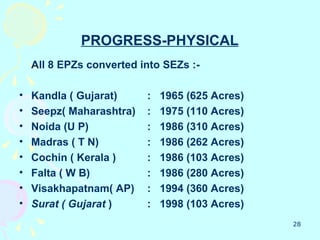

1) Special Economic Zones (SEZs) in India aim to provide internationally competitive environments to increase exports, attract foreign direct investment, and enhance economic growth.

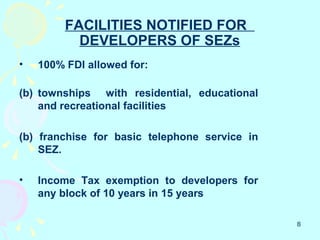

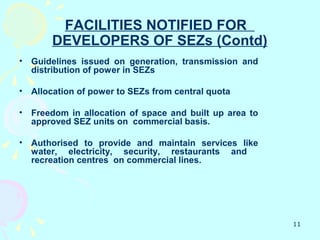

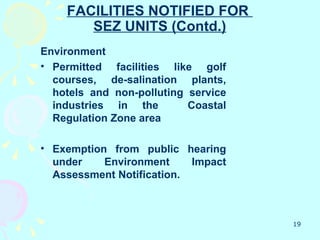

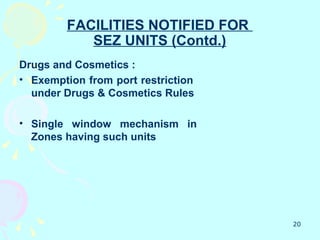

2) The approach includes special fiscal incentives for private developers, infrastructure support from state governments, and attractive facilities for setting up business units. A single window system streamlines central and state regulations.

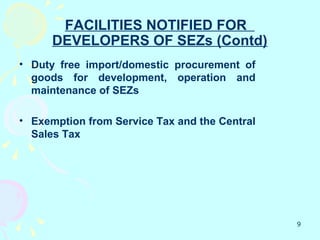

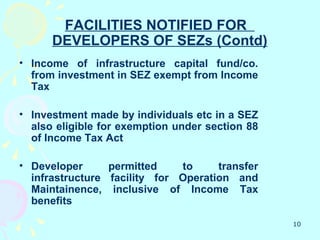

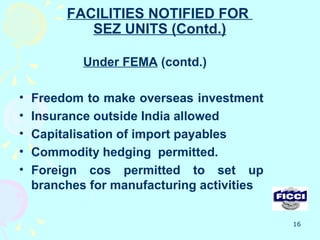

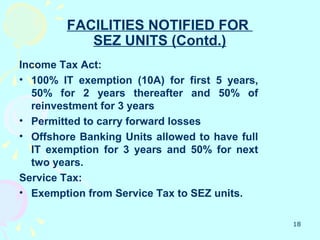

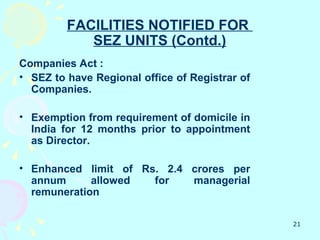

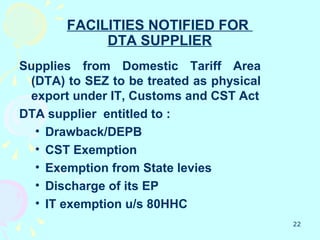

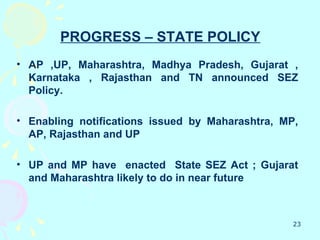

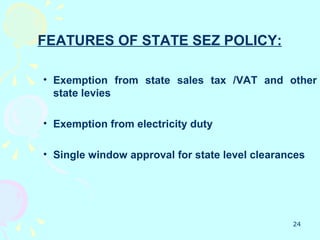

3) Developers and business units in SEZs receive various tax exemptions and other benefits like duty-free imports. State policies provide further incentives to encourage the development of SEZs across the country.