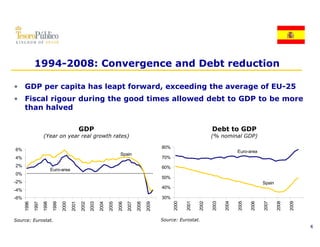

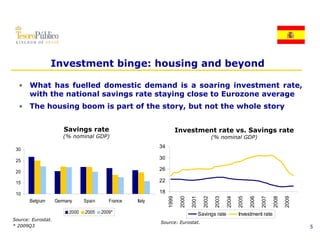

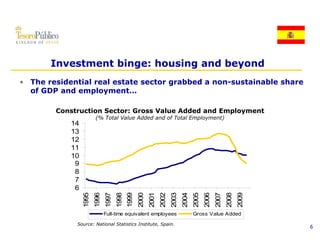

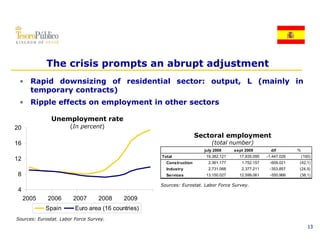

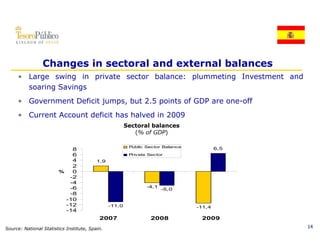

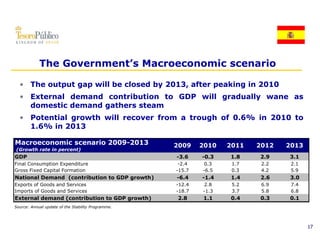

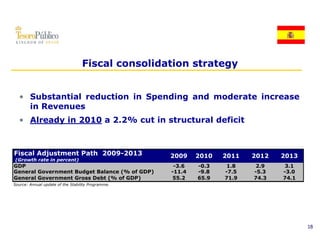

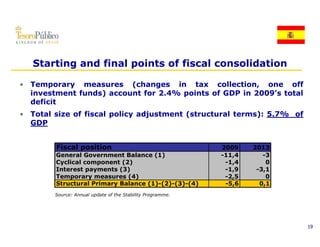

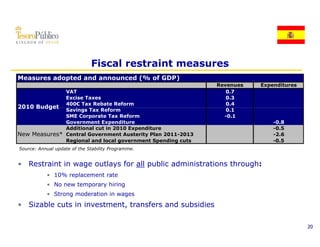

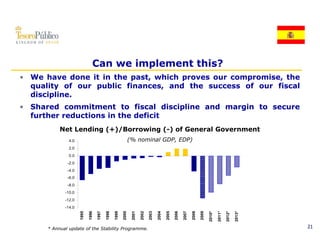

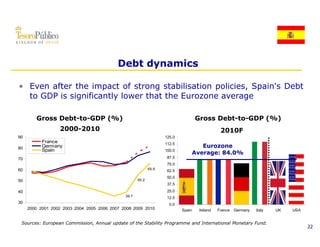

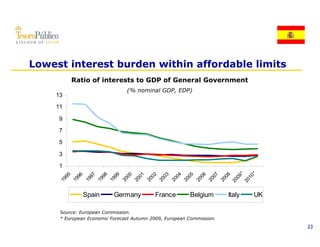

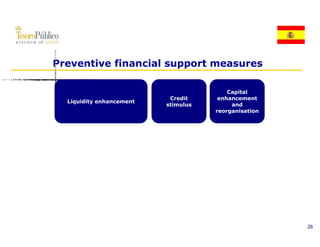

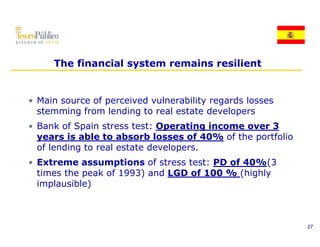

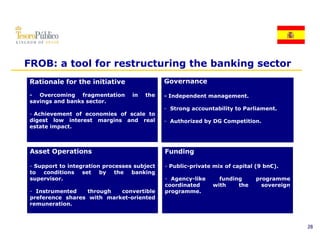

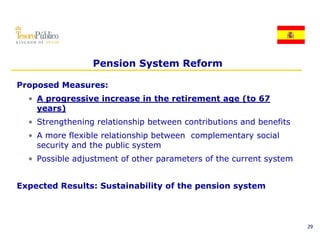

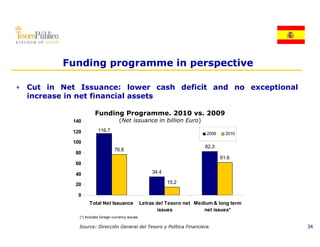

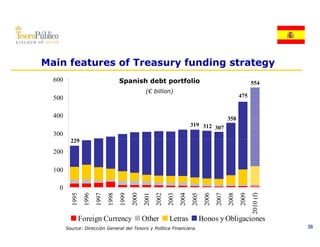

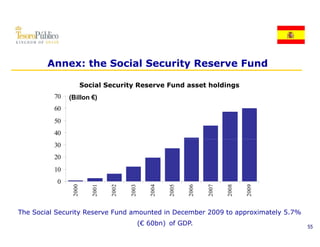

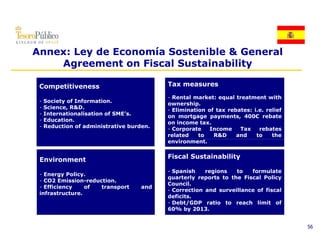

The document outlines Spain's economic policy and 2010 funding strategy. It highlights the long growth cycle prior to the international crisis and the important challenges of unemployment and deficit that resulted. The government is committed to fiscal consolidation through a 5.7% cut in the structural deficit by 2013 and structural reforms to boost potential GDP through a sustainable economy, bank reorganization, pensions, and labor market reforms. The funding strategy focuses on reducing spending and moderately increasing revenues to cut the structural deficit by 2.2% in 2010.