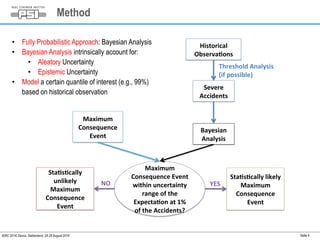

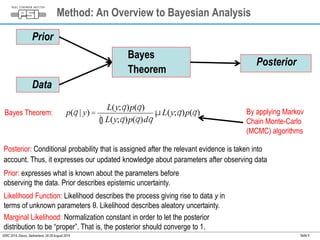

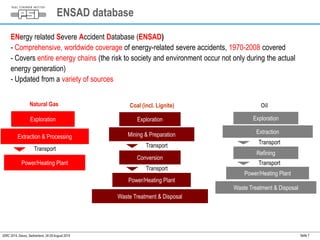

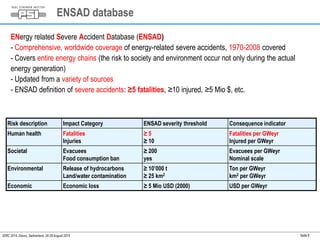

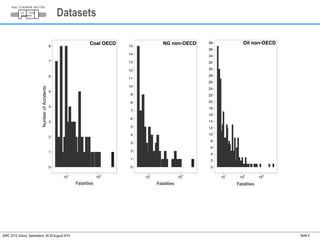

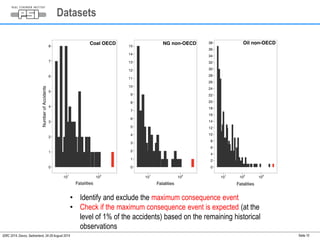

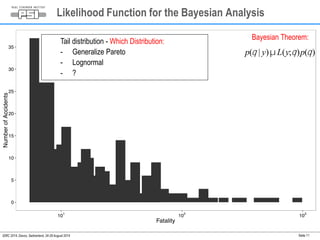

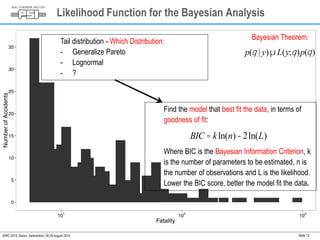

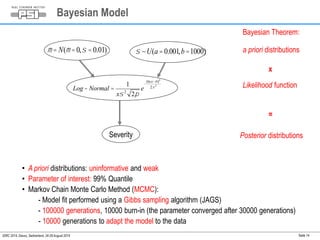

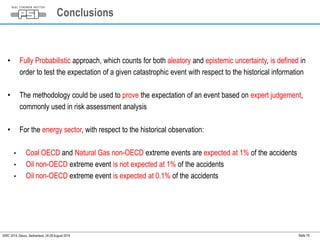

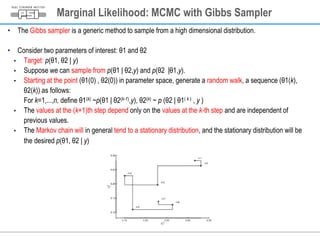

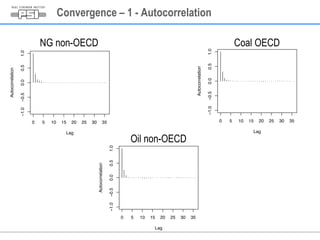

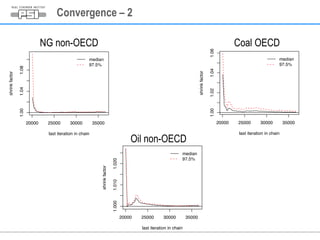

This document summarizes a study on assessing the probability of extreme consequence accidents in the energy sector based on historical observations. The study uses a Bayesian analysis approach on accident data from the ENSAD database. Key findings include:

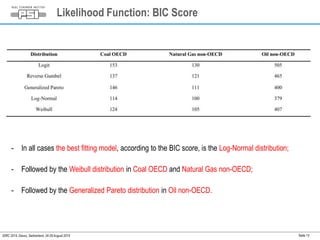

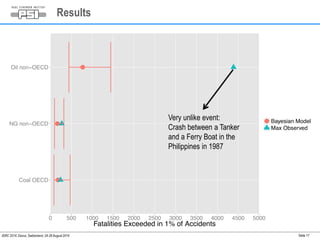

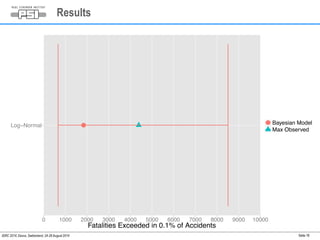

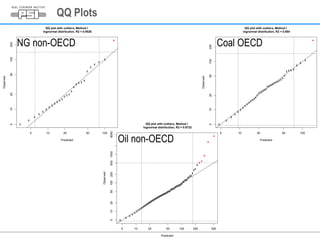

1) A log-normal distribution best fits the accident severity data for most energy types and regions.

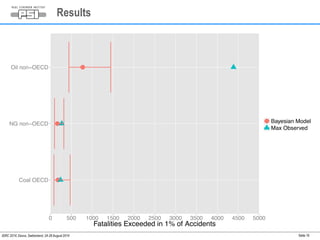

2) Extreme accidents were found to be statistically expected at a 1% probability level for coal in OECD and natural gas in non-OECD countries.

3) One extreme oil accident in non-OECD countries was found to be statistically unlikely given historical data.