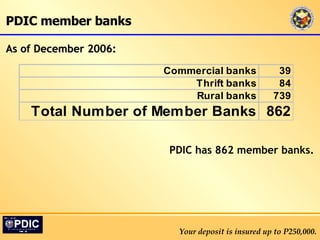

The document outlines the Philippine Deposit Insurance Corporation's (PDIC) program aimed at increasing awareness among Overseas Filipino Workers (OFWs) regarding deposit insurance and the economic significance of remittances. It highlights remittance statistics, the role of PDIC in protecting depositors, and the importance of financial literacy and consumer awareness initiatives for OFWs. The PDIC is tasked with ensuring public confidence in the banking system while managing deposit insurance claims, failure resolutions, and risk assessments.