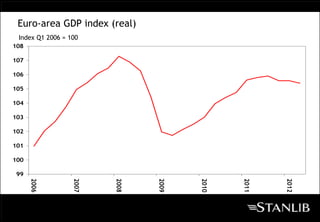

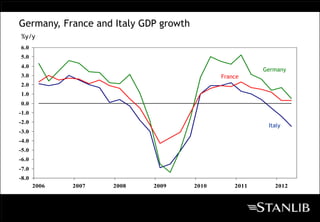

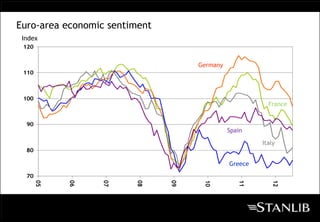

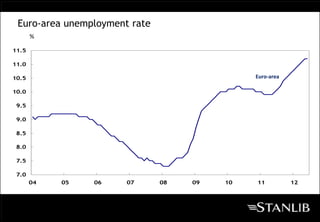

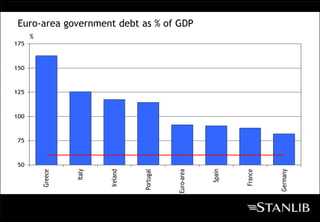

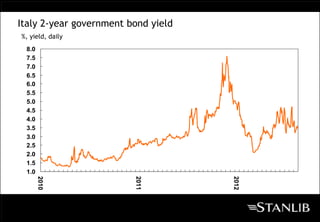

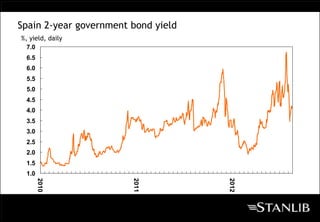

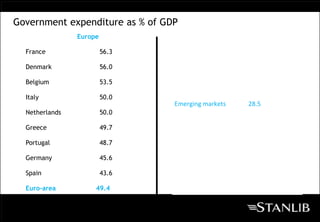

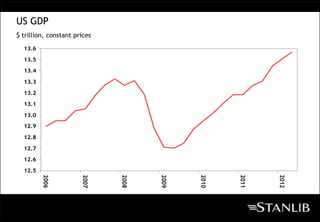

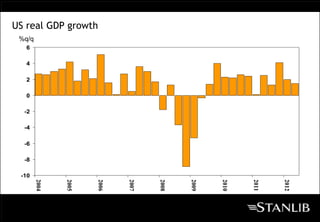

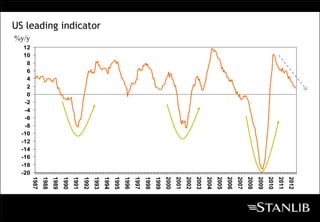

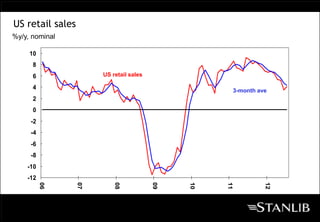

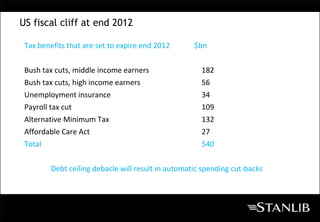

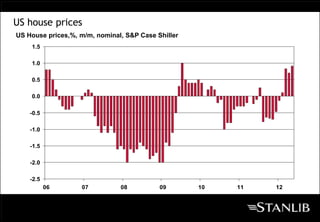

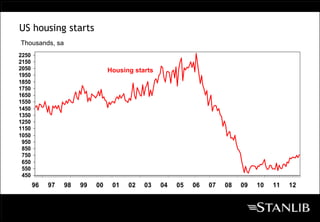

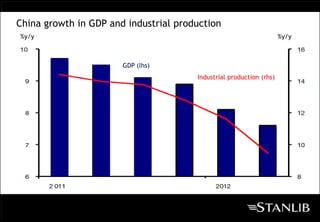

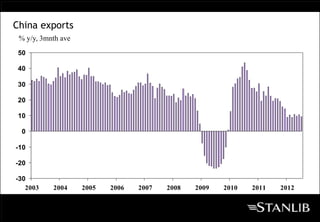

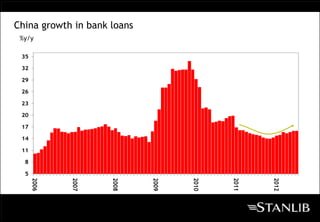

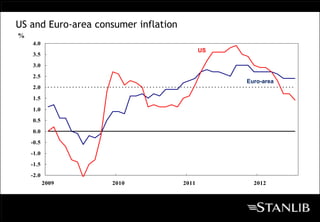

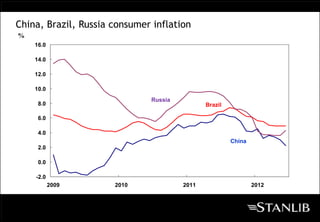

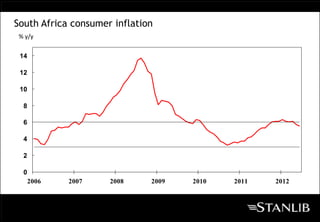

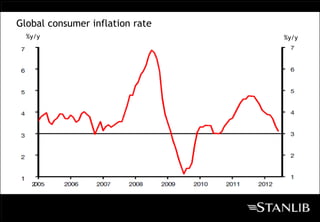

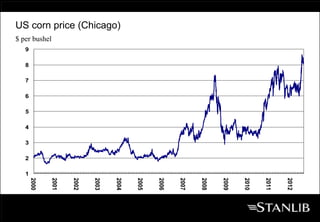

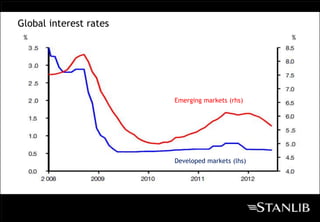

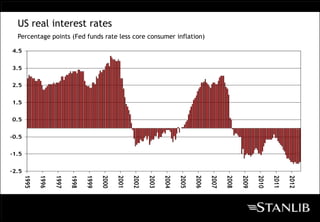

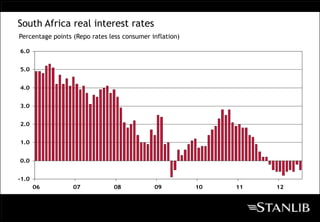

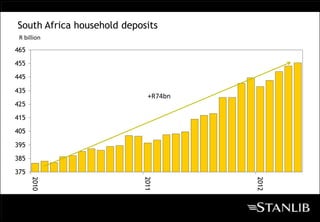

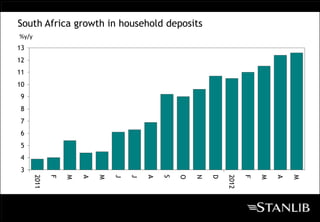

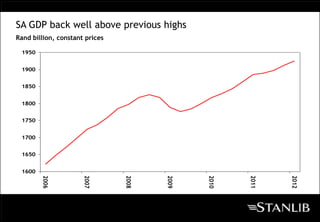

