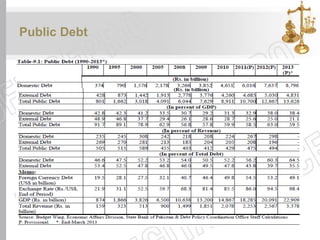

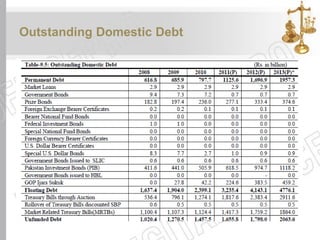

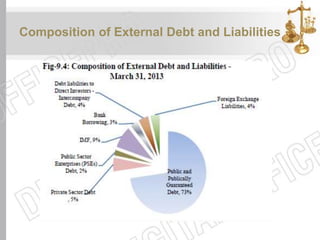

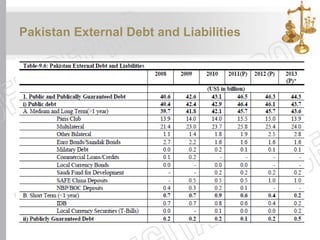

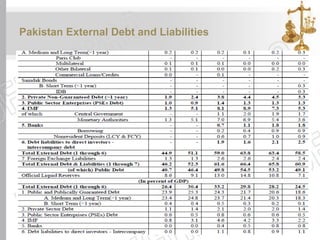

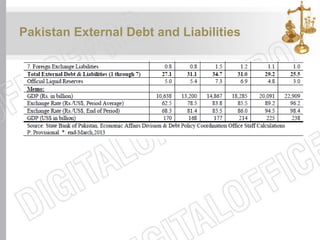

The document discusses debt management in Pakistan, explaining that debt is money borrowed under an agreement to be repaid with interest. It highlights the types of debt such as public, domestic, and external, and the importance of effective management to avoid negative impacts on economic growth and public services. The report also analyzes current debt statistics, including the growing trend in domestic debt composition and the government's challenge in maintaining debt levels within legal limits set by fiscal responsibility regulations.