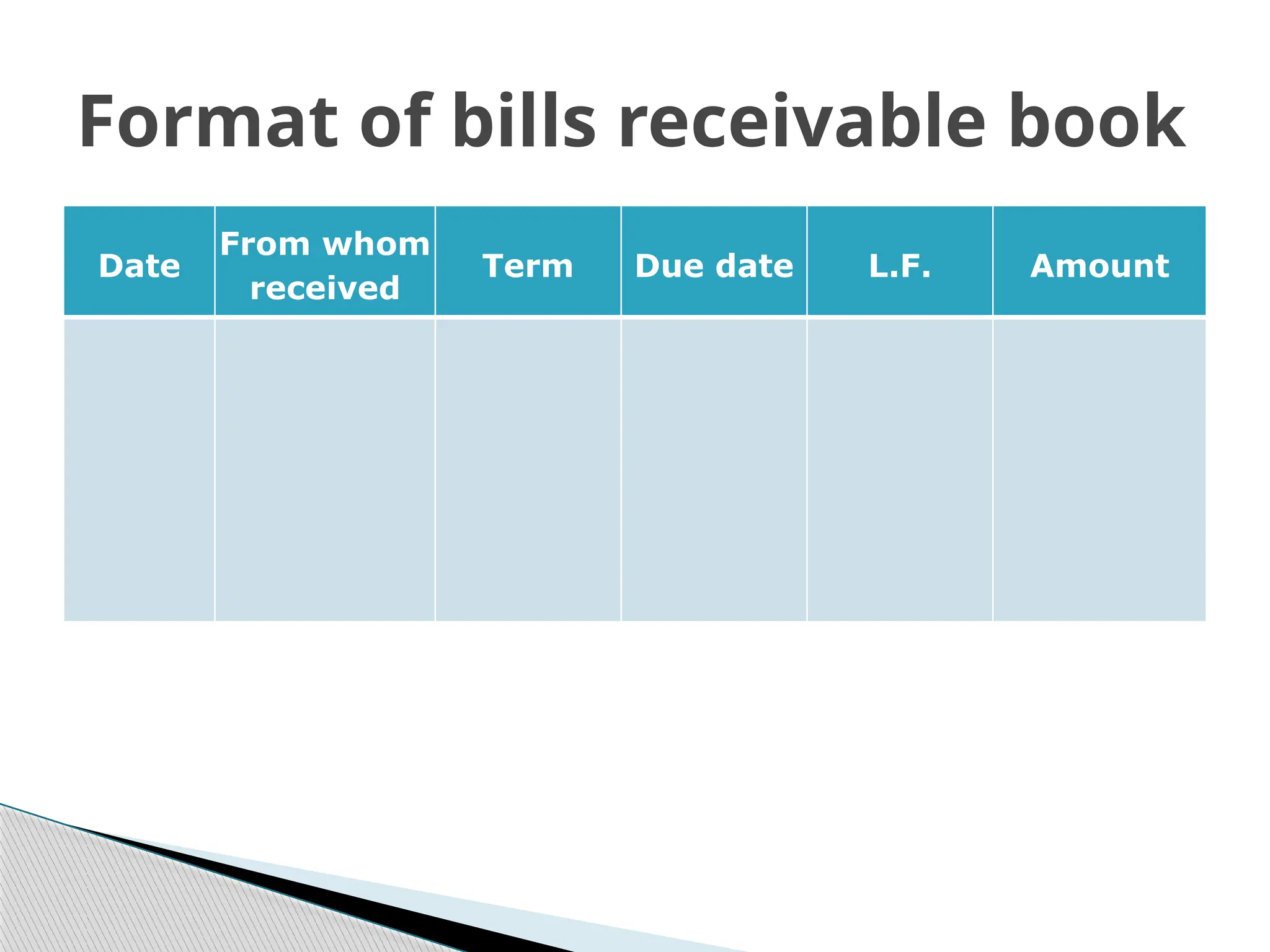

The document discusses subsidiary books, which are primary records for original entries in accounting, facilitating easy posting and access to transaction information. It outlines the types of subsidiary books, including purchase, sales, cash, and return books, and details their formats and functions. The document also highlights the advantages and disadvantages of using subsidiary books in accounting practices.