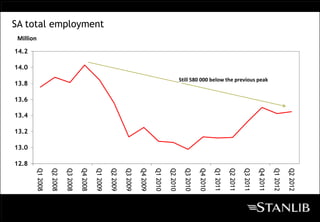

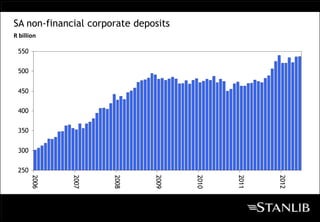

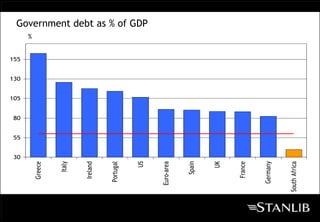

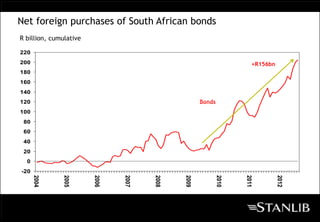

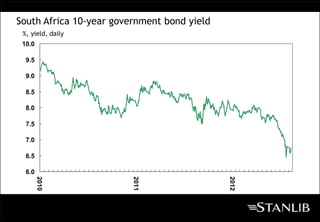

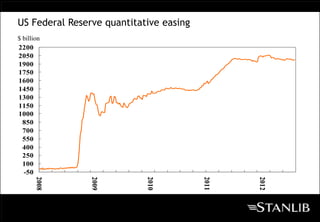

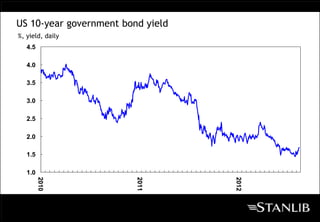

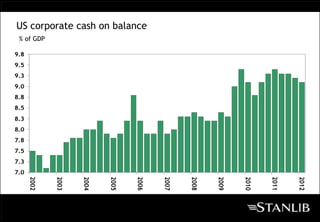

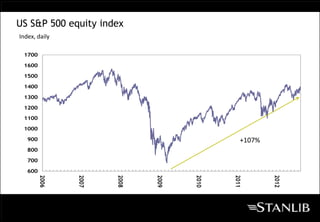

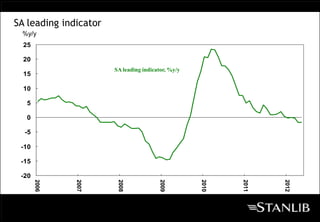

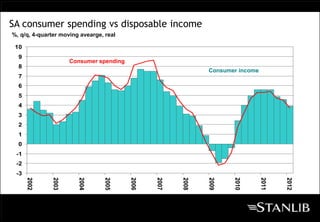

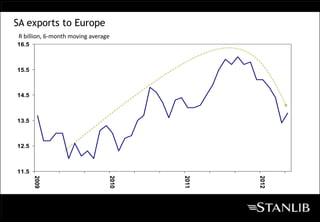

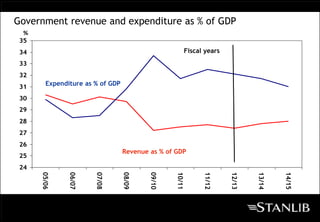

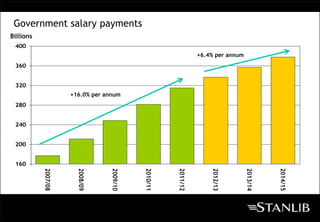

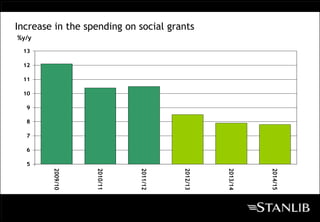

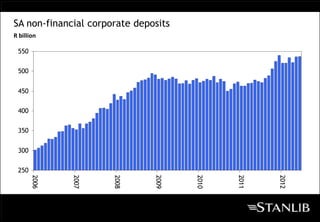

The document discusses the pressures facing the global economy and their implications for South Africa. It provides data showing slowing growth and rising debt in developed economies like Europe and the US. It also notes signs of slowing growth in emerging markets like China. This weak external environment poses challenges for South Africa's economy. However, some domestic factors such as strong growth in household deposits and rebounds in employment and the stock market could help support South Africa.