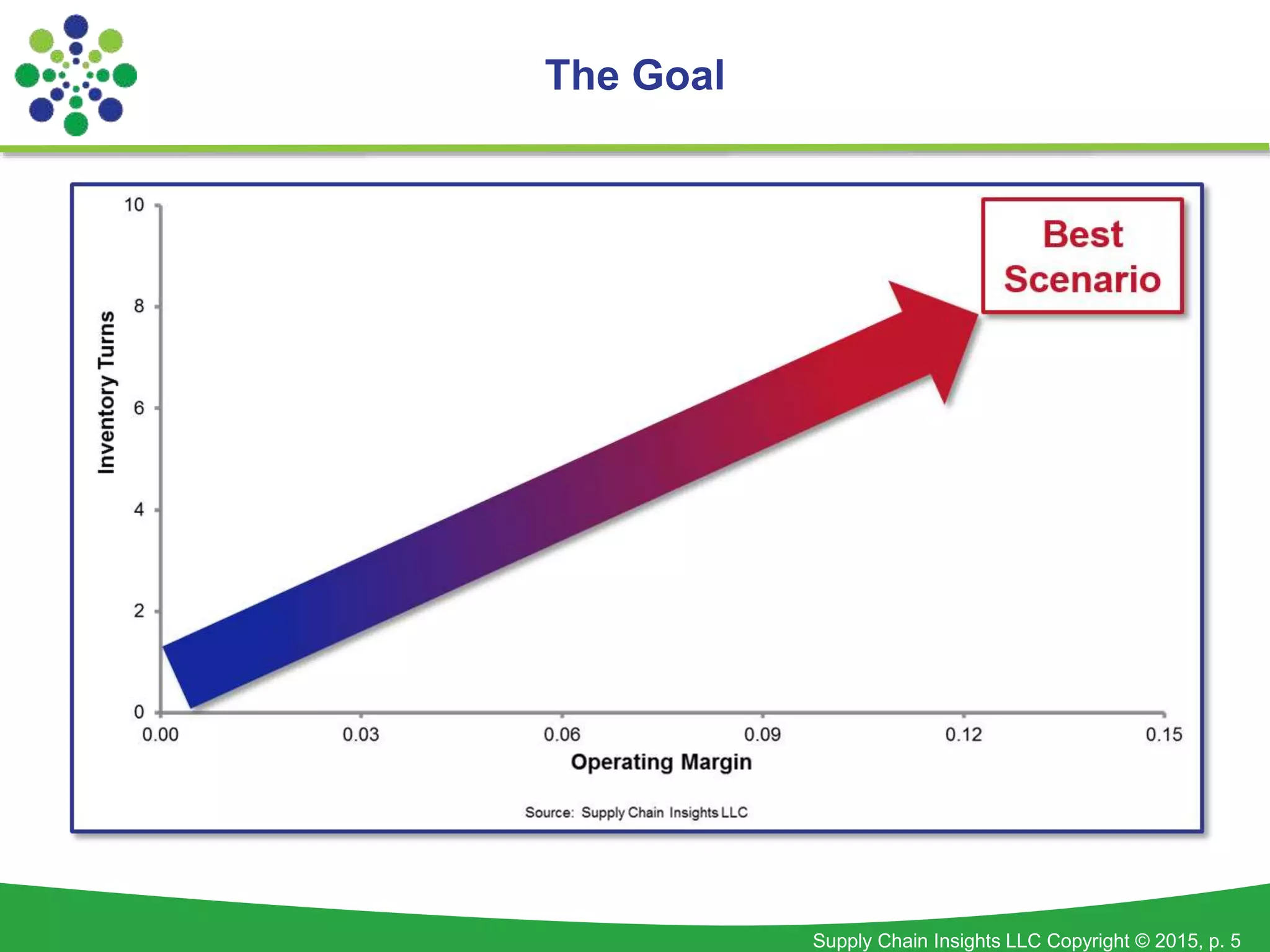

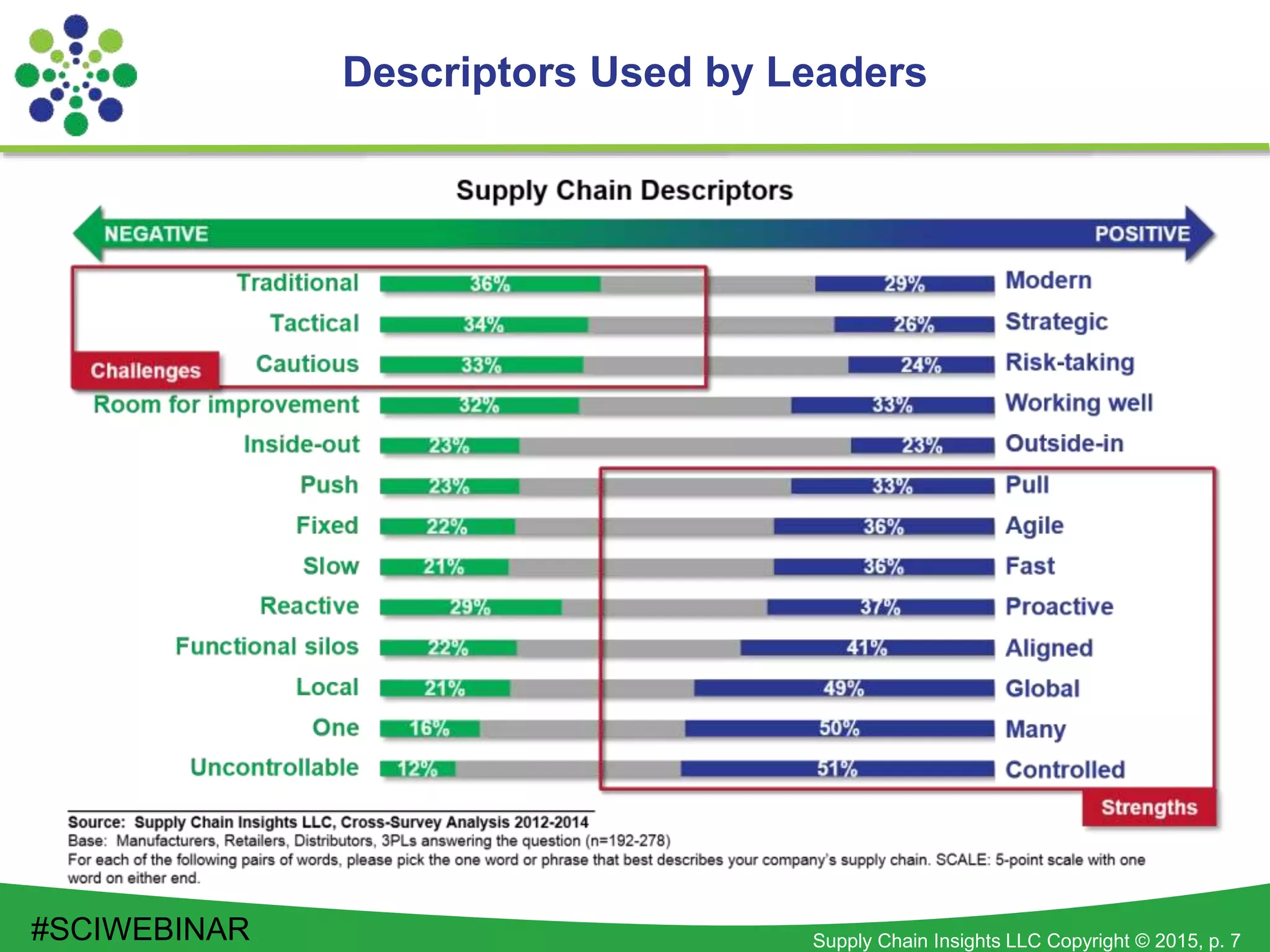

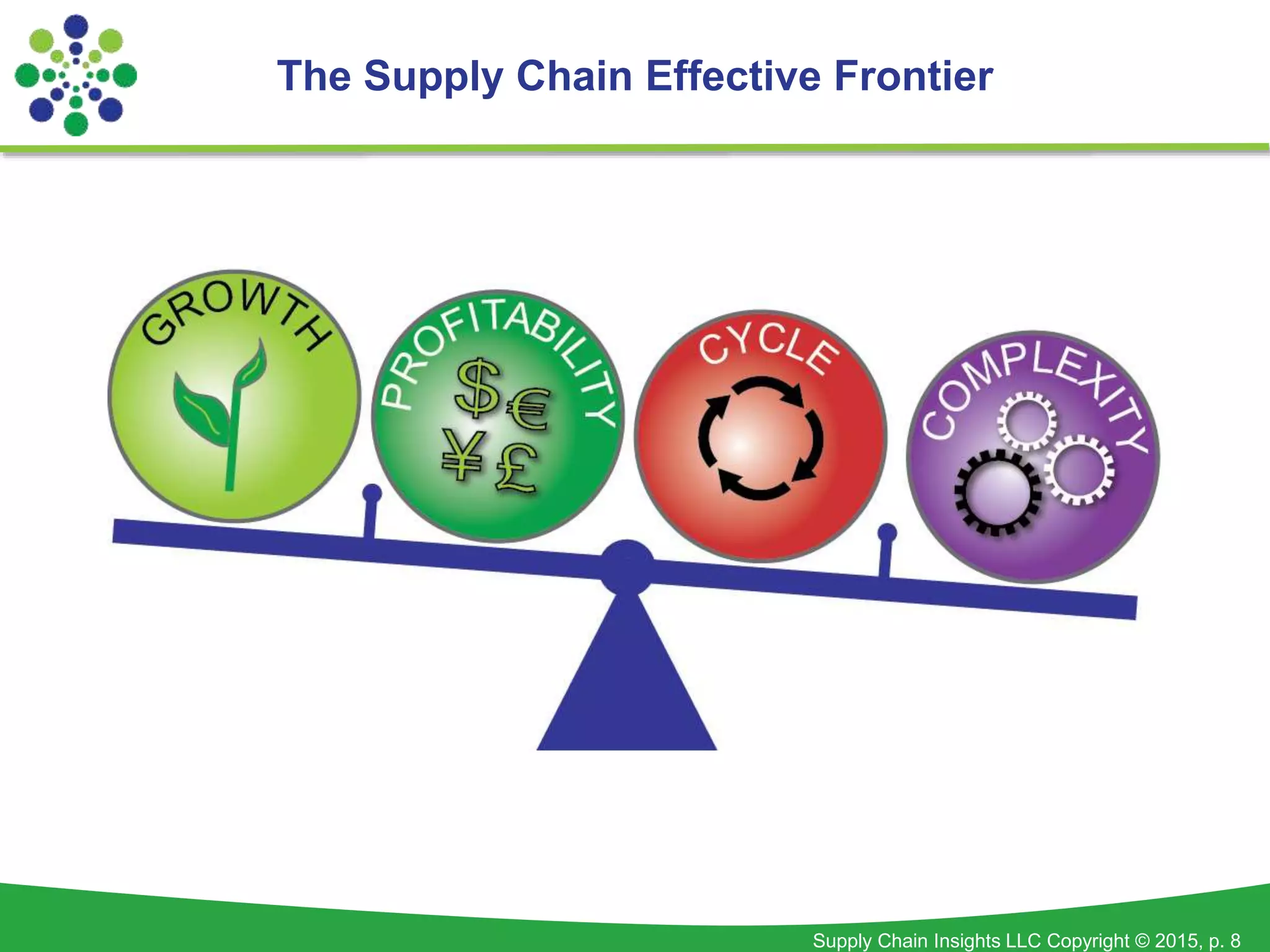

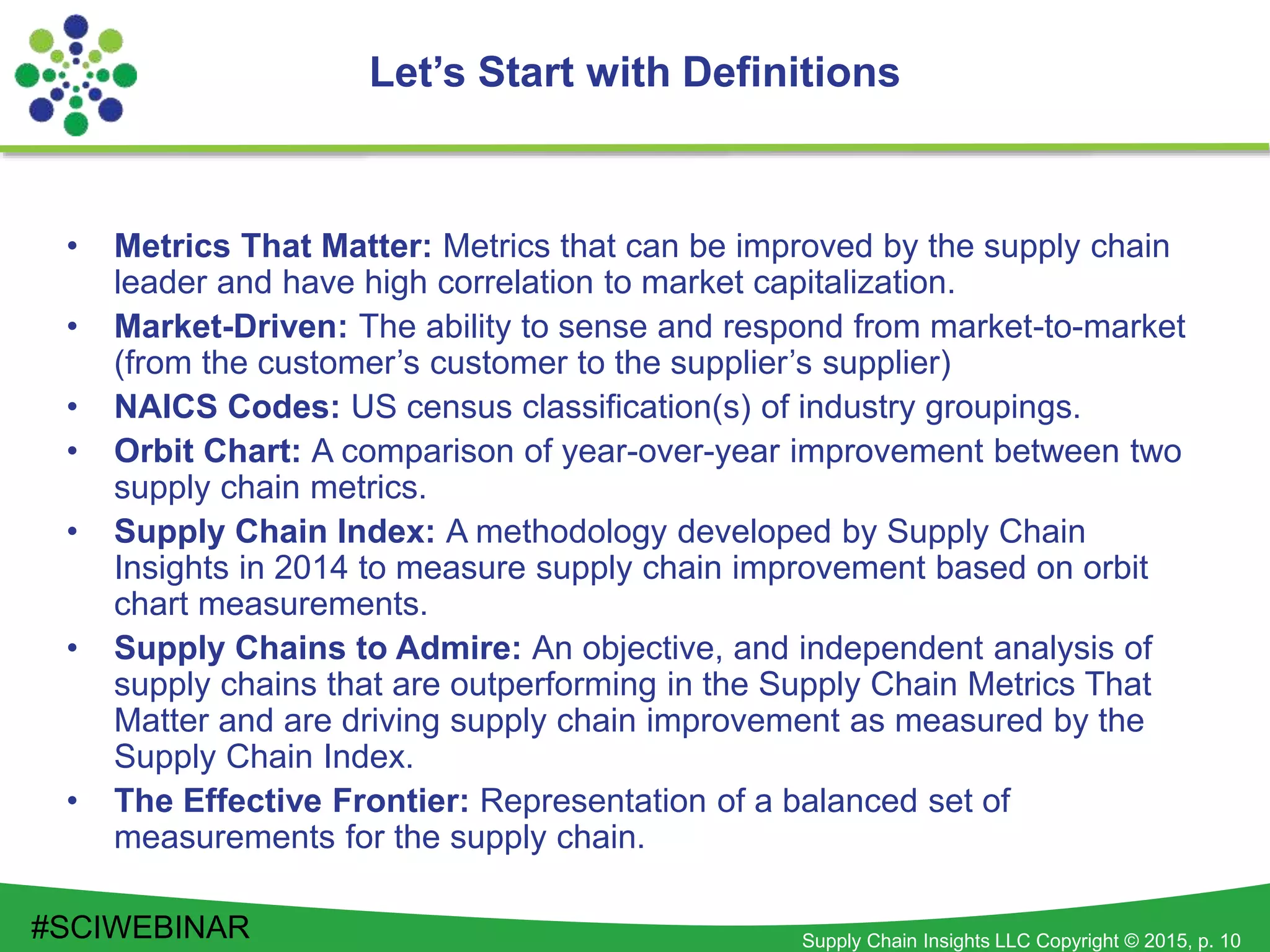

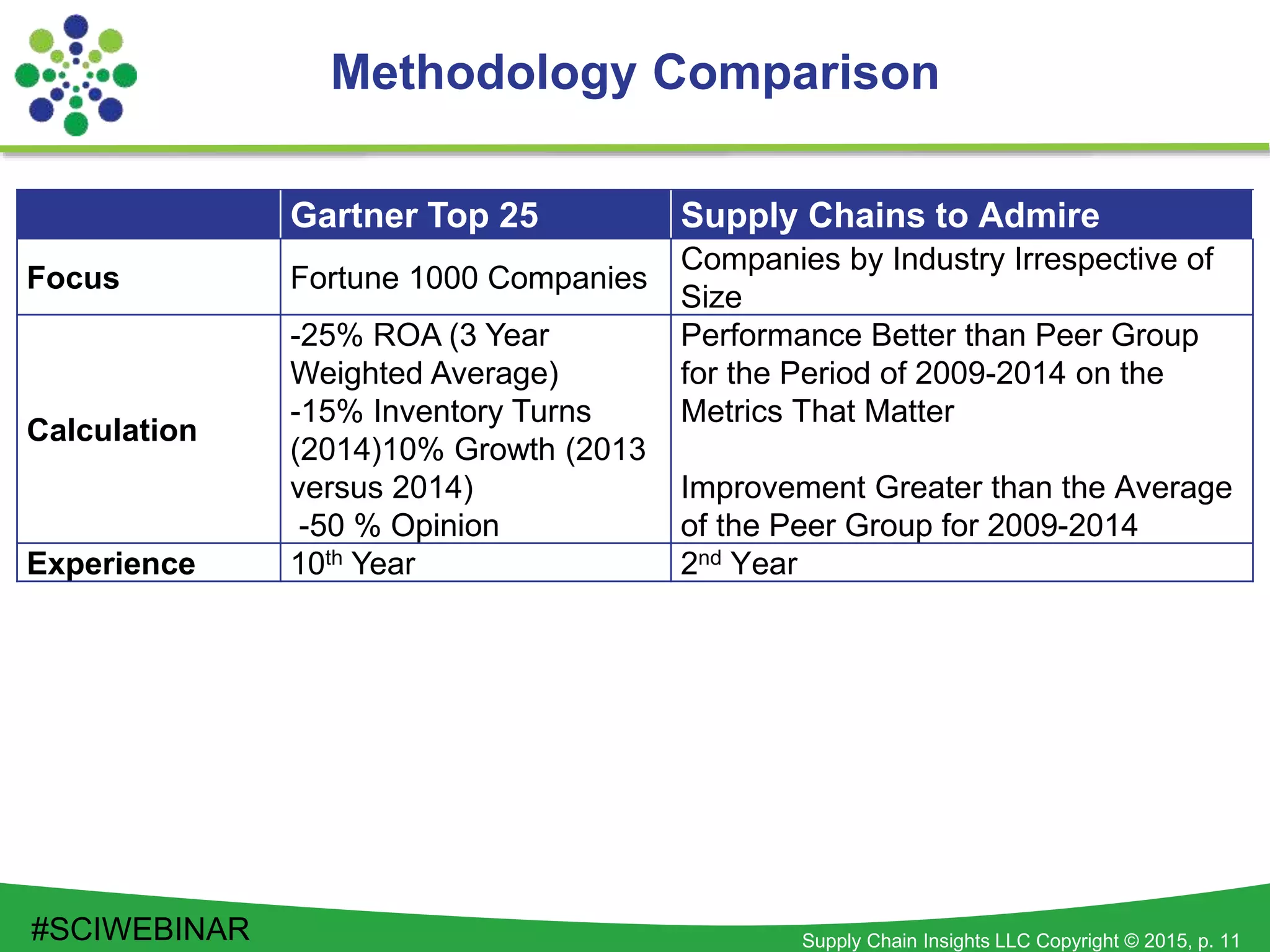

