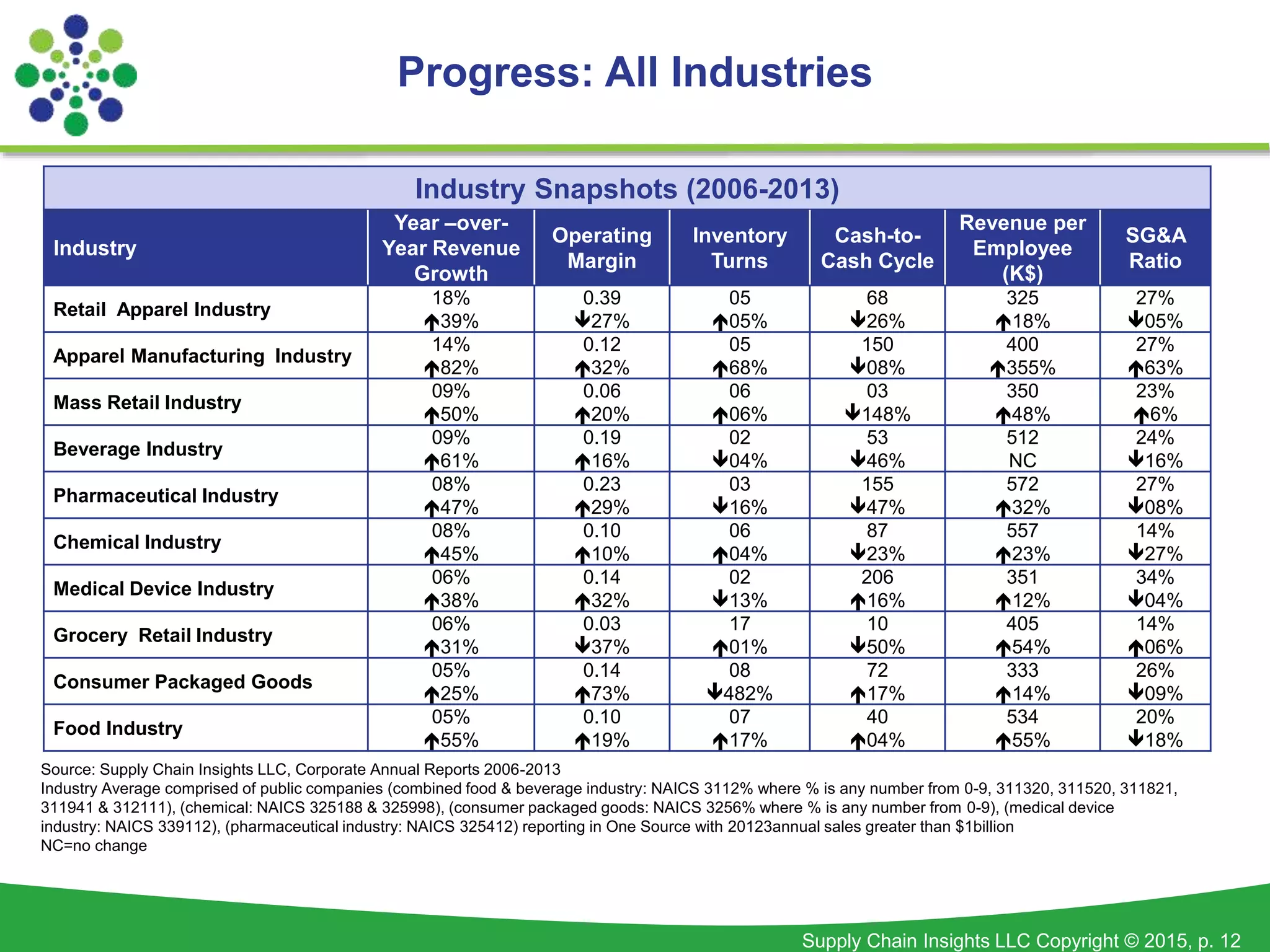

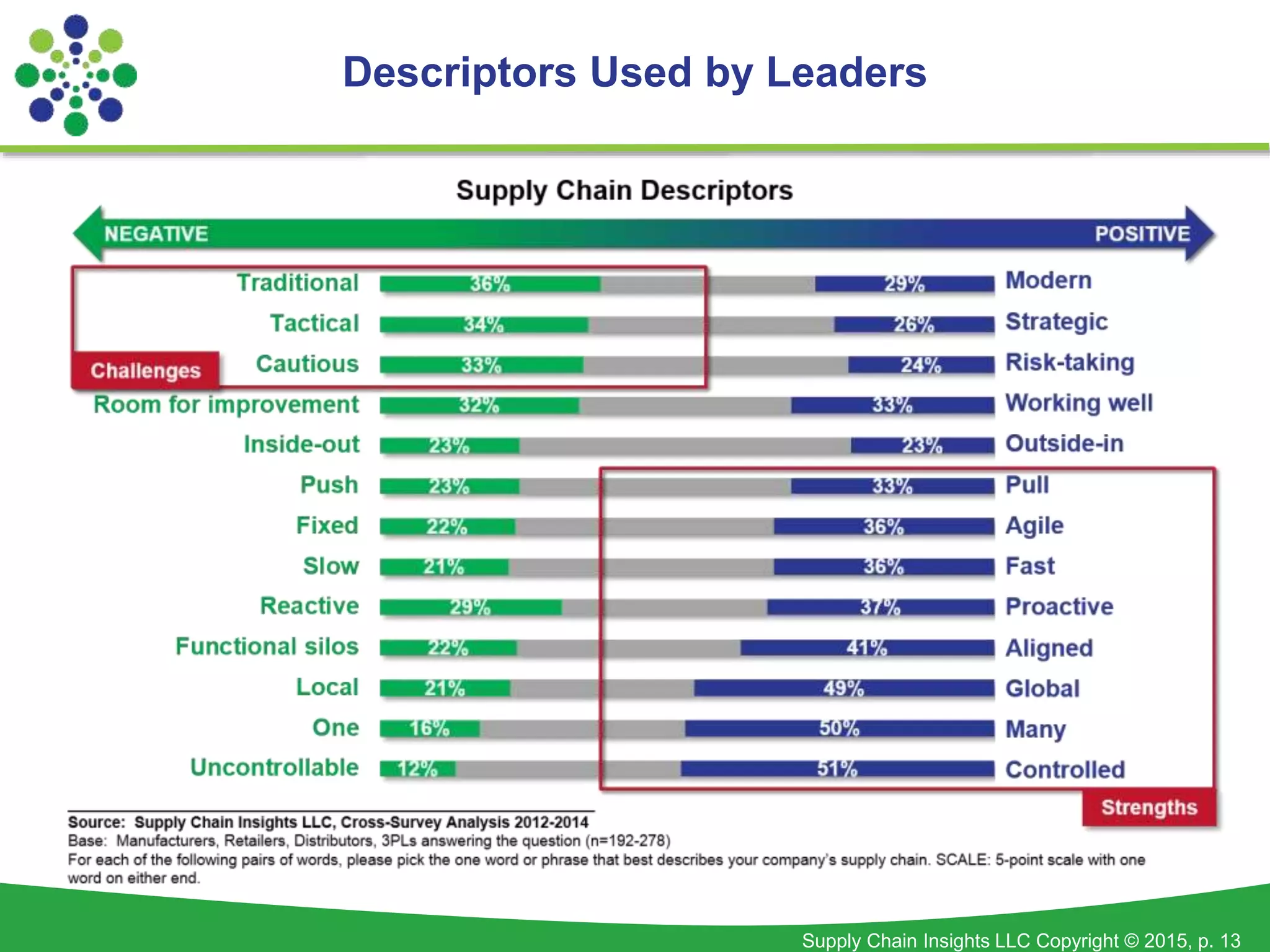

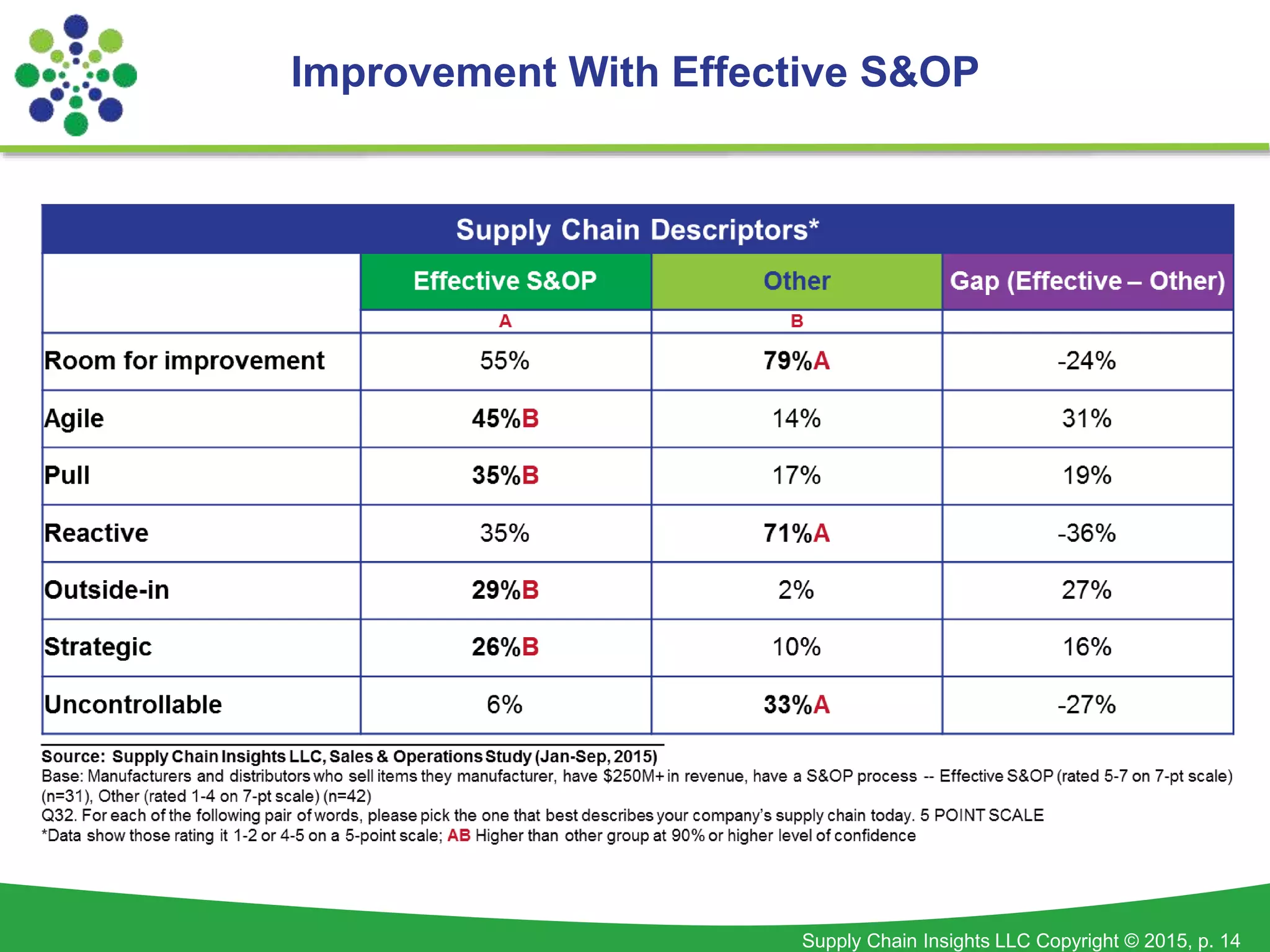

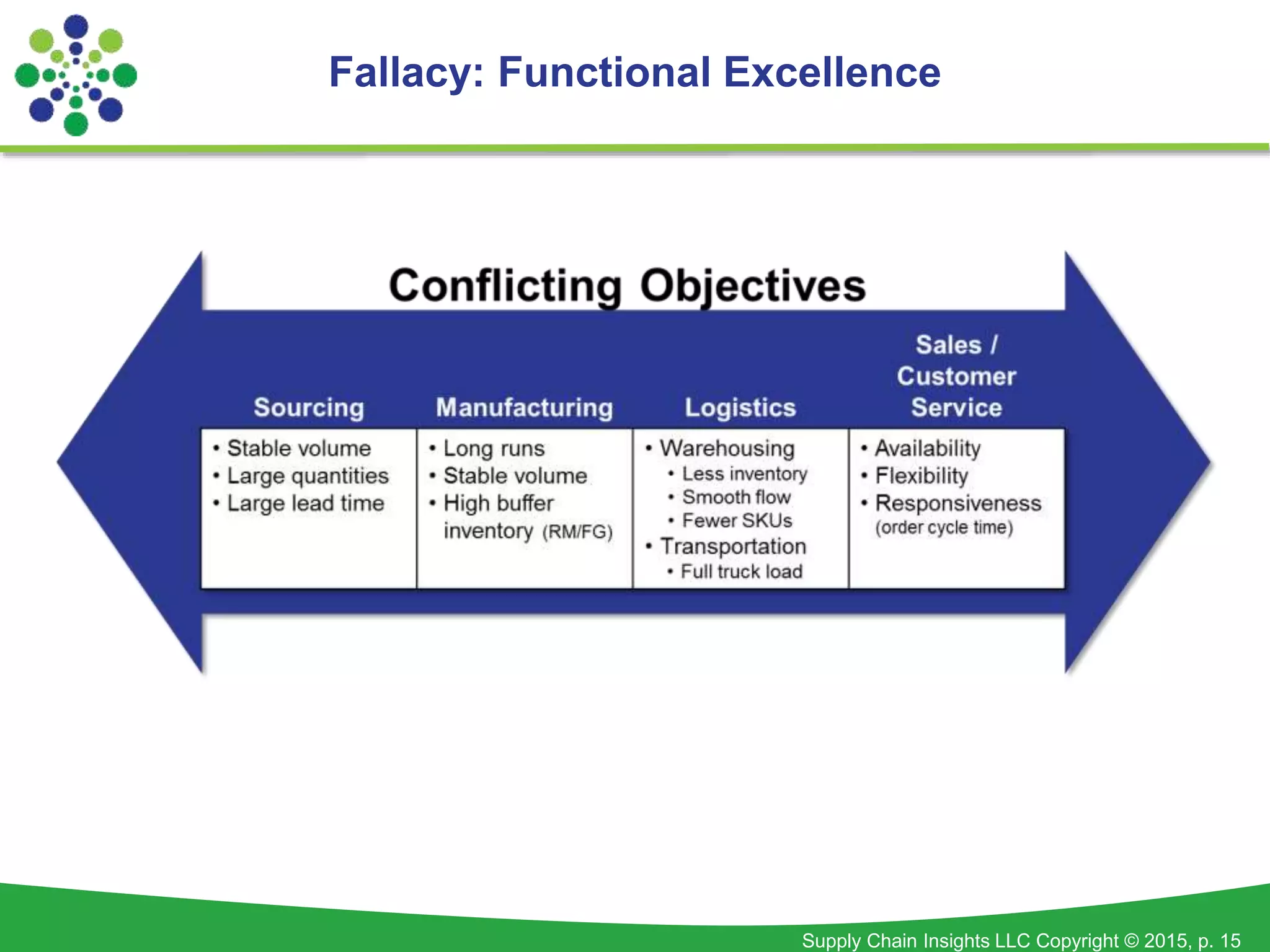

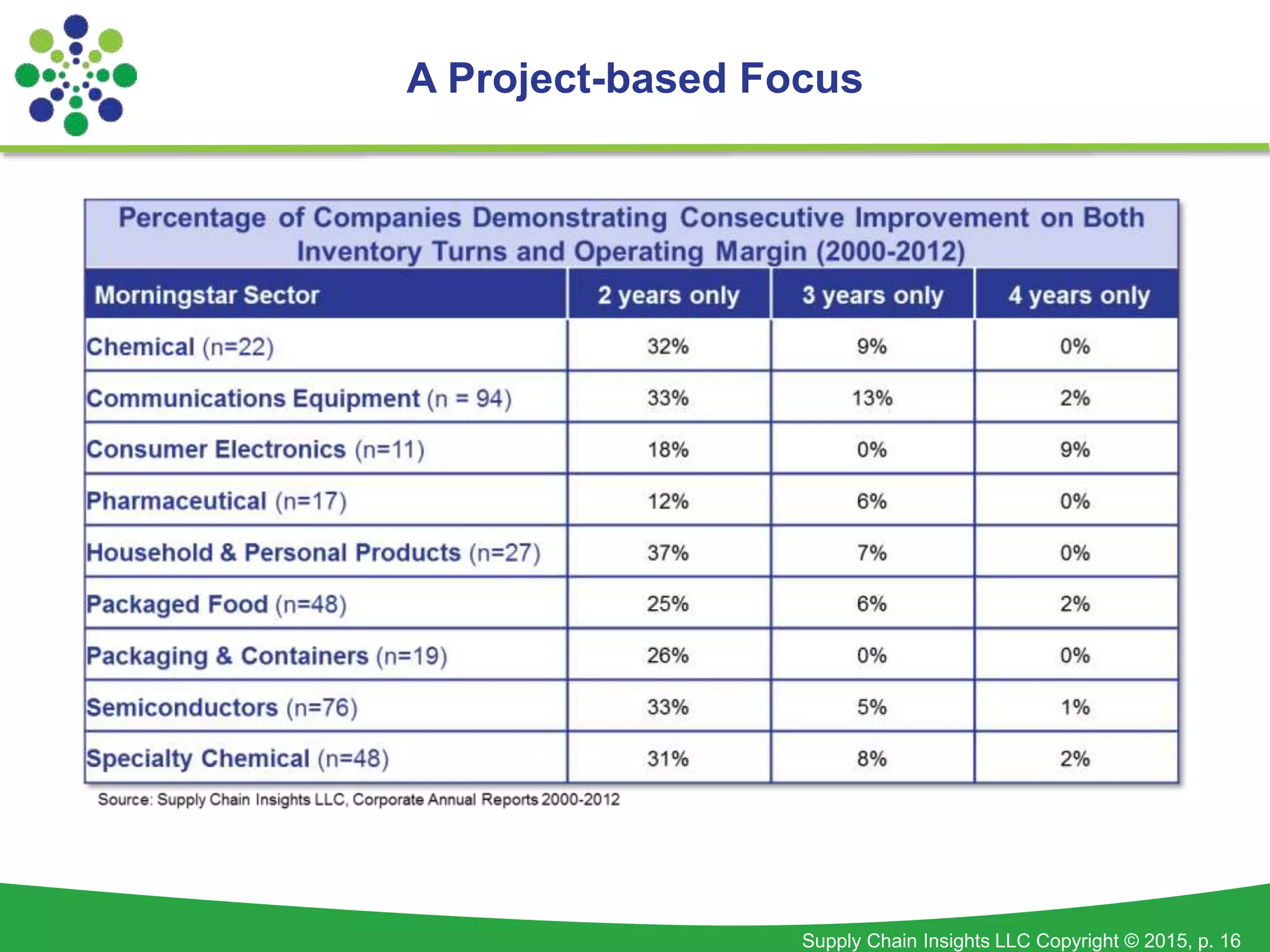

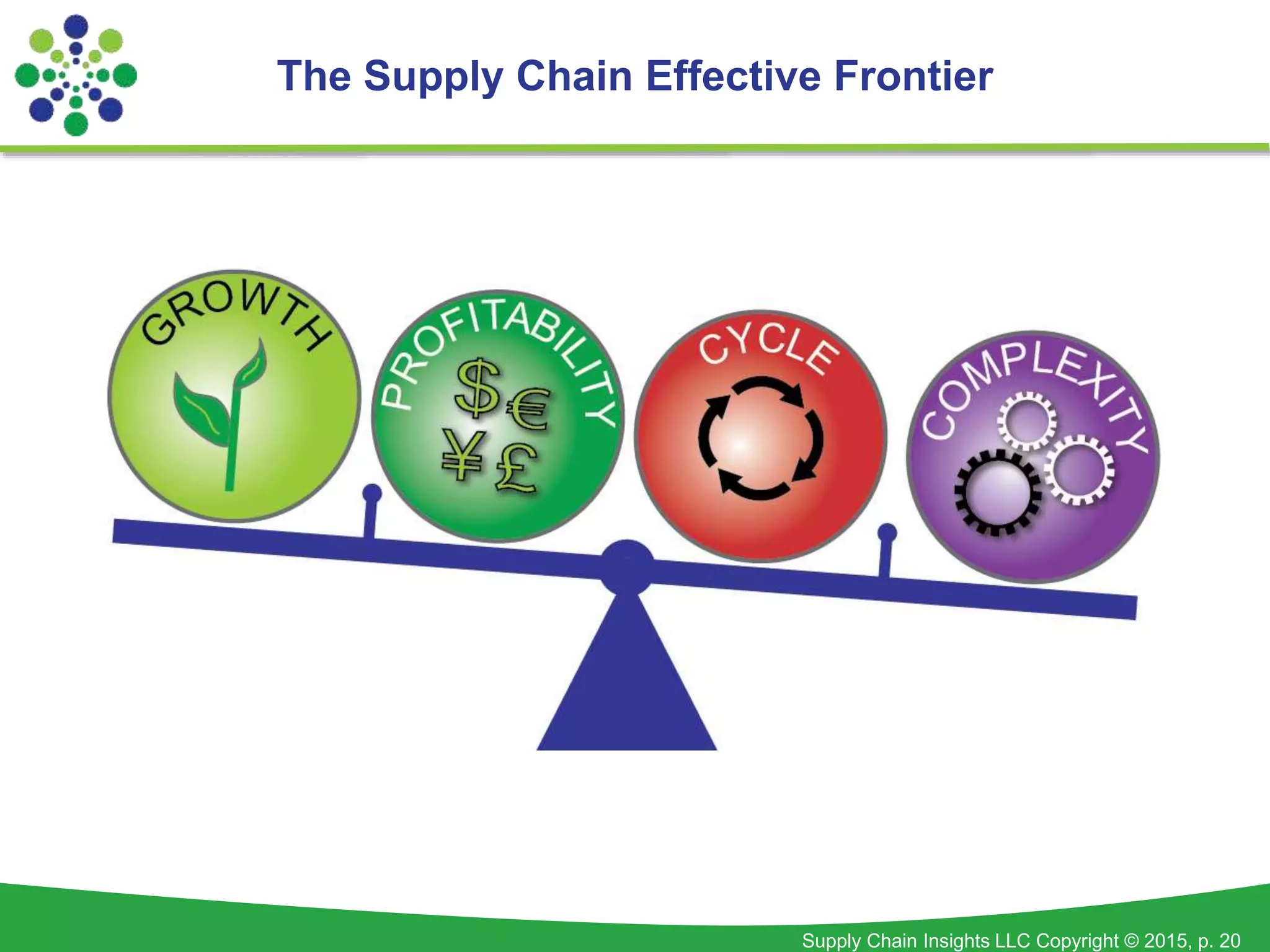

