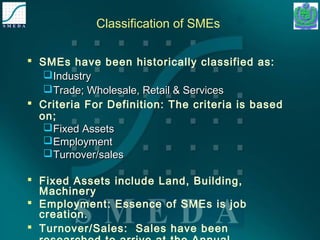

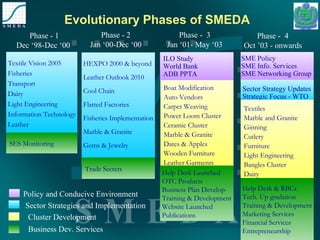

This document discusses small and medium enterprises (SMEs) in Pakistan. Some key points:

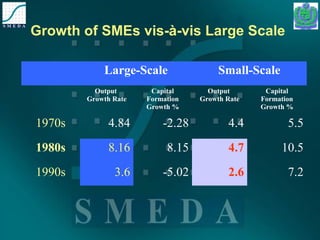

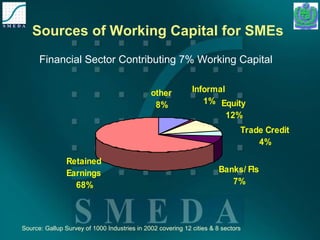

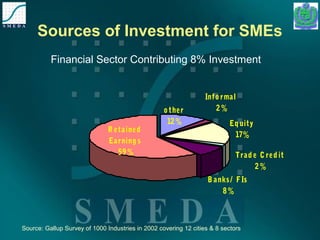

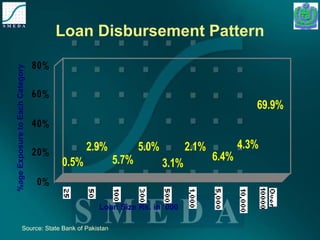

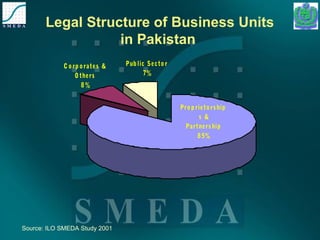

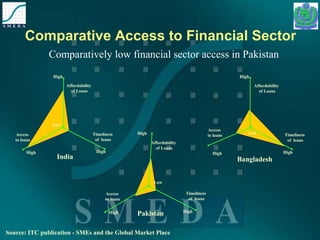

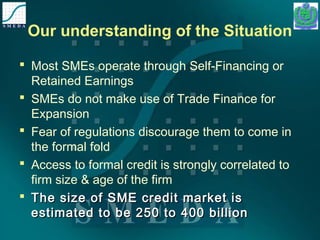

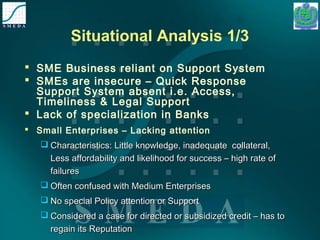

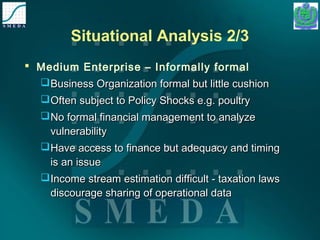

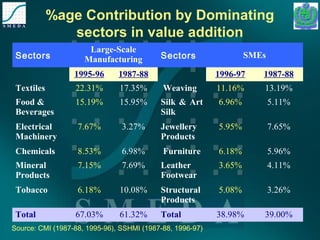

- SMEs make up over 99% of business units in Pakistan and generate a significant portion of GDP, exports, and employment. However, most SMEs are small, self-financed operations with limited access to formal financing.

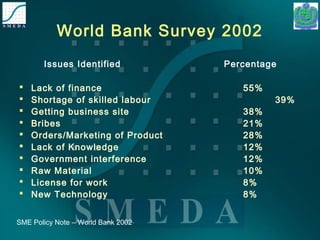

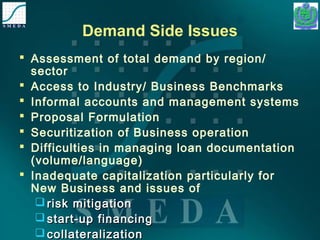

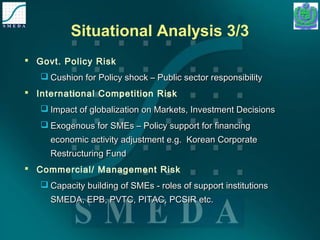

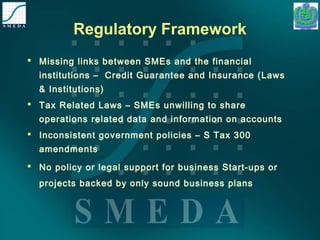

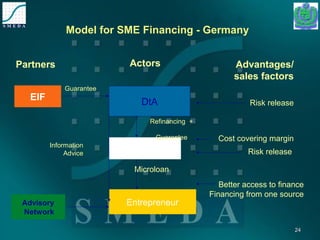

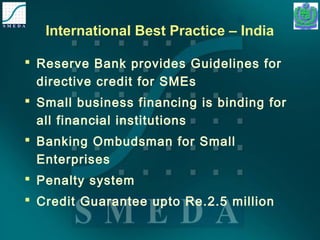

- The document analyzes barriers facing SME growth, including issues related to government policies, taxation, access to finance, skills, and infrastructure. International case studies on SME support mechanisms are also presented.

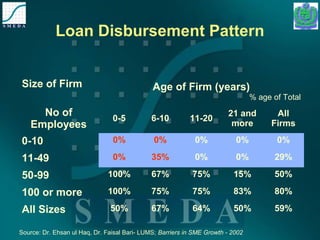

- In Pakistan, most SME financing comes from retained earnings rather than banks. The document proposes recommendations to strengthen the SME sector such as improving access to credit