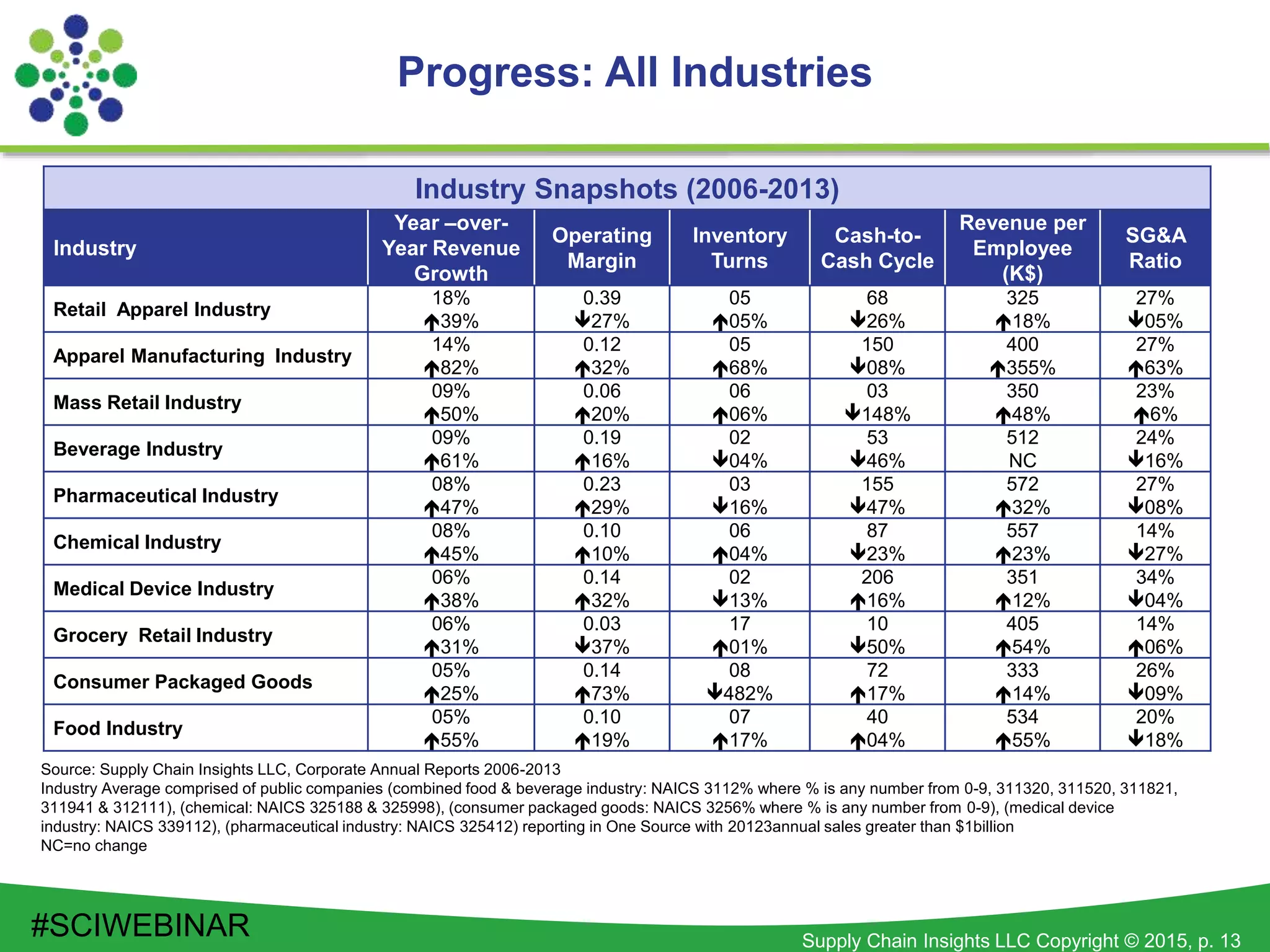

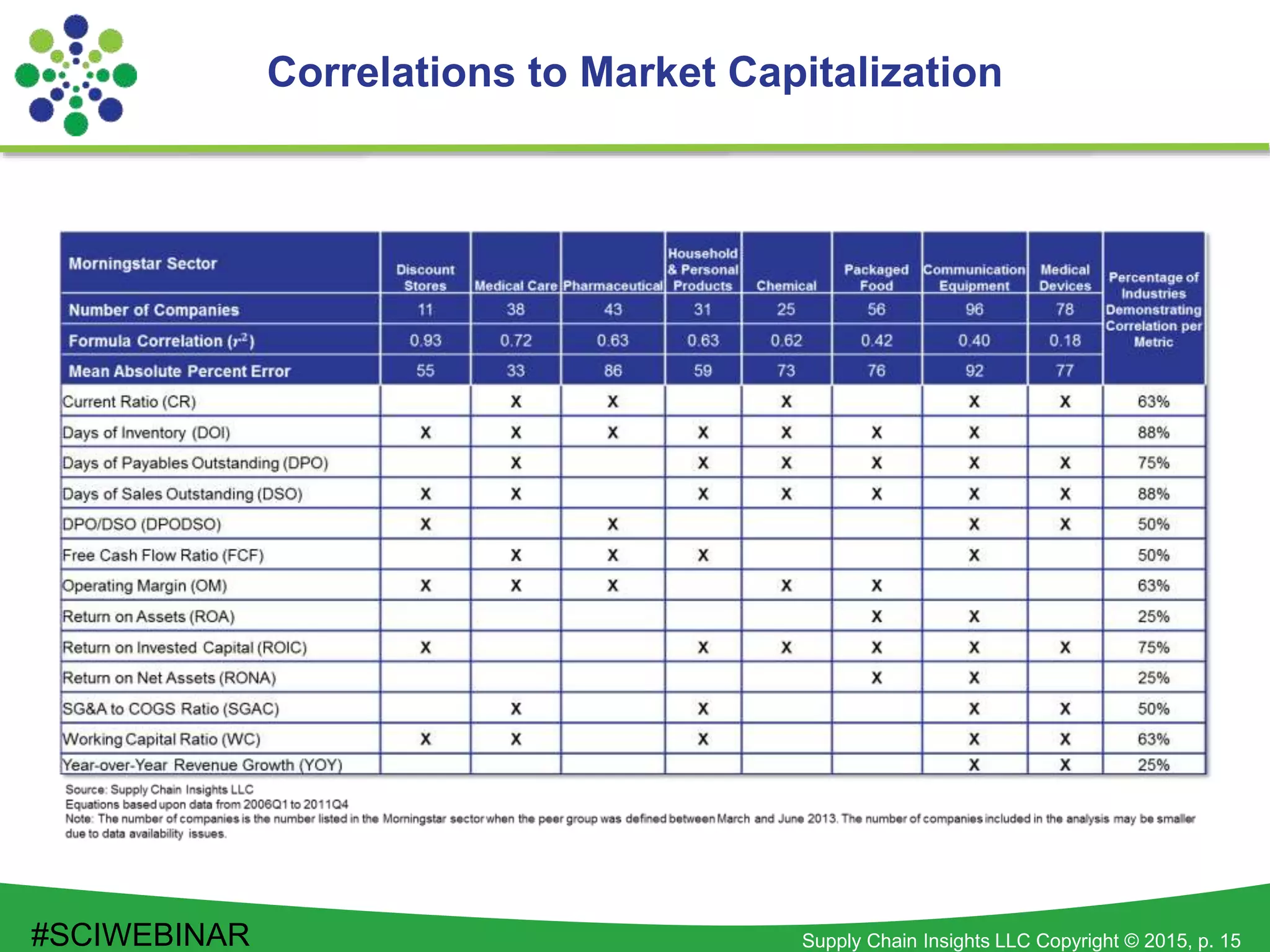

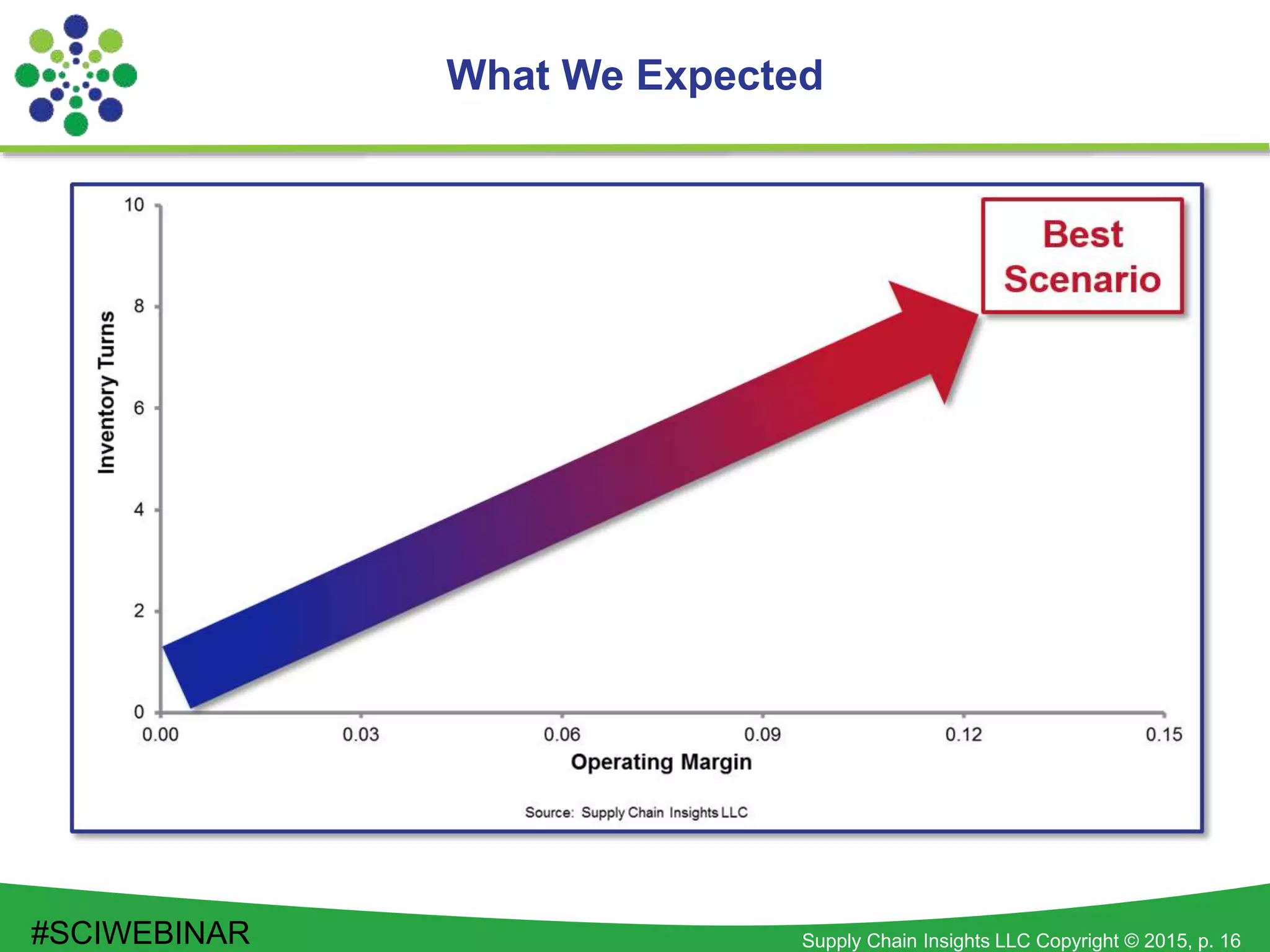

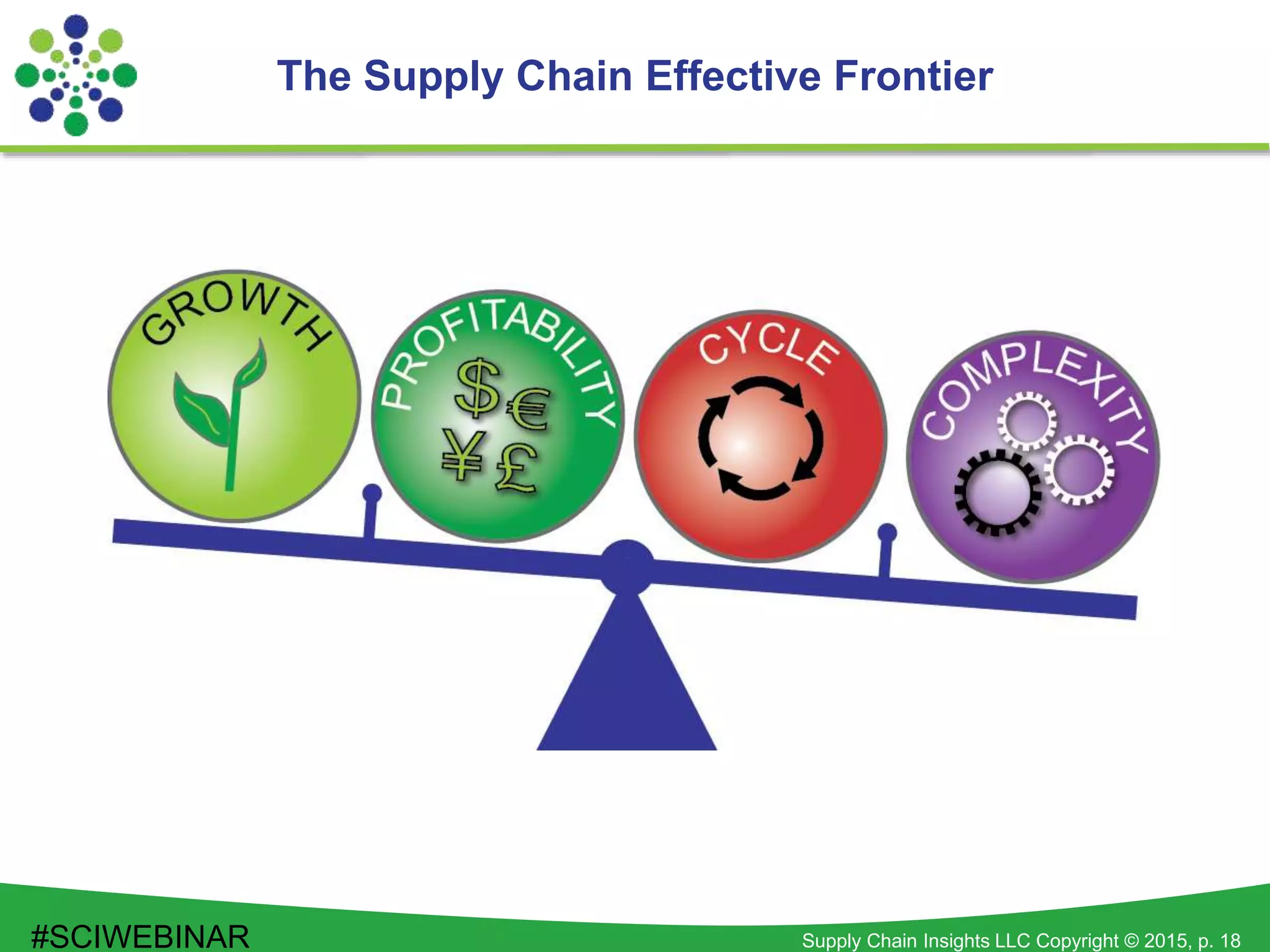

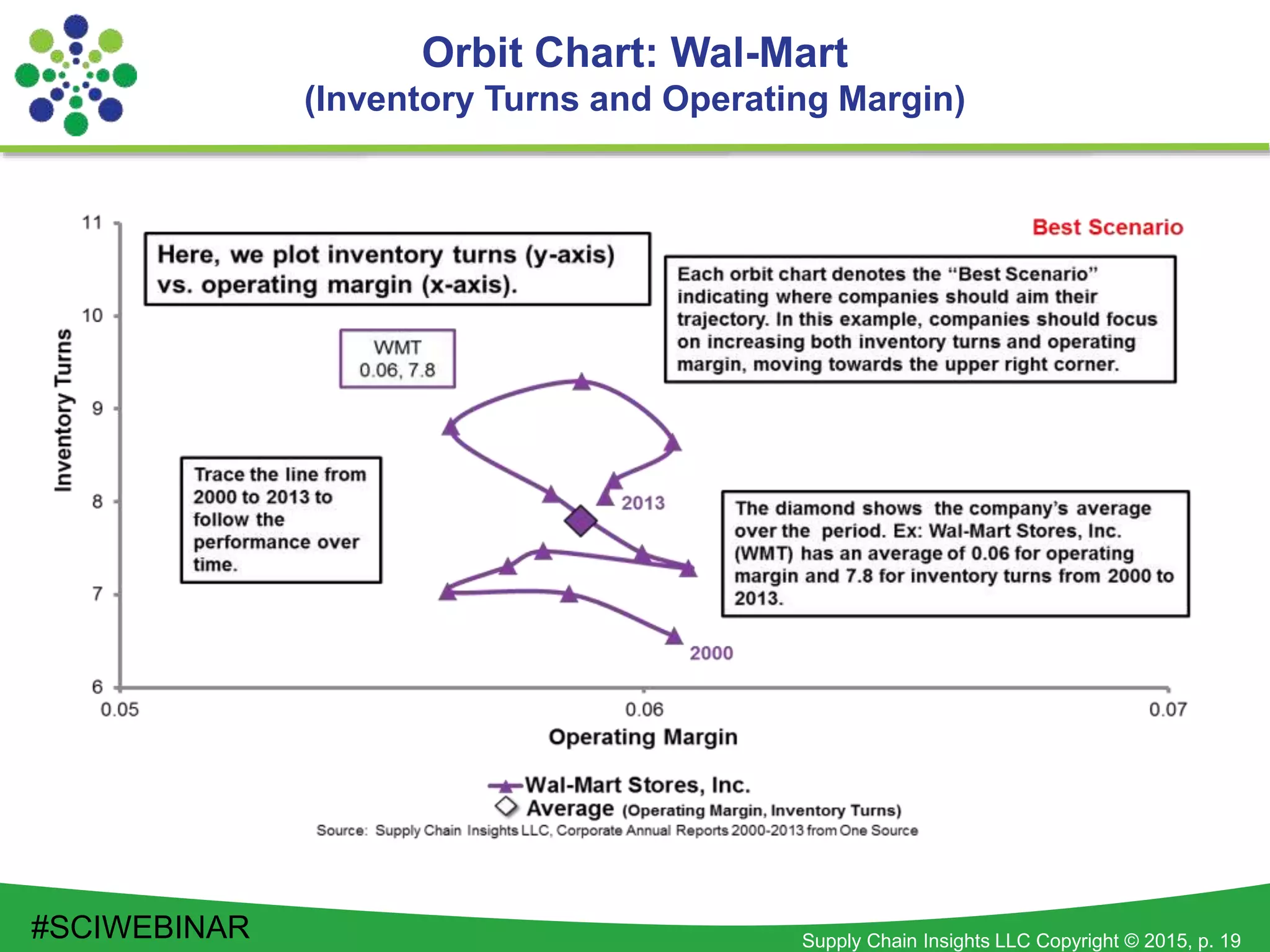

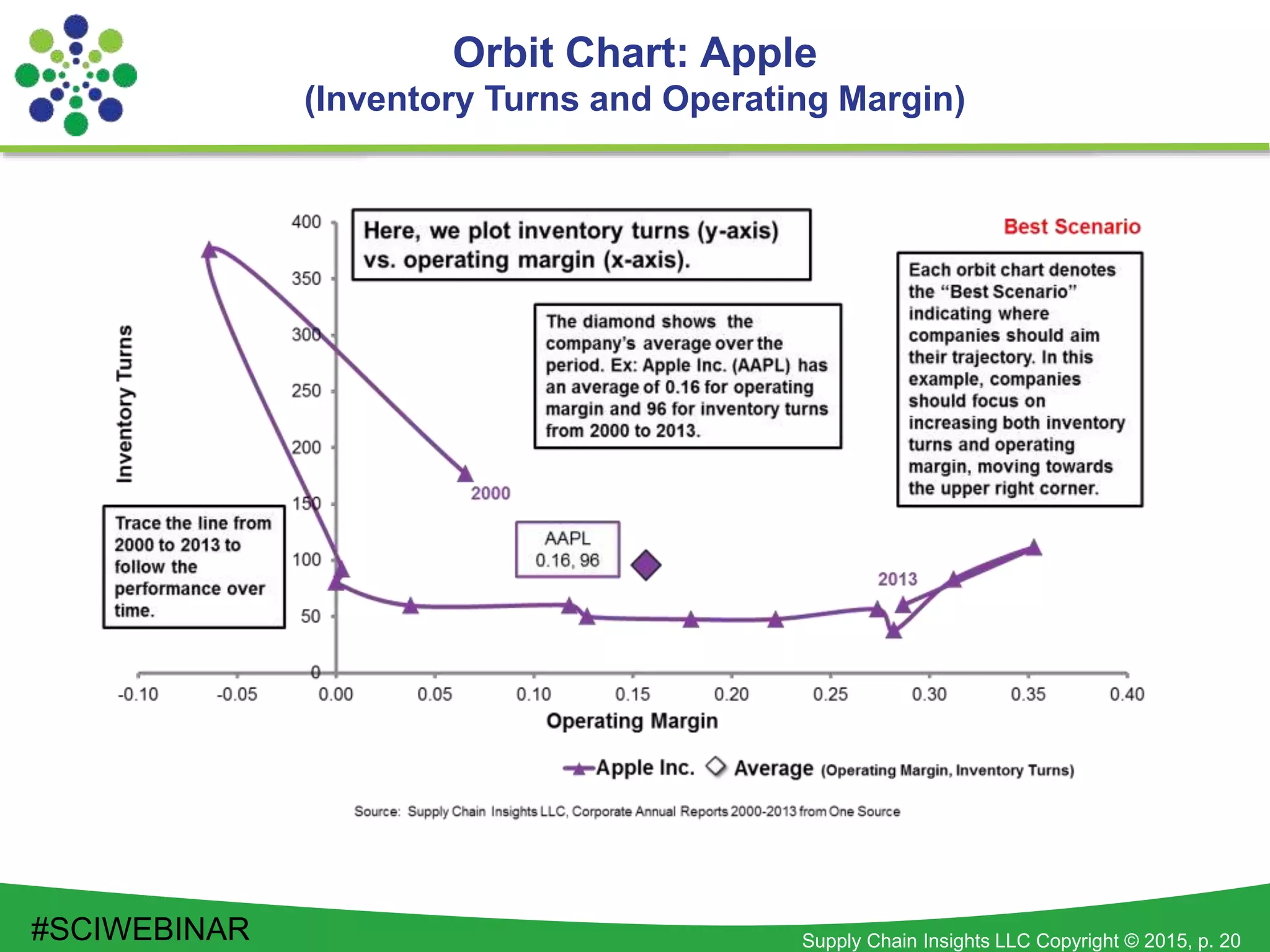

