The document discusses Liberty's balanced property portfolio, including:

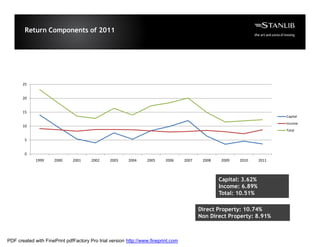

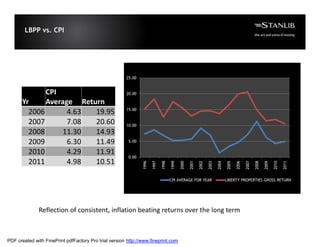

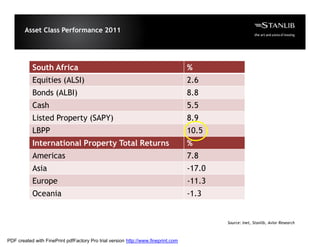

1. A review of the portfolio's 2011 performance, which saw a 10.51% total return, outperforming inflation and other local asset classes.

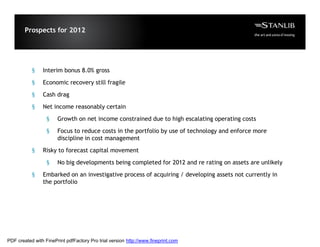

2. An outlook for 2012, expecting continued growth in net income but constrained by rising costs, and risky capital forecasts given a lack of new developments.

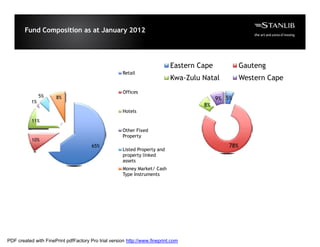

3. The fund's composition as of January 2012, consisting mainly of retail properties in South Africa, with some office, hotel and other properties, as well as listed property investments.