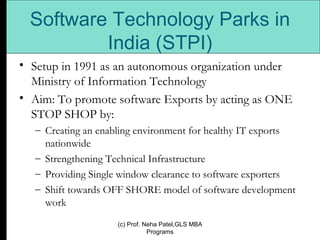

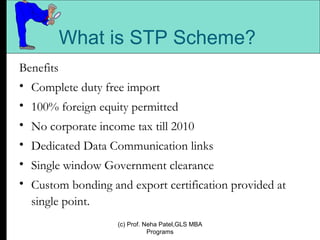

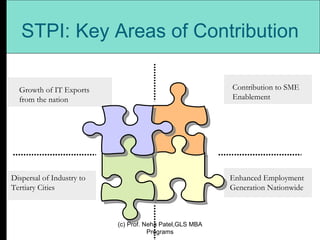

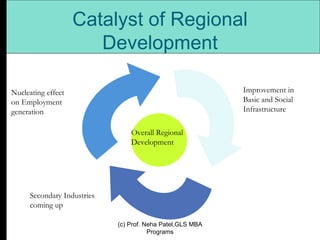

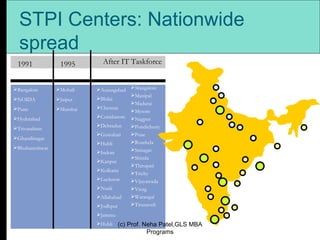

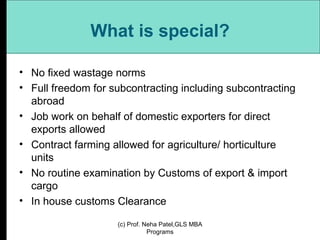

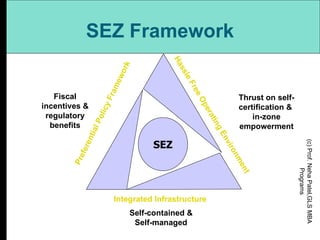

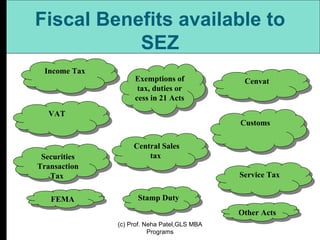

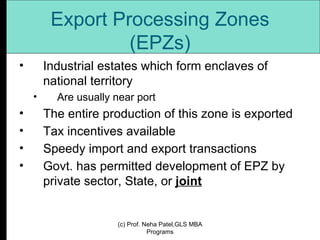

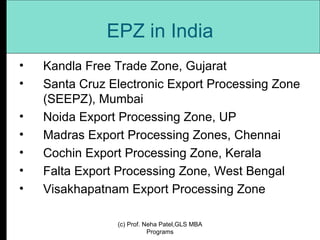

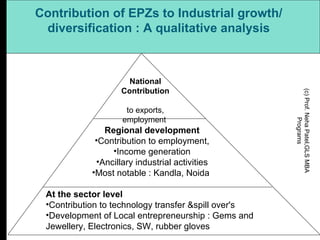

The document discusses different types of export zones and incentives in India, including Export Processing Zones (EPZs), Export Oriented Units (EOUs), Software Technology Parks (STPs), and Special Economic Zones (SEZs). EPZs are industrial estates where production is entirely exported and receive tax incentives. EOUs and STPs undertake to export all production and receive benefits like duty exemptions. SEZs are specifically delineated duty-free enclaves treated as foreign territory that receive various fiscal and regulatory benefits to promote exports.

![Export Oriented Units [EOUs] Units undertaking to export their entire production of goods and services Except permissible sales in Domestic Tariff Area (DTA) Electronic Hardware Technology Parks (EHTPs), Software Technology Parks (STPs) or Bio-Technology Parks (BTPs) Also covered under EOU scheme. These are product specific units availing the same benefits as EOUs. EOUs are allowed to manufacture goods including repair, re-making, reconditioning, reengineering, and rendering of services wherever applicable. (c) Prof. Neha Patel,GLS MBA Programs](https://image.slidesharecdn.com/epzseoustpssezs-6-111115072616-phpapp01/85/Ep-zs-eous-tps-sezs-6-6-320.jpg)