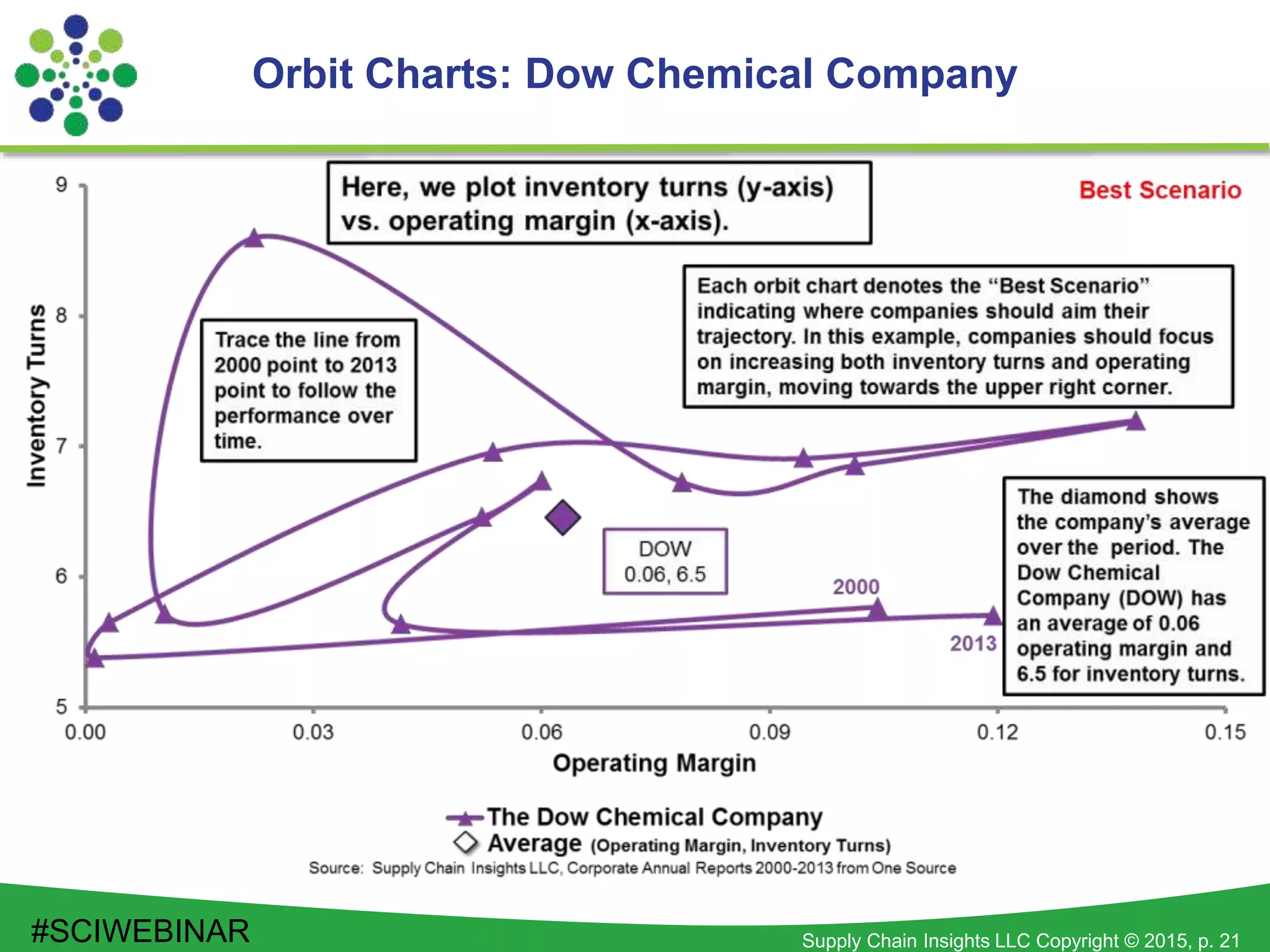

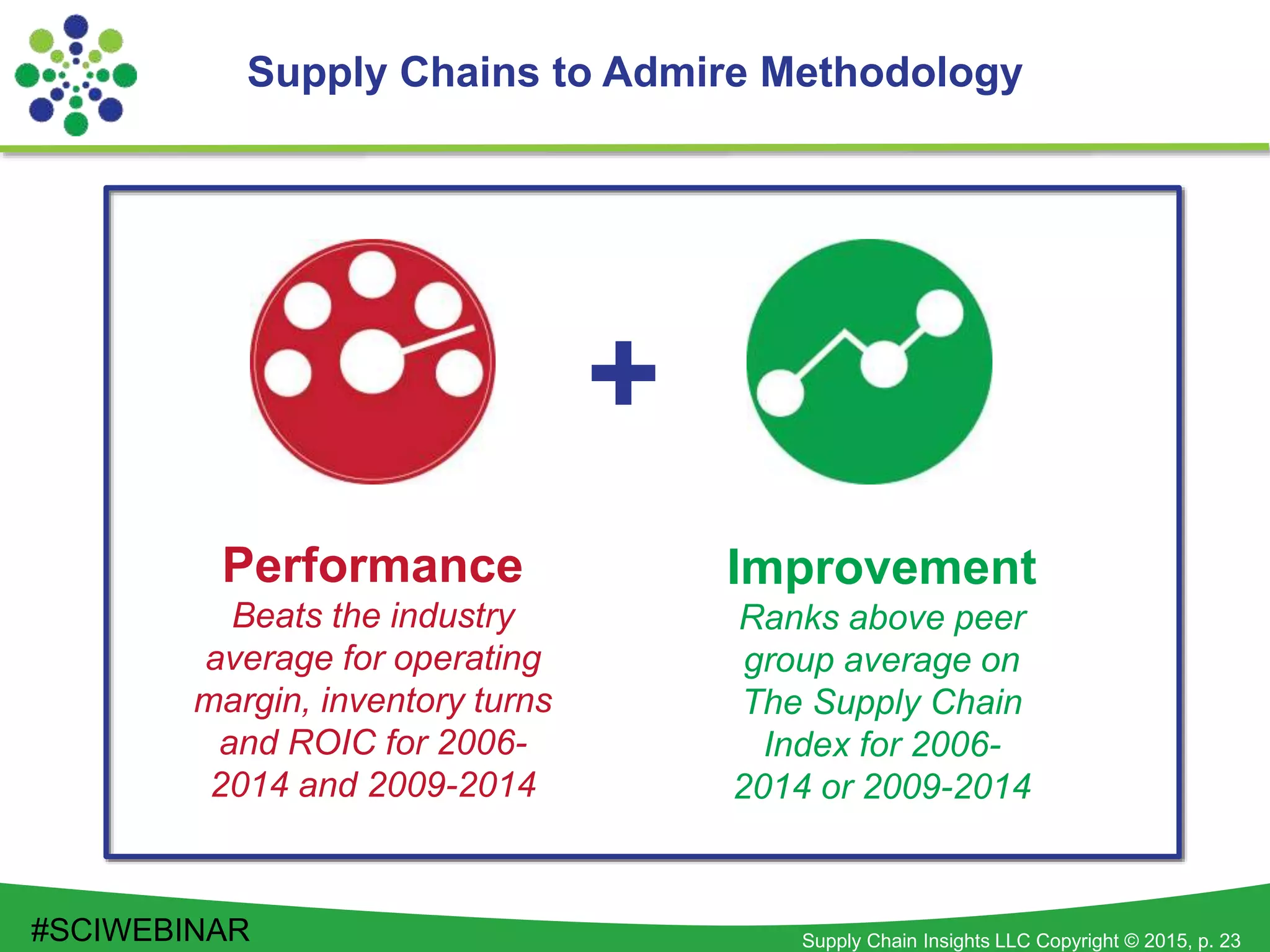

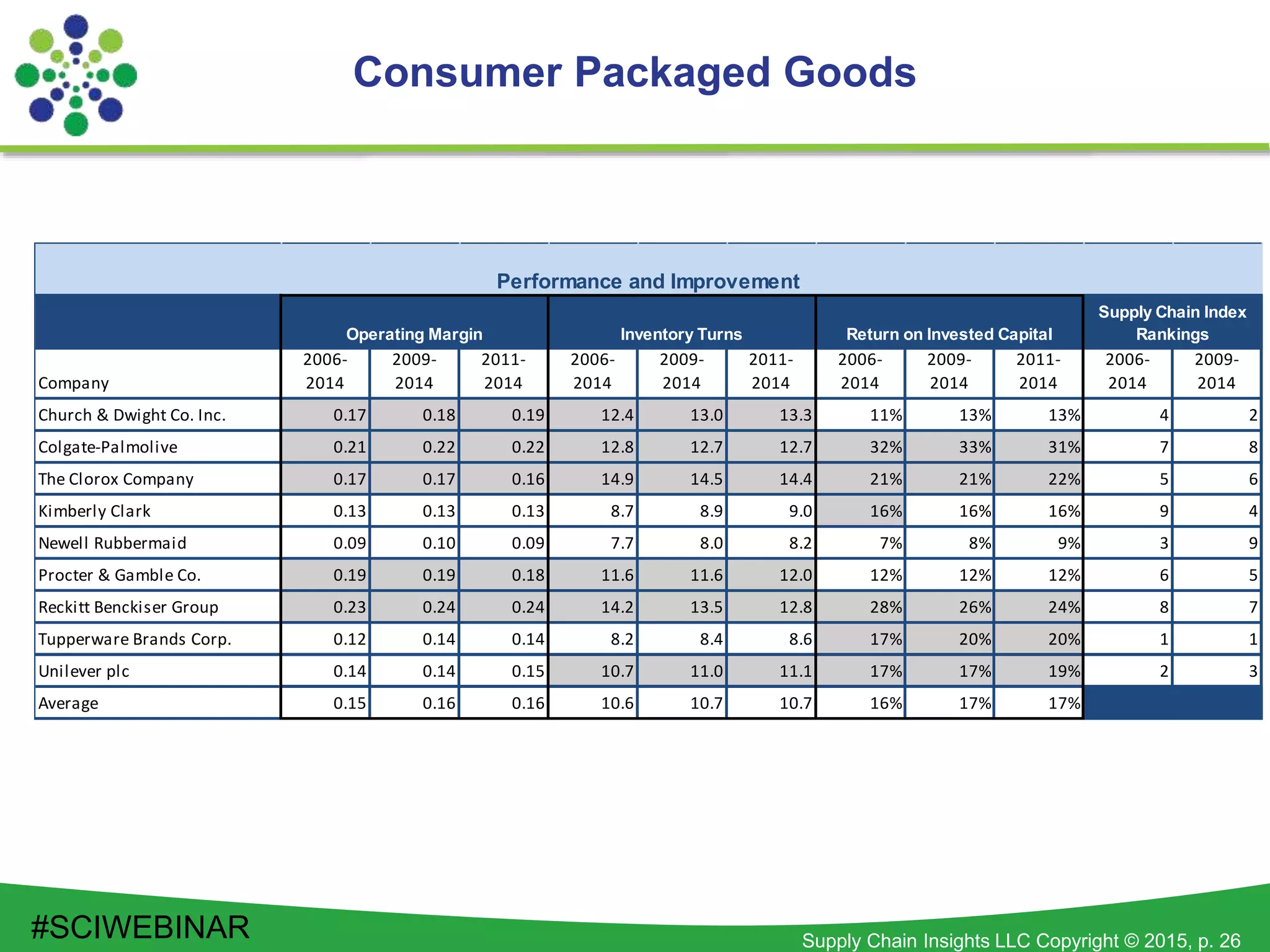

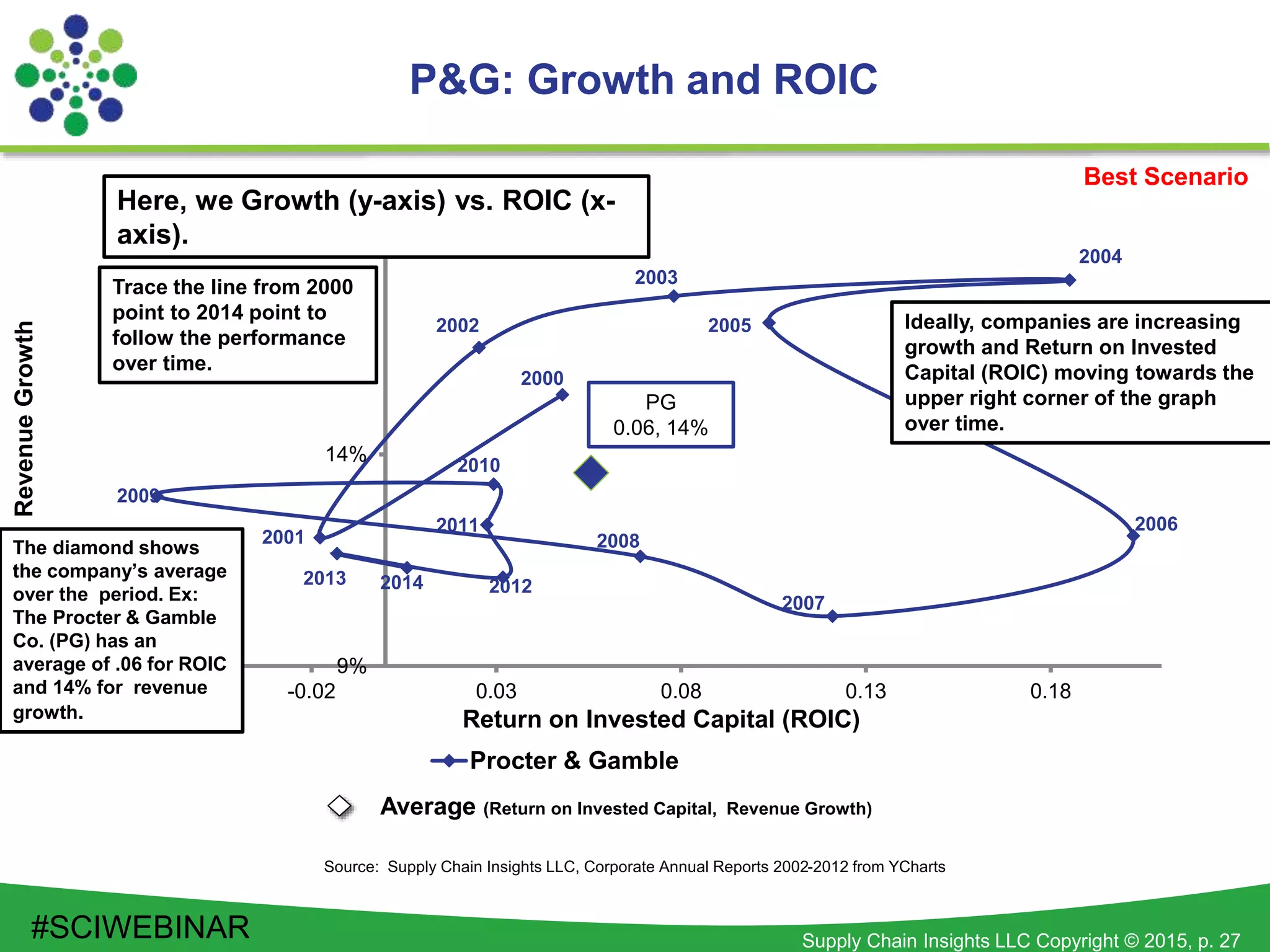

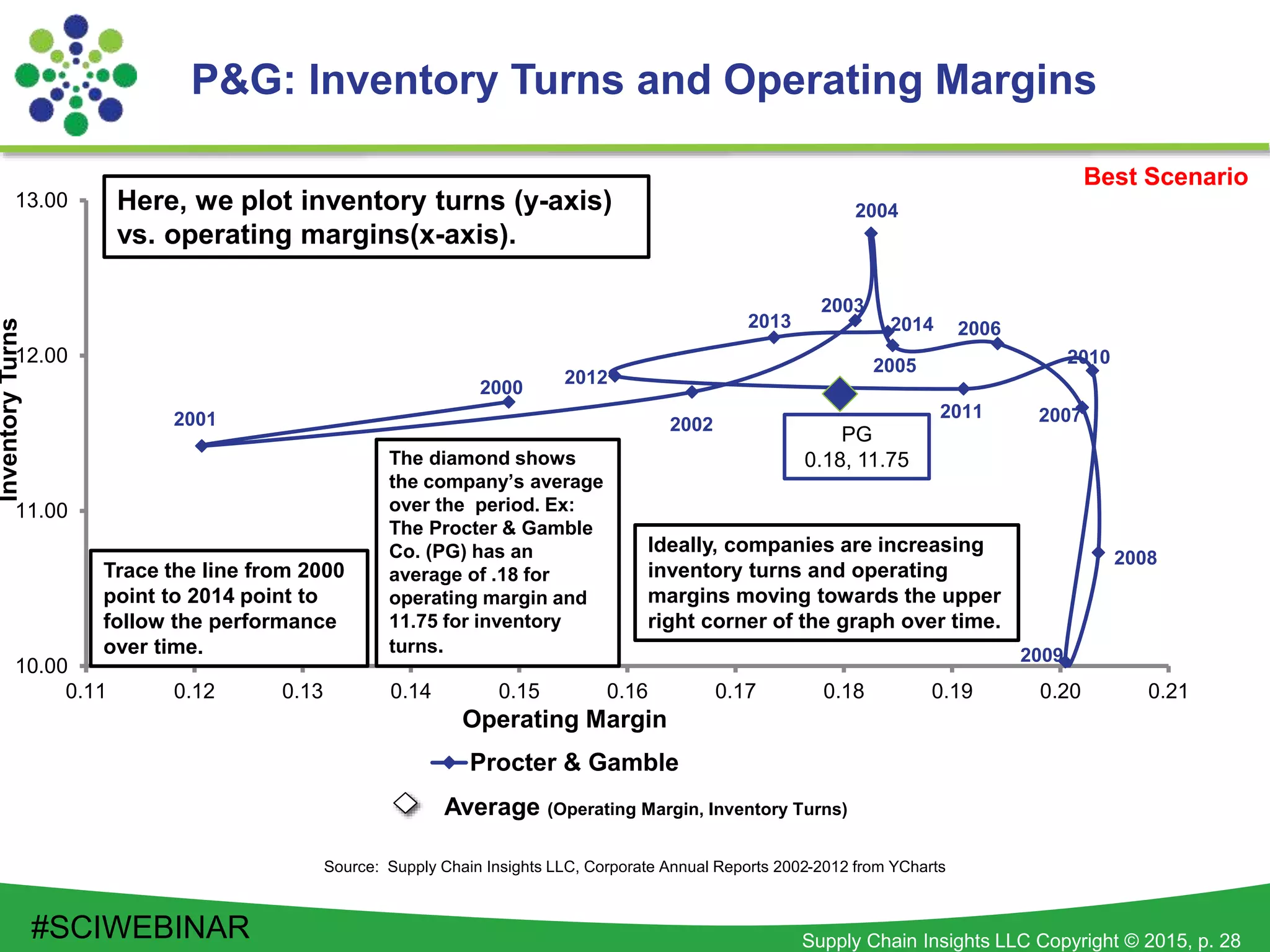

