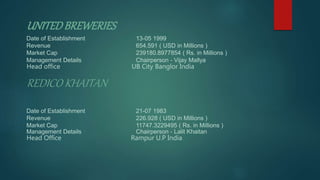

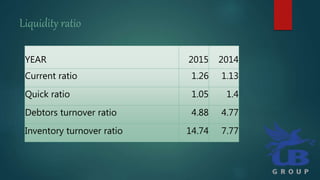

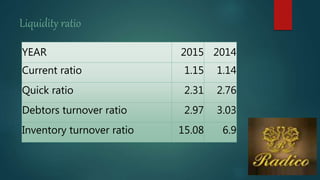

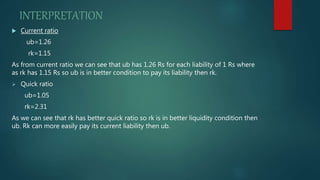

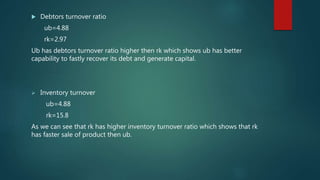

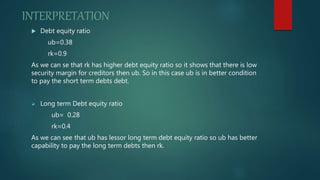

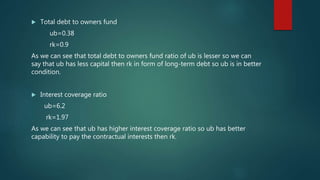

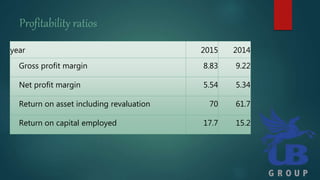

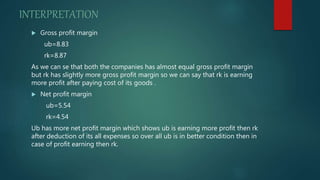

This document provides financial information and ratio analyses for two companies, UnitedBreweries (UB) and REDICO KHAITAN (RK). It includes details on establishment dates, revenue, market capitalization and management for each. It then analyzes liquidity, solvency, and profitability ratios for 2015 and 2014. Across most ratios, UB demonstrates better liquidity and profitability than RK, with higher current, quick, and debtors turnover ratios, as well as higher net profit margin and returns on assets and capital employed. However, RK shows a stronger quick ratio and inventory turnover. Overall, the interpretation is that UB is the better investment option due to its higher returns, margins, liquidity