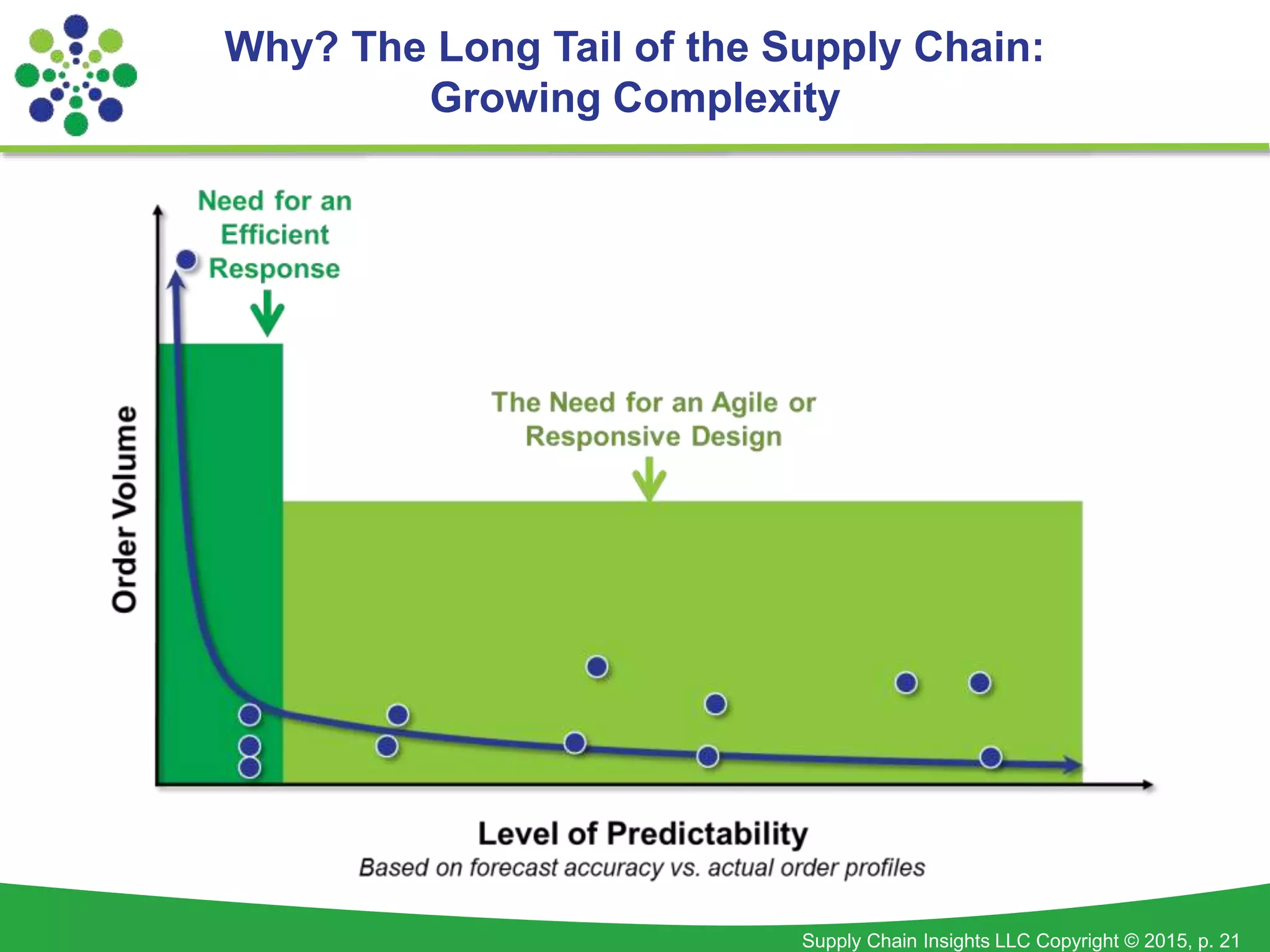

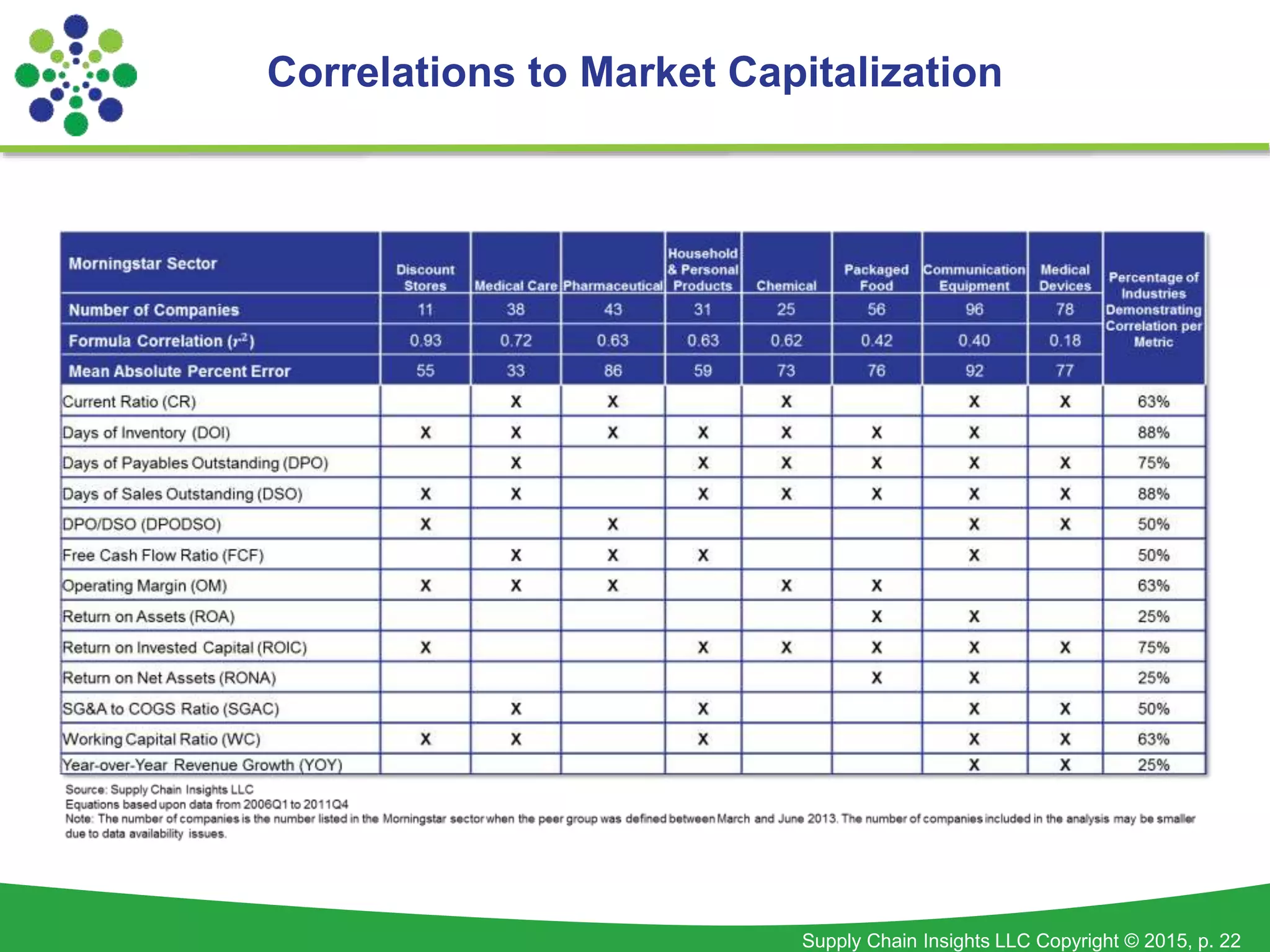

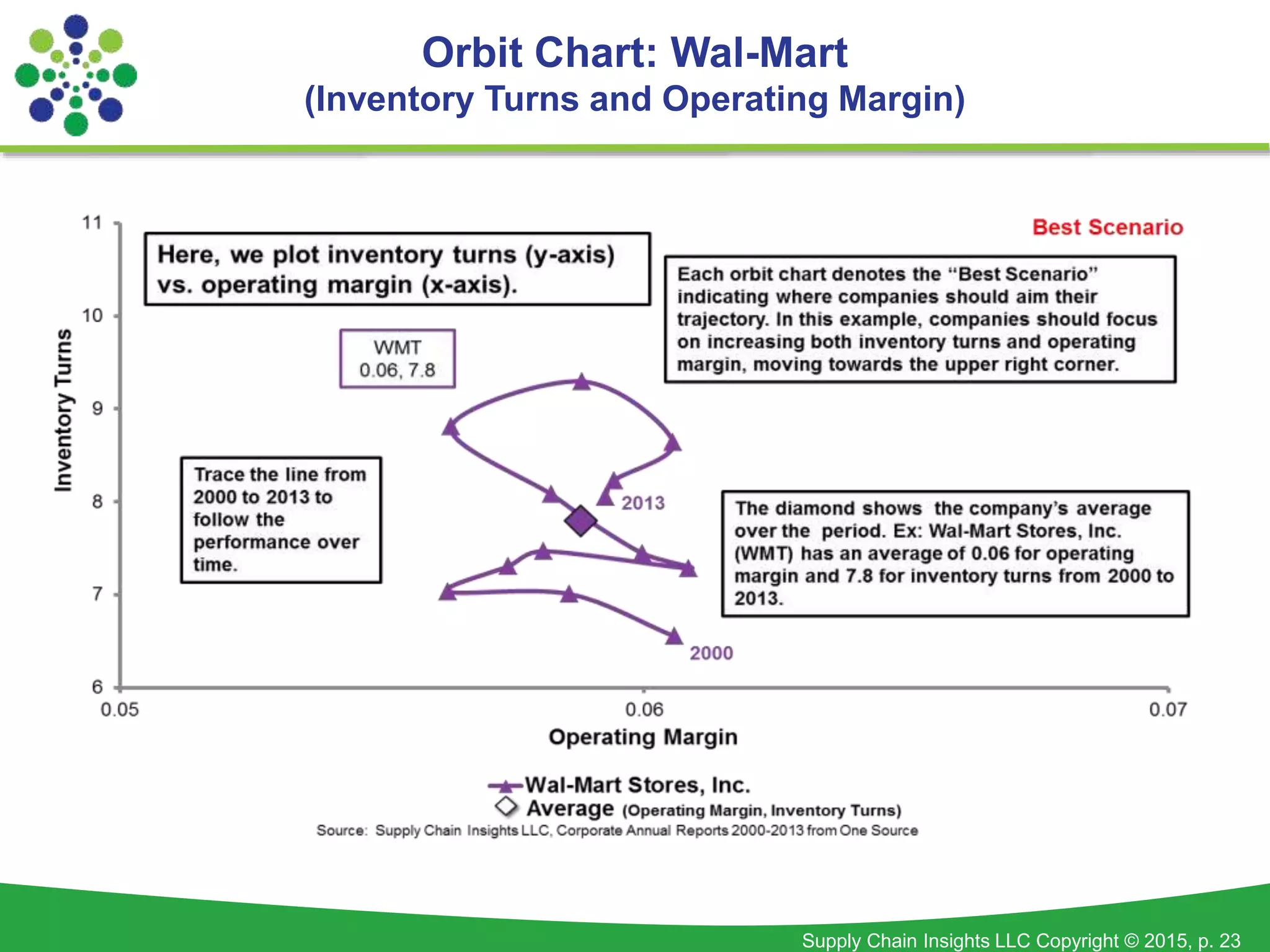

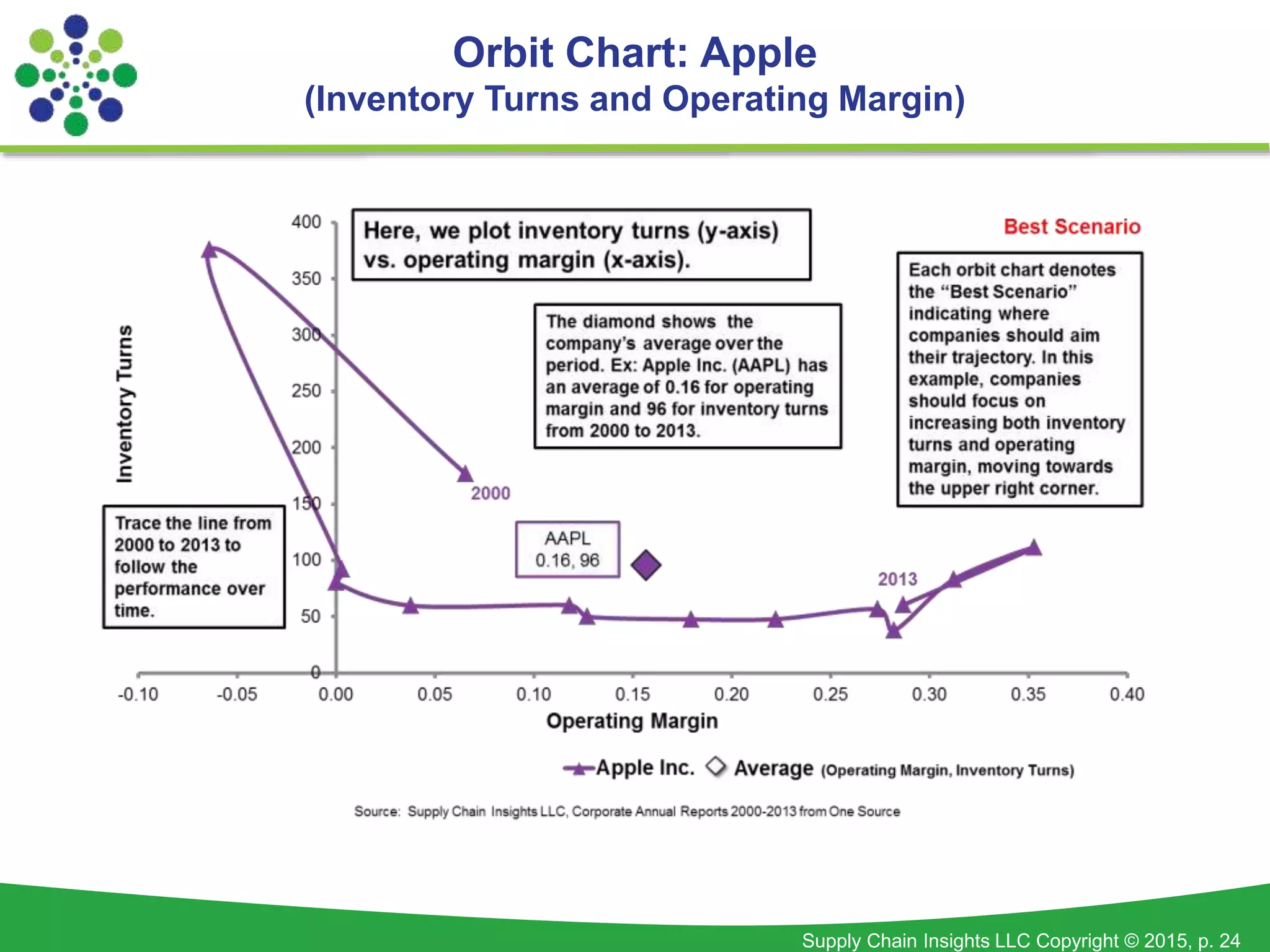

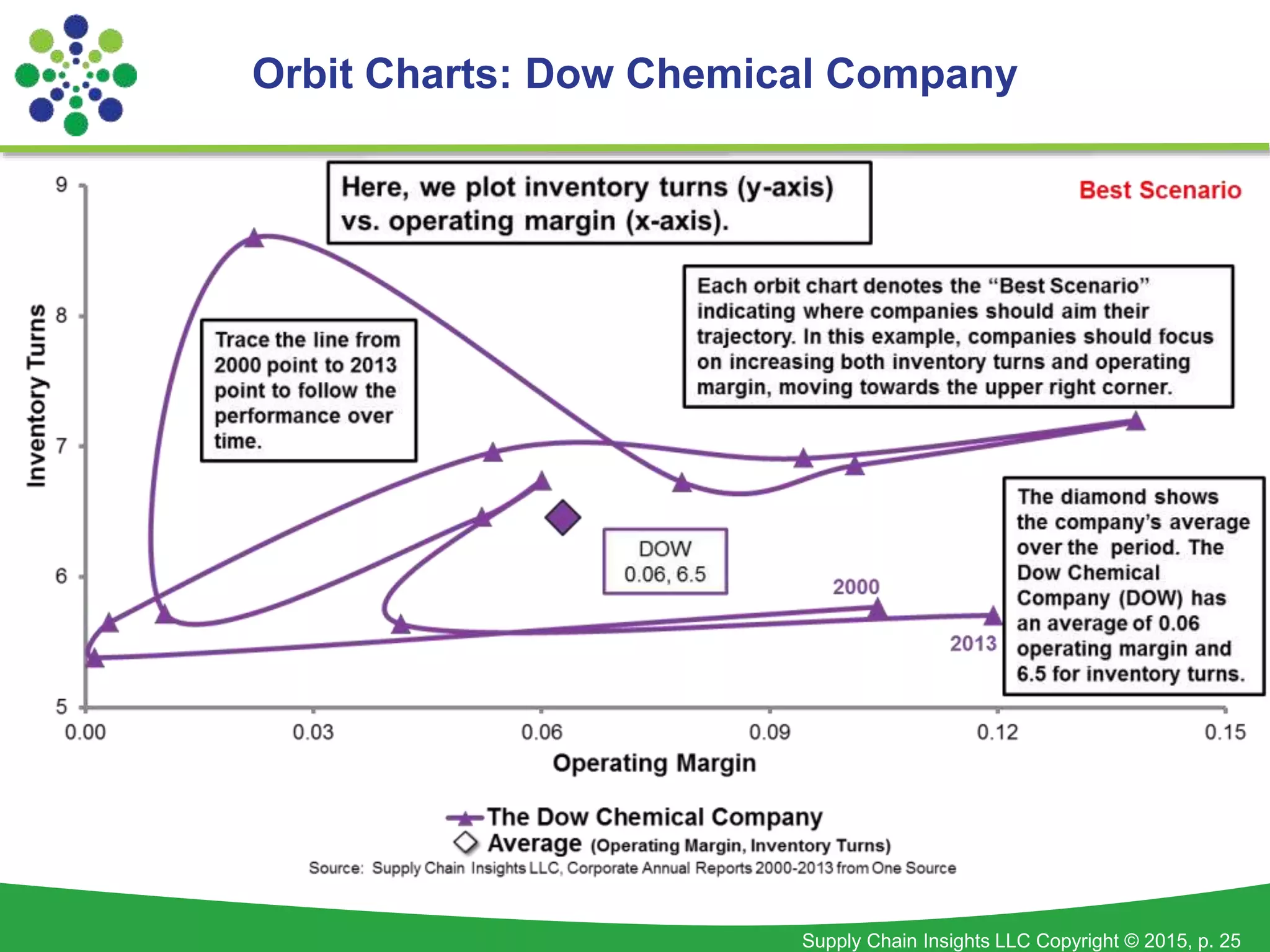

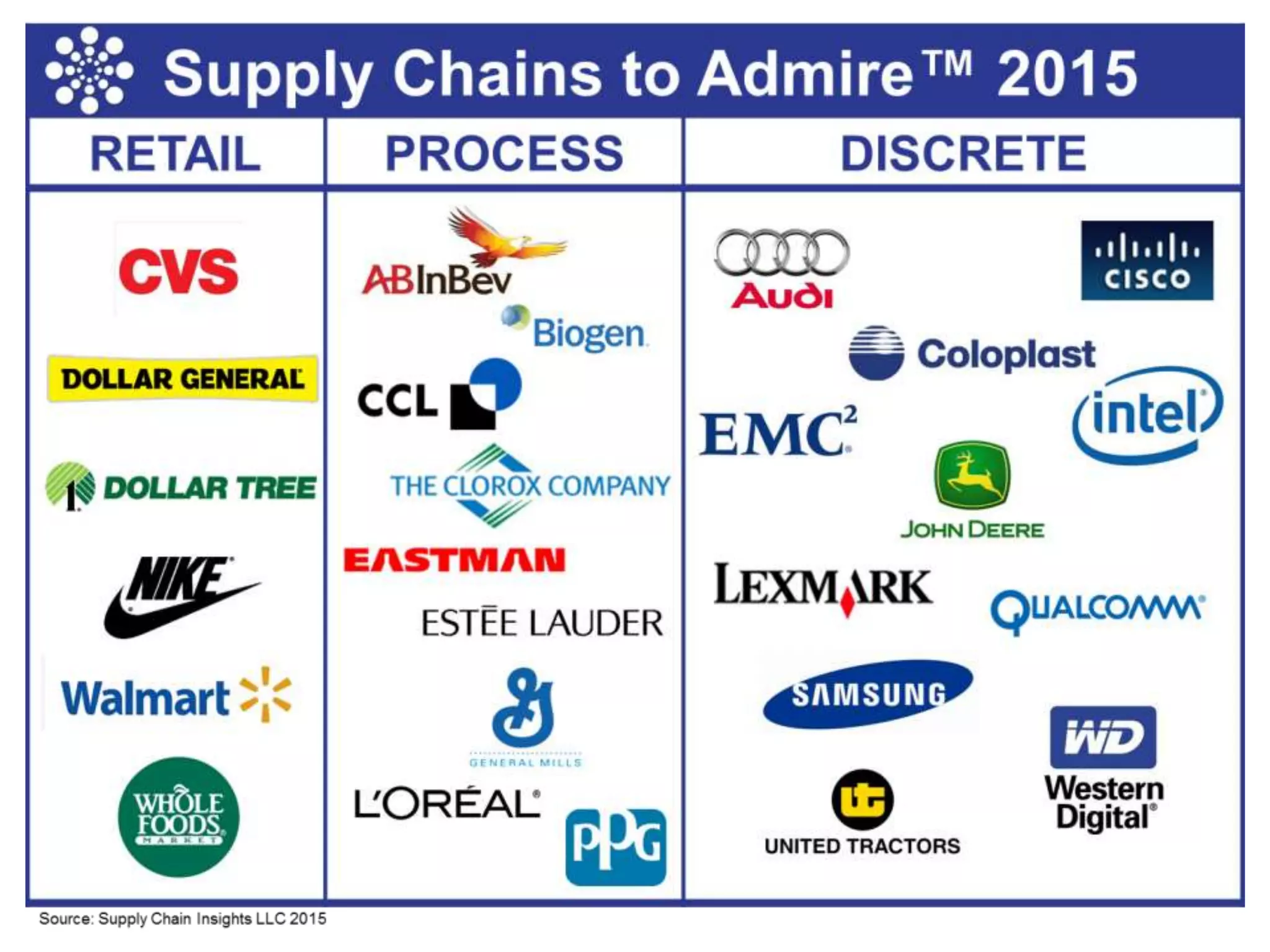