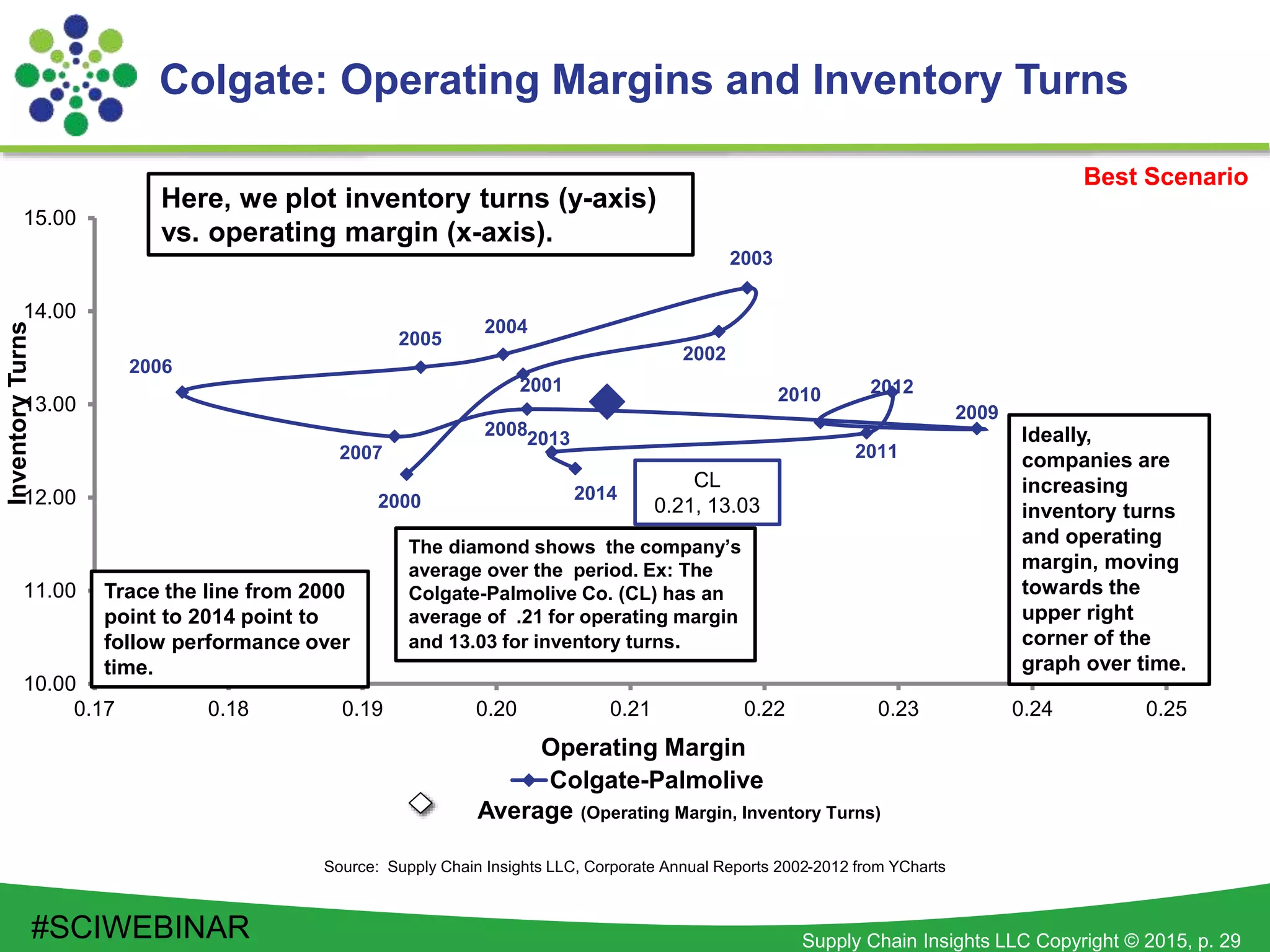

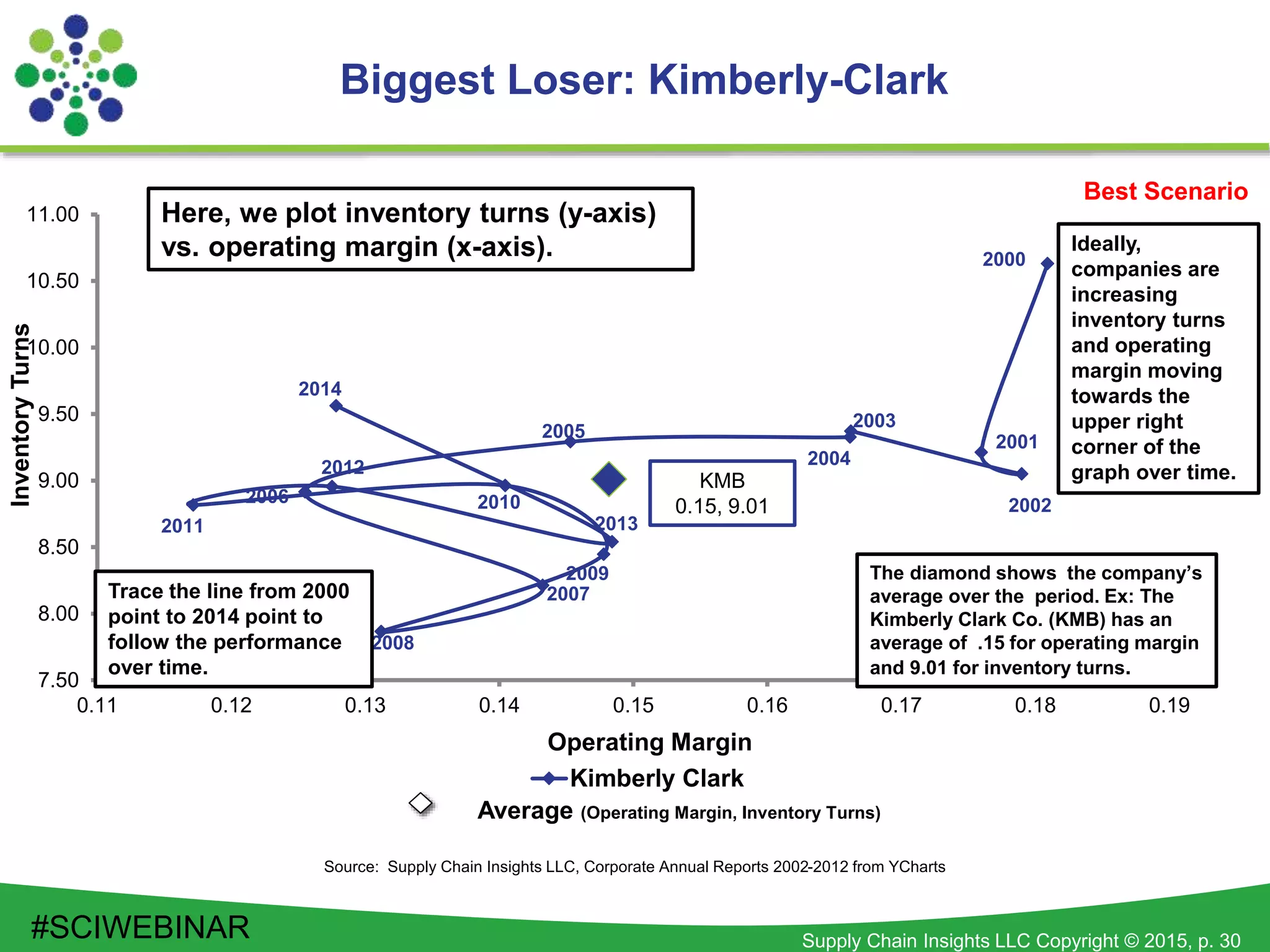

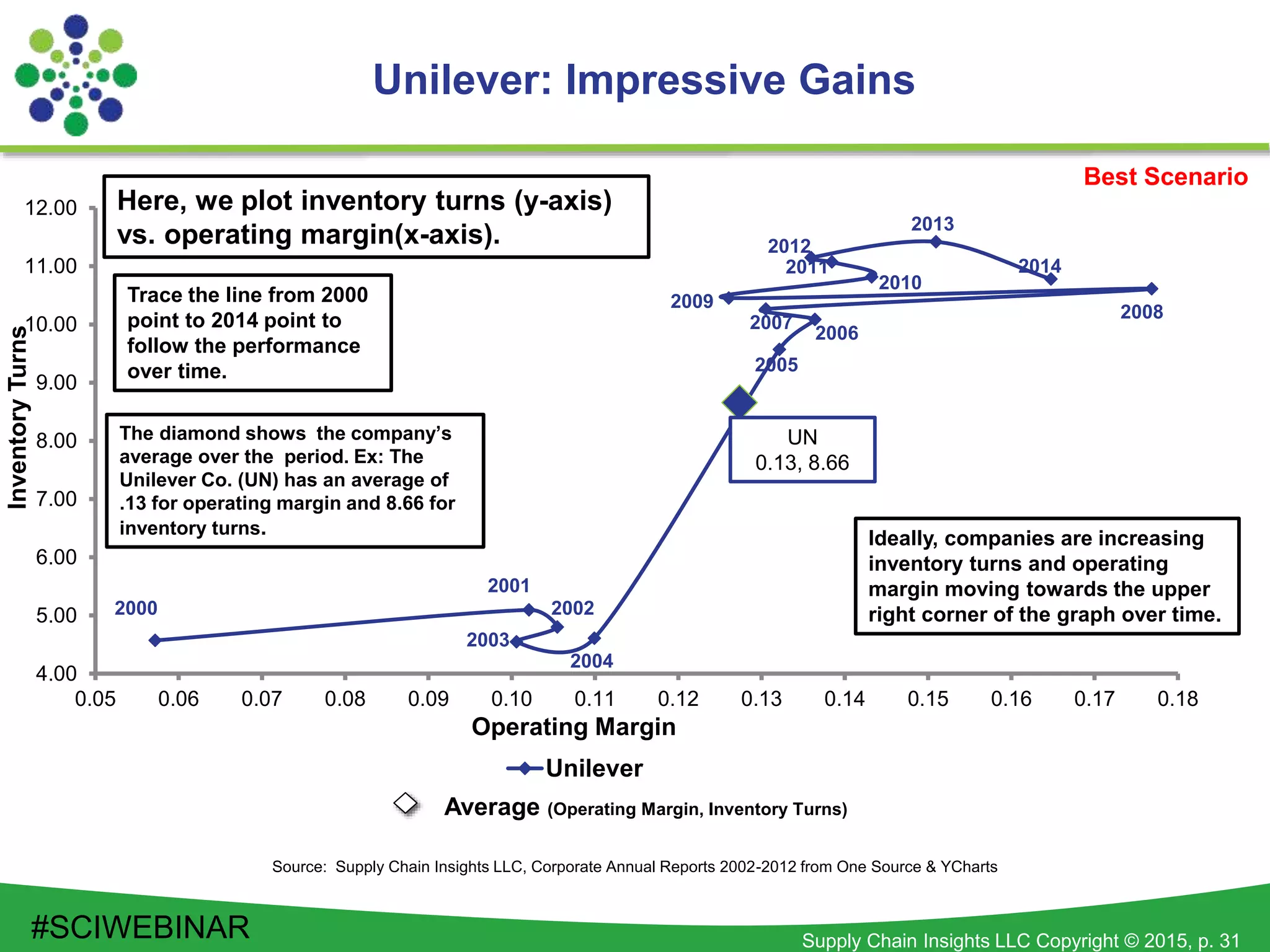

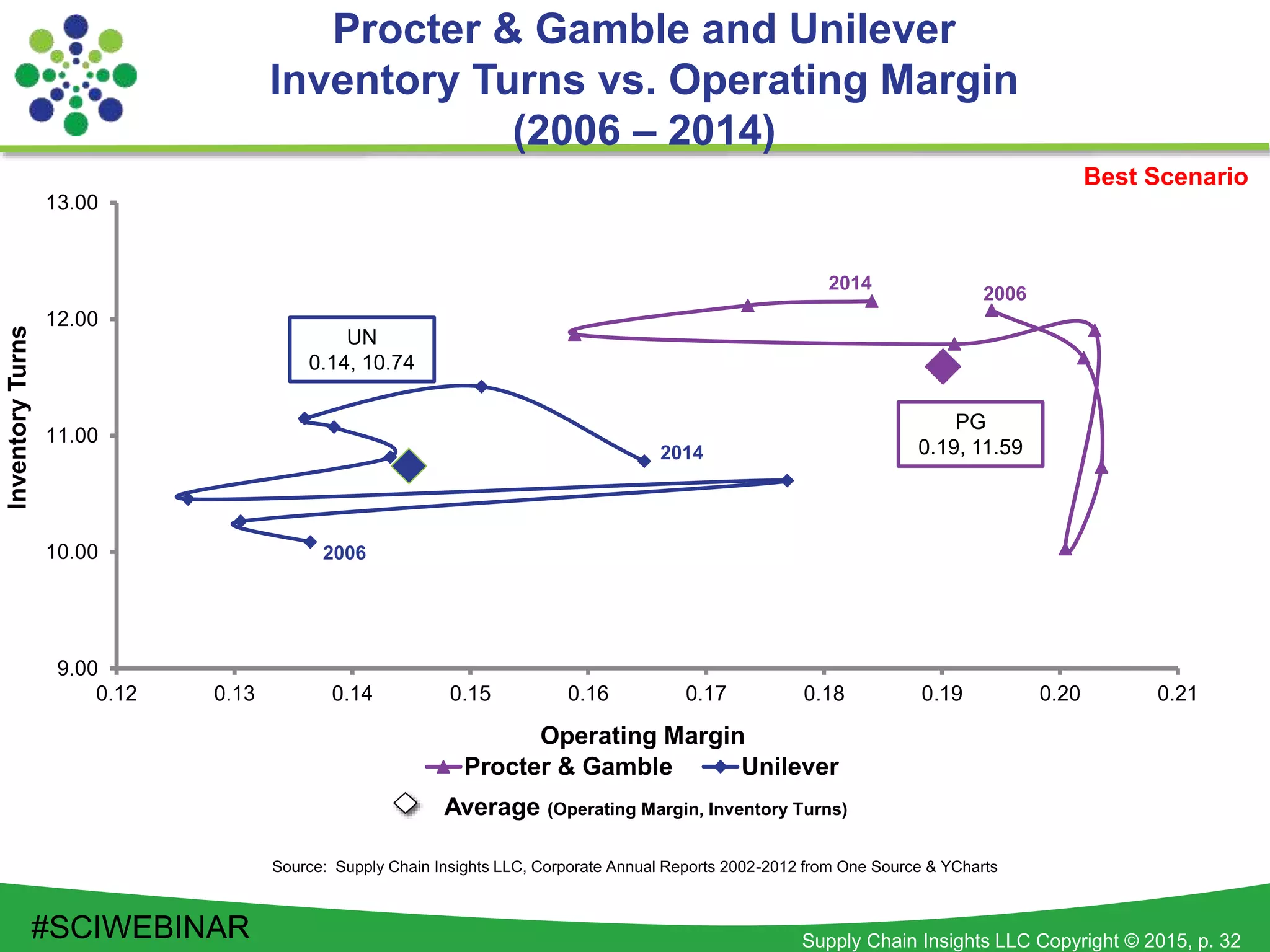

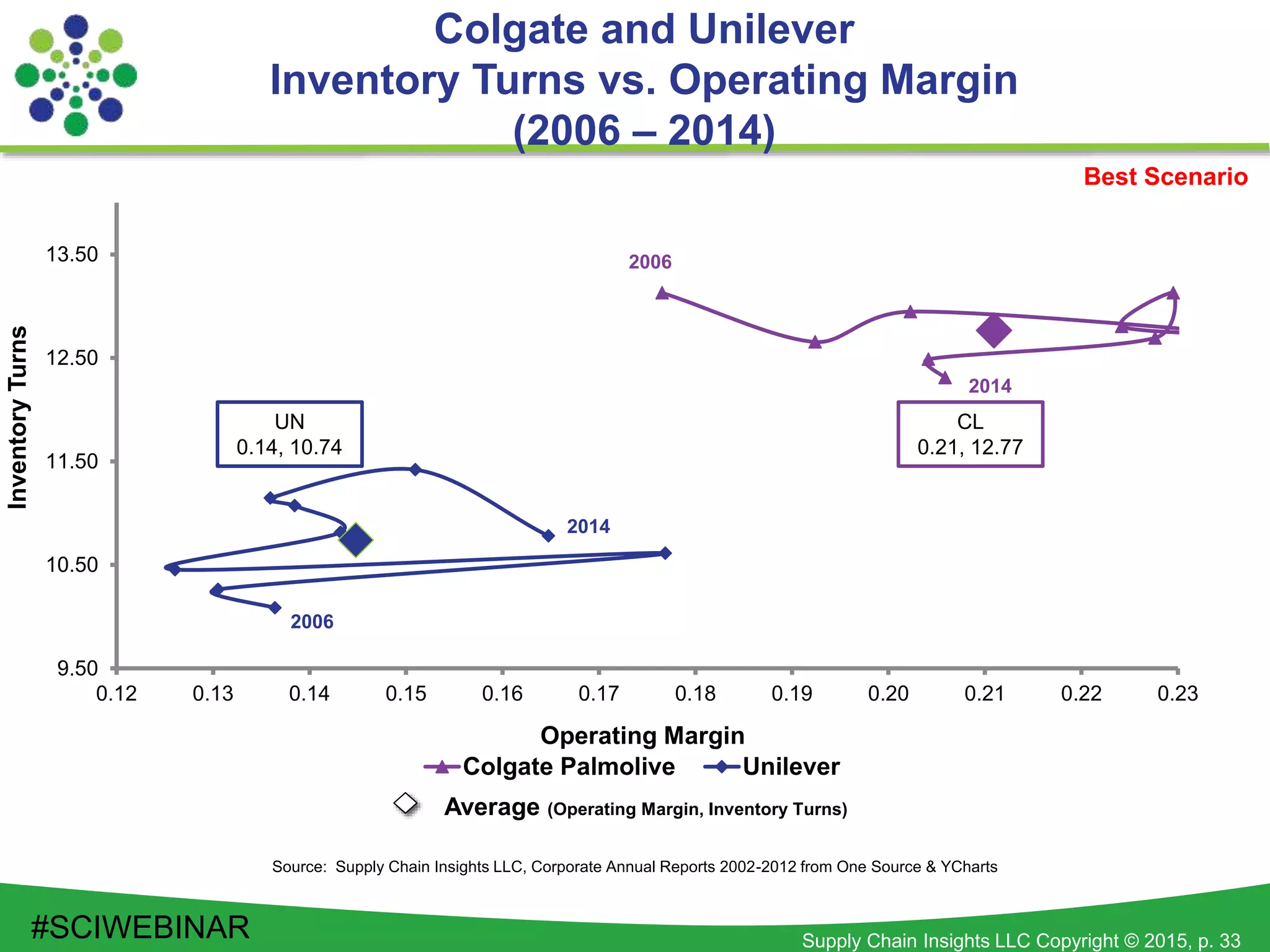

