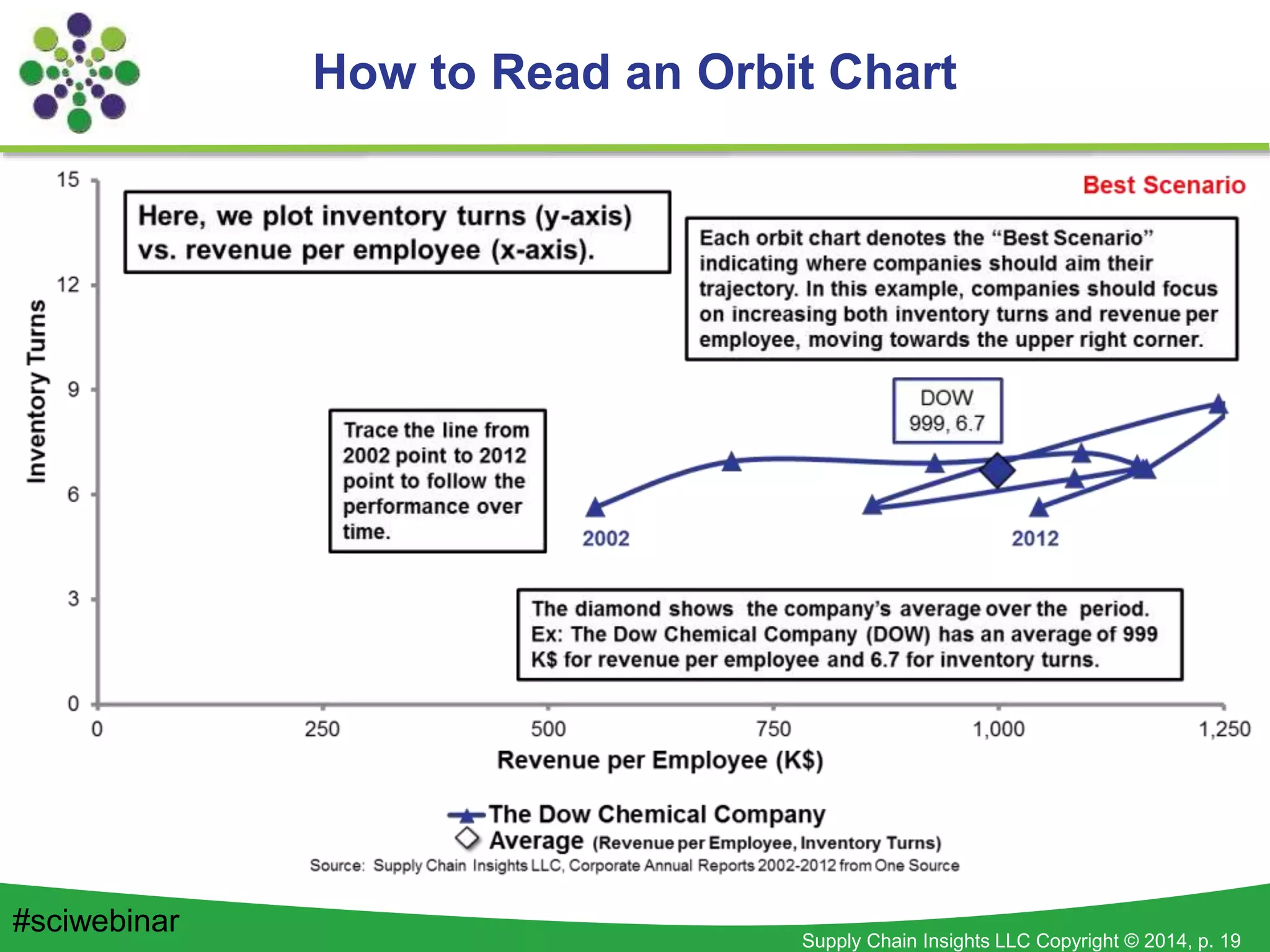

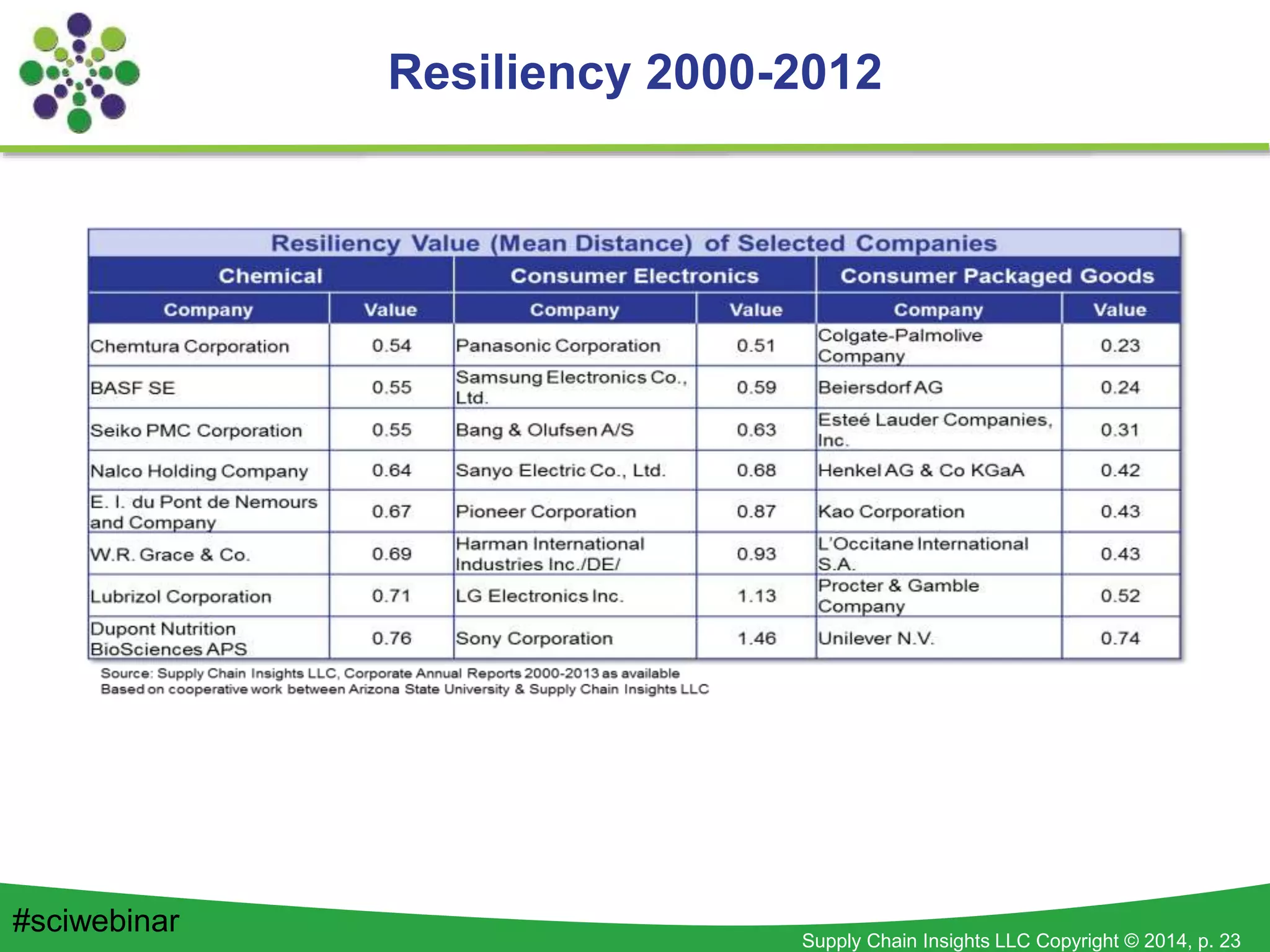

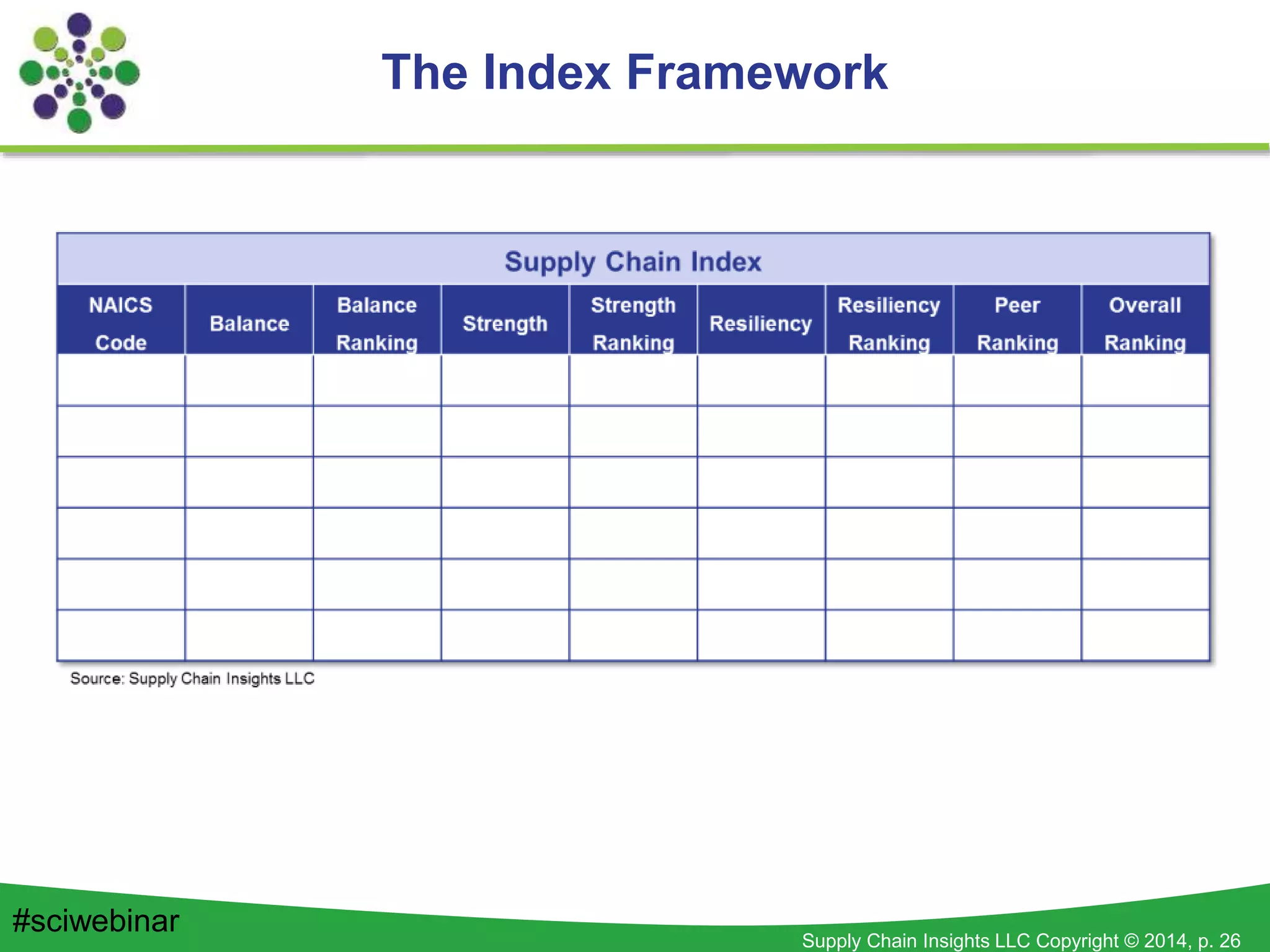

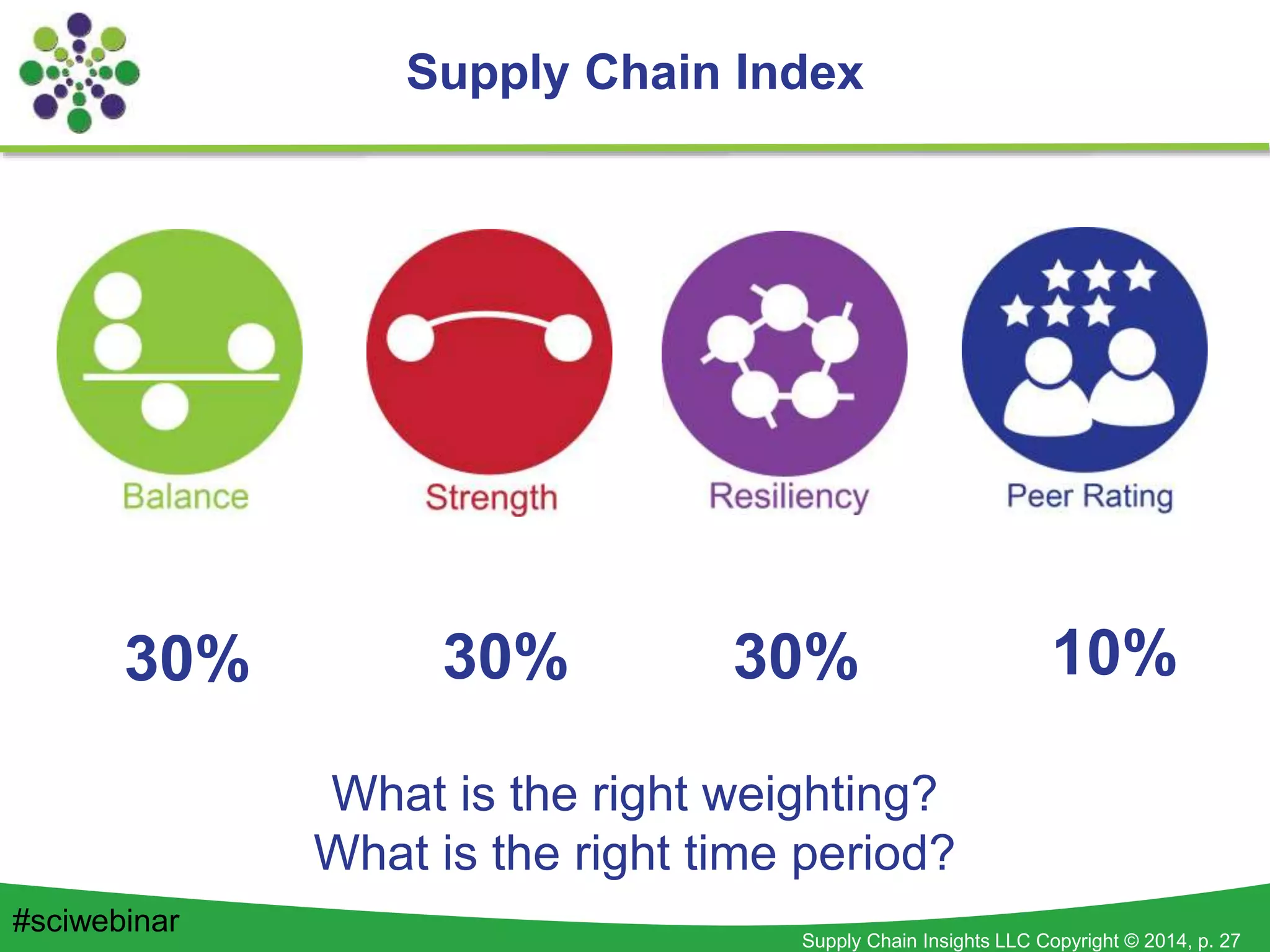

