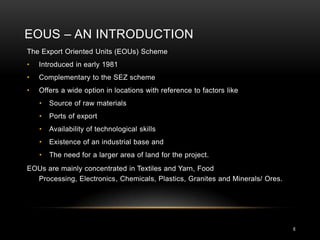

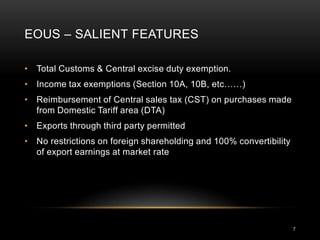

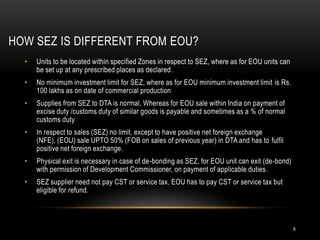

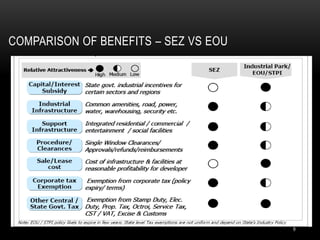

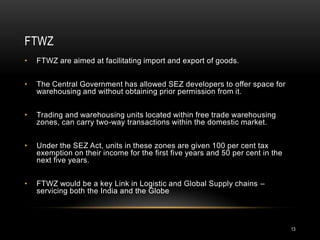

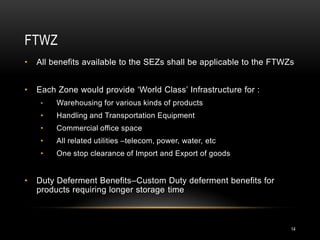

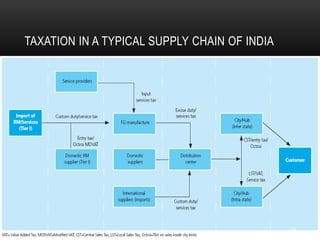

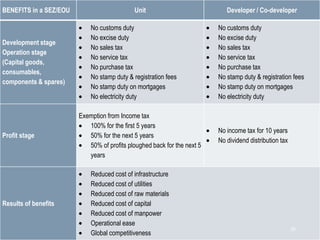

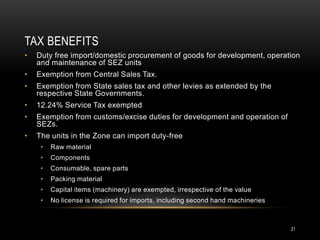

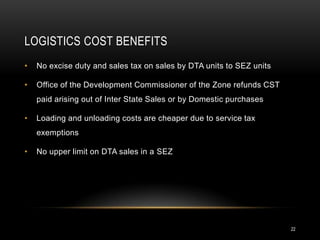

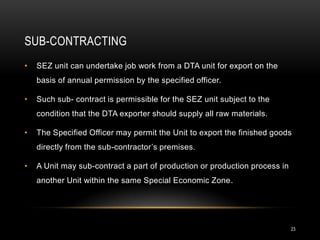

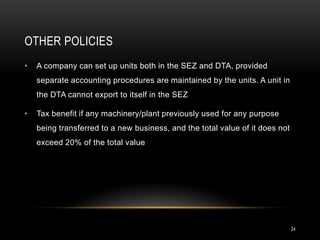

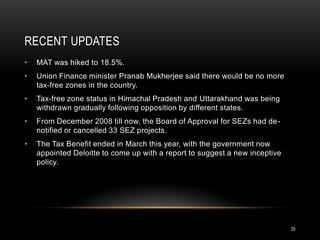

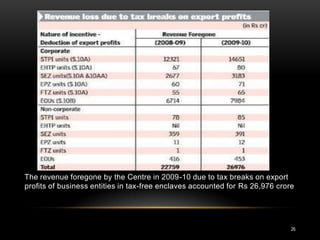

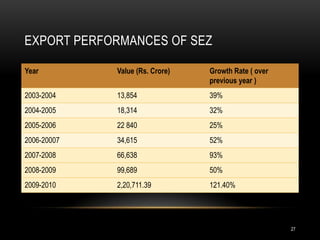

This document provides an overview of Special Economic Zones (SEZs) and Export Oriented Units (EOUs) in India and their impact on logistics. It discusses that SEZs are geographical regions with more liberal economic laws to generate economic activity and promote exports and investment. EOUs complement SEZs and can be set up in various locations. The document compares the benefits and tax incentives for SEZs and EOUs and discusses the logistics infrastructure like parks, warehouses, and connectivity that support them. It provides details on policies around subcontracting, exports, and recent updates to SEZ regulations.