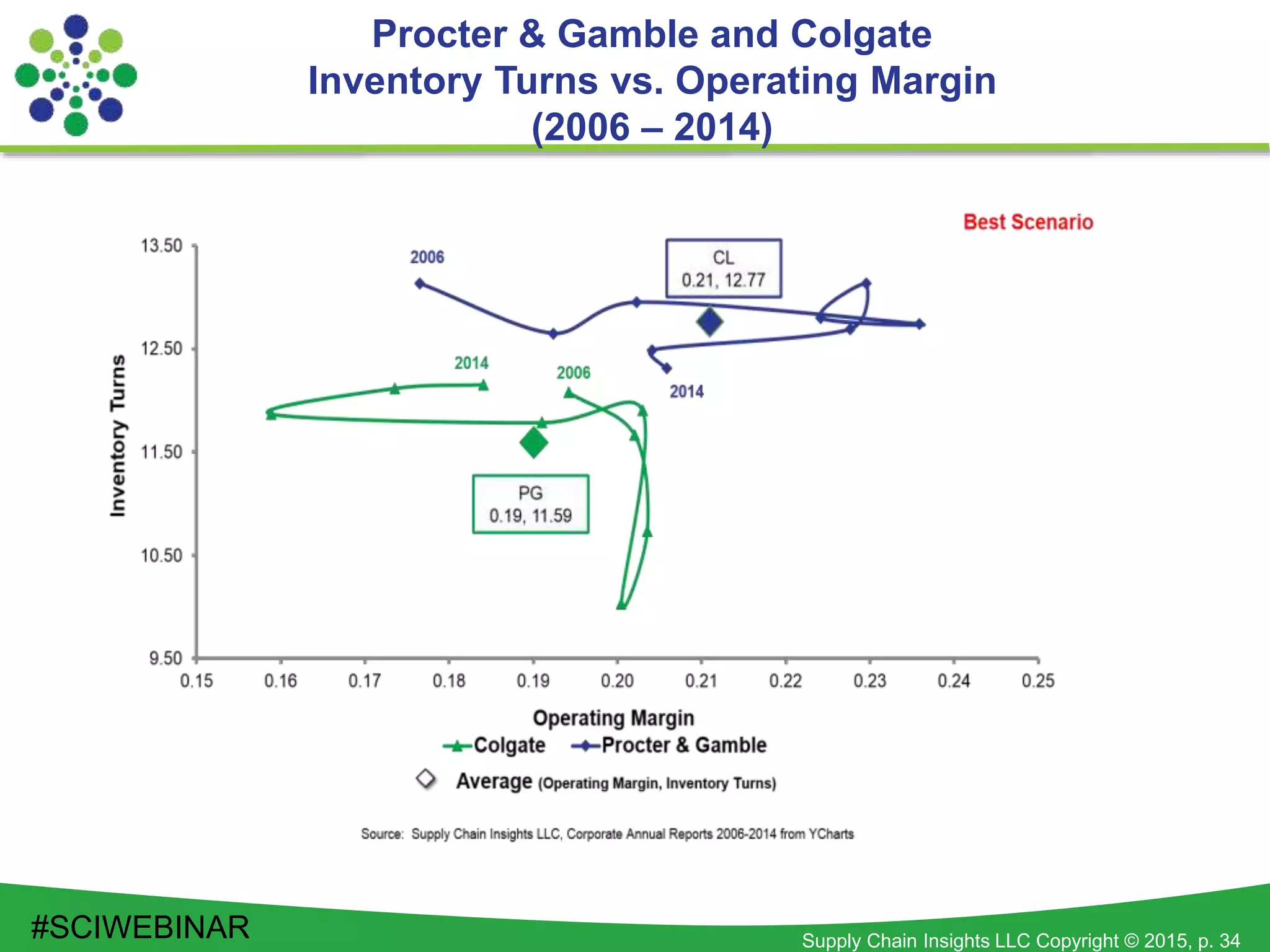

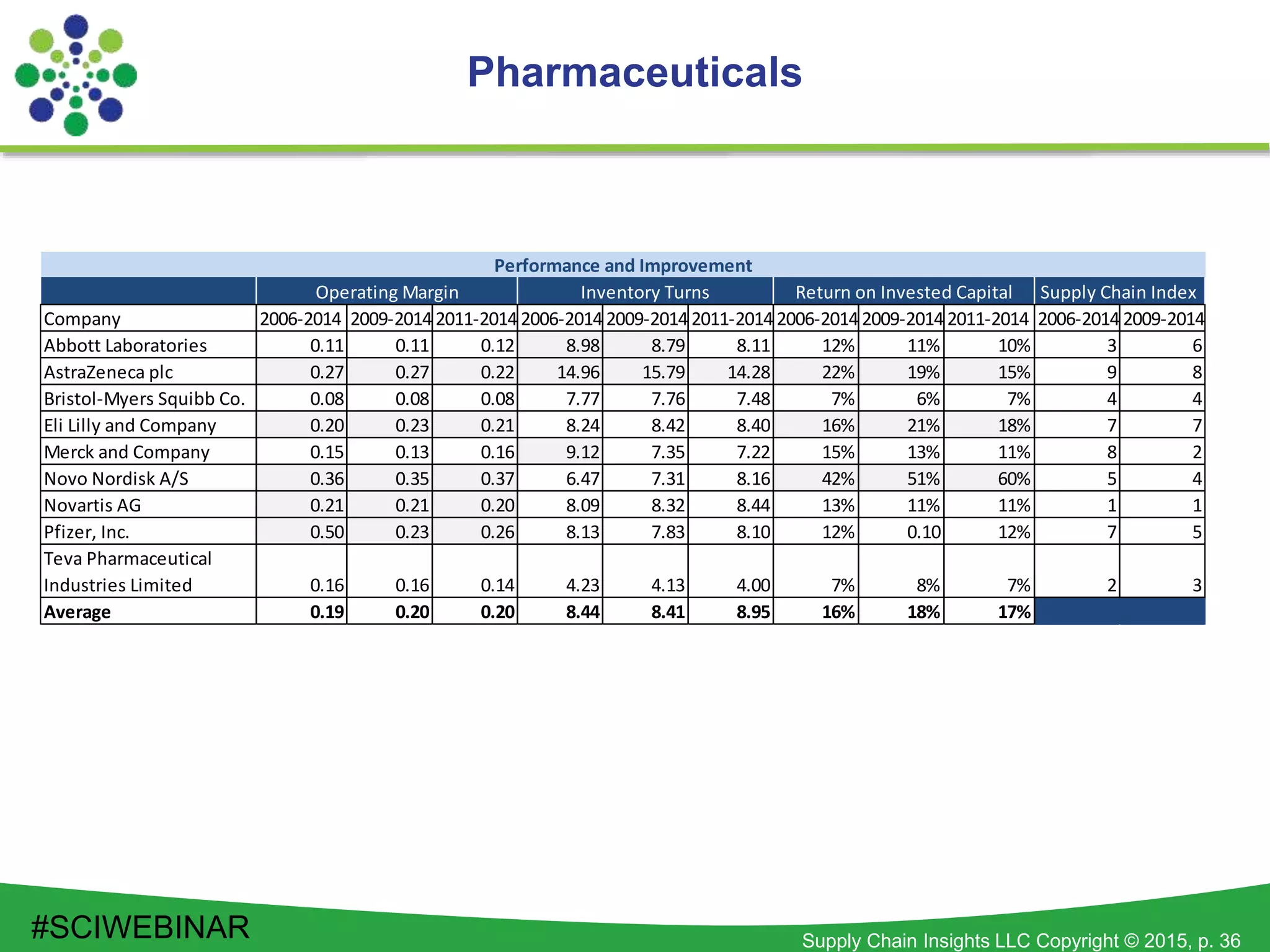

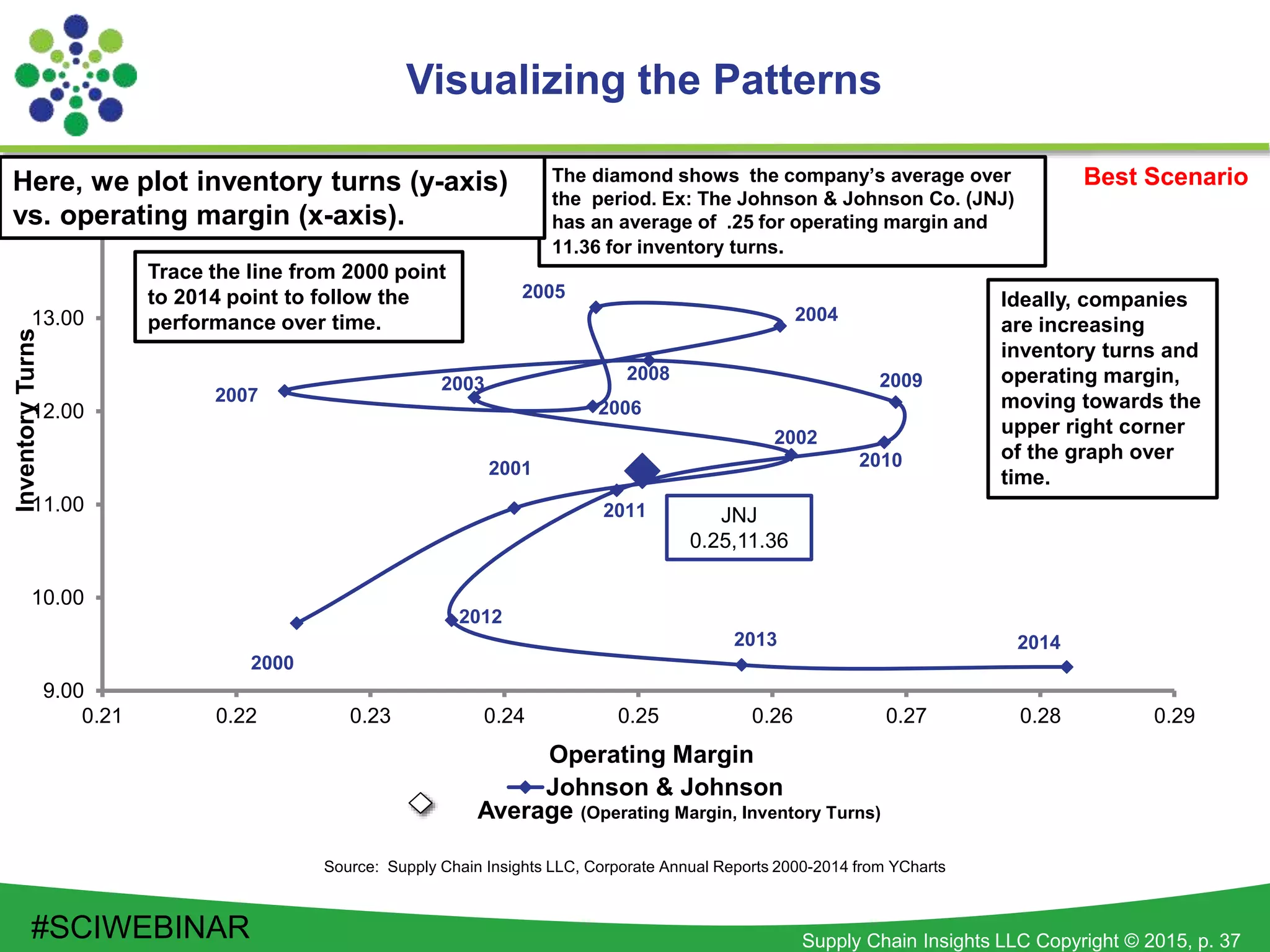

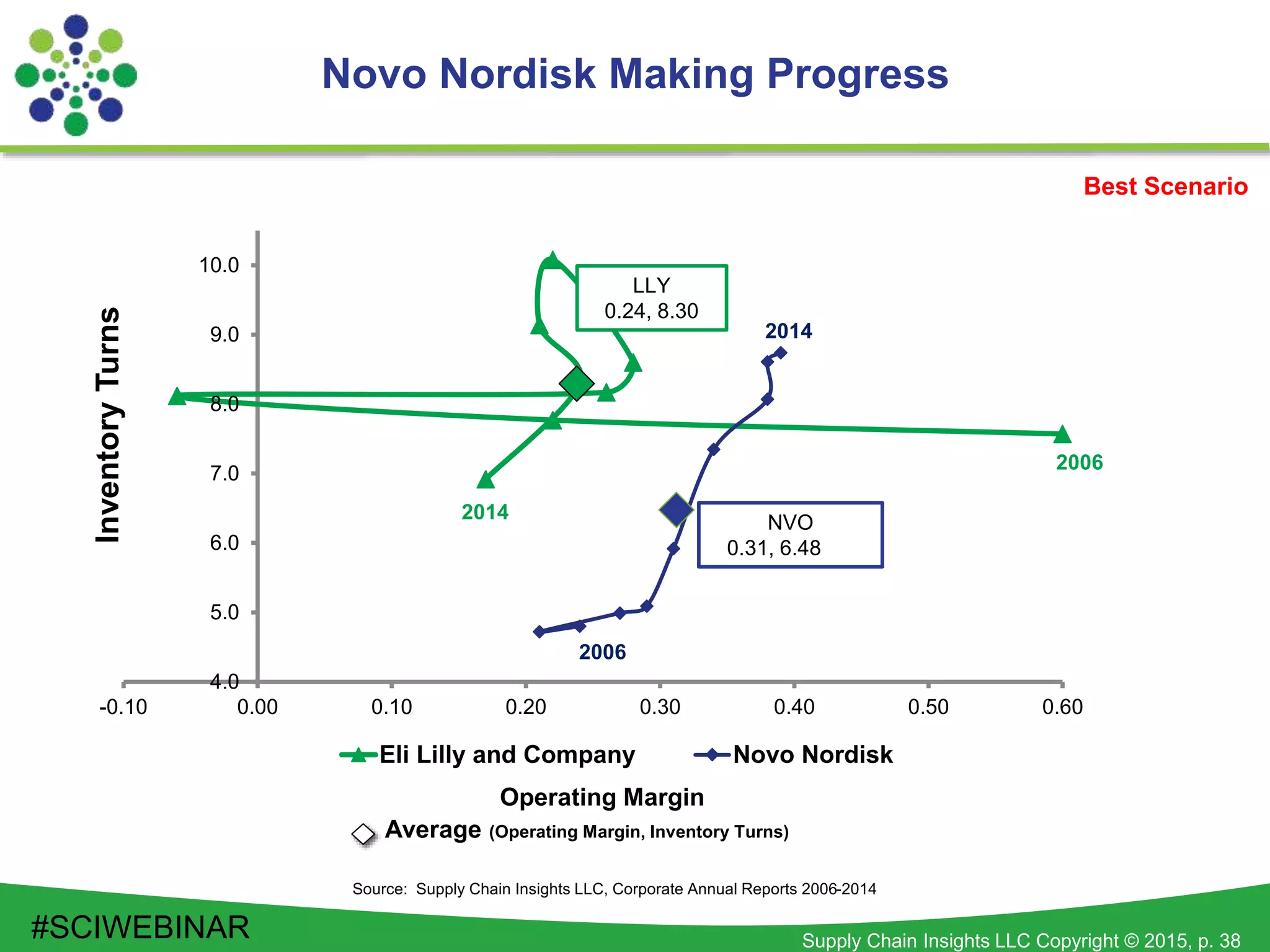

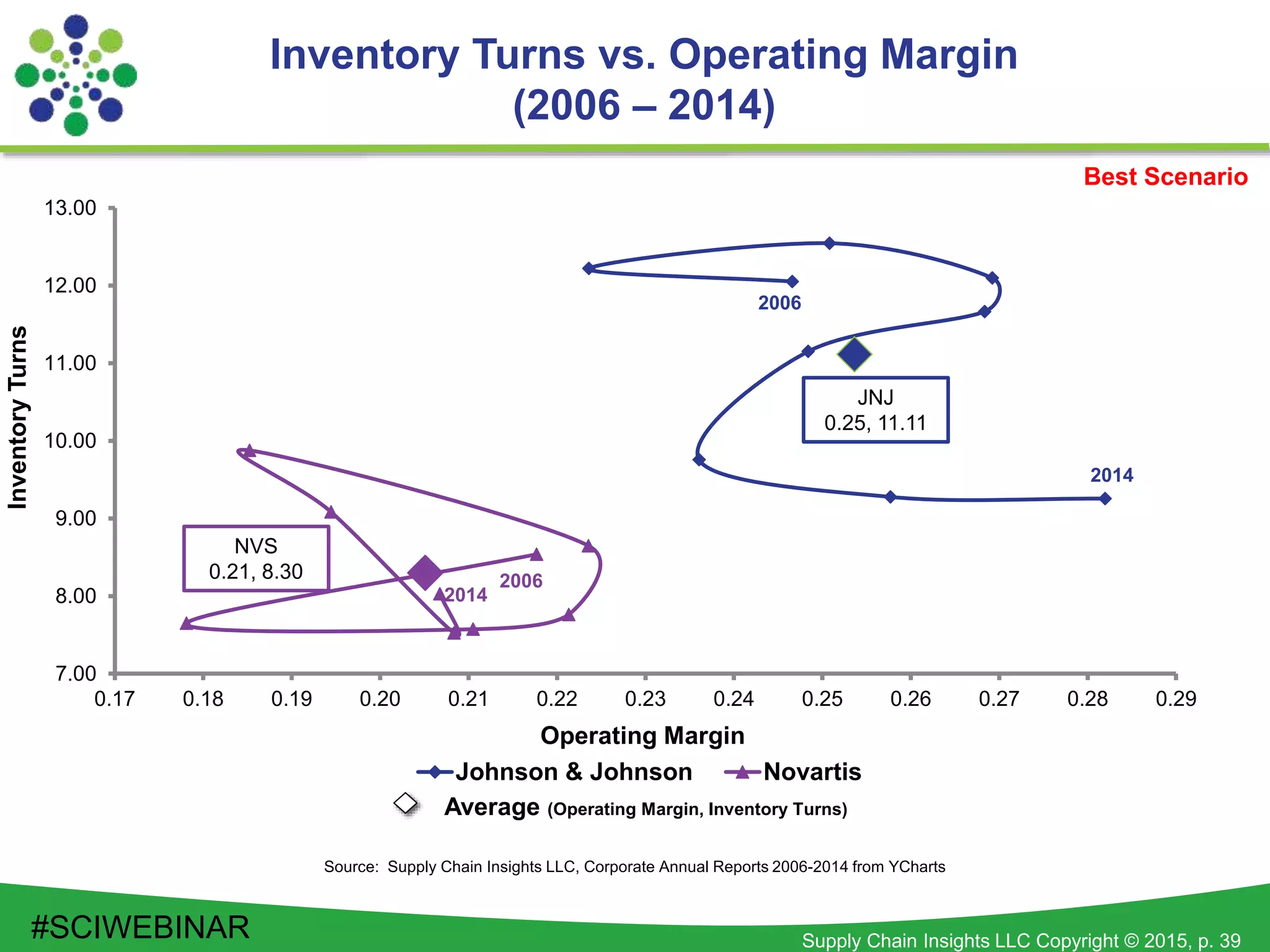