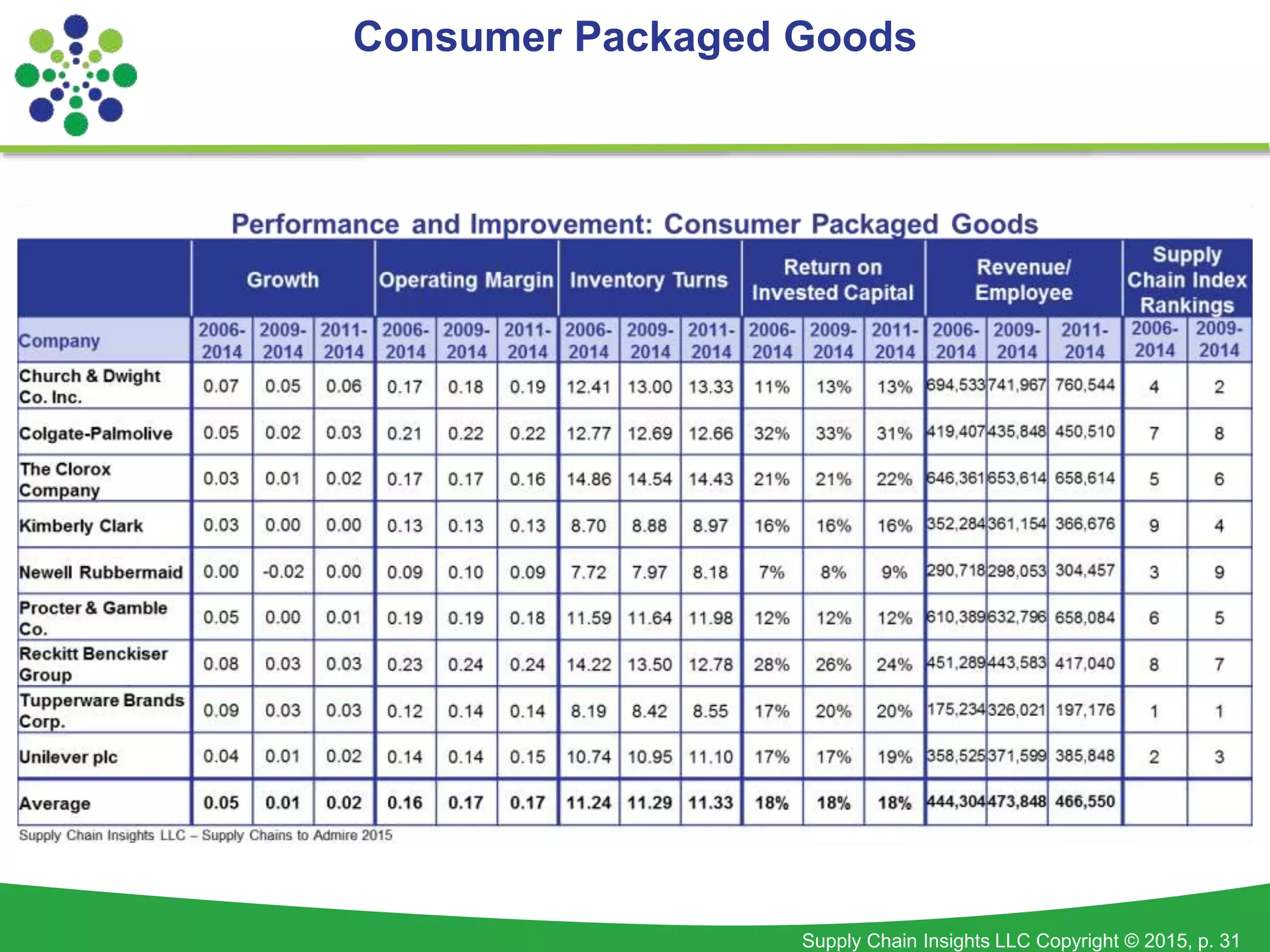

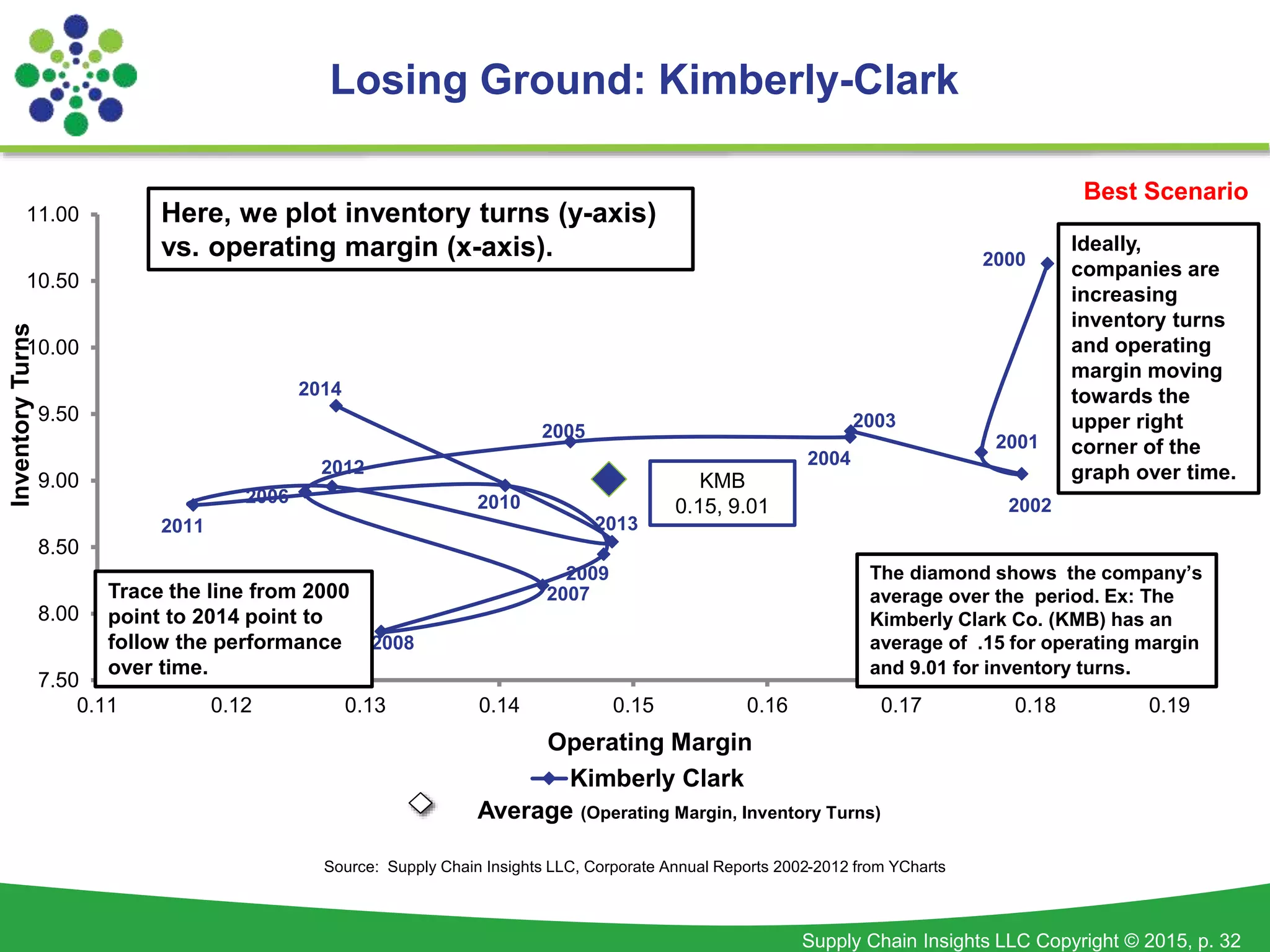

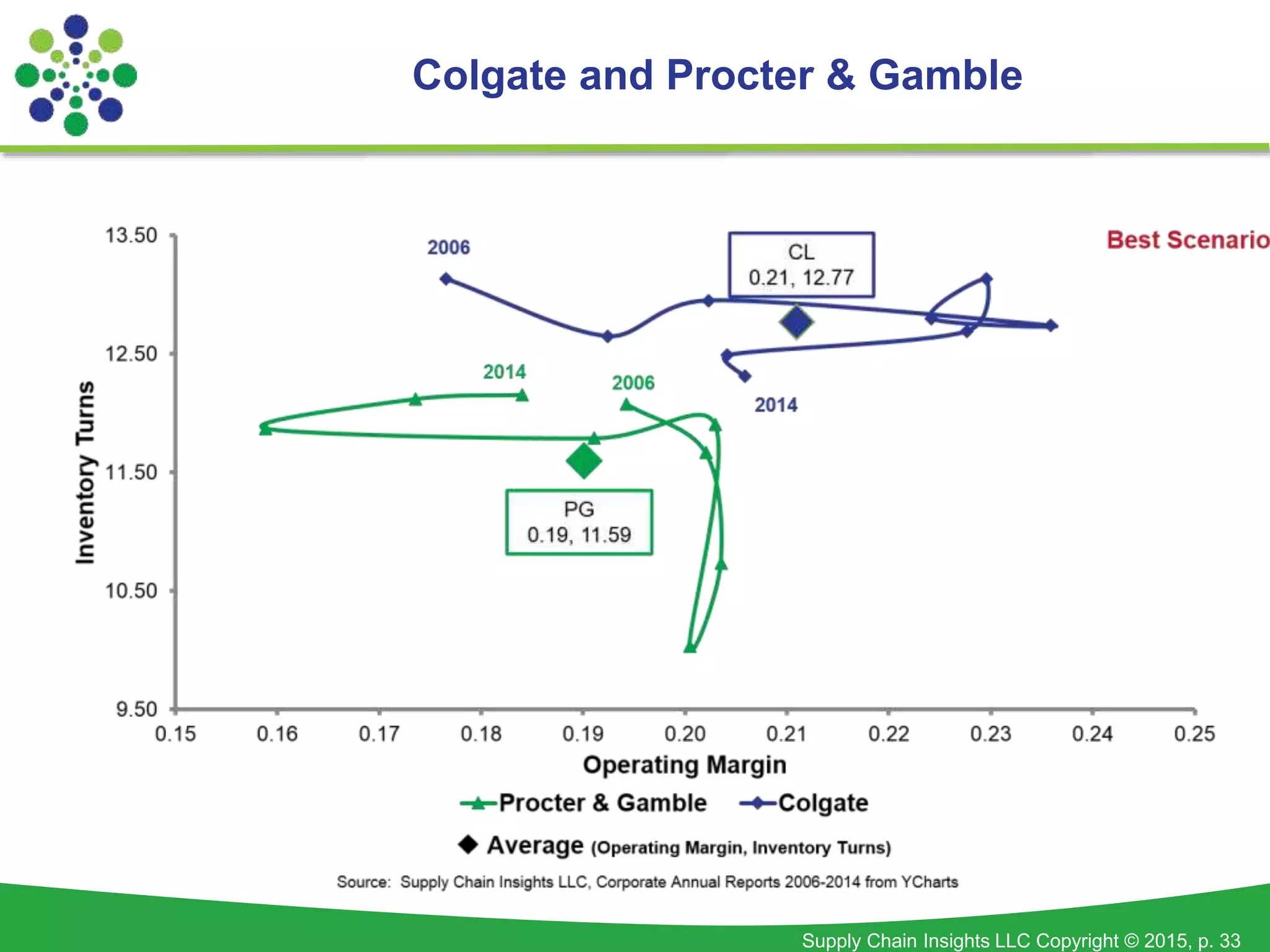

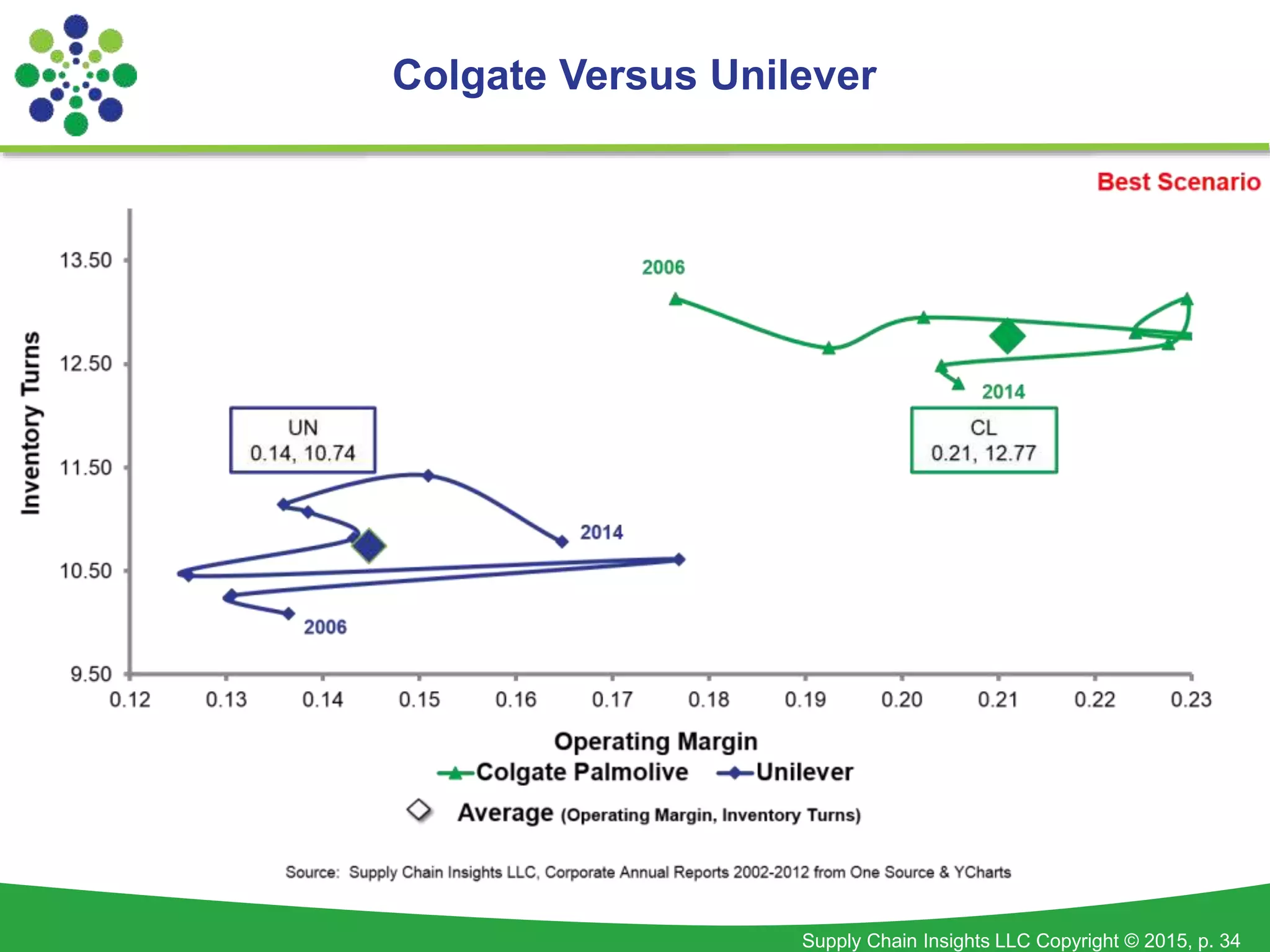

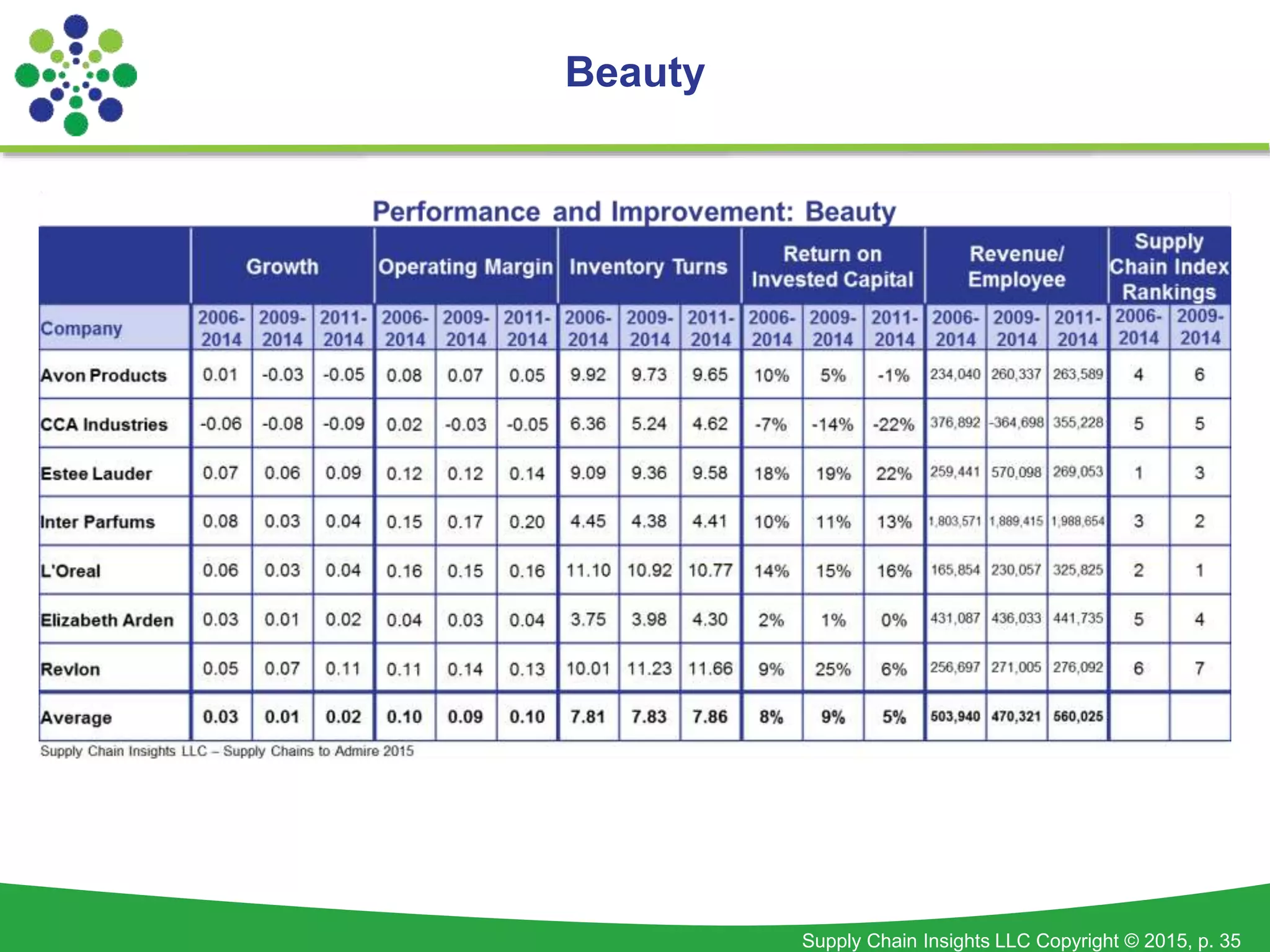

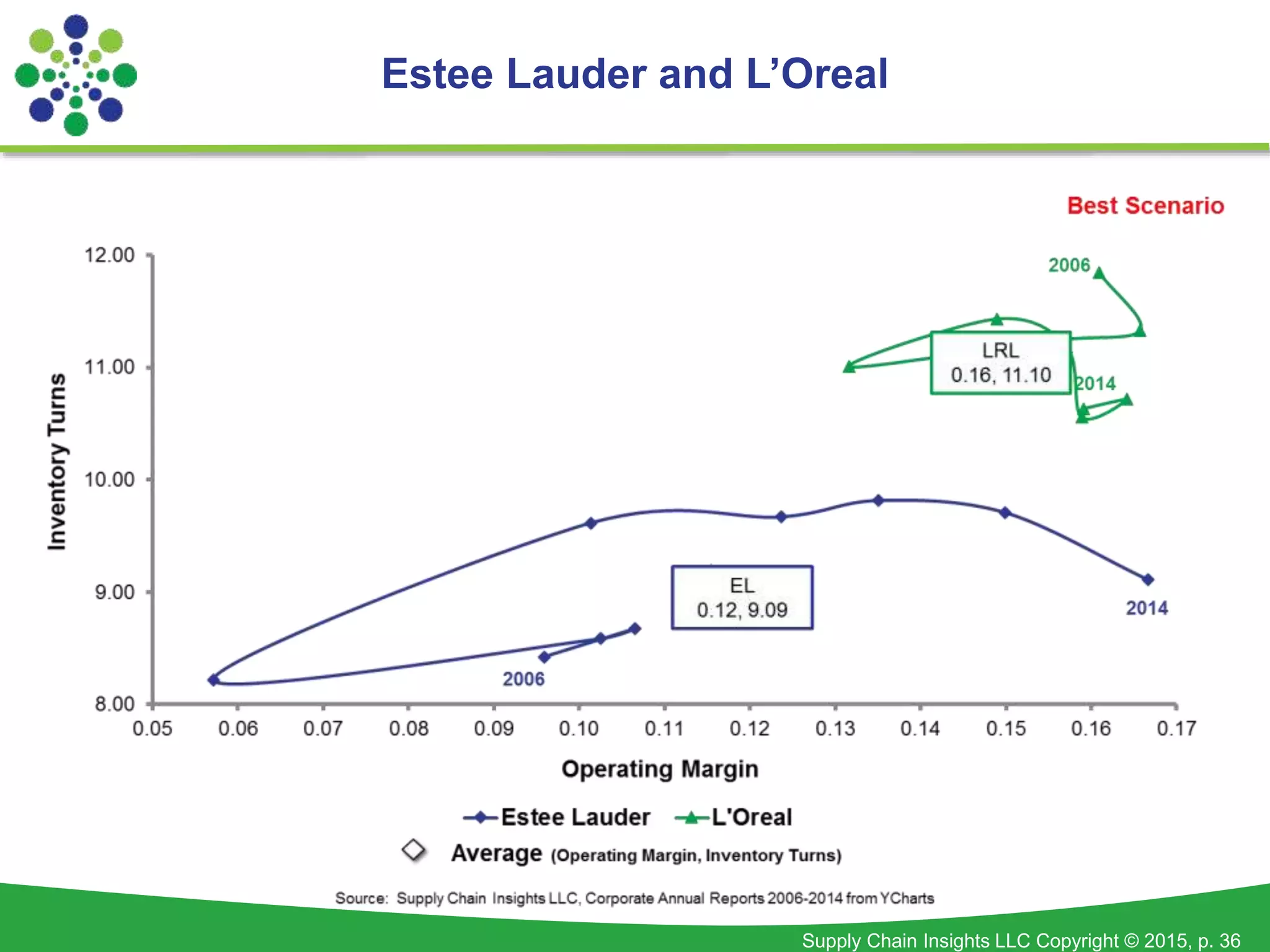

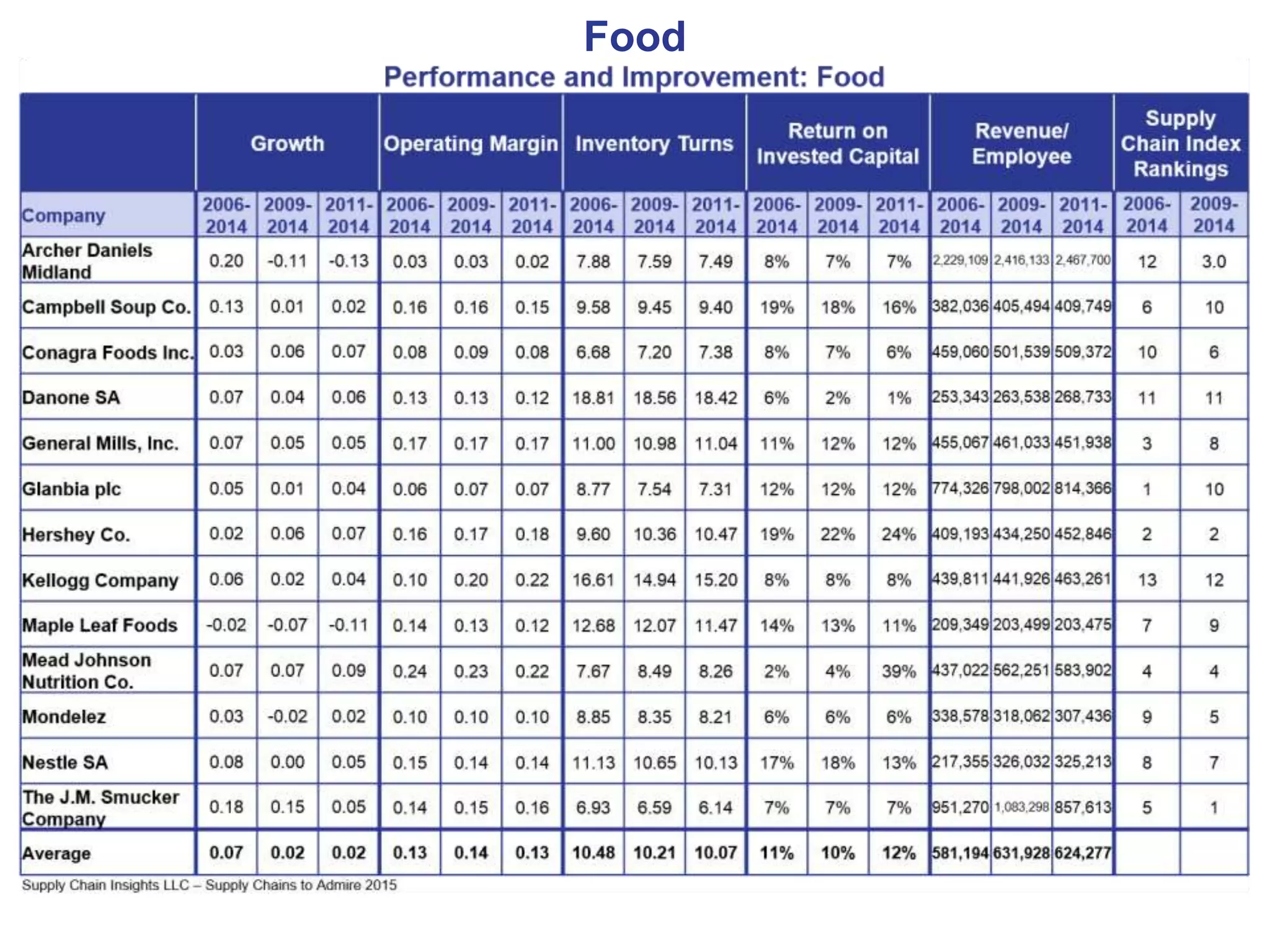

