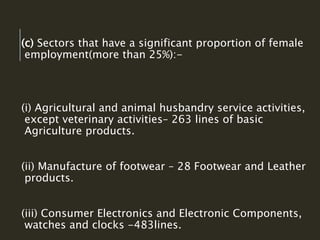

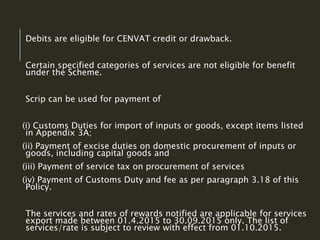

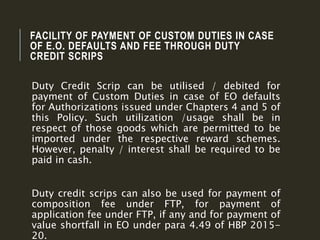

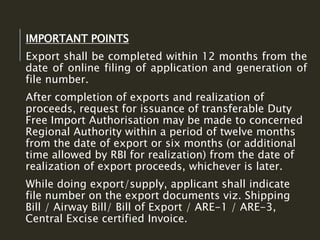

The document outlines India's Foreign Trade Policy (2015-2020), specifically focusing on two key schemes: the Merchandise Exports from India Scheme (MEIS) and the Service Exports from India Scheme (SEIS). MEIS aims to provide rewards to exporters to enhance India's export competitiveness by offsetting infrastructural inefficiencies, while SEIS encourages the export of notified services with transferable duty credit scrips. Both schemes define eligibility criteria, salient features, and specify ineligible categories to ensure targeted support for export growth.