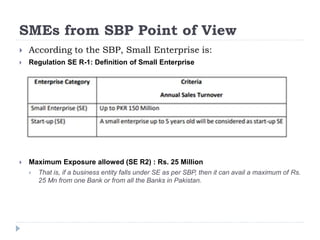

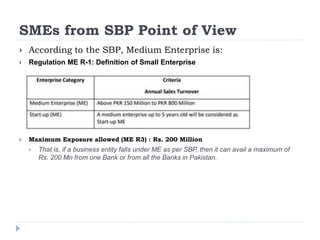

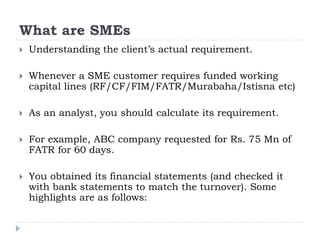

SMEs are an important part of any country's economy and provide opportunities for banks to diversify risk and earn higher profits. However, SMEs also carry more risk than larger businesses due to issues like lack of organization, financial transparency, and succession planning. The document discusses how the State Bank of Pakistan defines and regulates small and medium enterprises. It also provides tips for bankers to properly assess SME funding needs, obtain stronger security, and mitigate risks through steps like validating financials, market checks on owners, and close initial monitoring.