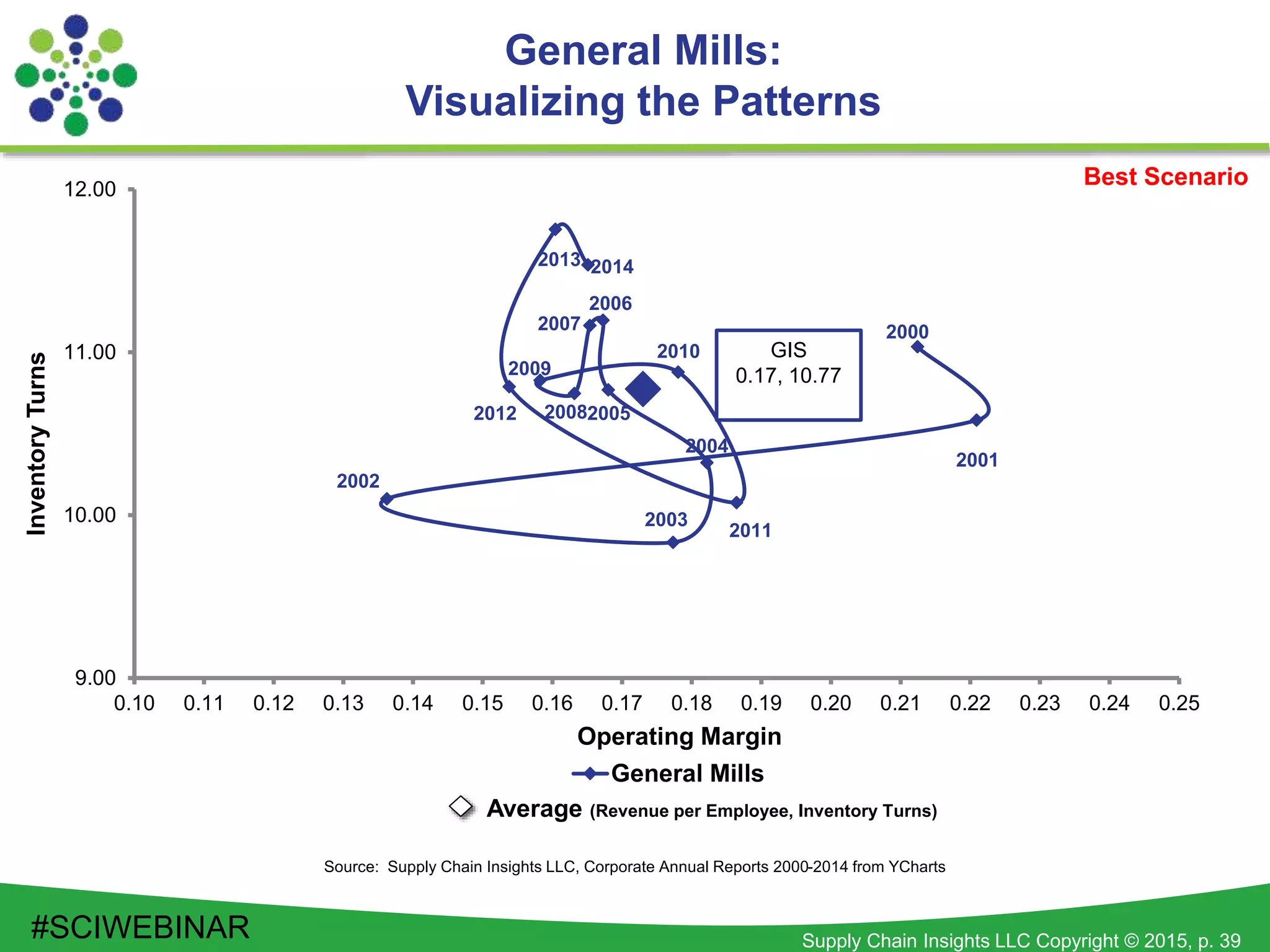

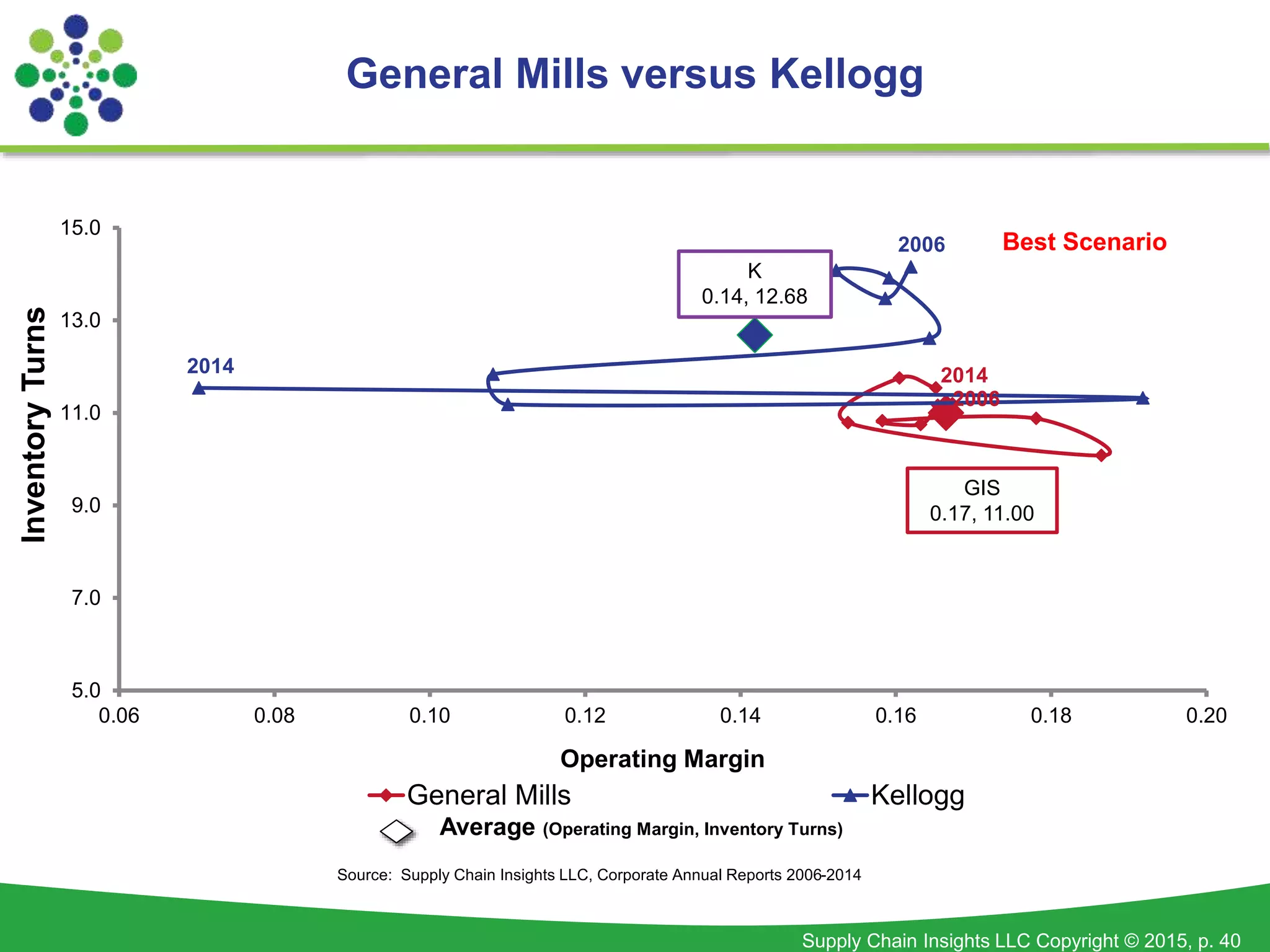

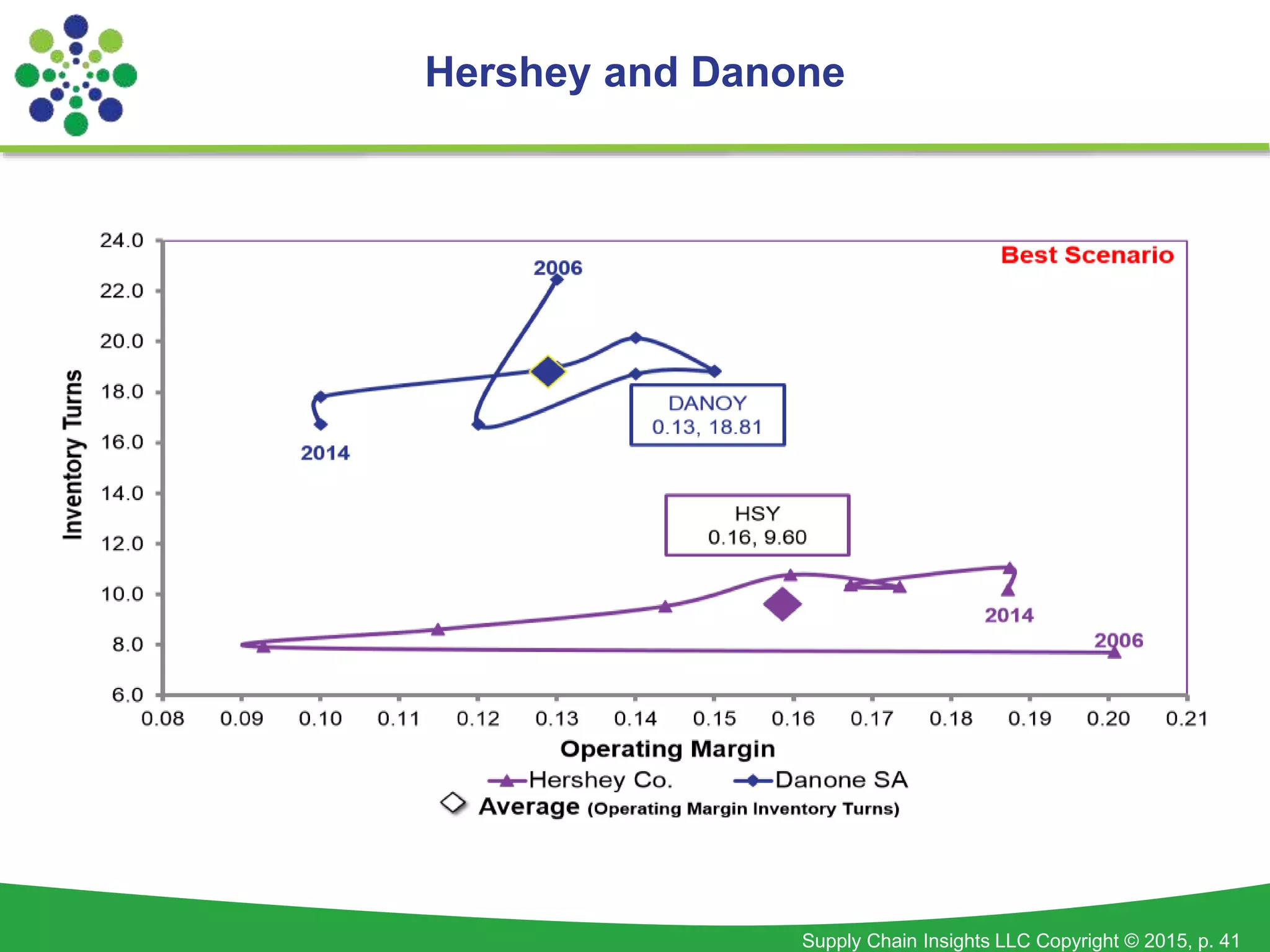

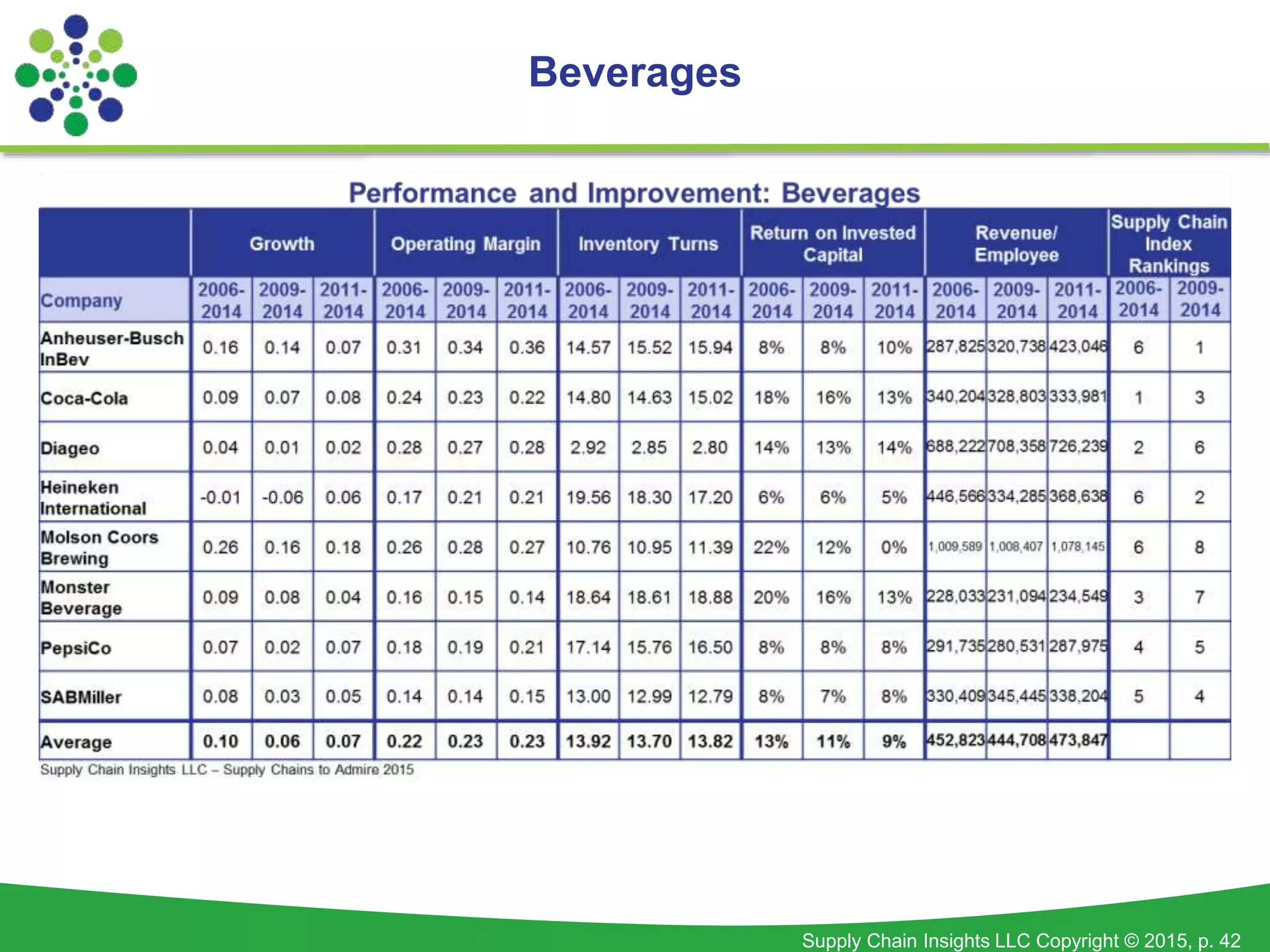

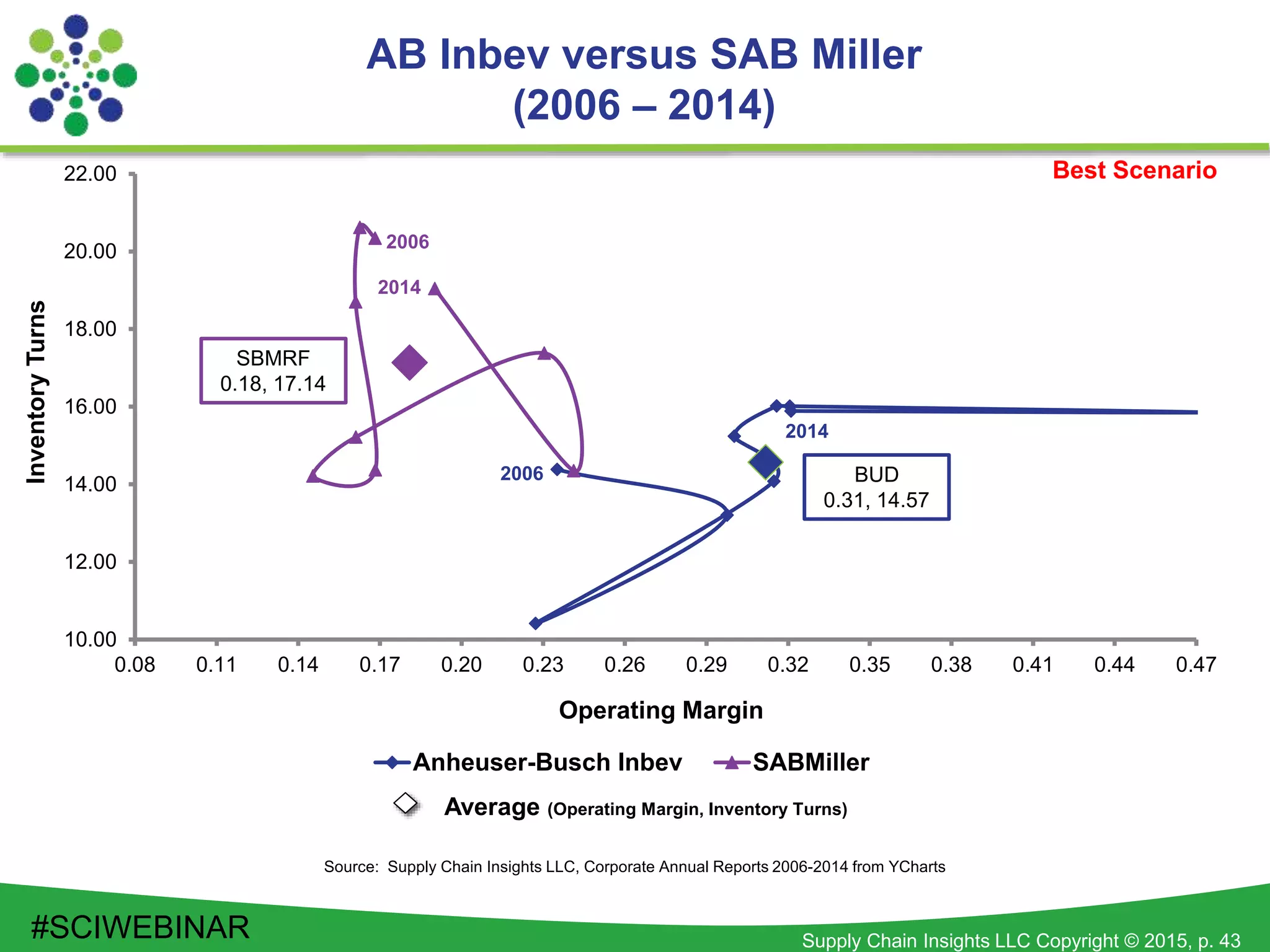

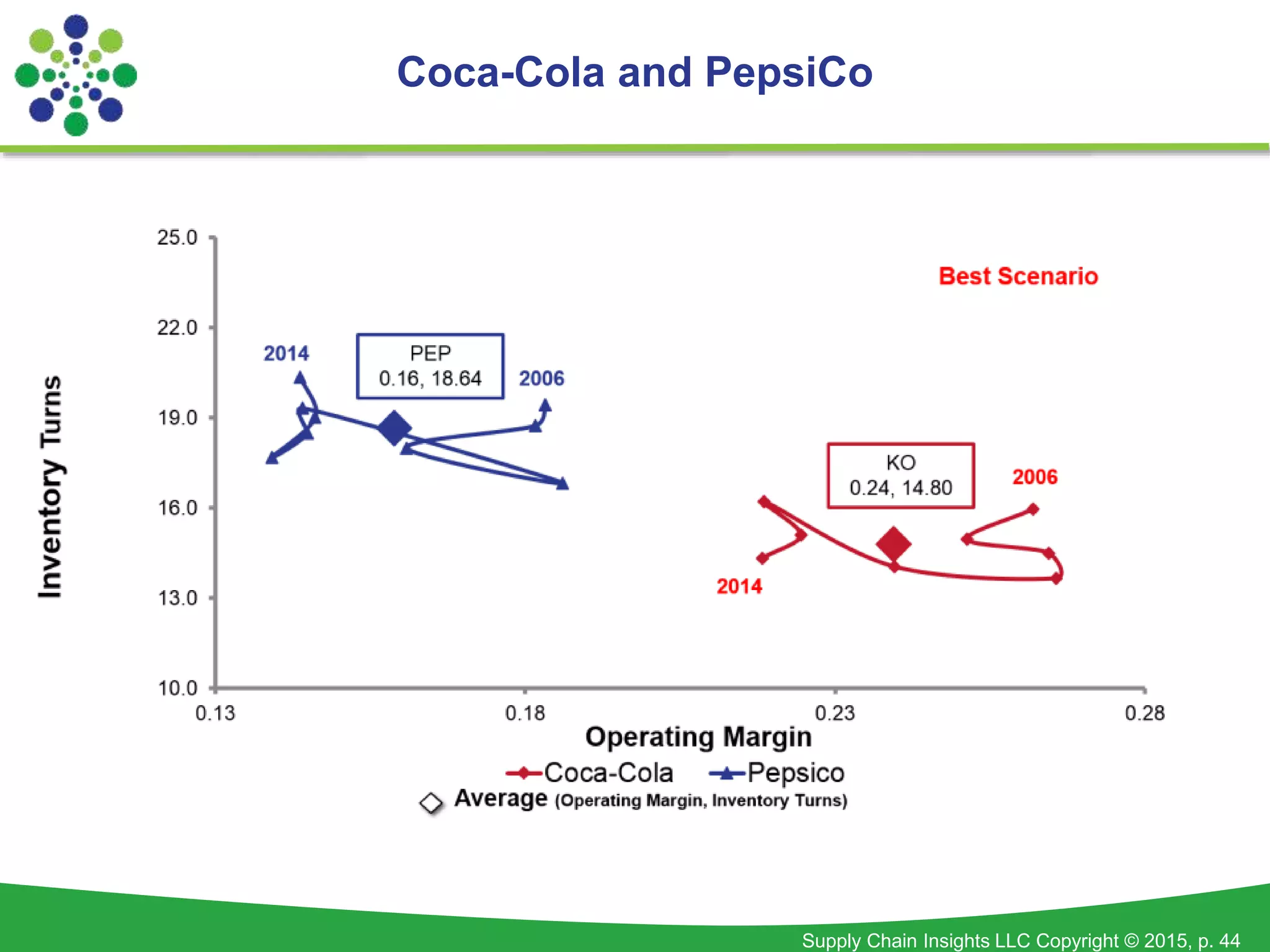

