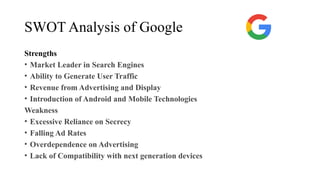

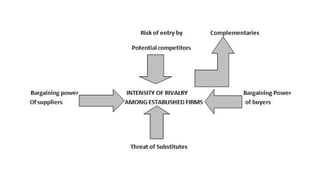

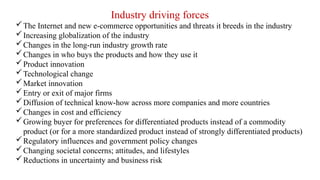

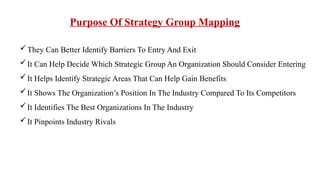

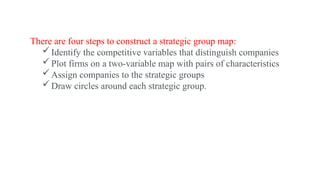

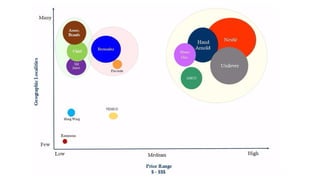

Strategic Management, Environmental Analysis: Internal Analysis: Competitive Advantage, Competencies, SWOT Analysis, Resources, Capabilities and Core Competence, Resource Base View of a Firm, Key Success Factors, Value Chain Analysis, Bench Marking. External Analysis: Components of External Analysis, Segments of General Environment, Industry ‘s Dominant Factors, Porter ‘s Five Forces Model, PEST Analysis, Industry Driving Forces, Strategic Group Mapping.