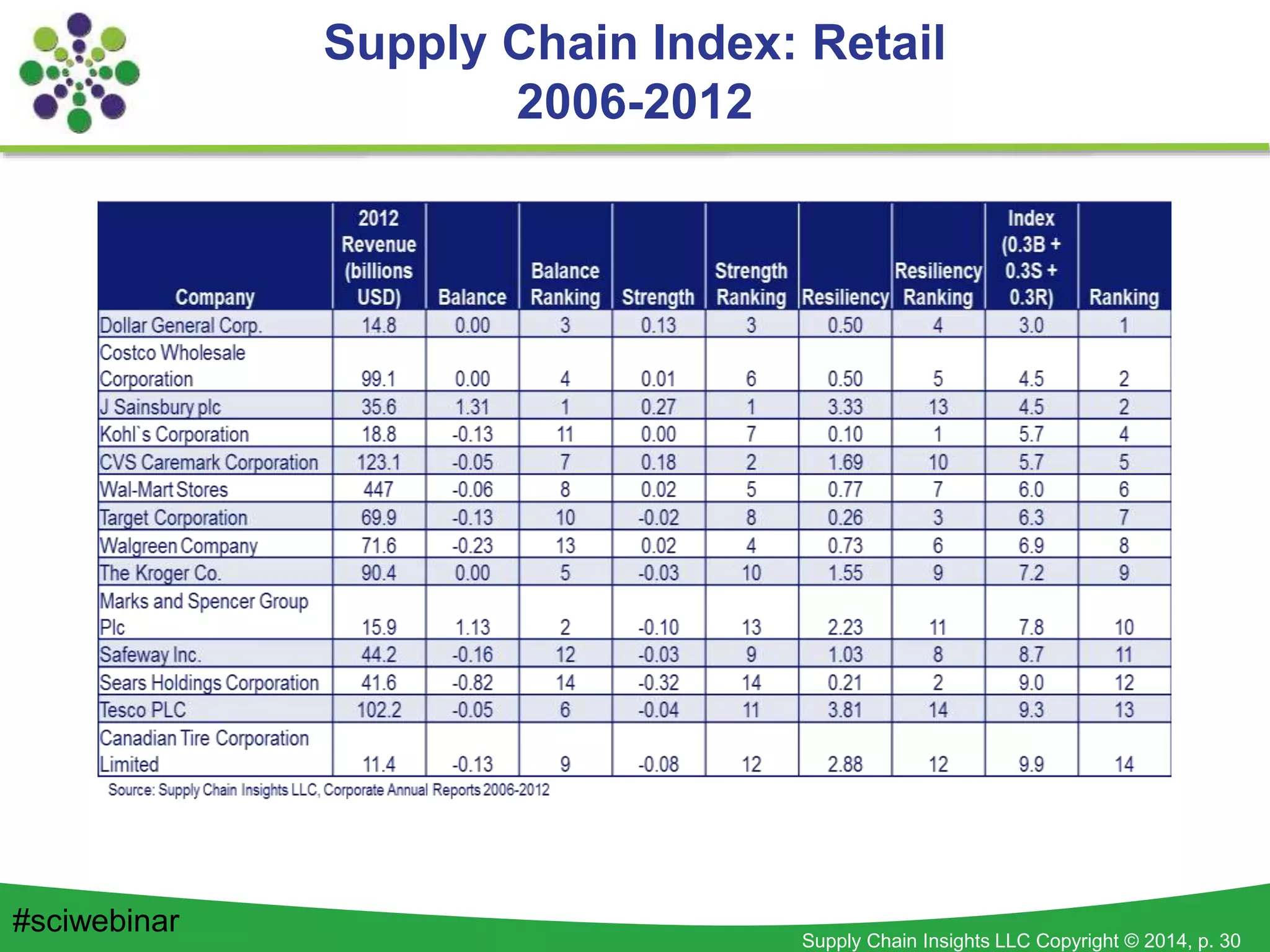

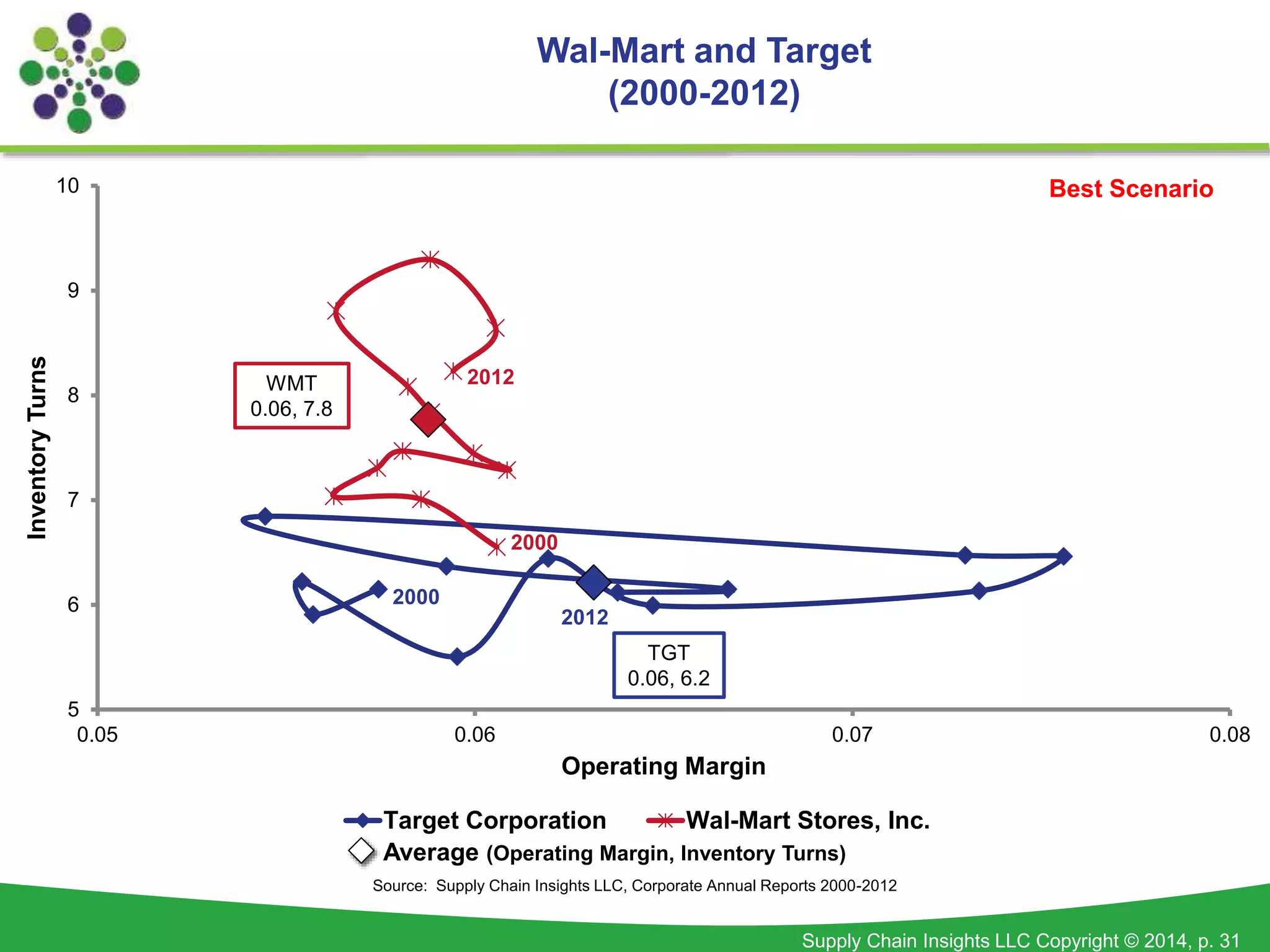

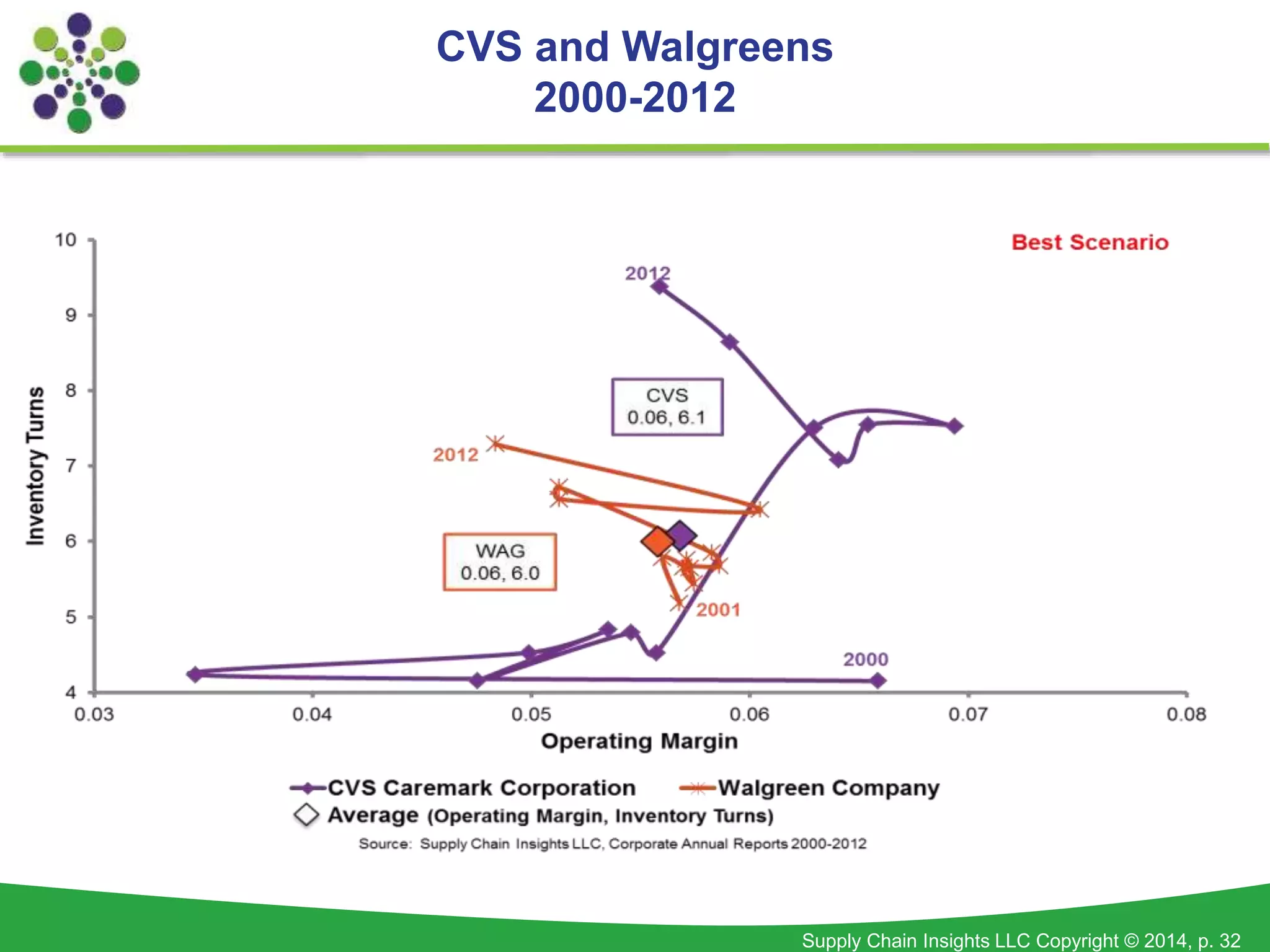

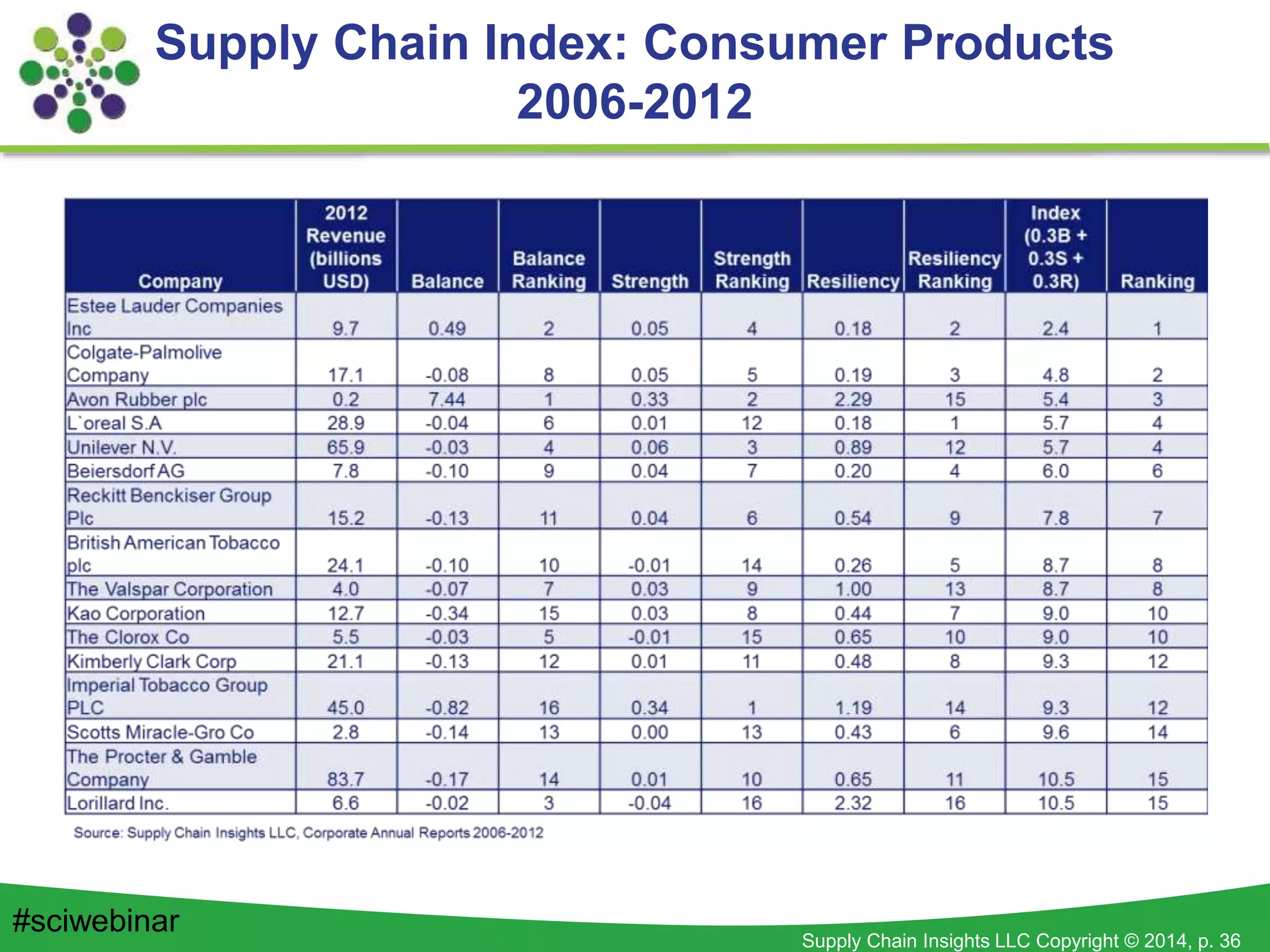