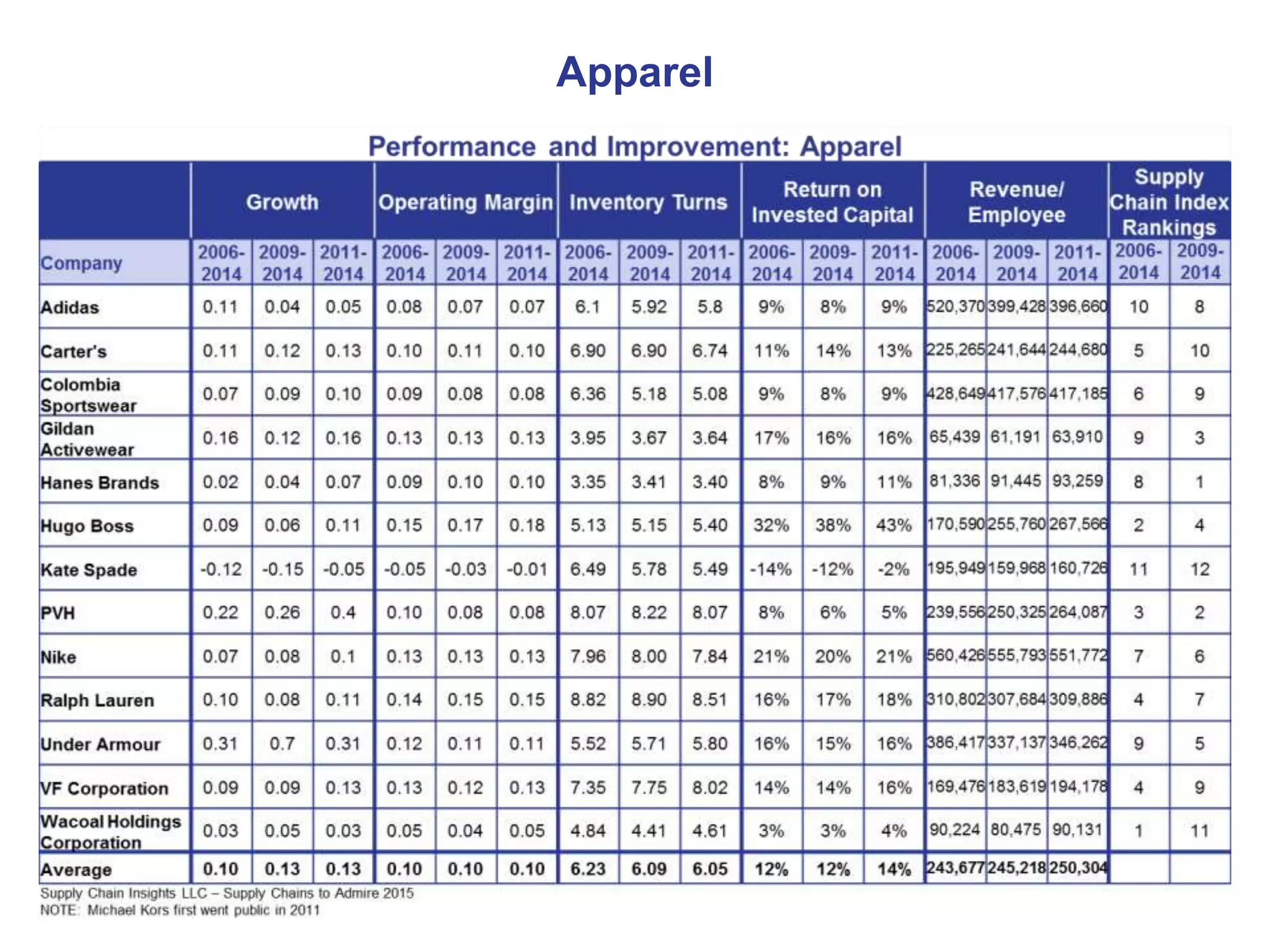

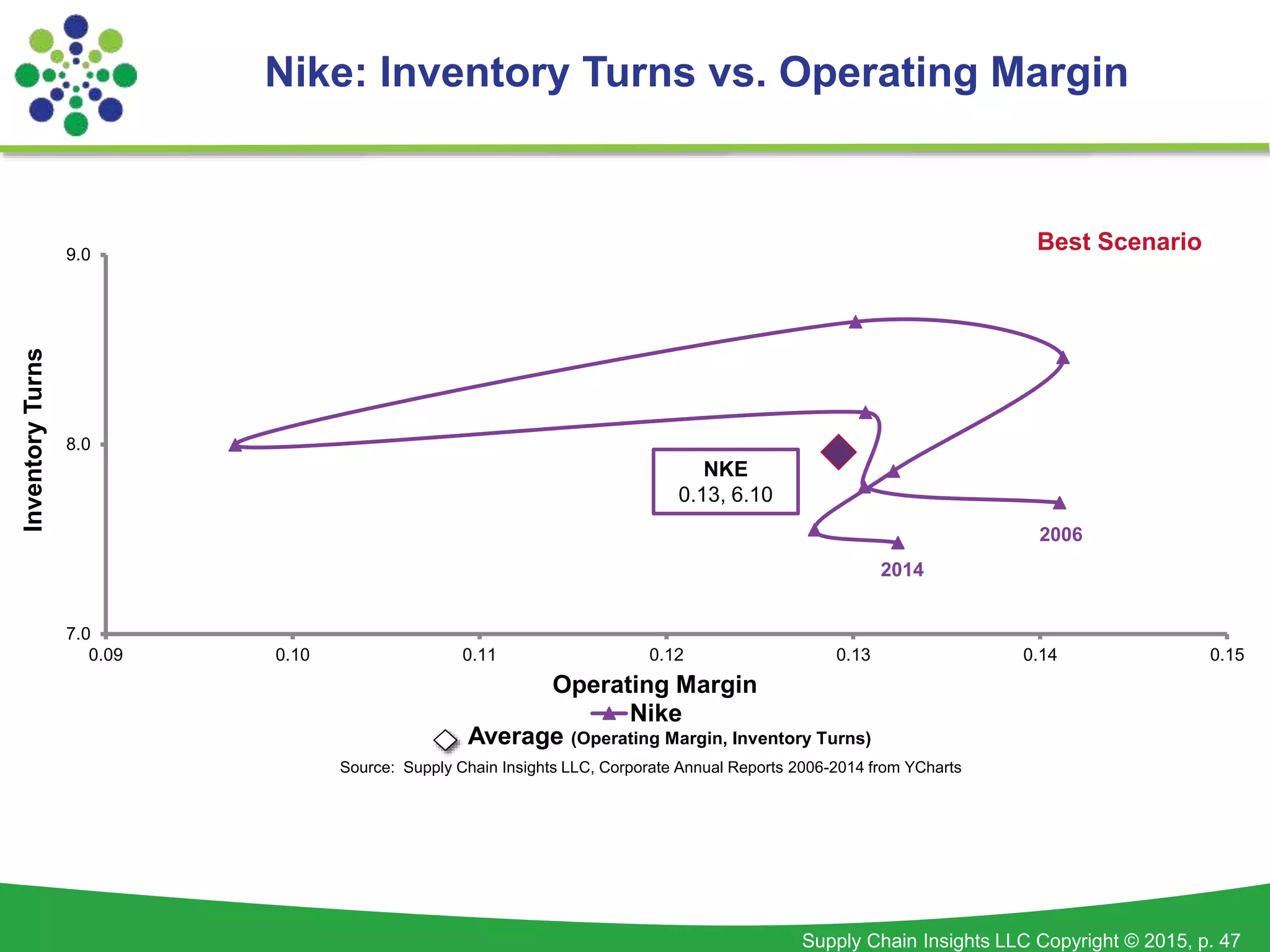

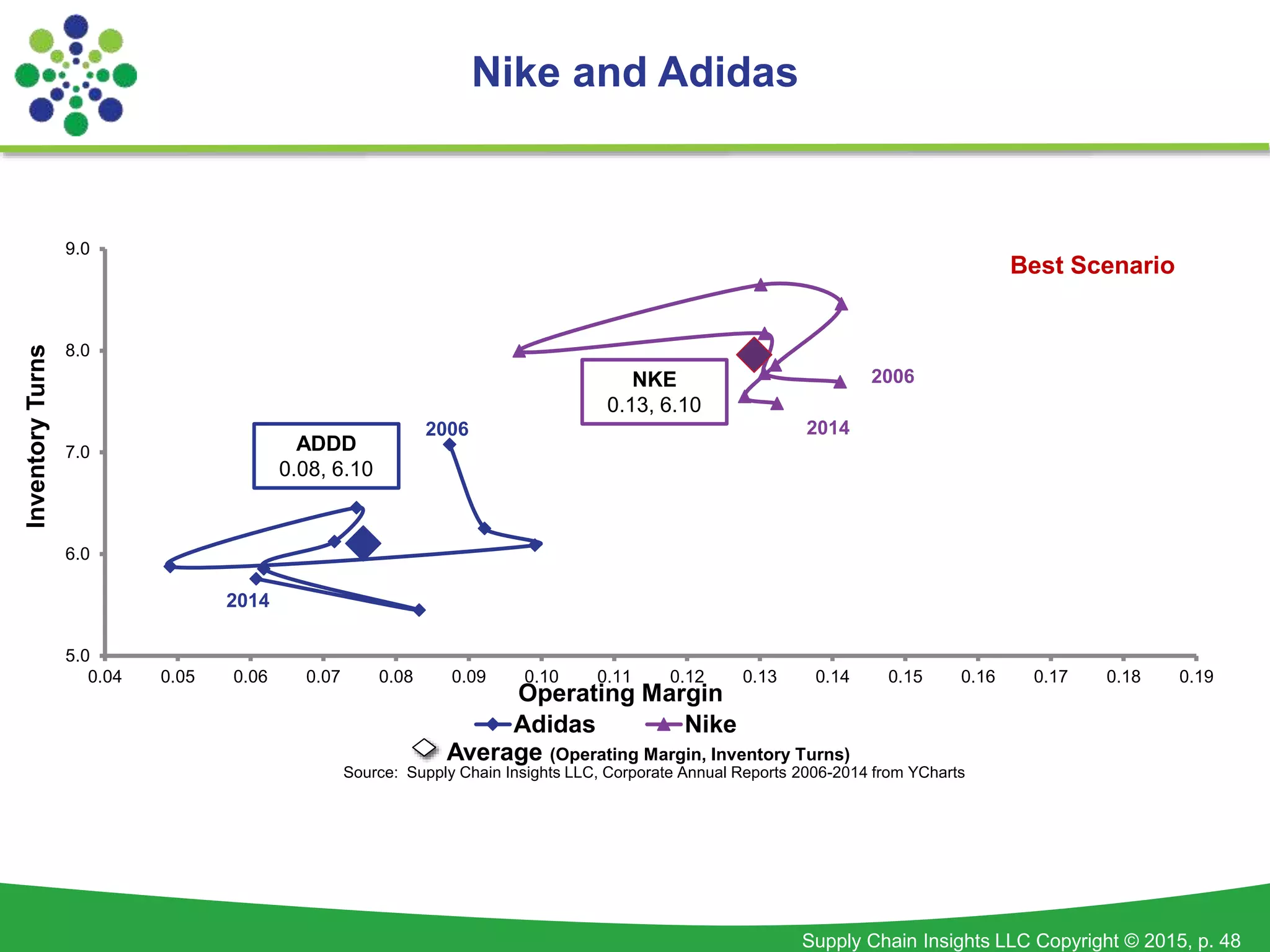

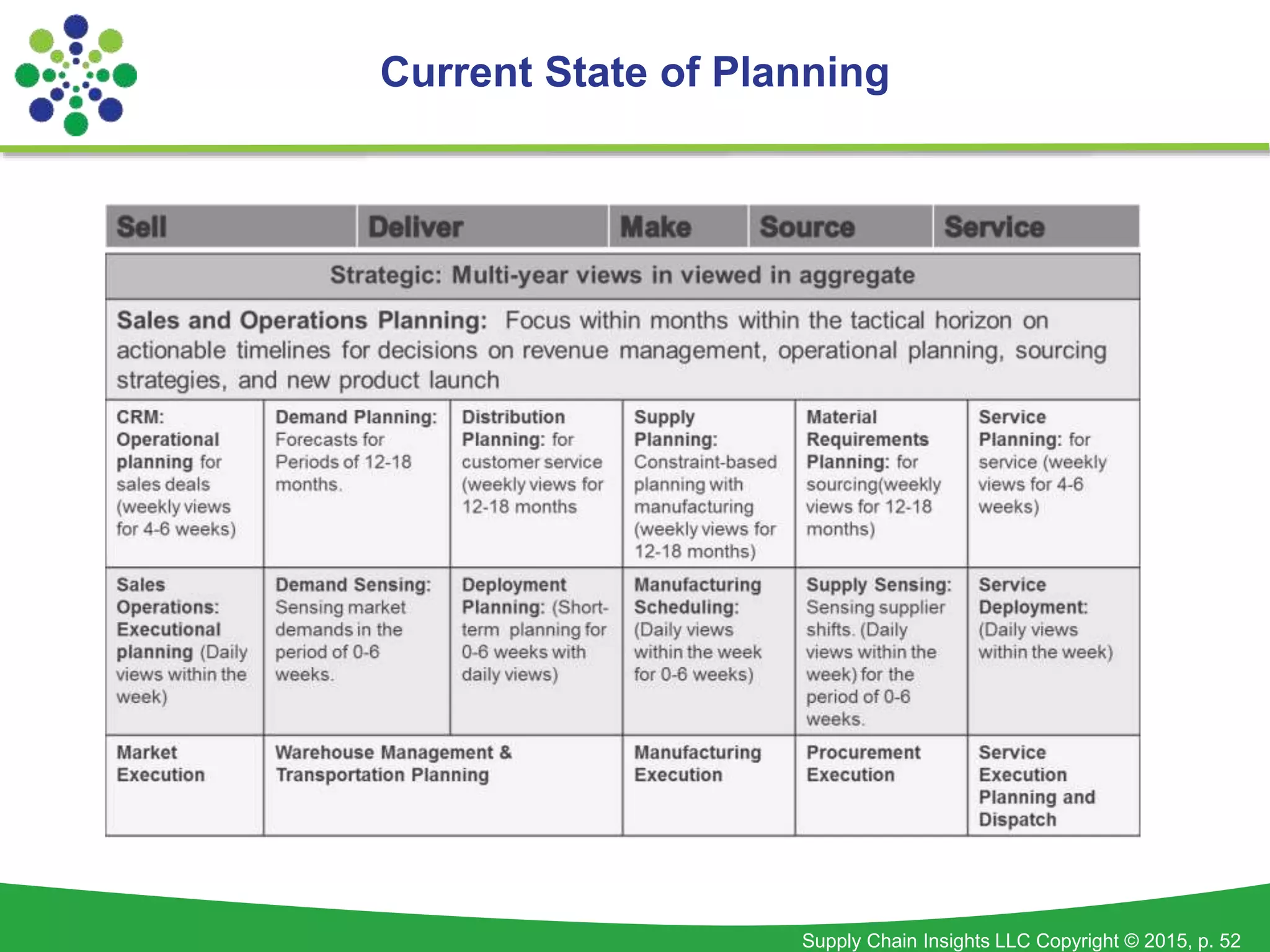

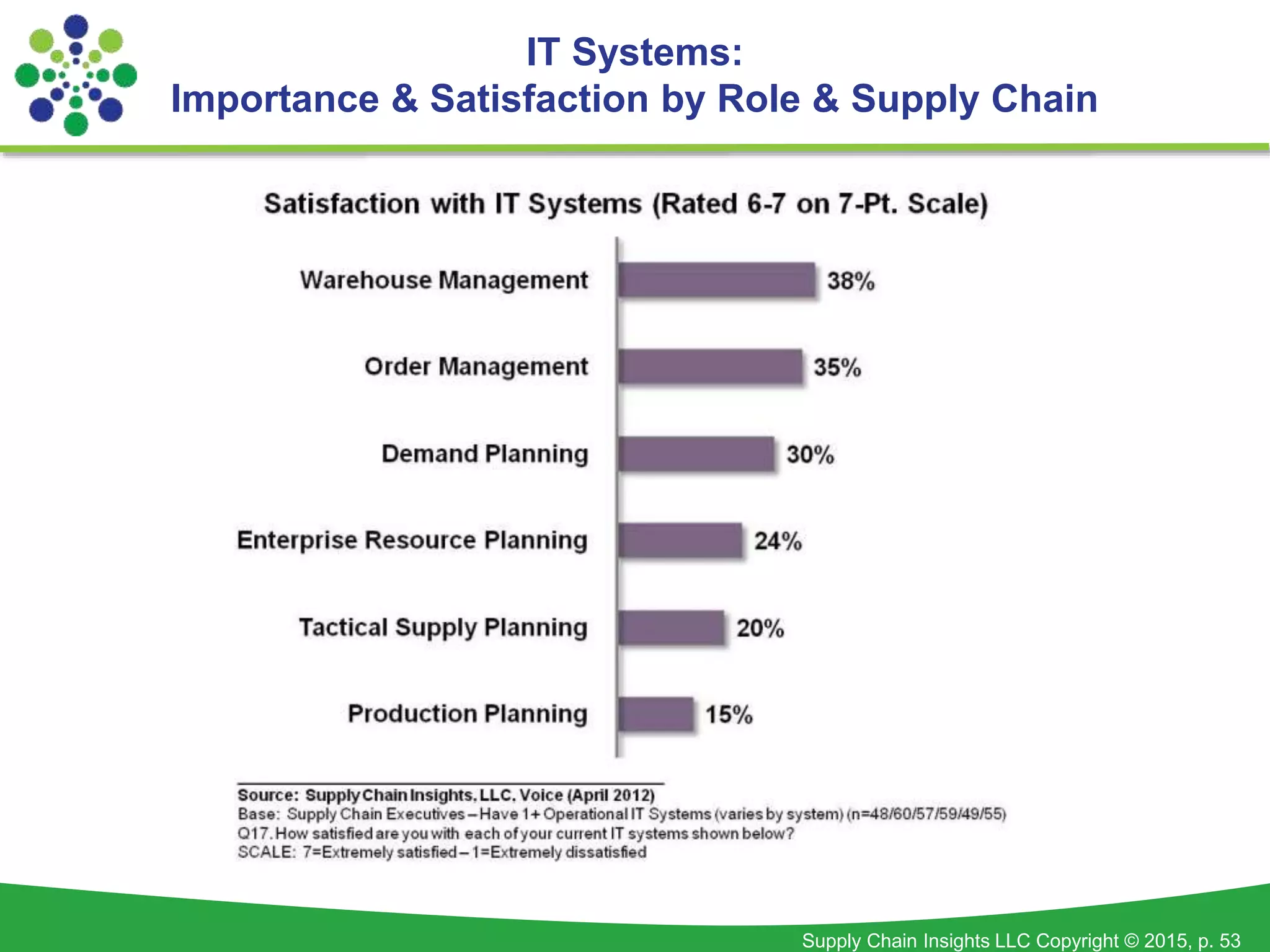

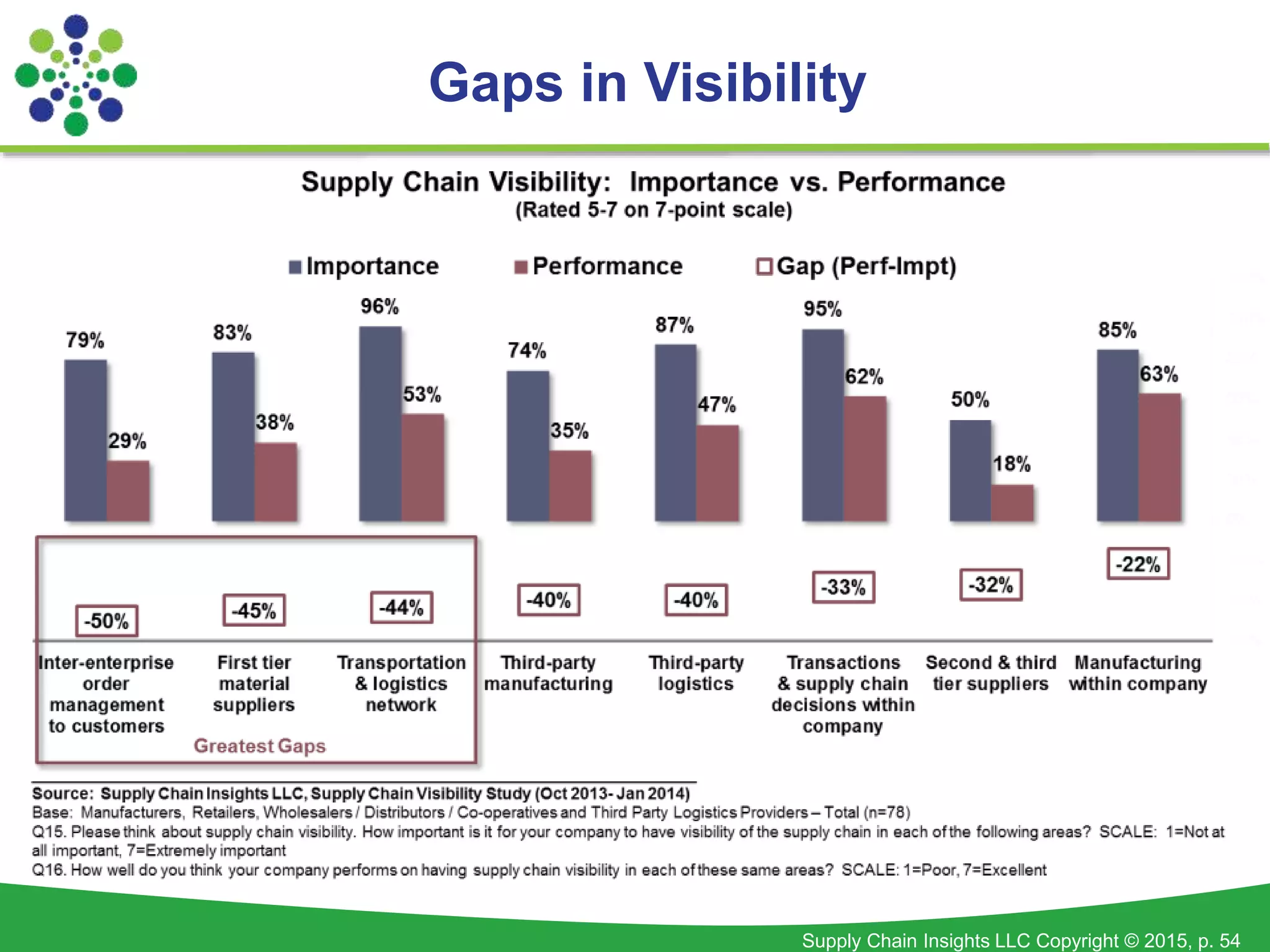

