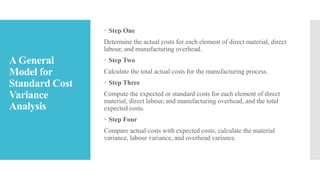

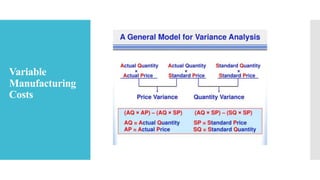

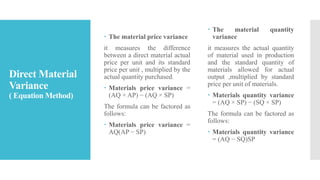

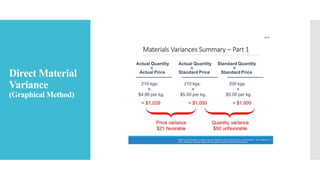

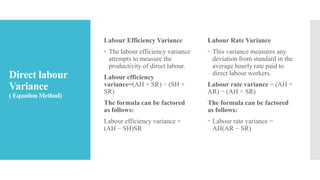

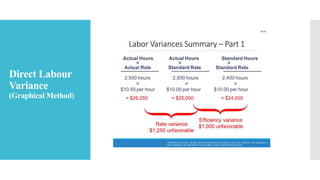

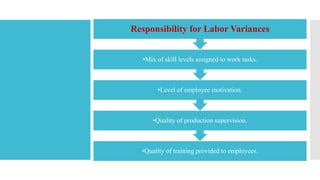

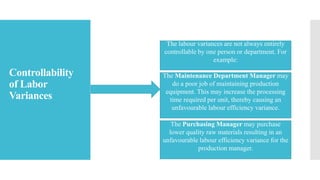

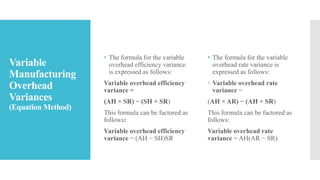

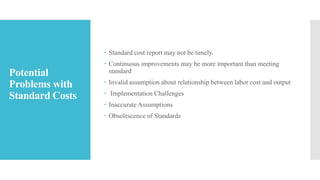

This document presents a managerial accounting project on standard costs and variances. It defines standard costs and variances, and explains how to calculate variances for direct materials, direct labor, and variable manufacturing overhead. Variances identify areas for cost reduction and efficiency improvements. The document outlines the calculation methods and significance of price and quantity variances for direct materials, rate and efficiency variances for direct labor, and rate and efficiency variances for variable manufacturing overhead. Responsibilities for variances and limitations of standard costing are also discussed.