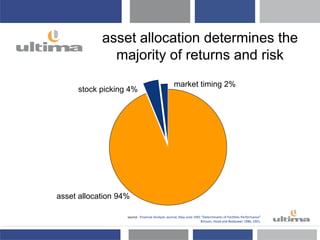

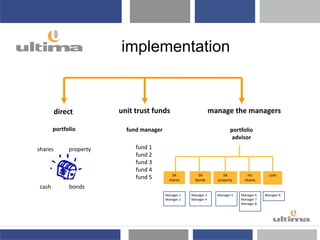

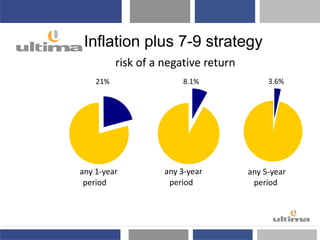

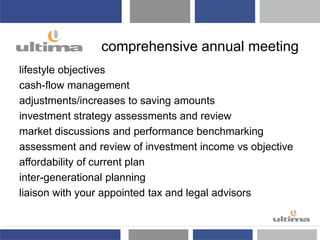

Lifestyle financial planning aims to achieve clients' lifetime goals through financial independence by focusing on lifestyle goals and using a team of strategists to provide comprehensive services like tax planning, retirement planning, cash flow planning, etc. The financial planner acts as a partner and buffer between the client and portfolio managers, with the goal of an ongoing relationship and annual meetings to review the clients' strategy and ensure it can achieve their goals. Asset allocation is key, determining most of returns and risk, while stock picking and market timing have less impact.