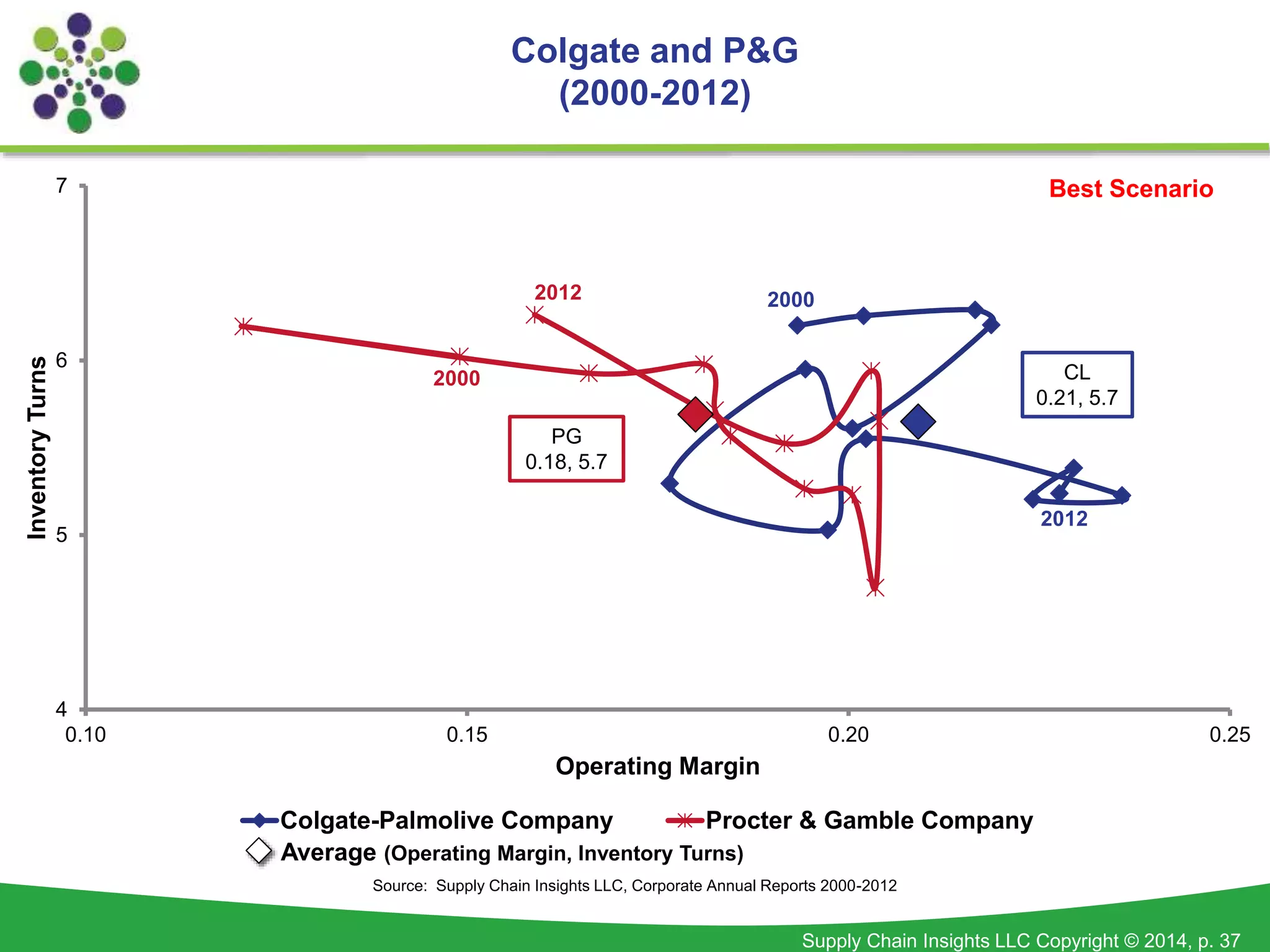

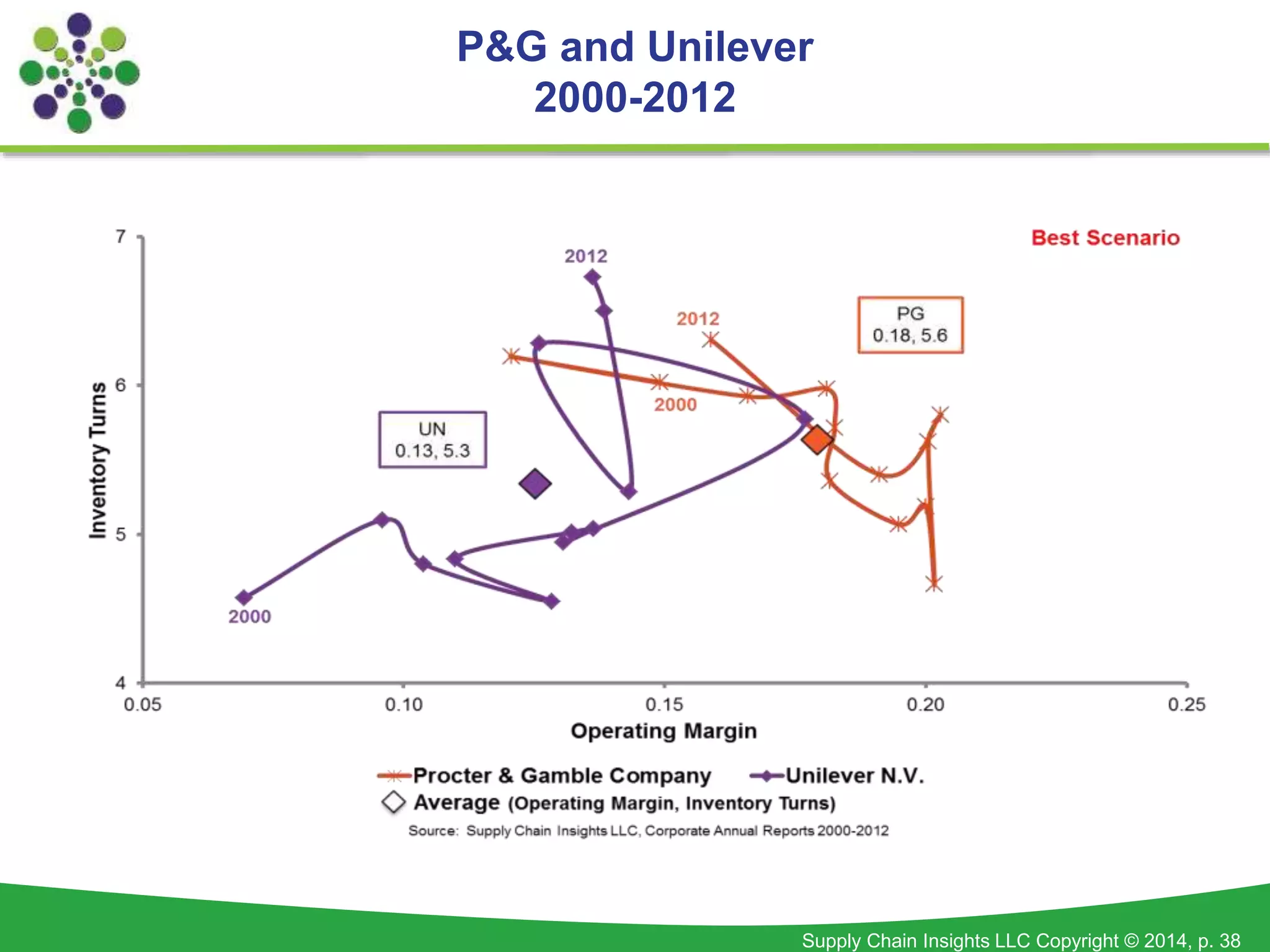

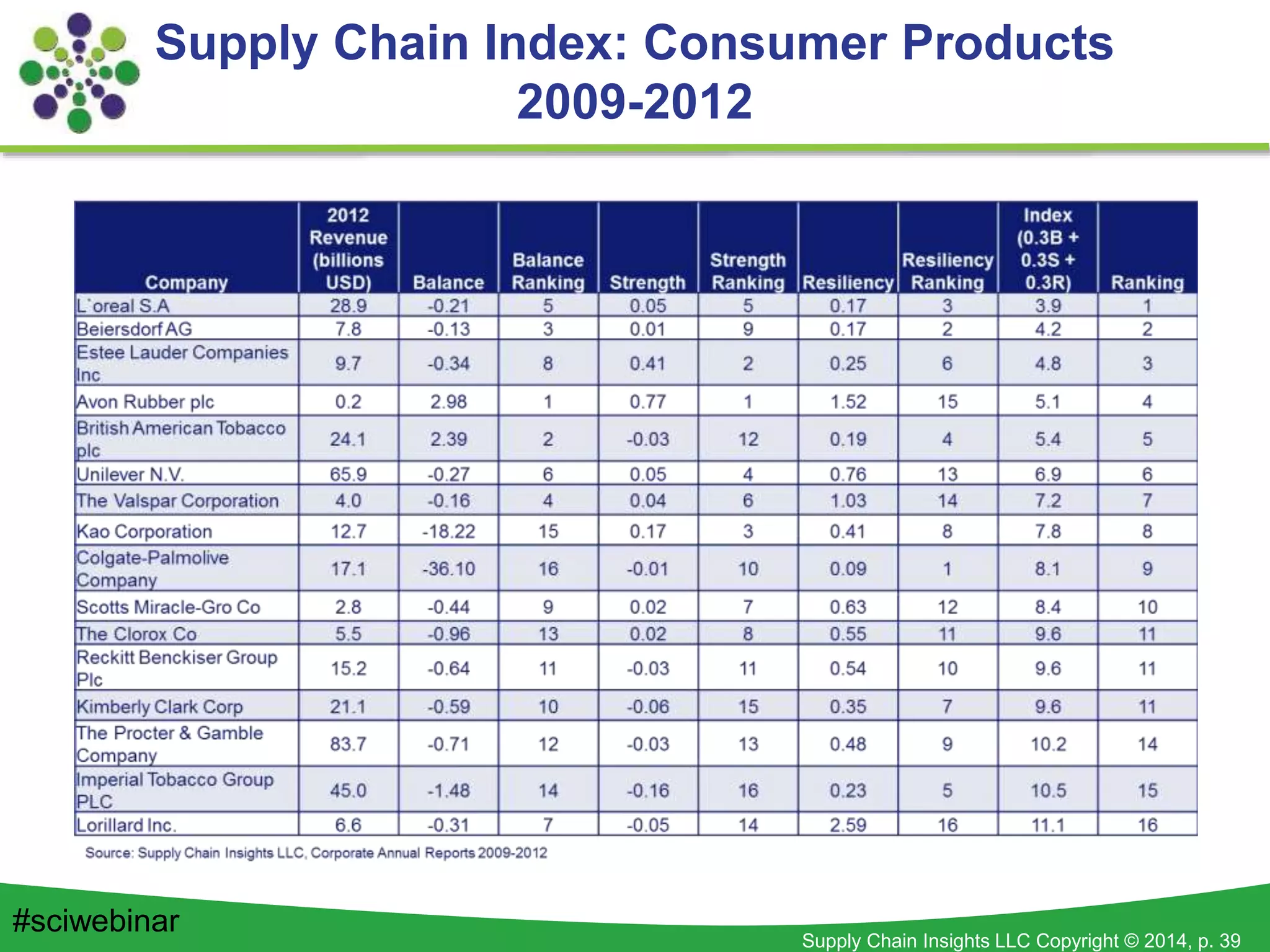

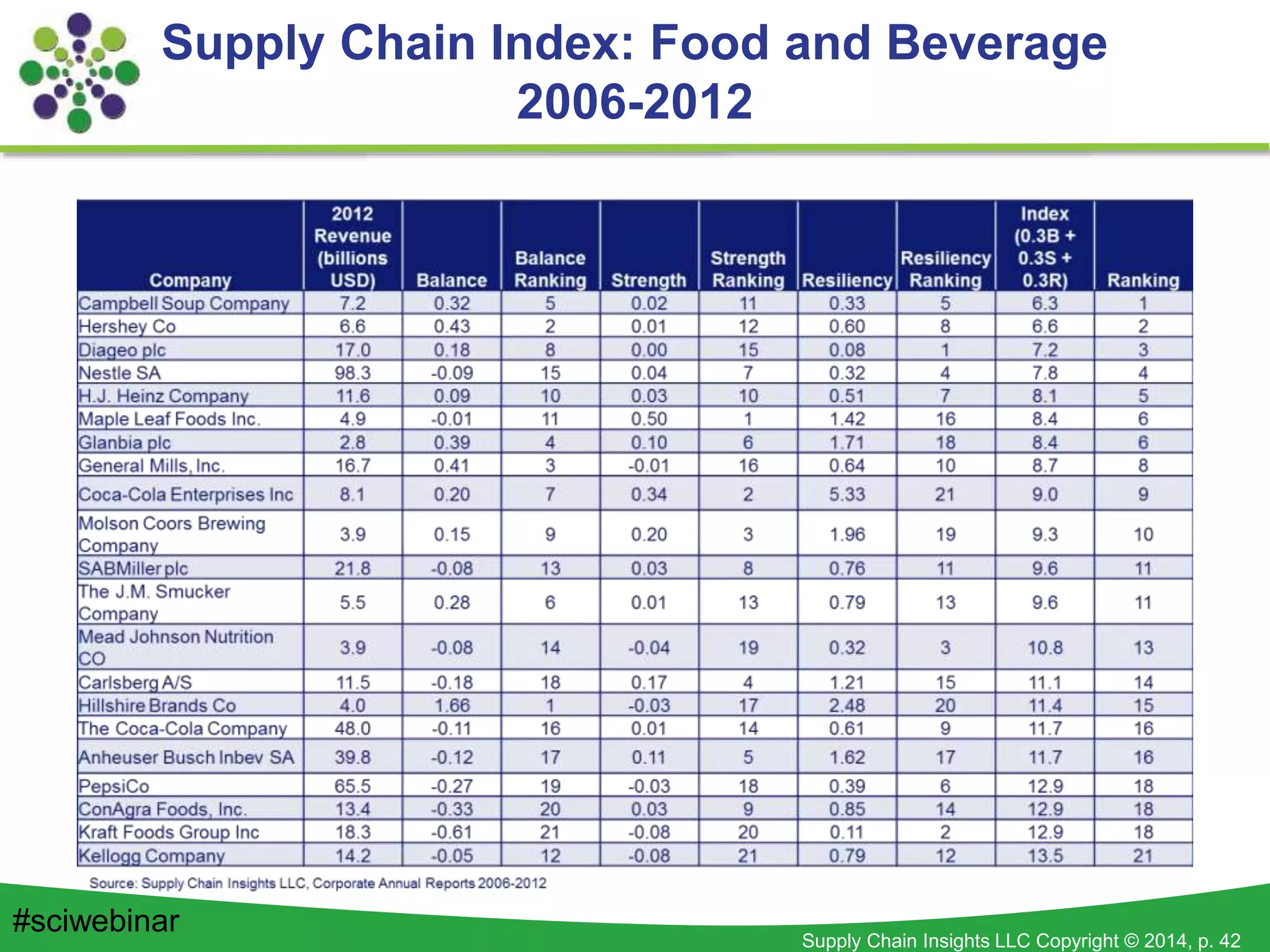