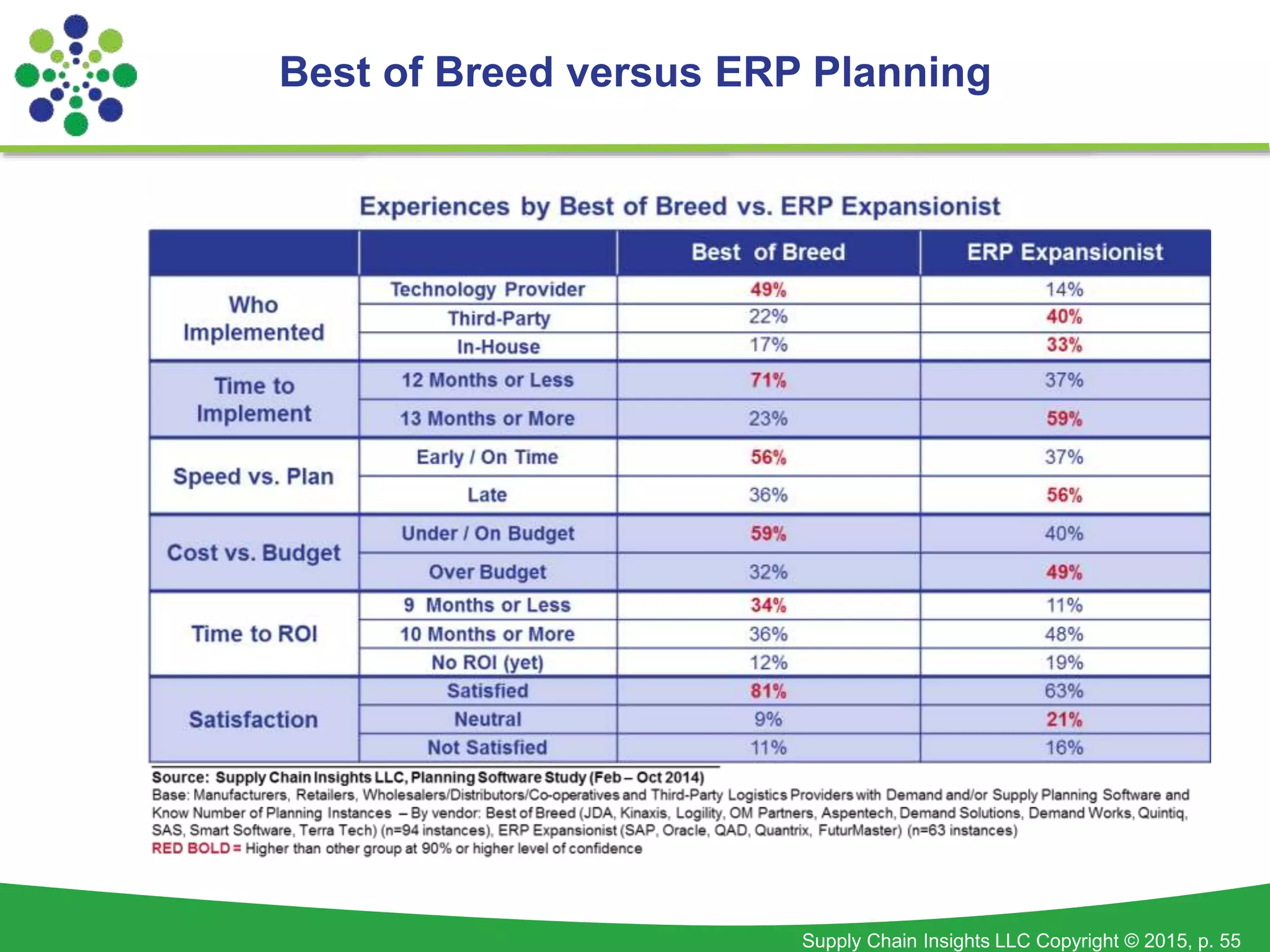

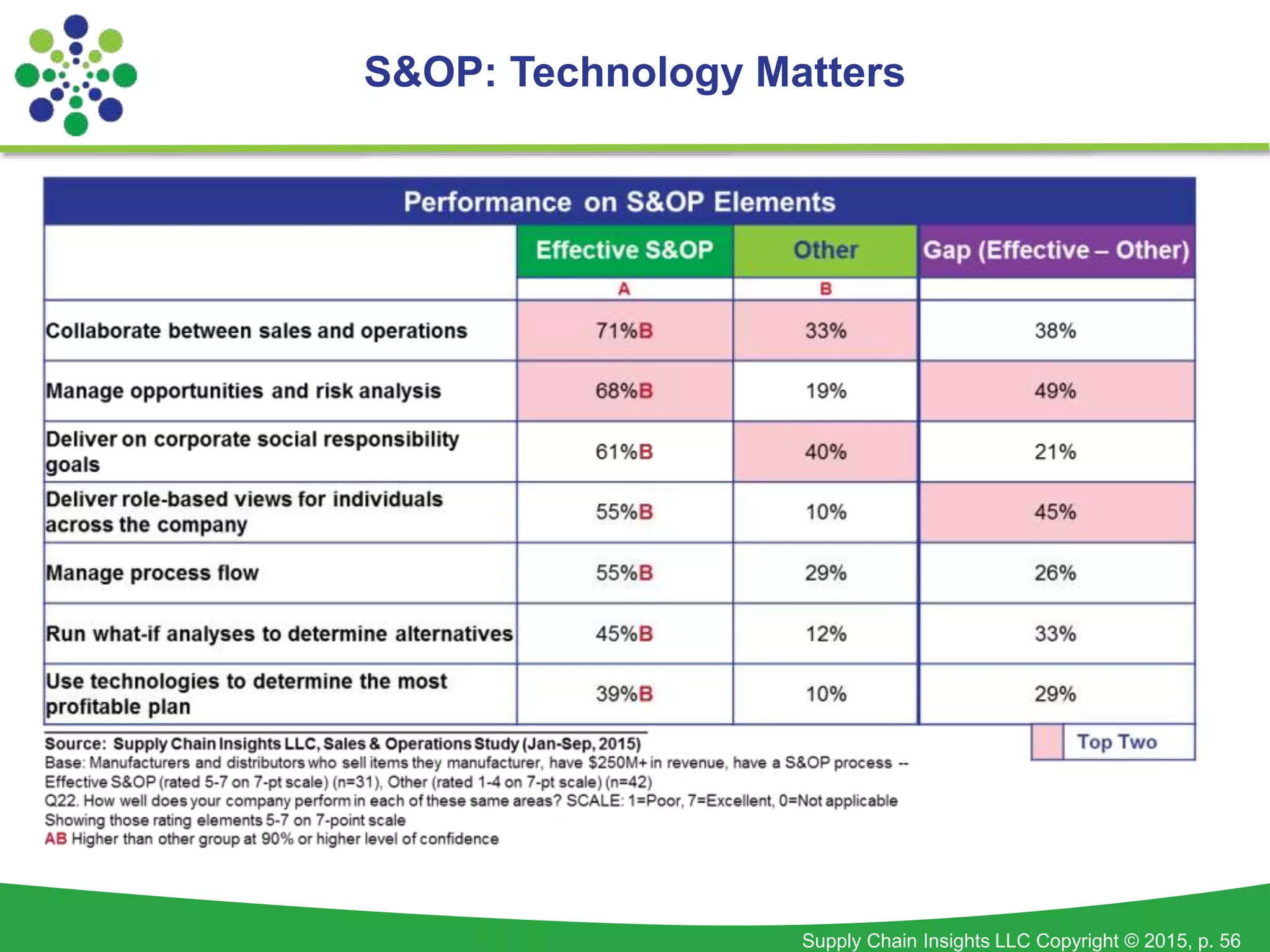

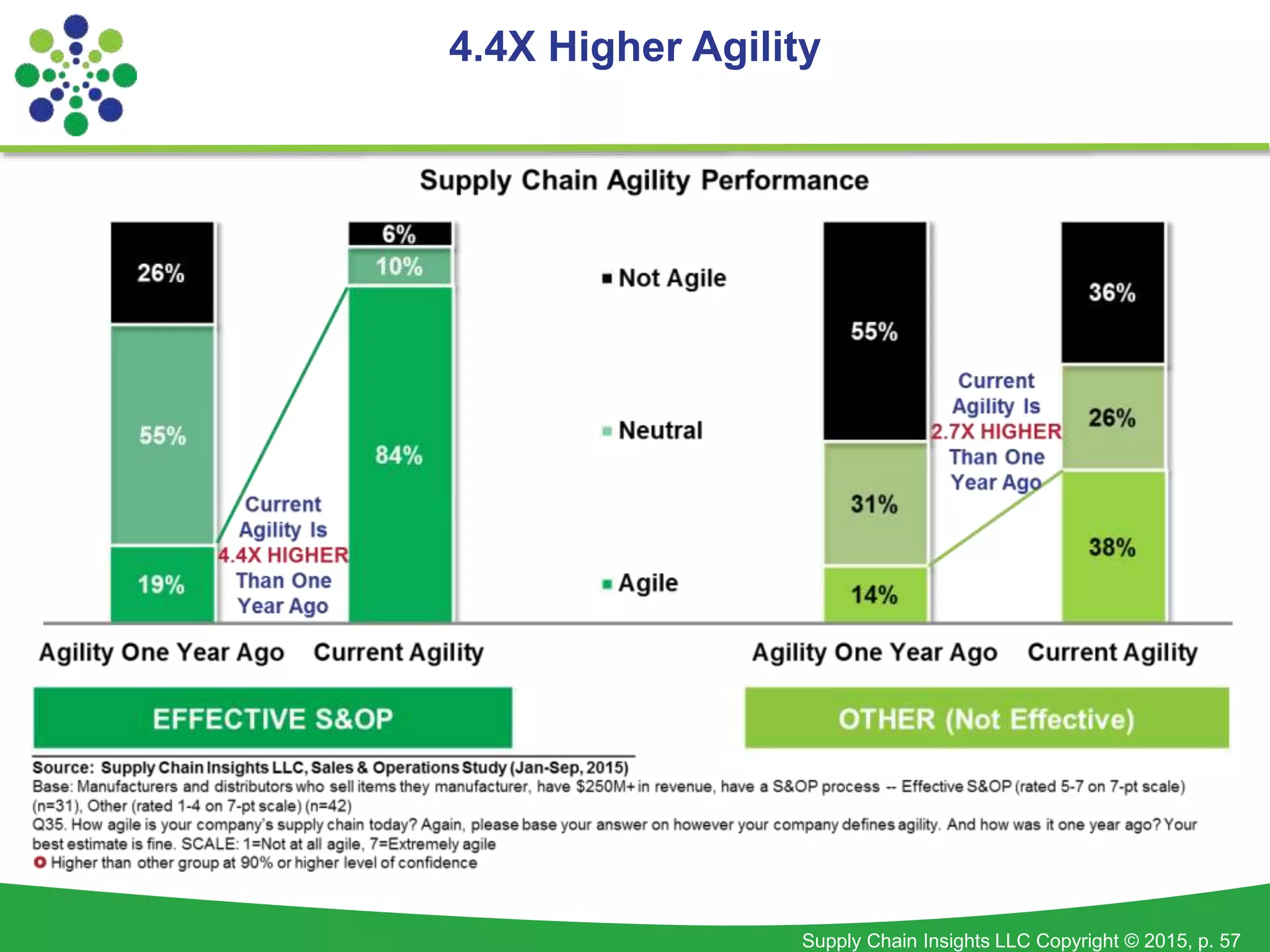

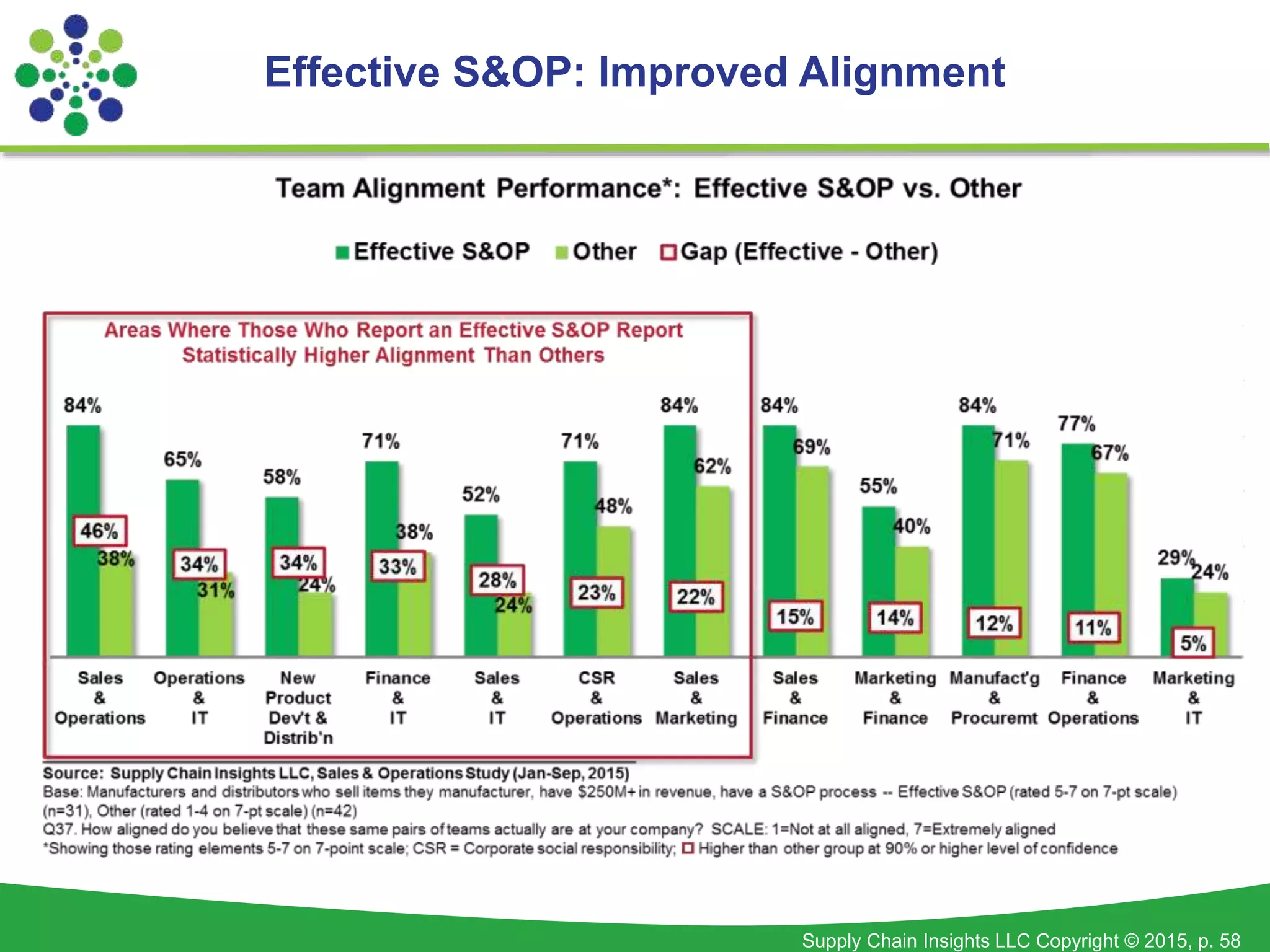

This document is from Supply Chain Insights LLC and discusses metrics that matter for supply chain performance. It provides examples of "orbit charts" that plot inventory turns versus operating margin for various companies over time. Some companies have improved on both metrics while others have lost ground. The document advocates focusing on metrics that correlate with market capitalization, like growth, margins, inventory turns and return on invested capital. It also discusses factors that drive top supply chain performance like continuity of leadership, talent development, and supply chain planning technology.