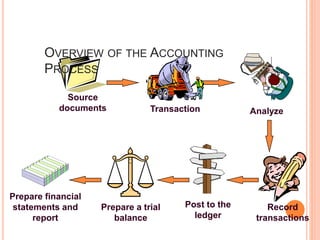

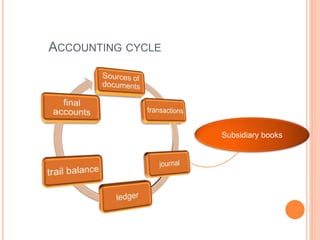

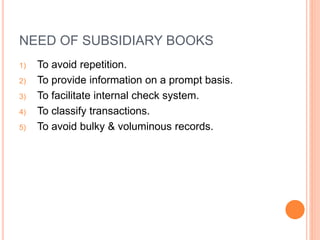

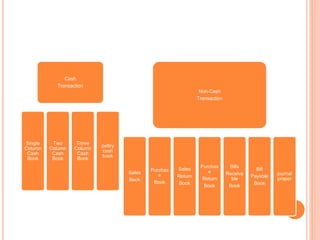

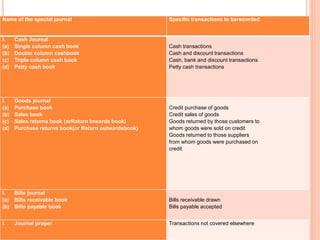

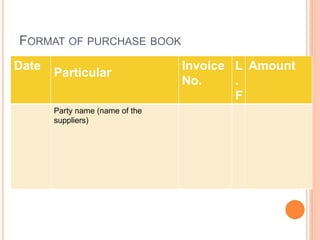

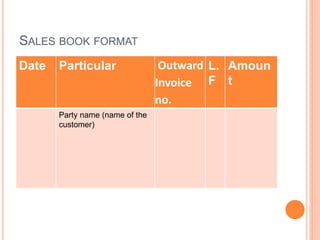

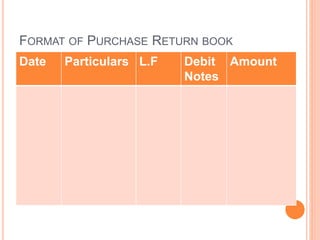

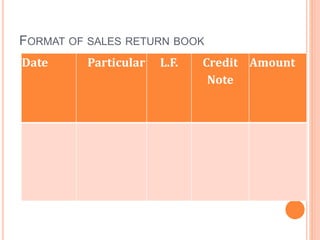

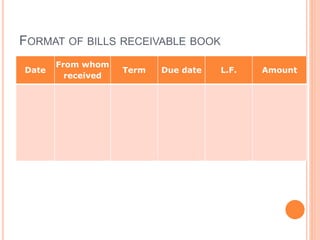

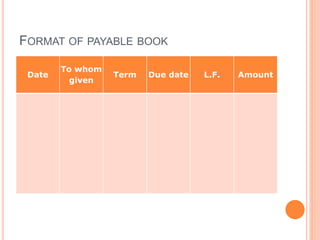

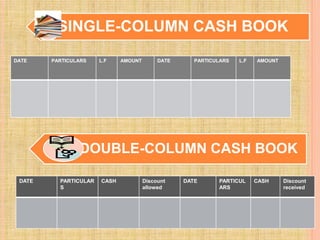

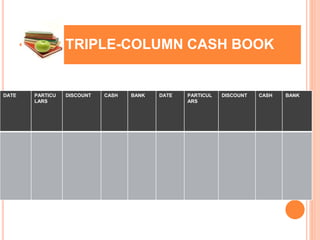

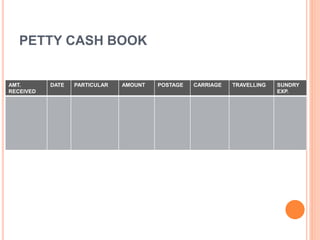

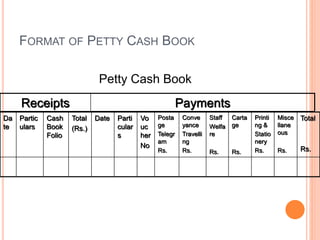

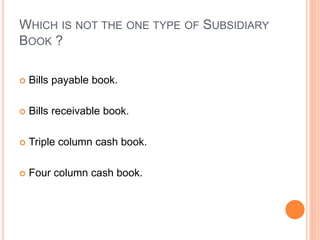

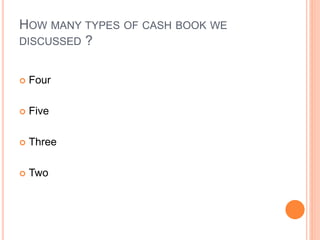

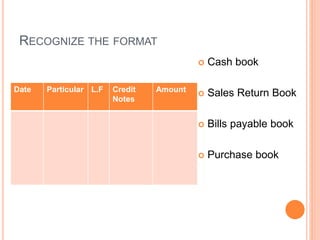

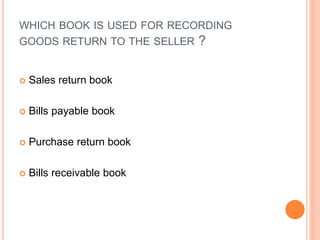

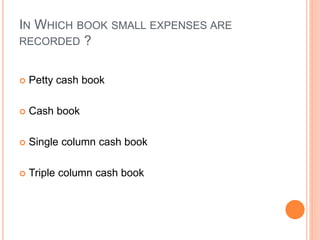

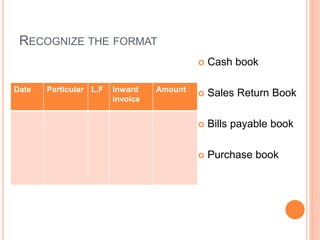

This document discusses subsidiary books, which are subdivisions of the general journal used to record large volumes of transactions. It describes the various types of subsidiary books, including cash books, goods journals for purchases and sales, bills receivable and payable books, and a petty cash book. The key types are cash books (single-column, double-column, and triple-column), purchase and sales books, returns books, and bills receivable and payable books. Each book has a specific purpose and standard format for recording transactions.