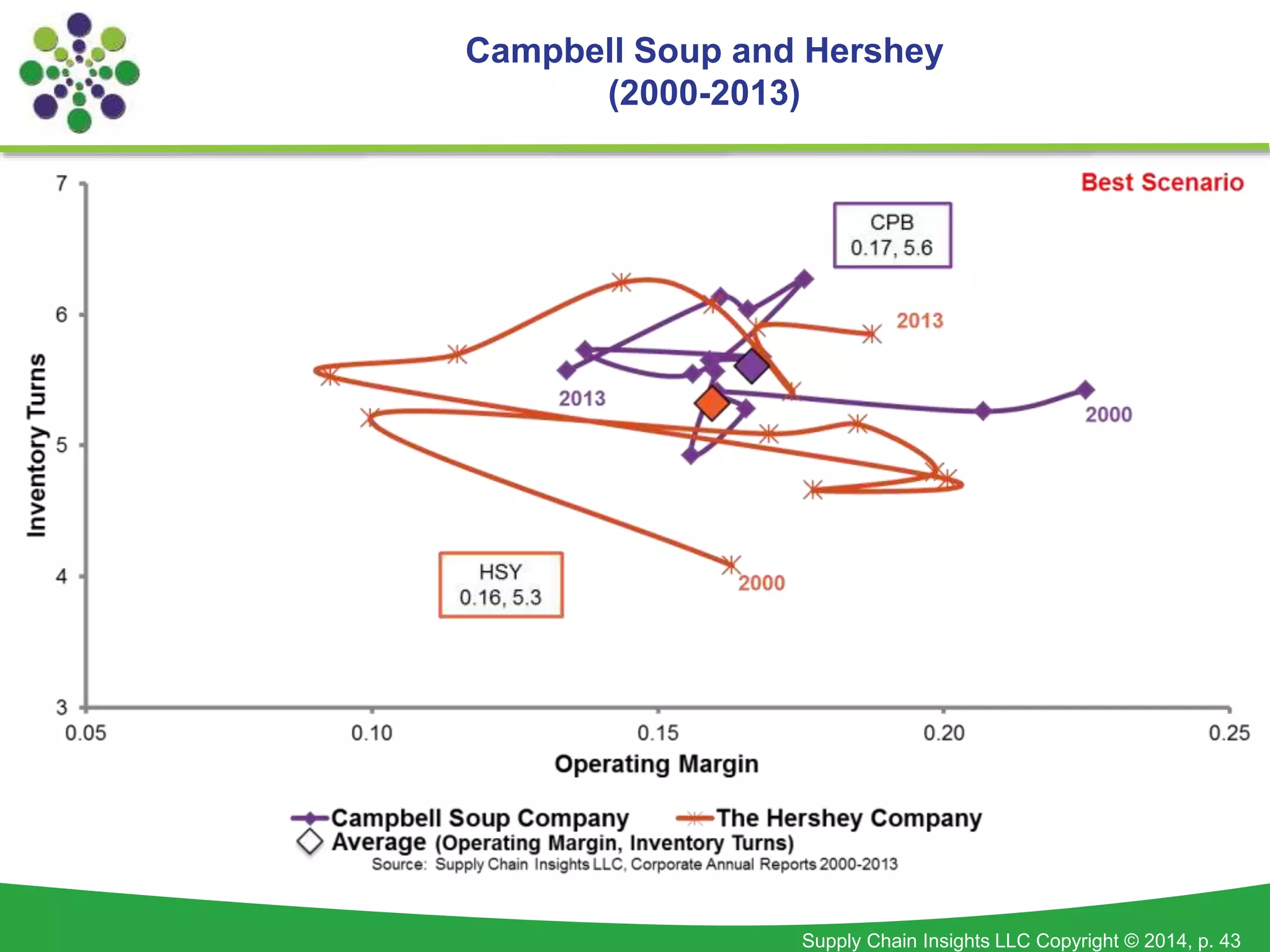

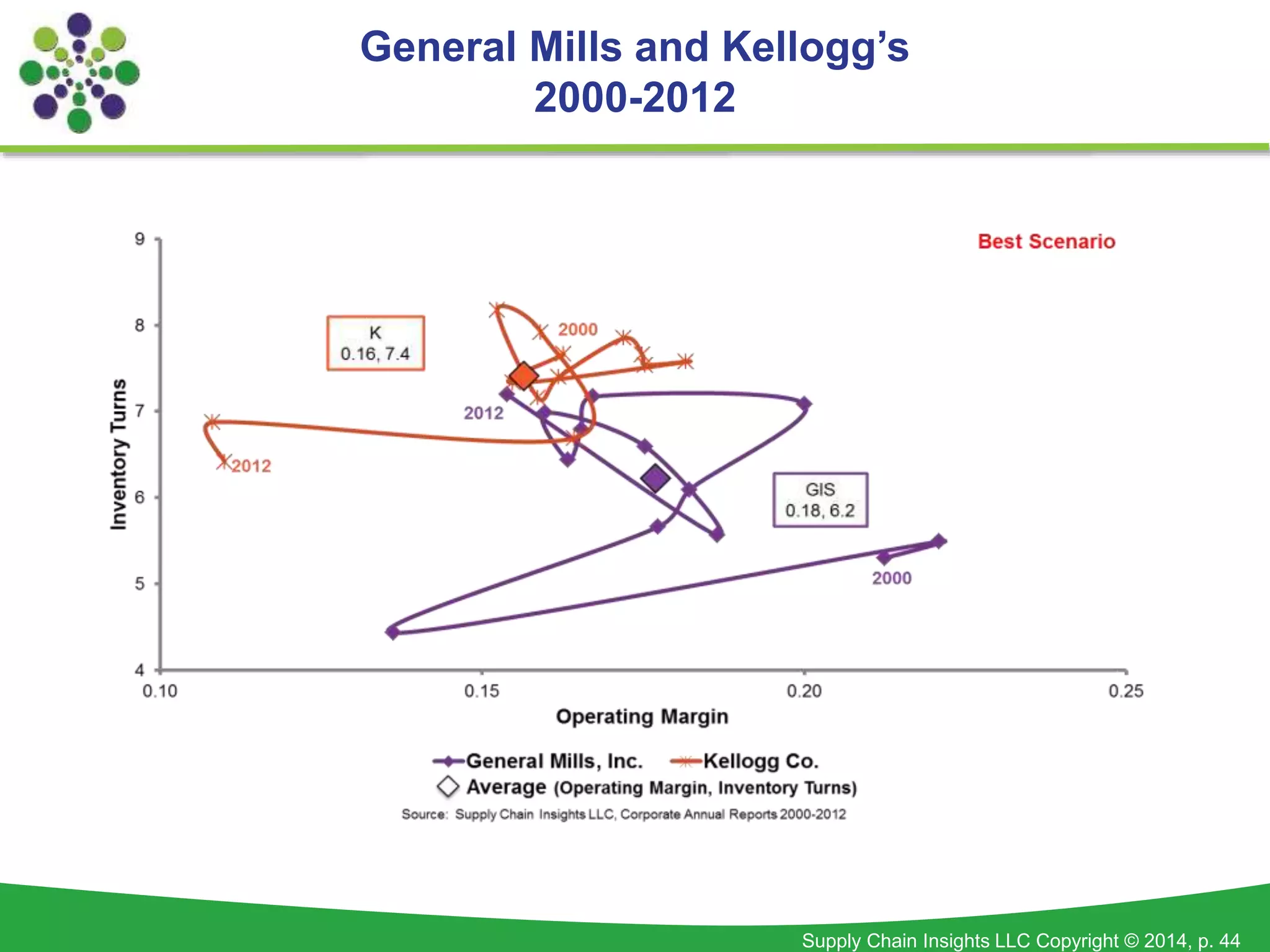

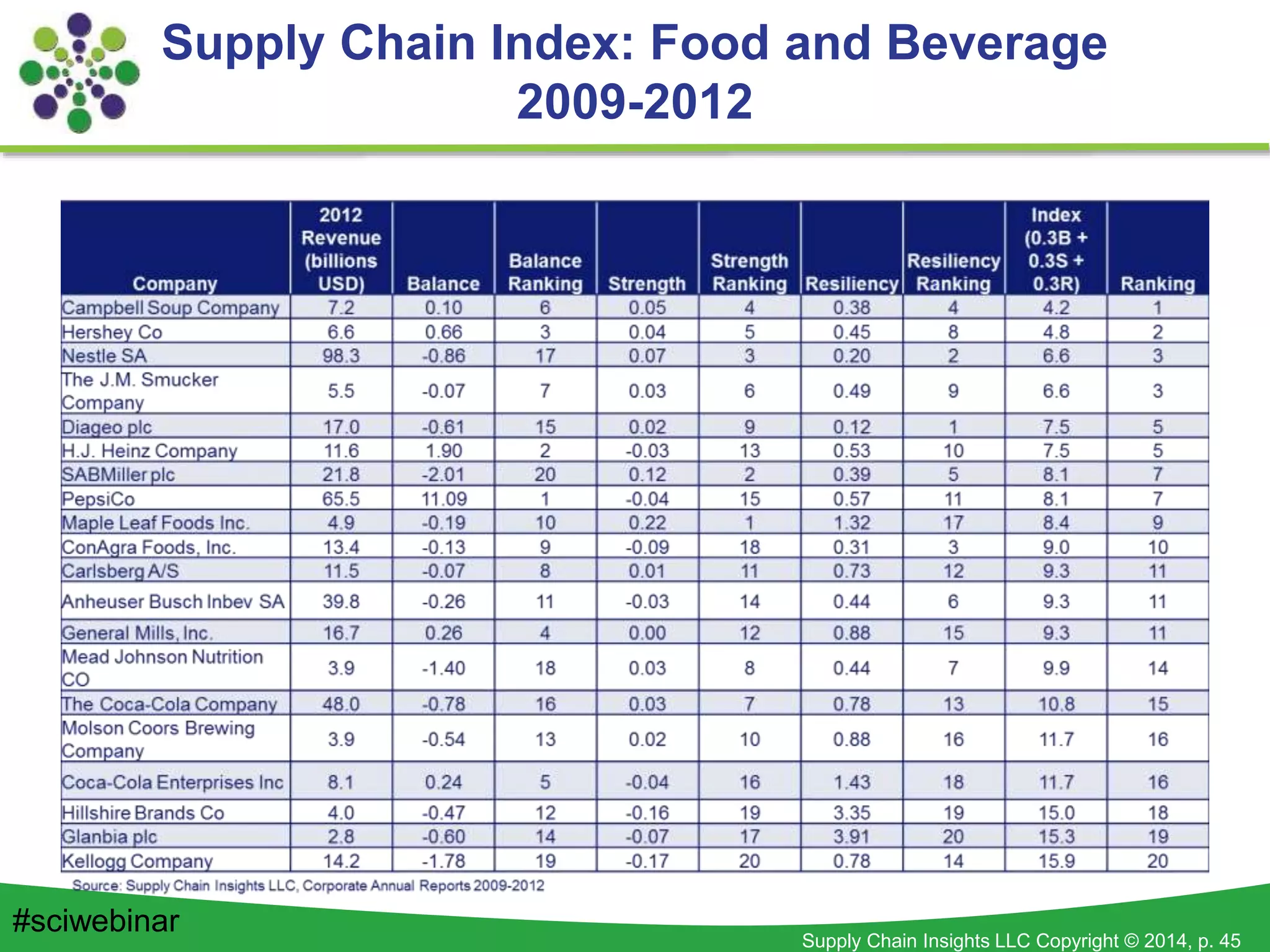

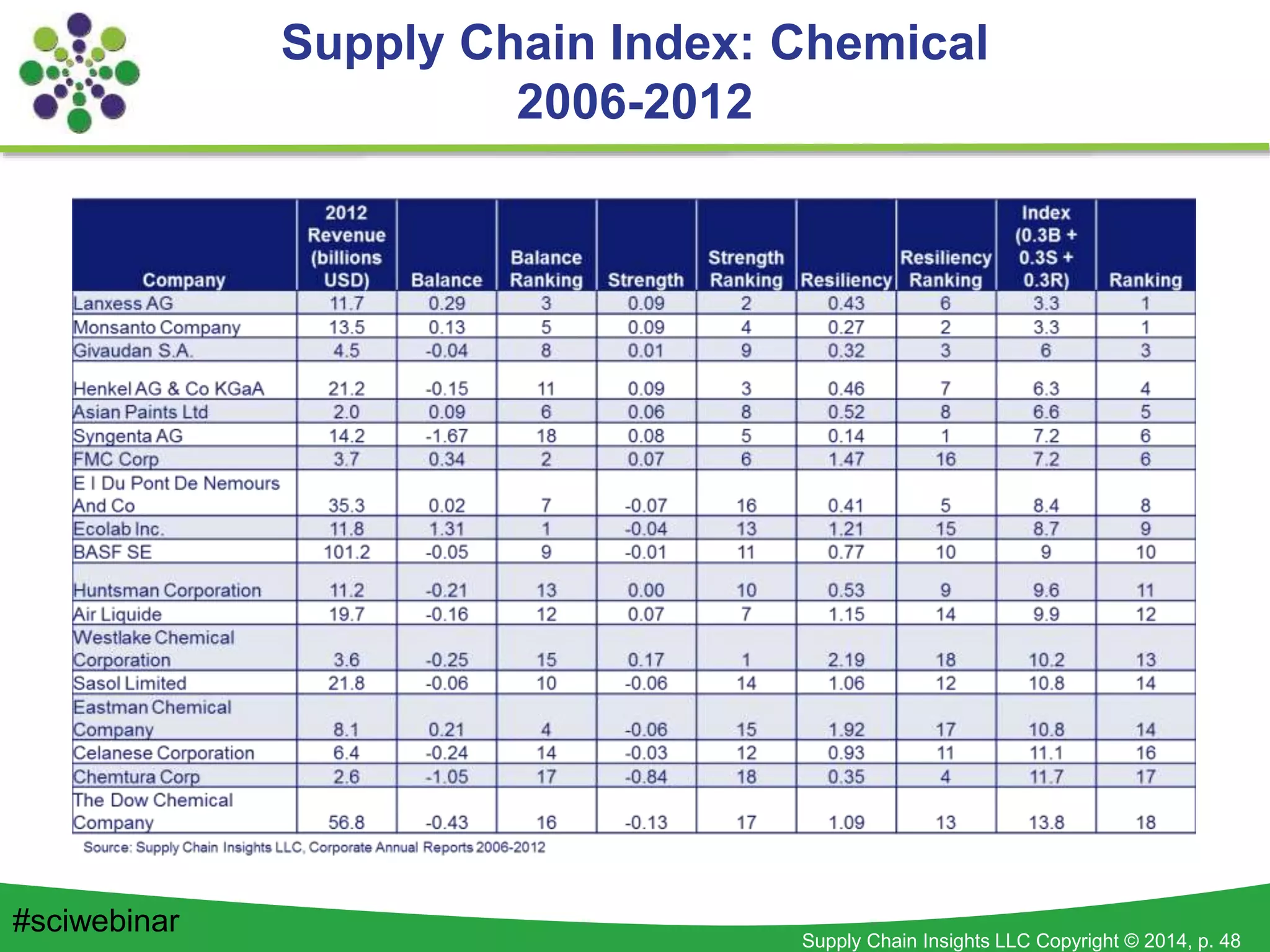

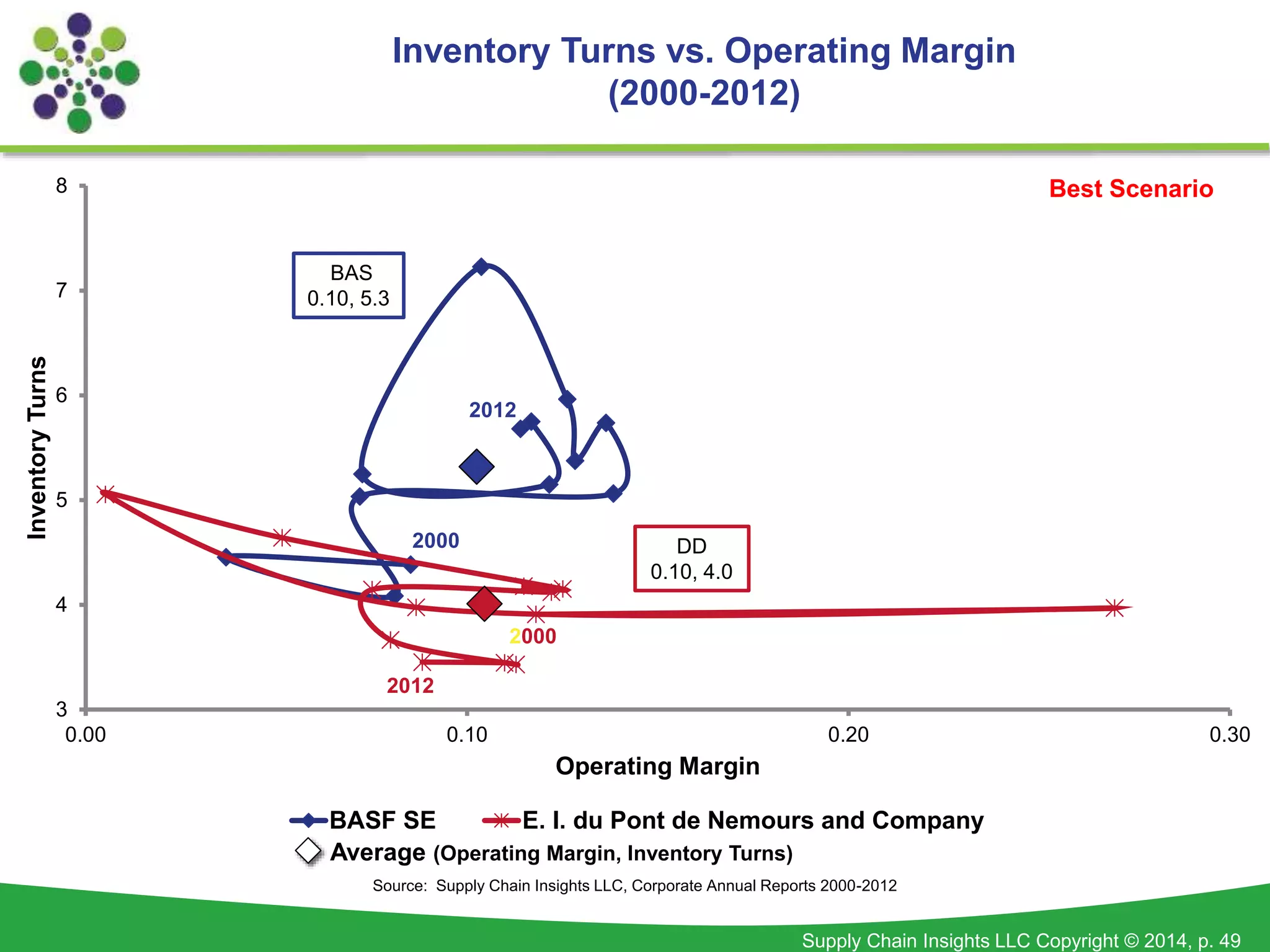

