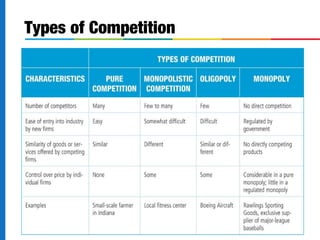

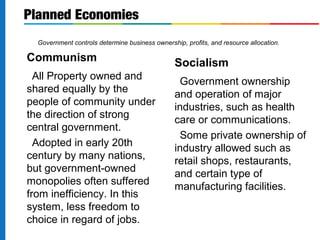

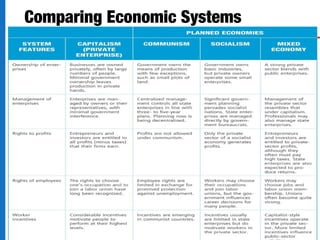

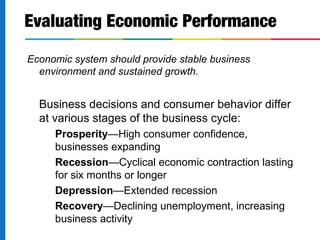

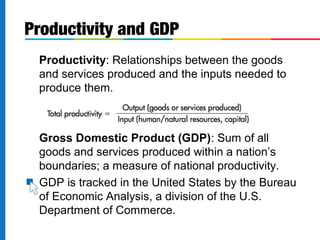

This chapter discusses macroeconomic concepts and the factors that influence the stability of an economy. It begins by defining microeconomics as the study of small economic units like individuals and businesses, while macroeconomics examines a nation's overall economy. It then explains the four types of market structures and compares the main economic systems of capitalism, socialism, and mixed economies. The chapter concludes by analyzing how monetary and fiscal policy can be used to manage economic performance and the major global economic challenges faced in the 21st century.