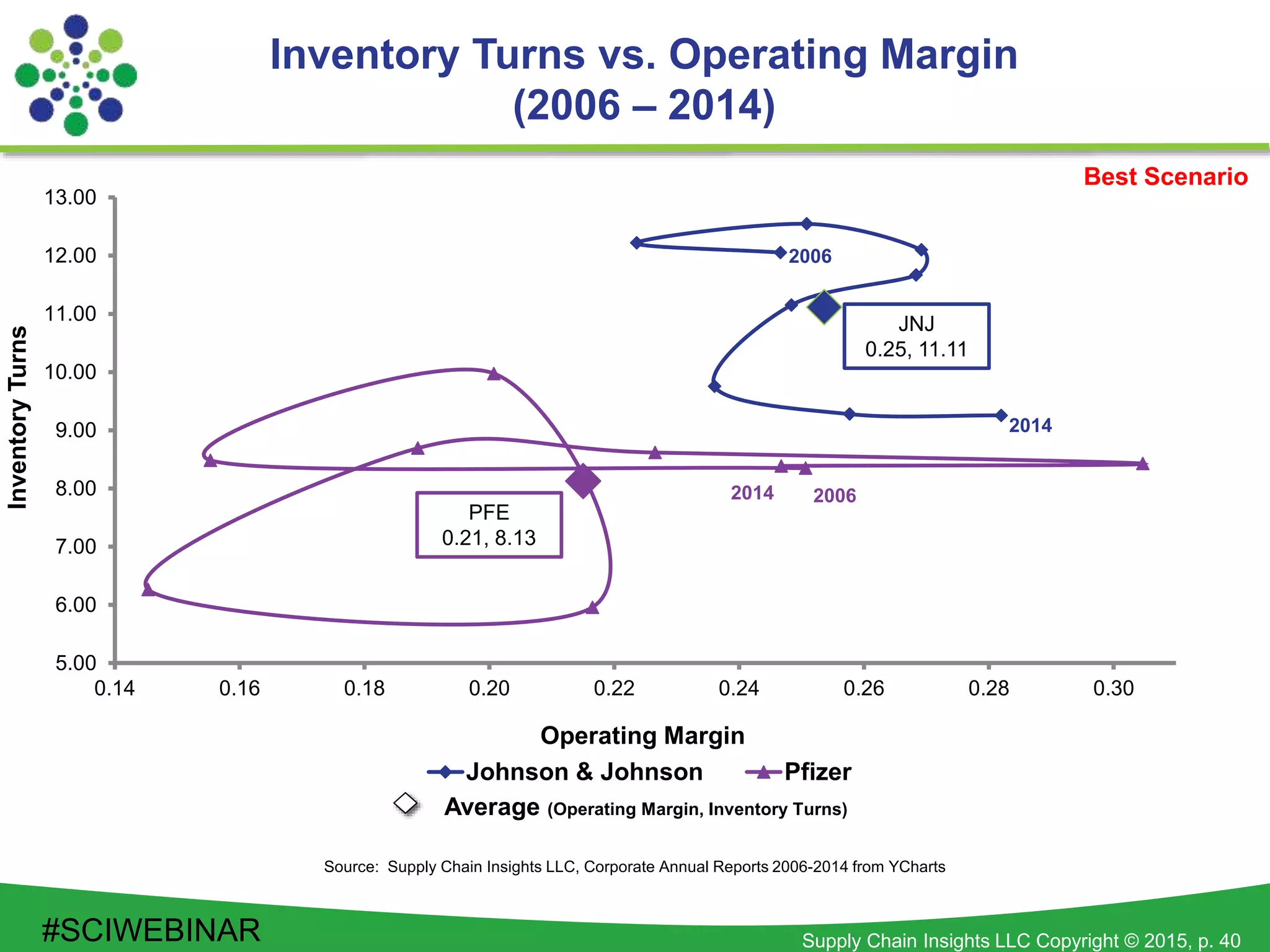

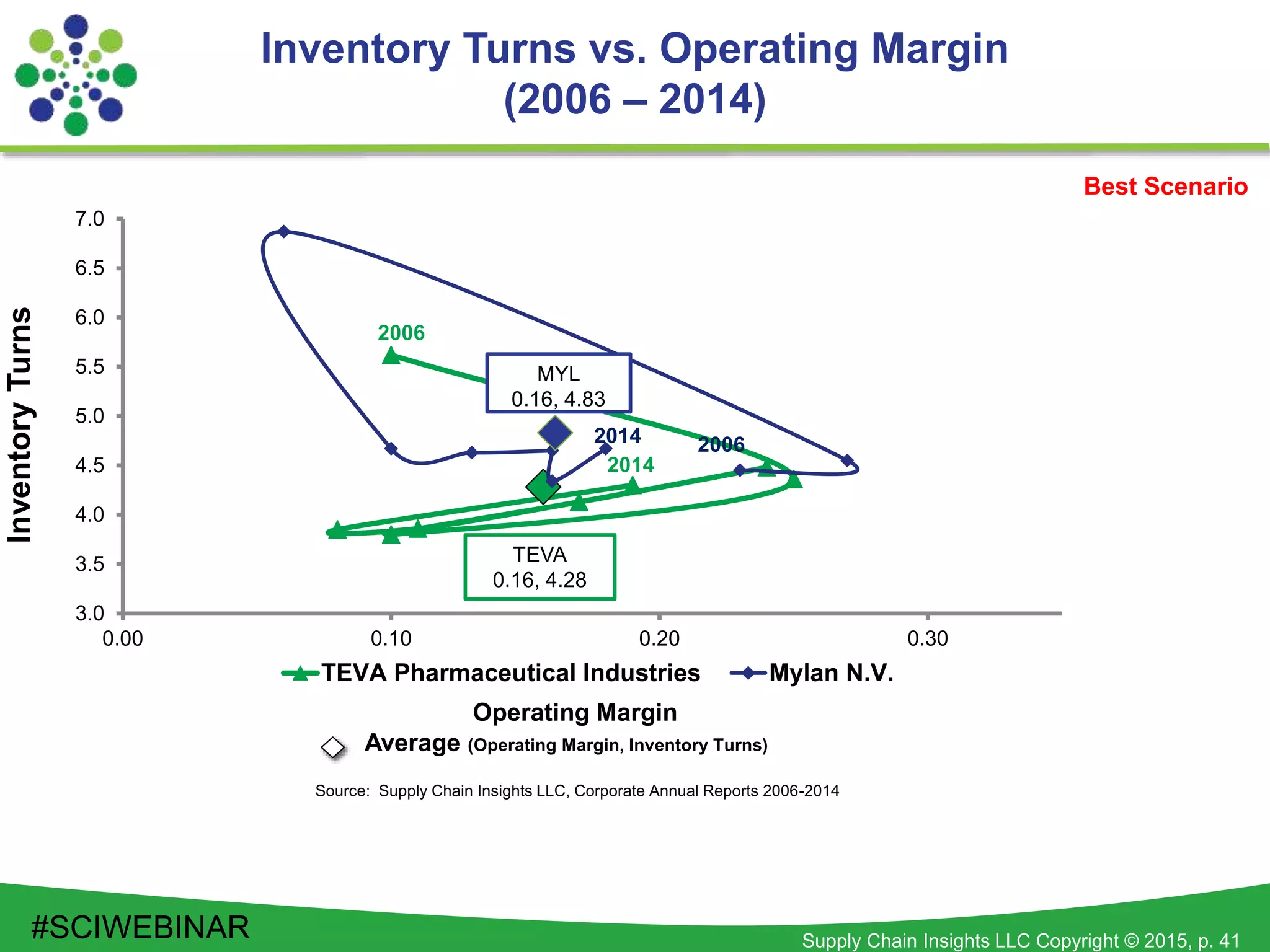

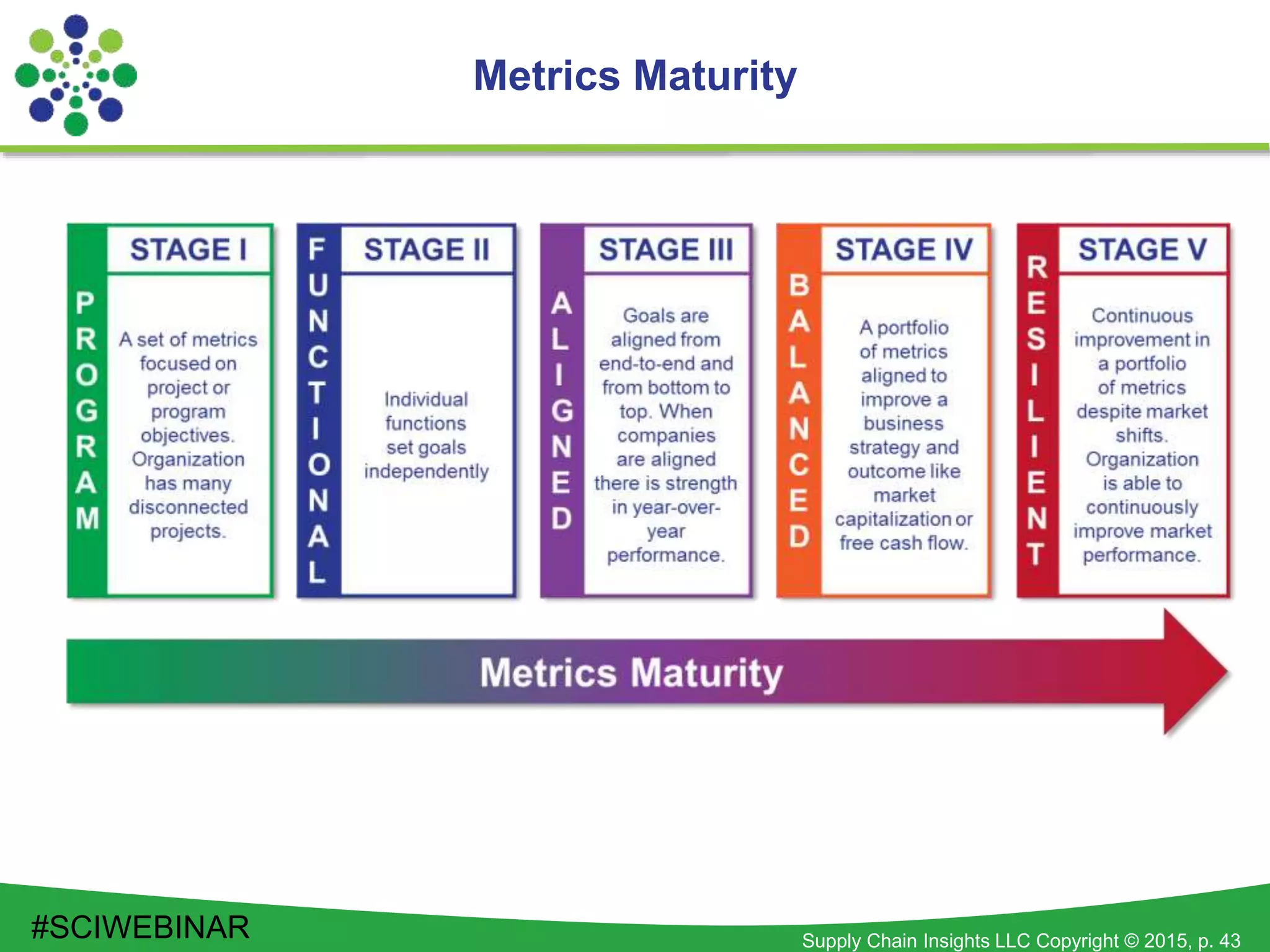

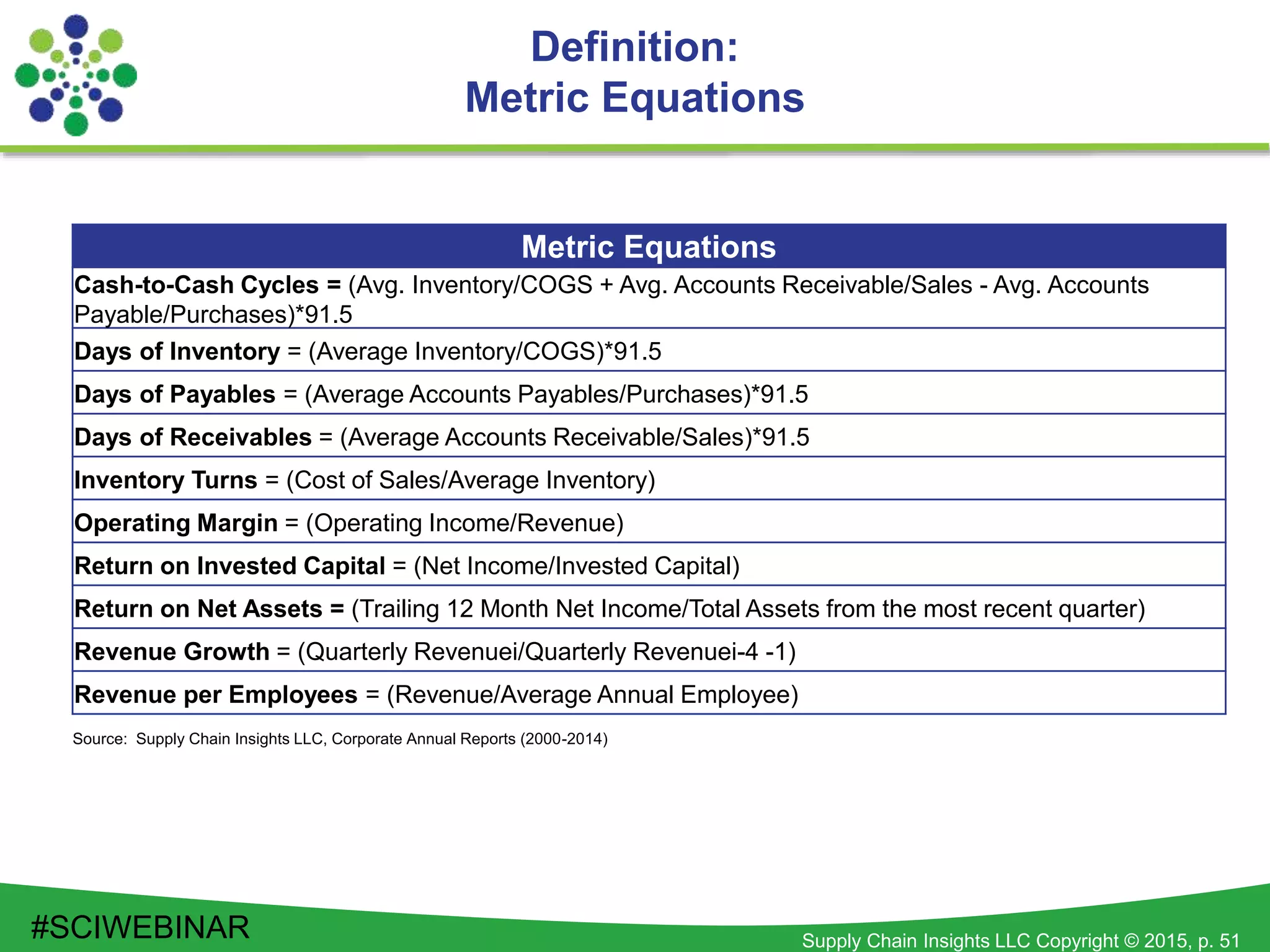

The document outlines insights from Supply Chain Insights LLC aimed at understanding supply chain performance, highlighting the complexities and challenges faced in the industry. It introduces methodologies like the Supply Chain Index, which measures supply chain improvement based on key metrics, and discusses rankings of notable companies based on their supply chain efficiency. Additionally, it presents details on upcoming research and reports concerning various industry sectors and their performance metrics.