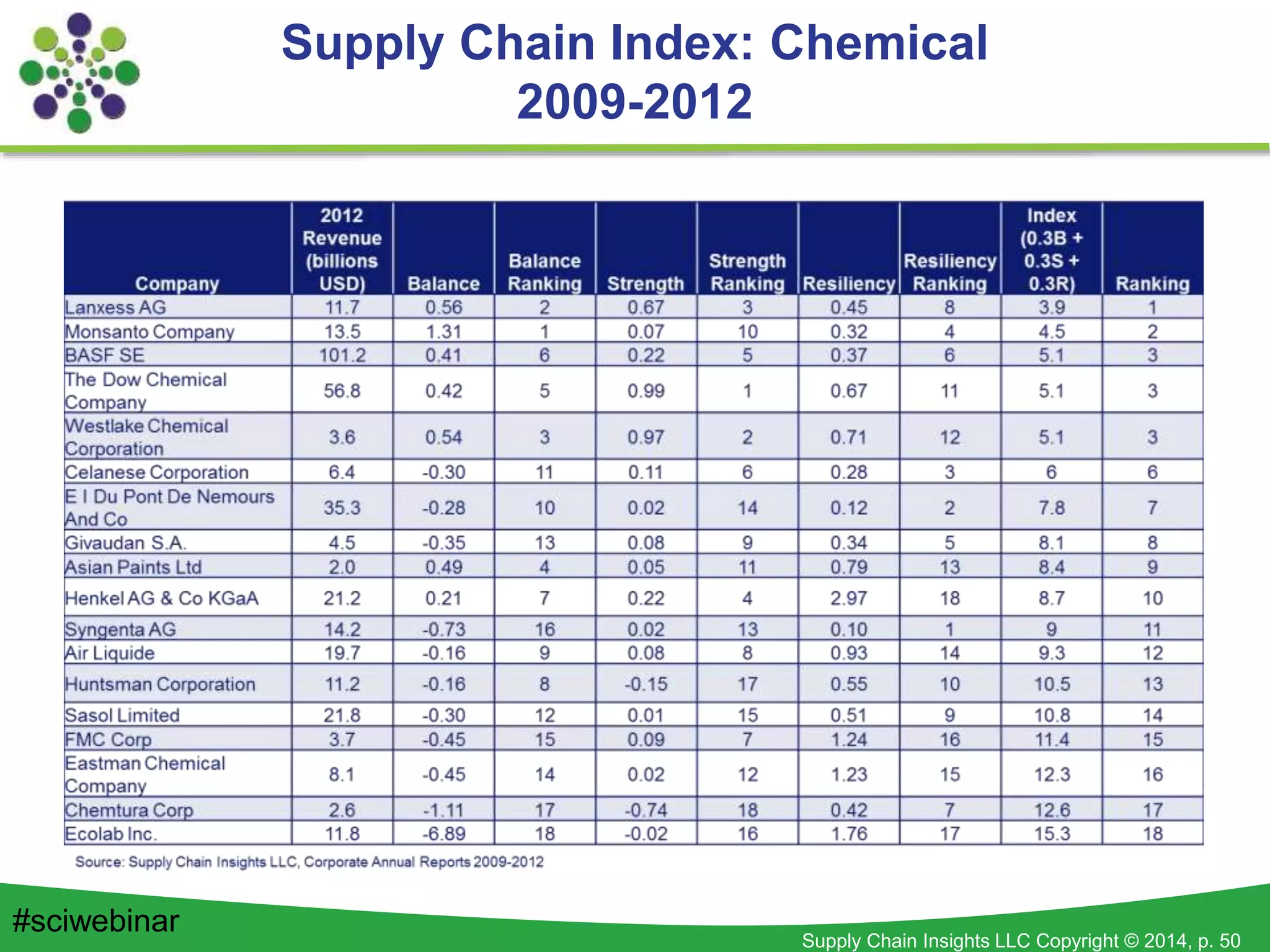

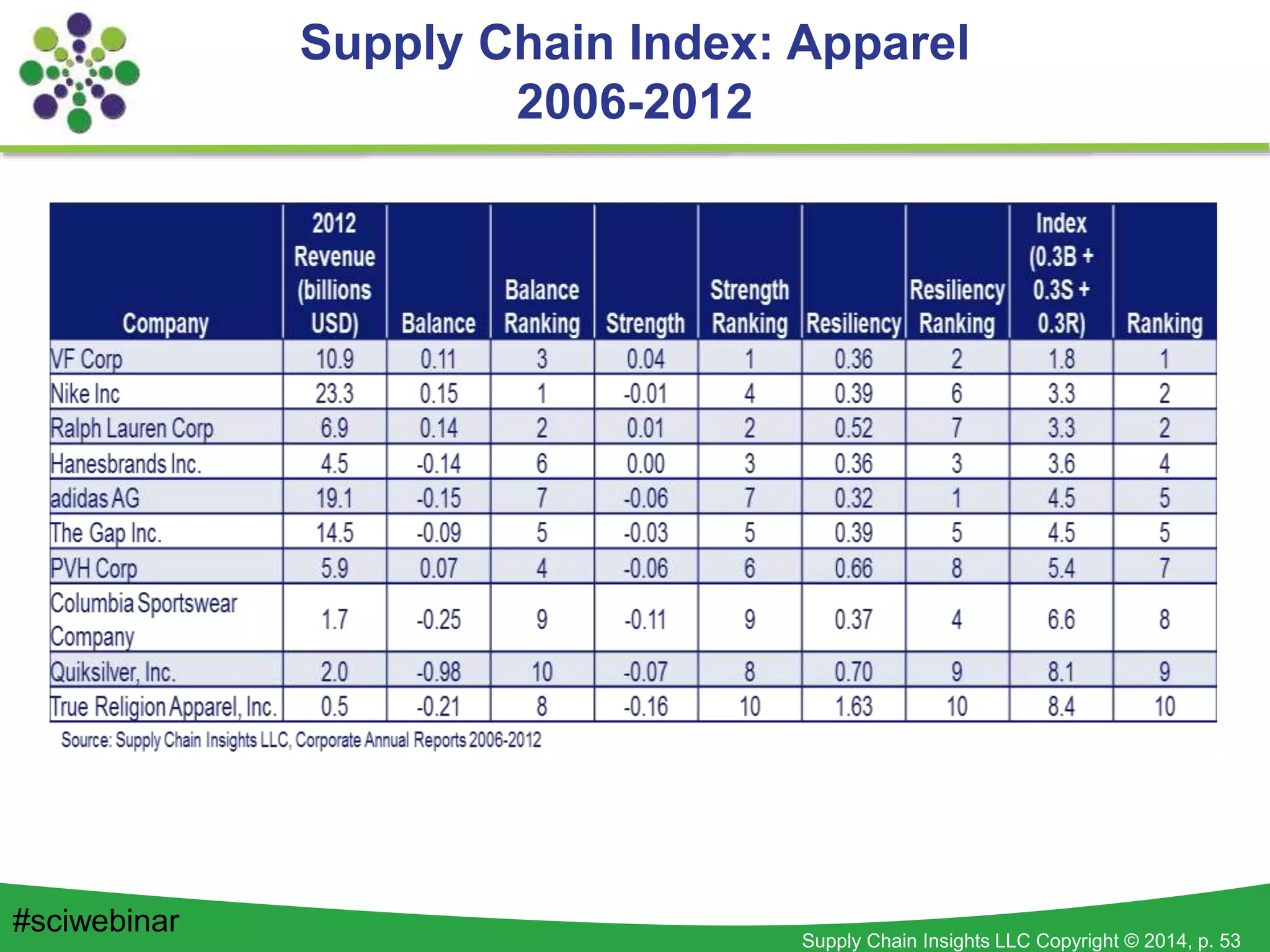

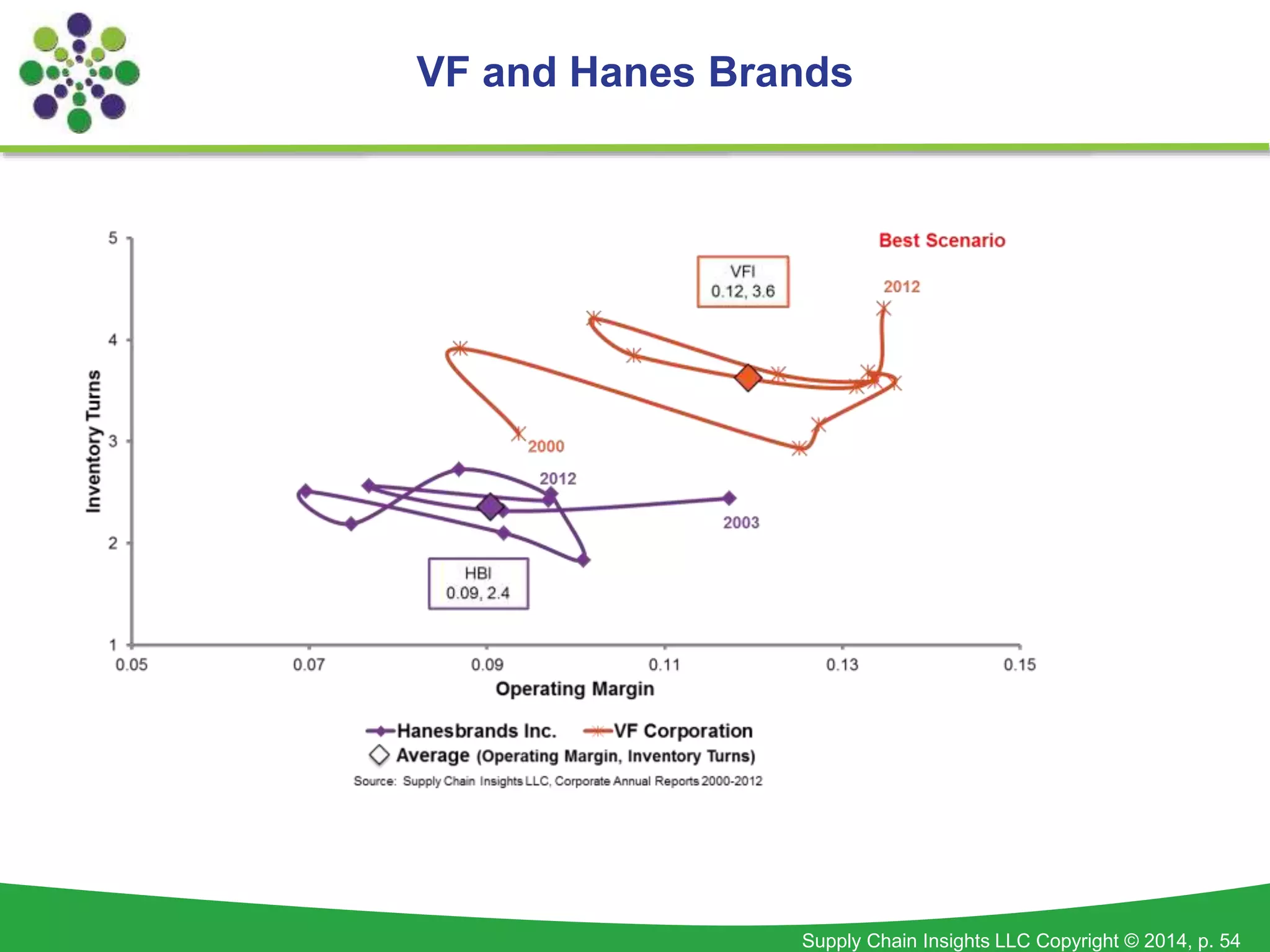

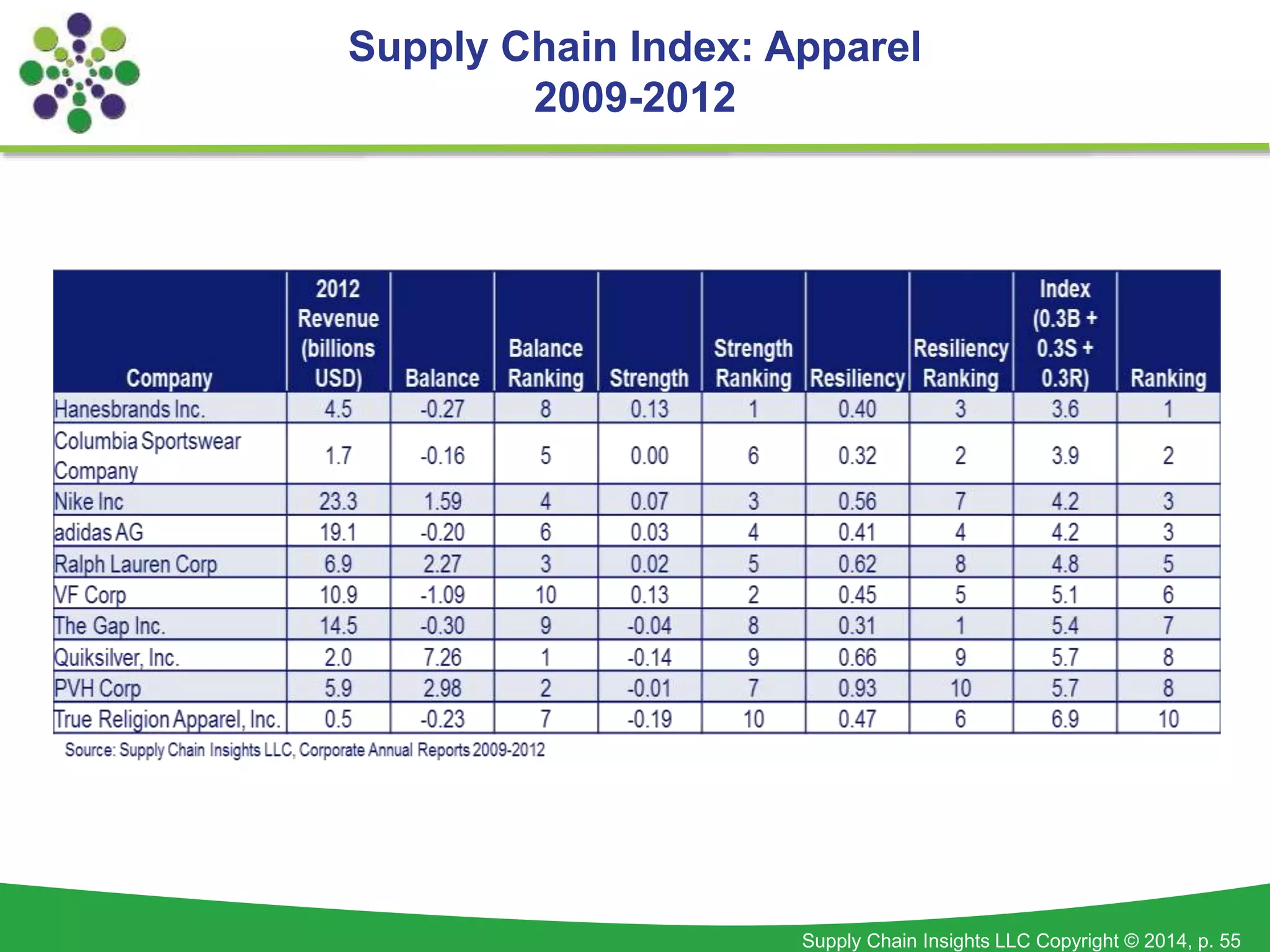

The document discusses methodologies for measuring supply chain performance and outlines the Supply Chain Index, which evaluates companies based on balance, strength, resiliency, and industry peer rankings. It highlights the increasing complexity of supply chains and how nine out of ten companies struggle with maintaining balance between inventory turns and operating margins. Additionally, there are insights into various industry sectors, showcasing shifts in performance among leading companies from 2006 to 2012.