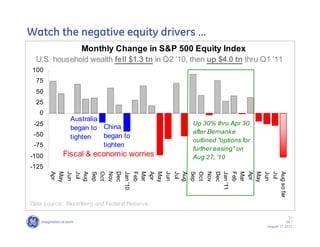

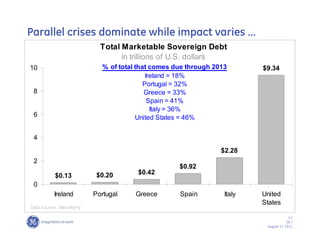

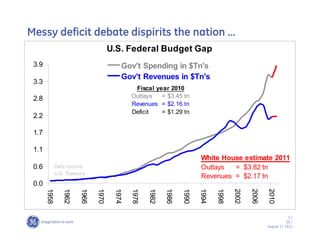

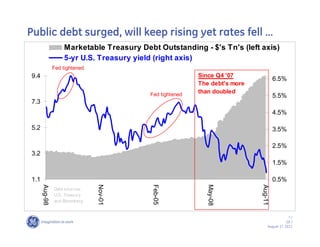

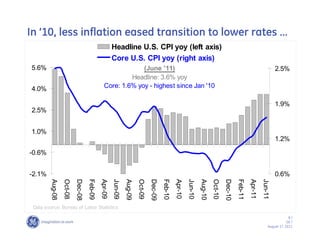

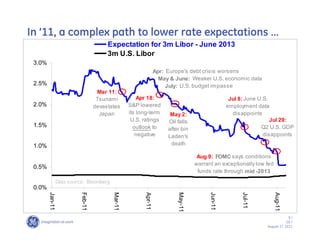

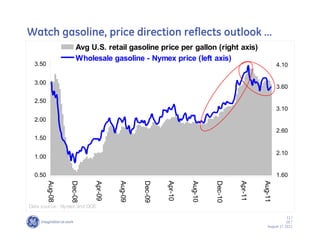

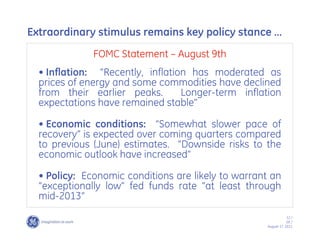

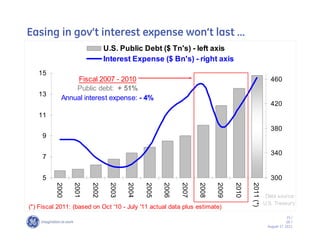

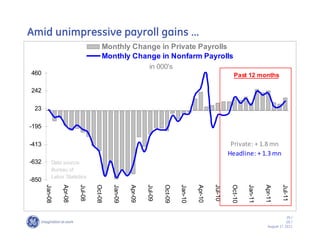

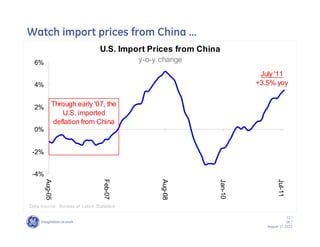

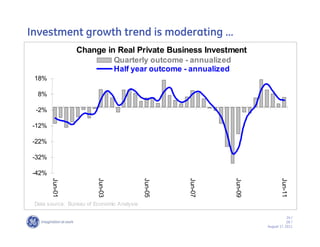

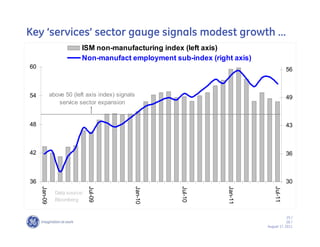

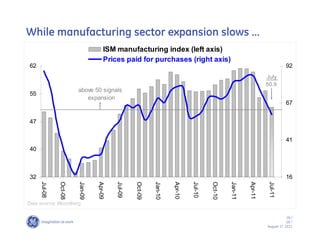

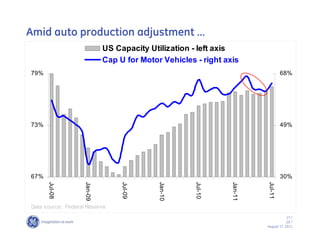

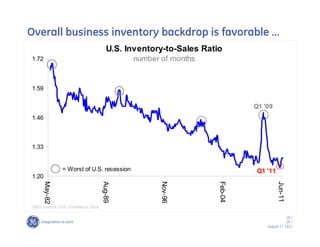

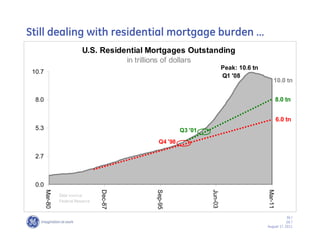

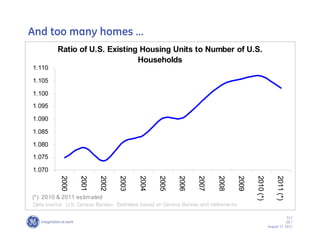

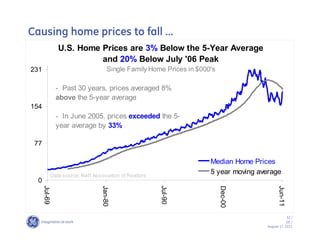

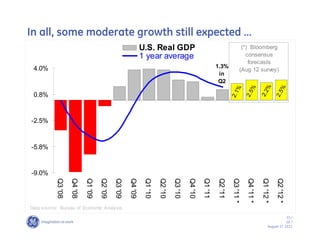

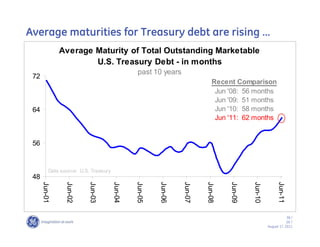

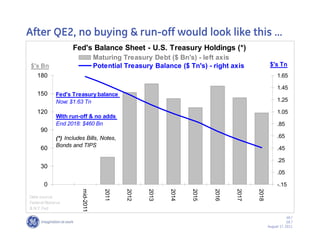

The document discusses the state of the U.S. economy and interest rate outlook in August 2011. It notes that greater uncertainty threatens economic expansion due to inflation hurting demand, supply chain issues from Japan, and weak confidence from unemployment and fiscal policy issues. Key risks include financial market volatility and unfavorable fiscal situations in Europe and the Middle East. Continued government support and contained oil prices are key to maintaining the expansion. Housing and employment remain weak areas and the federal budget committee must address deficit issues.