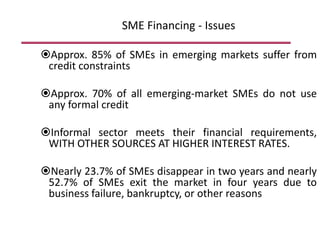

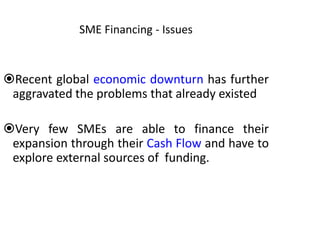

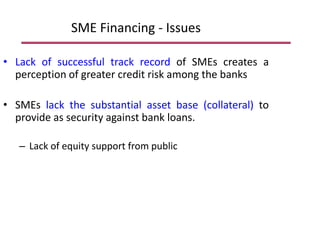

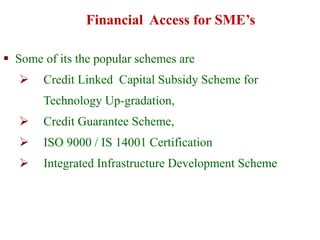

The document discusses the challenges faced by SMEs in emerging markets, particularly regarding access to financing, with approximately 85% experiencing credit constraints and high reliance on informal funding. It outlines government initiatives aimed at improving financial access, such as credit rating schemes, specialized banks, and various support programs to enhance competitiveness and reduce reliance on public support. Additionally, the document highlights the importance of credit scoring for facilitating loans and the implementation of strategies to support the sustainability and growth of SMEs.