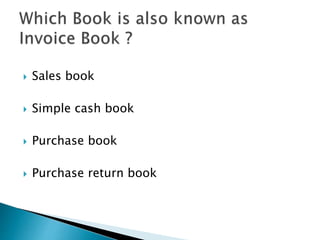

Subsidiary books are books of original entry that record transactions, including cash book, sales book, purchase book, purchase return book, sales return book, bills receivable book, bills payable book. Transactions are initially recorded in these books and then posted to ledger accounts. Subsidiary books make it easy to locate transactions and provide important details to access related information.