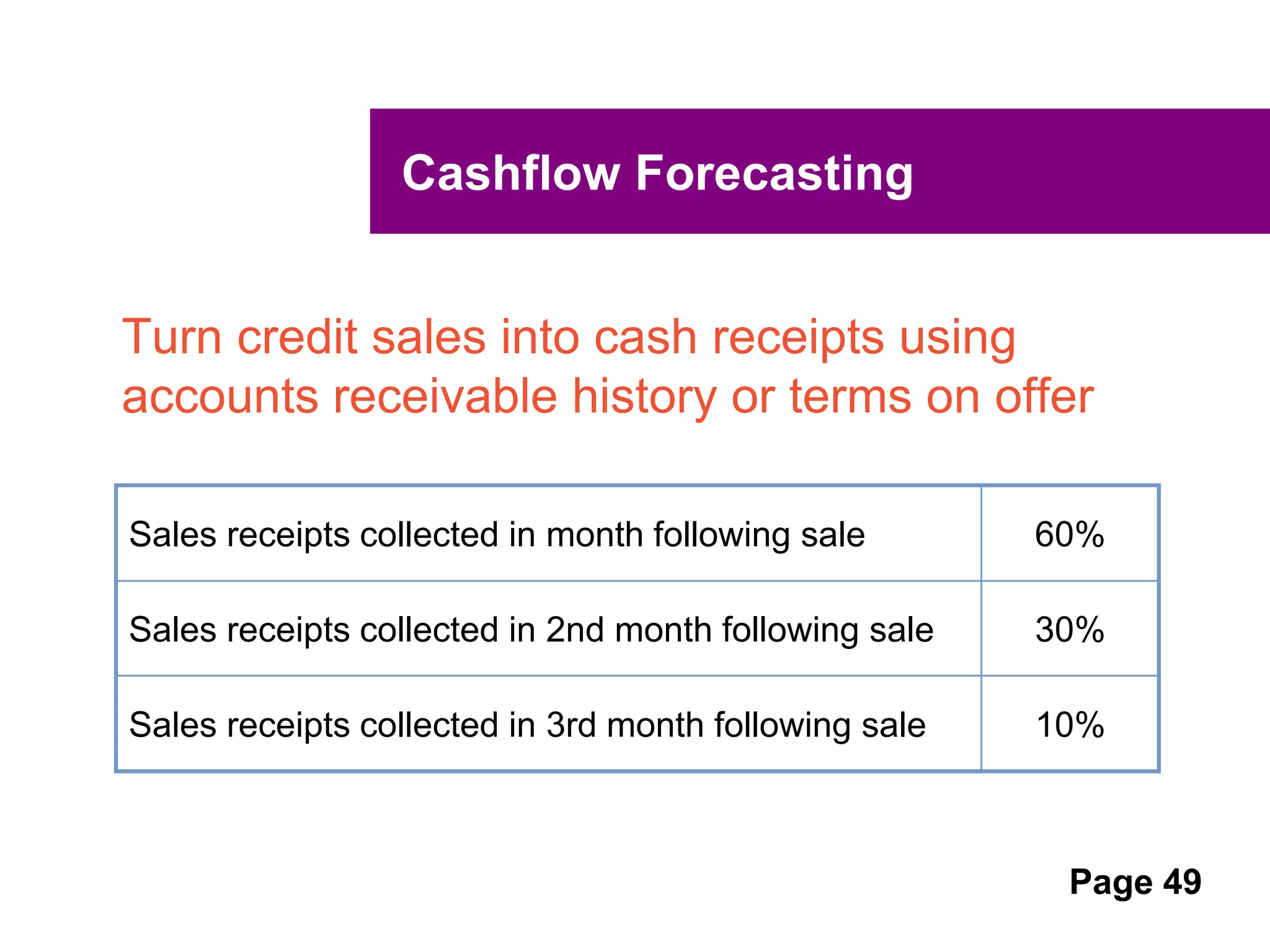

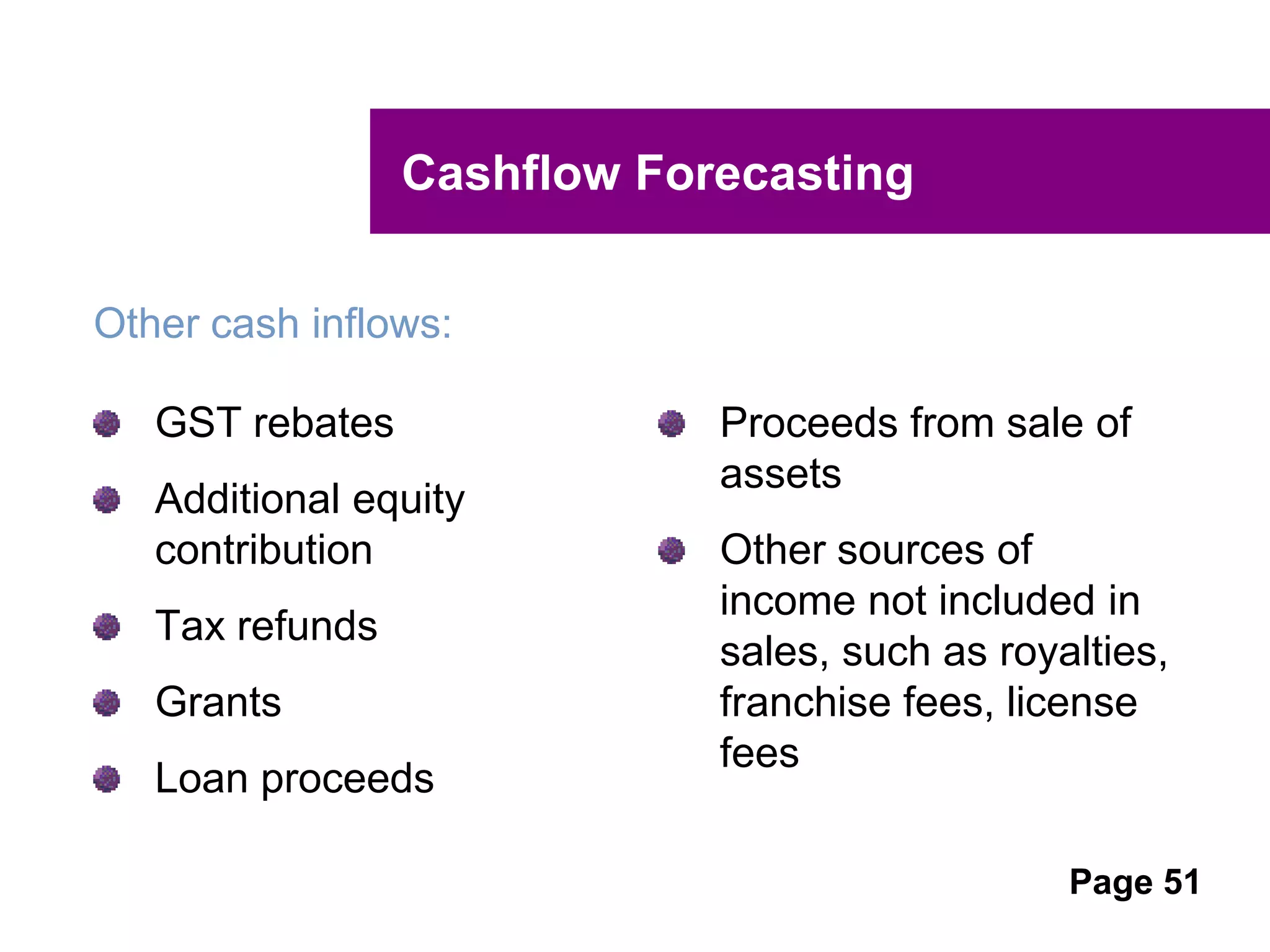

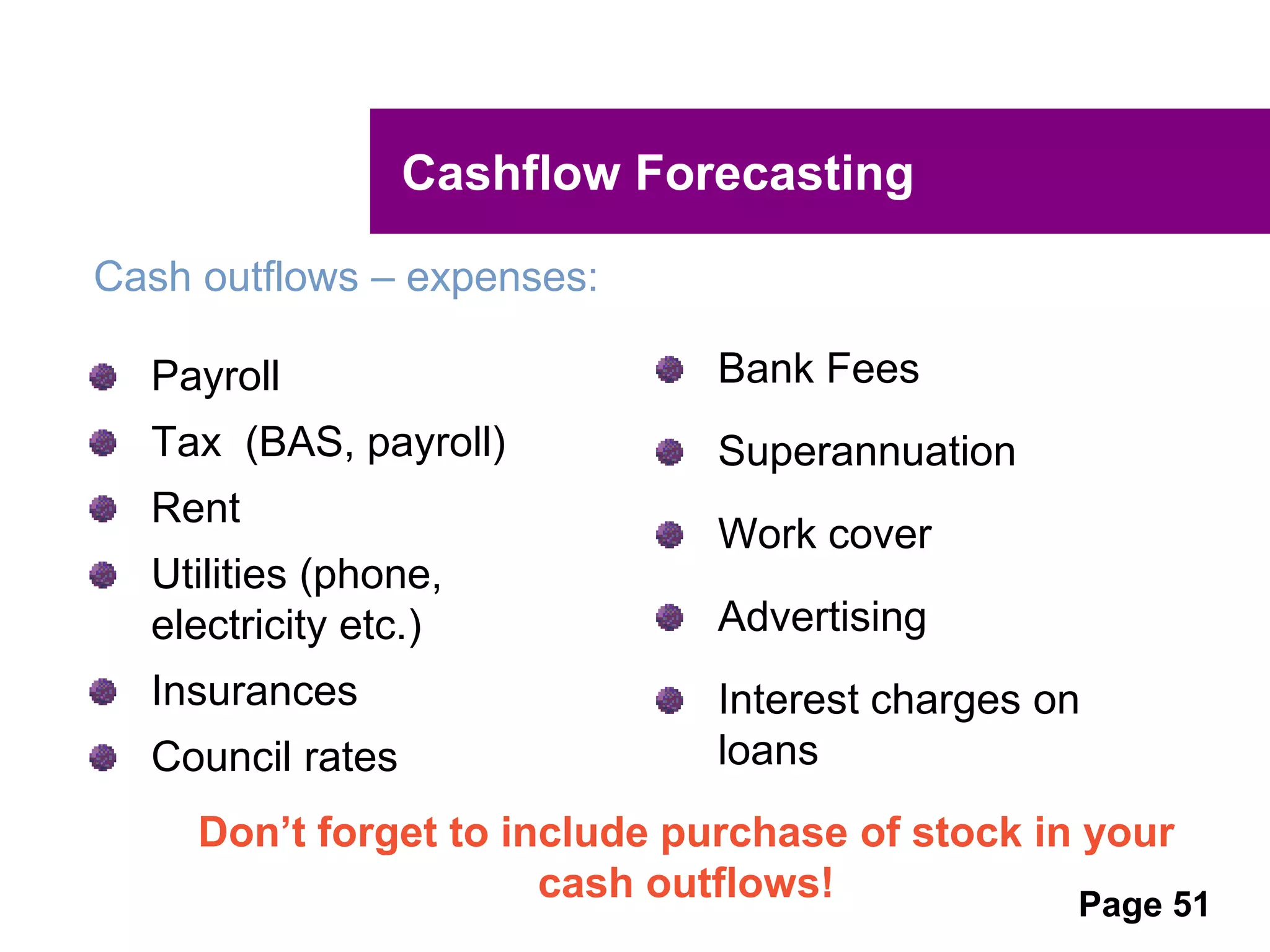

The document outlines a seminar focused on developing financial strategies that align with business objectives, emphasizing the importance of budgeting, cash flow forecasting, and the evaluation of business performance. It provides guidelines for effective financial planning, such as creating a one-page business plan, utilizing profit and loss budgets, and continuously reviewing financial strategies. Key topics include the distinction between budgets and forecasts, techniques for managing cash flow, and the benefits of mentorship in achieving business success.