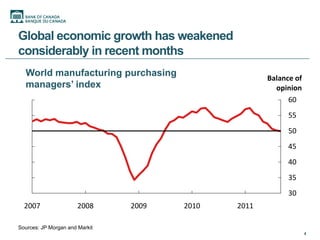

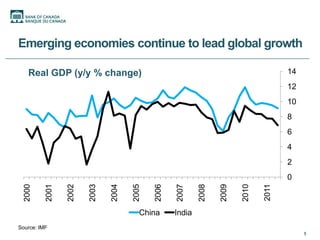

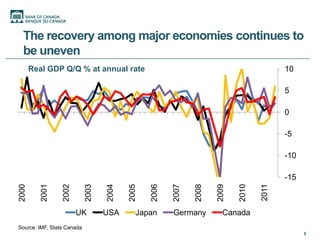

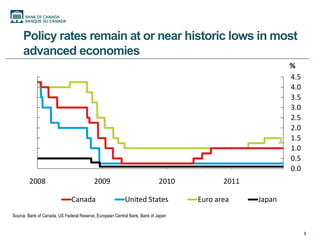

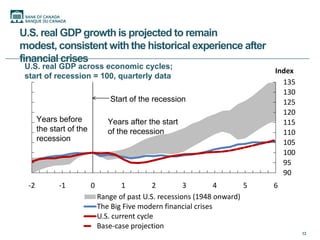

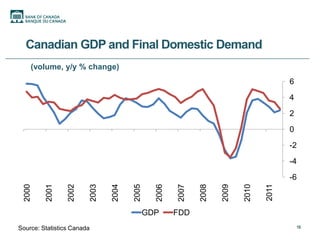

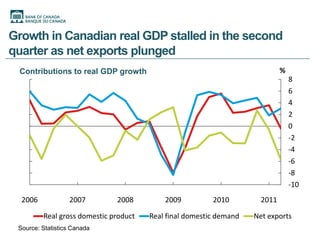

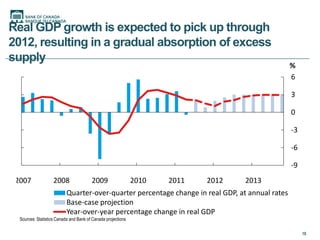

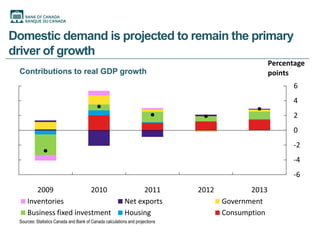

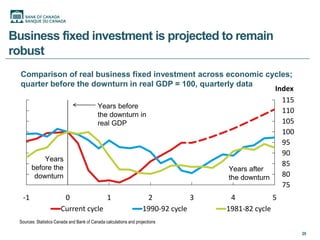

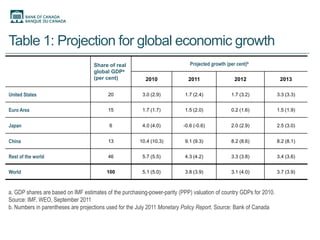

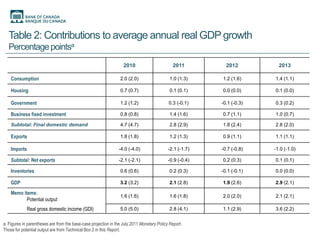

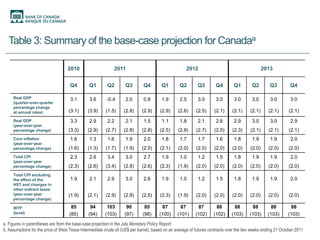

The document summarizes recent economic developments in Canada and provides projections. It finds that while global growth has weakened, emerging economies continue to lead growth. Domestic demand is projected to be the main driver of growth in Canada, with exports and business investment remaining strong. Real GDP growth is expected to pick up in Canada through 2012 as excess capacity is absorbed.